Definition: The concept of Investment Multiplier suggests that the increase in Investments will lead to income generation in multiples. In other words, the amount of Income/Output amplifies, resulting from the increase in the level of Investments.

Investment Multiplier is the contribution of the famous economist John Keynes. He explained it with the help of the country’s investment and Gross Domestic Product (GDP).

The amplified income is in the multiple of the initially invested amount. We assess the number of times it manifolds during the process. The investment multiplier works in both directions:

- Forward

- Backwards

Forward action is due to an increase in investments. On the other hand, backward action is a decrease in investment.

The multiplication occurs because the income received from investment is spent on consumption. Further, this income from the consumption is spent again due to MPC.

Simultaneously, saving some part of the total income due to Marginal Propensity to Save (MPS). This process takes place until there is no scope left for further Consumption and Saving.

Content: Investment Multiplier

- Formula and Diagram

- Maximum and Minimum value

- Working of Investment Multiplier

- Static, Dynamic and Reverse Multiplier

- Leakages from Multiplier

- Importance

- Limitation

- Criticism

- Example

- Conclusion

Investment Multiplier Formula and Diagram

There are three alternative formulas available for the calculation of the Investment Multiplier.

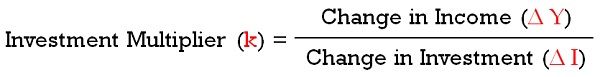

1. Formula:

where,

Δ k is the value of the Investment Multiplier,

Δ Y shows the change in Income,

and, Δ I depict the change in Investment.

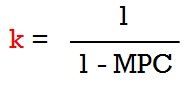

2. Formula using MPC:

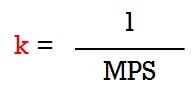

3. Formula using MPS:

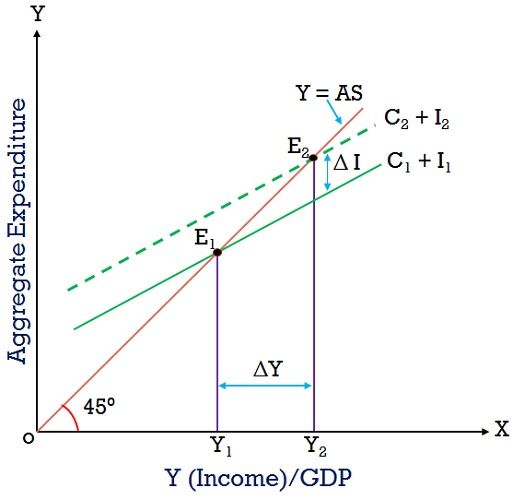

Graphical representation of Keynes Investment Multiplier:

Relationship with MPC & MPS

There exists a direct relationship between investment multiplier and MPC. For this reason, the investment multiplier increases with the increase in the MPC.

MPC ↑ k ↑

However, MPS is inversely related to the investment multiplier. This is because, a part of total income is saved and not consumed, leading to a reduction in the multiplying effect.

MPS ↑ k ↓

Maximum and Minimum value of the Investment Multiplier

Maximum Value

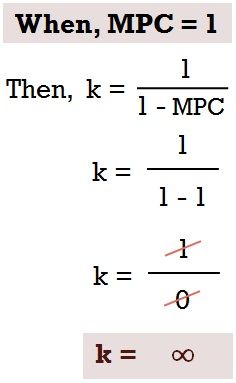

When the MPC is one, then the value of the Multiplier is Infinite. It is explained with the help of the equation given below:

Minimum Value

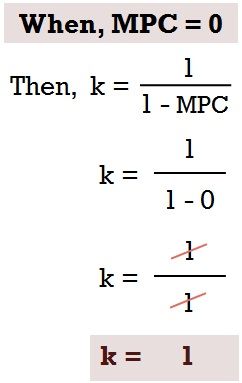

When the MPC is zero, then the value of the Multiplier is One. Explained in the following equation:

Working of Investment Multiplier

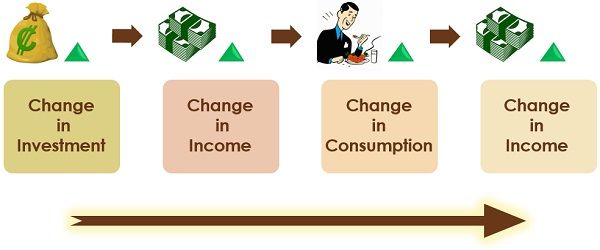

Working is based on the fact that the expense of consumption by one person is another person’s income. The points below explain the working of the Multiplier in detail:

- The investments are the income for people that they will spend on consumption due to MPC. However, they wouldn’t consume the total income but save some part of the income.

- The amount people spend on consumption will be the income for those offering the products.

- After that, these people will also spend this earned income on consumption with some savings.

- Thereby, creating a loop of Investment, Expenditure, Consumption and Income. This chain of income and consumption continues, and the overall income goes on increasing.

- After each round, there will be a decrease in the income from consumption of people due to MPS. The process continues until a point is reached when there will be no scope for further consumption and savings.

- Then we calculate the number of times the income multiplied after each round due to the initial investment.

Assumptions

- Marginal Propensity to Consume (MPC) remains unchanged throughout the process.

- There is a net increase in the investments with no indirect effects.

- There is no time lag within the increase in income and investment.

- Consumer goods industries can meet the increased demand for consumer goods instantly.

- The process is happening in the closed economy. So, the imports and exports are not taken into consideration.

- The prices of goods are assumed to be constant.

- The economy is an under-employed economy.

Static, Dynamic and Reverse Multiplier

Static Multiplier

Here, the multiplier effect on the income of the changes in investment happens simultaneously. Furthermore, income multiplication takes place without any delay or time lag.

We can also refer to it by following alternative terms:

- Logical Multiplier

- Timeless Multiplier

- Lagless Multiplier

- Simultaneous Multiplier

Dynamic Multiplier

Unlike Static in Dynamic Multiplier, there exists a time lag during the process. The multiplication process takes place gradually over time, i.e. stage by stage, in various rounds.

So, the Dynamic Multiplier is a gradual increase in the total income until it reaches the multiplier value.

It is alternatively known as:

- Period Multiplier

- Sequence Multiplier

Reverse Multiplier

In case of a decrement in investments, a reduction in income starts taking place. This process is the complete reverse of the investment multiplier. Consequently, we refer to it as Reverse Multiplier.

The Reverse Multiplier can be a product of the investment deficiency in the economy.

Leakages from Multiplier

Leakages are the factors that slow down the multiplying process. Following are the factors that are the leakages in the Investment Multiplier:

- Paying Off Debts

- Imports

- Idle Cash Balances

- Taxes

- Increment in Prices

- Savings

- Inflation

- Loan Payments

Importance

The importance of this theory in the country’s economy is as follows:

- Full Employment: This theory explains the importance of investments in creating employment.

- Policy Formulation: It plays a crucial role in the framing of economic policies.

- Effects on Savings: Besides consumption, it also examines the impact of the investment on savings.

- Recovery from Depression: It can be a remedial therapy to recover from economic depression.

- Better Understanding of Trade Cycle: Multiplier facilitates an in-depth understanding of the phases of the Trade Cycle.

- Significance of Investment: This concept clearly explains the role of Investments in the country’s economy.

Limitation

Following are the limitations of this theory:

- A higher multiplier demands continuous investments. But, it is not possible to make regular investments in an economy.

- We can only reach full employment when the economy has some ideal resources.

- Practically, there exists a time lag between income and expenditure.

- The consumer goods must be available for disposal during the reinvestment each time.

Criticism

The economists criticised this theory on the following grounds:

- This theory assumes that the MPC remains constant. But, in reality, MPC changes with income.

- It involves numerous calculations and is difficult to assess.

- The theory excludes the impact of consumption on investments.

- Not suitable for underdeveloped countries.

Example

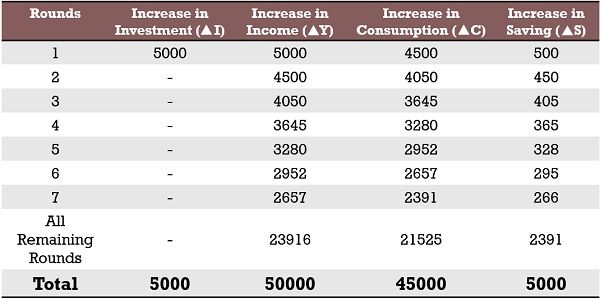

Let us suppose that an investment of Rs.5000 Cr is made in an economy. And the assumed Marginal Propensity to Consume (MPS) is 0.9%.

Calculate the value of the Multiplier along with the table of Income Generation.

Solution:

From the above table, we can conclude that:

- After a while, the initial investment of Rs.5000 Cr generated an income of Rs.50,000 Cr.

- The total savings became equal to the total invested amount at the beginning.

k = Change in Income( Y) / Change in Investment (I)

k = 50000 / 5000 = 10 Times

Hence, the value of the Investment Multiplier (k) is 10 Times.

Conclusion

All in all, this theory explains the impact of injecting investments on income and output. The investment will boost revenue and consumption. As a result, the invested amount will manifold several times.

But, this theory has some criticisms and majorly explains the static multiplier. It does not include the dynamic variables during the entire process.

Leave a Reply