Definition: The Circular Flow model represents the continuous flow of money among various sectors of the economy. The money flow results in economic activities such as production, consumption, investment and expenditure. It plays a significant role while calculating the country’s national income.

The major sectors of the economy are:

- Domestic or Household

- Corporate or Firms

- Government

- Foreign or Rest of the world

The model shows the cycle of economic activities among these sectors of the economy. The level of flow is depicted through two, three and four sectors models.

Content: Circular Flow Model

- Types of Flow

- Two-Sector Model

- Two-Sector Model with Saving and Investment

- Three-Sector Model

- Four-Sector Model

- Principles

- Importance

- Limitations

- Final Words

Types of Flow

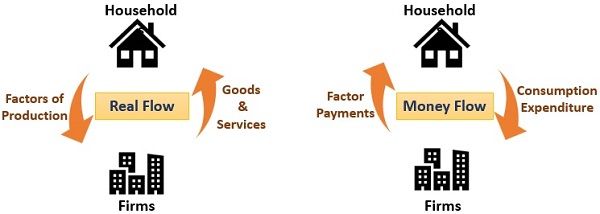

There are two types of flow within the model, i.e. Real flow and Money flow:

Real Flow: It is the mobilization of resources and commodities in the economy. For example, factors of production, goods and services.

Money flow: It depicts the movement of money between households and firms. For example, factor payments and consumption expenditure.

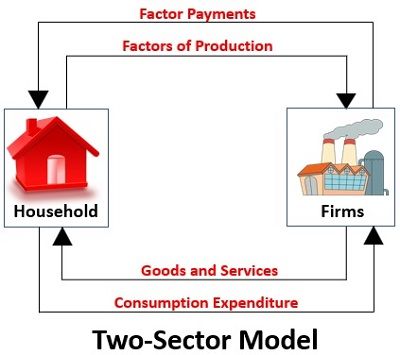

Two-Sector Model

This model shows the circular flow of income in a simple economy. It consists of two sectors, i.e. households and firms. The domestic sector provides the factors of production to the firms like:

- Land

- Labour

- Capital

- Enterprise

The firms use these resources in the production of goods and services. The household spends its total income on the consumption of goods and services. On the other hand, firms make factor payments like:

- Wages

- Rent

- Interest

- Profits, etc.

Assumptions of a two-sector model

- The firms recruit factors of production from the domestic sector.

- The households consume goods and services produced by firms.

- There are no savings and investments.

- There are no borrowings among the households.

- Complete absence of foreign trade.

- No role of government.

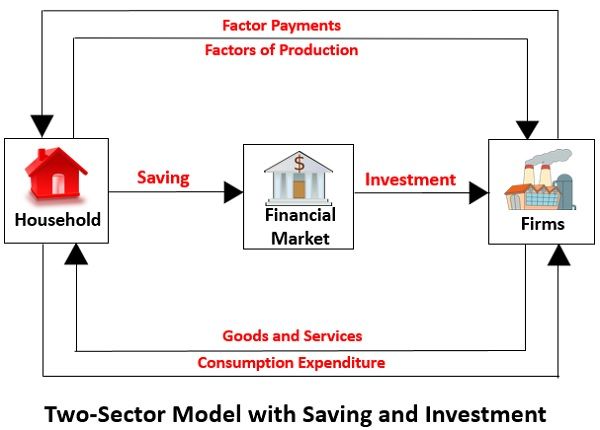

Two-Sector Model with Saving and Investment

In this model, we assume that the household saves some amount from their income. However, savings are the leakages from the economy, as discussed in the previous sections.

Because of the simple or closed economy, the firms will get less money for production. Hence, it will affect the volume of production and decrease national income.

So, firms borrow money from the financial markets to maintain the flow of money. It is also called injections in the economy.

Therefore, in the two-sector model, the equilibrium is obtained when

S = I

Where,

S is Savings

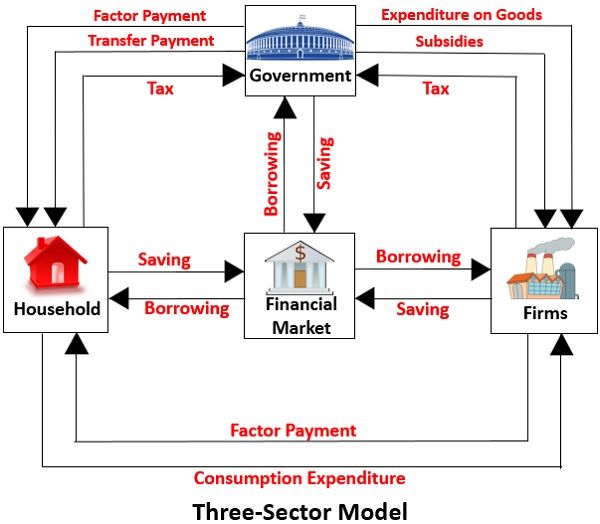

Three-Sector Model

The Three-sector Model includes government along with domestic and corporate sectors. It plays a crucial role in maintaining balance in the economy.

Government acts both as a producer and consumer for households and firms. As it receives money in the form of direct and indirect taxes. Whereas, spends money by giving subsidies, services and investments in construction projects.

The flow of income between government and different sectors is as follows:

- Household and Government

The government take factors of production (army, administration, etc.) from the household. On the other hand, makes factor payments (salary, pensions, scholarships, etc.) to them. Also, the households pay direct taxes to the government. - Firms and Government

The government purchases goods and services of the firms. Also, provide subsidies to them. Firms pay corporate taxes to the government. - Financial Market and Government

The government invests excess money into financial markets. It also borrows money from the market to pay off its expenses.

Therefore, in the three-sector model, the equilibrium is obtained when

C + S + T = C + I + G

Where,

C is consumption

S is savings

T is taxes

I is investments

G is government expenditure

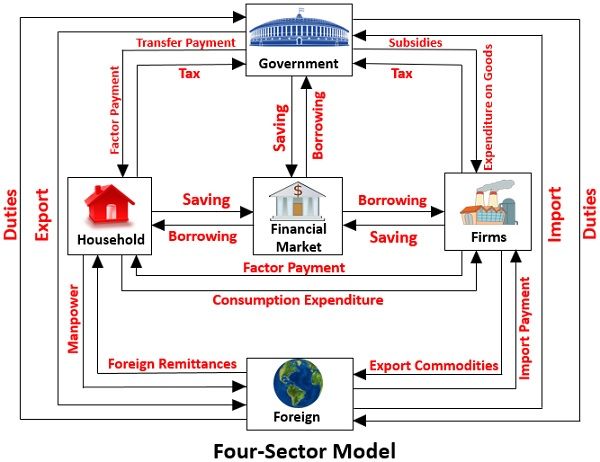

Four-Sector Model

The Four-sector model shows the flow of income in an open economy. It consists of economic activities between the three sectors with the foreign sector/rest of the world. The trading involves imports and exports with foreign countries.

In an open economy, imports and exports affect the national income.

Assumptions of a four-sector model

- Only exports and imports of goods & services are taking place.

- The domestic sector exports only human resources and receives foreign remittances.

The flow of income between foreign and different sectors is as follows:

- Household and Foreign Sector

The household provides human resources and pays for imports to the foreign sector. They receive factor payments and transfer payments from the foreign sector. - Firms and Foreign Sector

The firm exports goods and services to the foreign sector. In return, they receive payments for the exports. - Government and Foreign Sector

The government export and import goods and services to/from the foreign sector. It receives payments for exports and makes payments for imports. Also, it receives payment through duties and taxes during foreign trade. - Financial Market and Foreign Sector

The foreign sector invests and borrows money from the financial market. For example, Foreign Direct Investment (FDI).

There can be three possibilities:

- Exports > Imports

- Increment in National Income

- The outflow of Goods and services

- Inflow of money

- Injection in the flow of income

- Imports > Exports

- Decrease in National Income

- Outflow of money

- The inflow of goods and services

- Leakage in the flow of income

- Imports = Exports

- A balanced flow of income

Therefore in the Four-sector model, the equilibrium is obtained when

Y = C + I + G + (X-M)

Where,

Y is Income

C is Consumption Expenditure

I is Investment Expenditure

G is Government Expenditure

X-M is Net Exports

Principles of Circular Flow Model

- In the exchange process, the amount purchased should be equal to the amount spent.

- The mobilization of goods and services should be in one direction. The receipts from them should be in the opposite direction.

- The real and money flow are opposites, which causes a circular flow.

- The income flow from sectors should always show receipts and payments.

Importance of Circular Flow Model

- It is a measure of National Income.

- Gives an idea about the injection or leakage in the flow of money.

- It shows the interdependence of economic sectors and their activities.

- Represents the overall health of the economy.

- The model helps to detect causes and remedies for the imbalance in the economy.

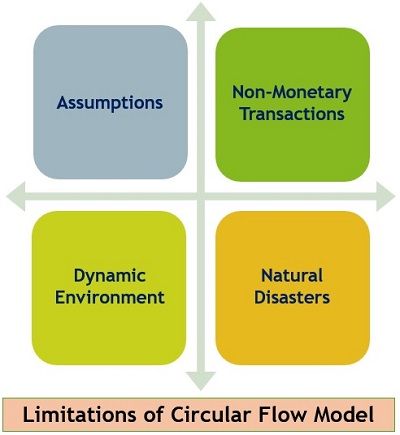

Limitations of Circular Flow Model

-

- Assumptions: These models are based on assumptions. It does not provide a clear picture of the economic equations.

- Non-Monetary Transactions: Non-monetary transactions are excluded from the model.

- Dynamic Environment: The dynamic environment leads to continuous changes in the economy.

- Natural Disasters: Natural disasters cause huge damage to the country’s economy. But, the decrease in money flow due to disasters is not considered.

Final Words

All in all, the circular flow model provides an idea about the working of the economy. It shows the flow of money among economic sectors through two, three and four sector models. The flow of income impacts the National Income of the country. Leakage and injections also affect the cycle by increasing or decreasing money flow.

There should be a balance in the flow of income in the economy. It may be achieved by the Fiscal and Monetary policies of the country.

Dwyane Hector L. Barrientos says

Thanks for the informative post