Definition: Reverse Stock Split merges companies’ stocks into fewer units in the Financial Market. It is the complete converse of the Stock Split. Moreover, it is the company’s strategic decision to convert the number of existing shares to fewer yet more valuable ones. The split takes place based on a predetermined ratio.

It is also known as Stock Consolidation, Share Rollback and Stock Merge.

A reverse stock split leads to a reduction in the number of shares. However, the market capitalization of the company remains unchanged. It only changes the distribution pattern of shares.

A reverse stock split leads to a reduction in the number of shares. However, the market capitalization of the company remains unchanged. It only changes the distribution pattern of shares.

Post split, the outstanding shares reduce in number. On the other hand, there is a significant boost in the per-share price.

Top-level management mostly takes this decision after detailed analysis and discussion.

It is adopted mainly by the penny stock companies in the stock market. It is also observed that struggling companies in the stock exchanges go for it.

Sometimes company’s share prices may degrade to the extent that they lose a significant value. And if this situation persists, the company may even get delisted from the exchange. Due to this fear, they adopt share consolidation as a strategy to induce the share price.

Content: Reverse Stock Split

Stock Split

Before moving further, let’s understand what a stock split is.

It is a situation where companies divide the existing shares into multiple shares. The motive behind practising a stock split is to increase liquidity by reducing the share price.

It is also known as Forward Stock Split.

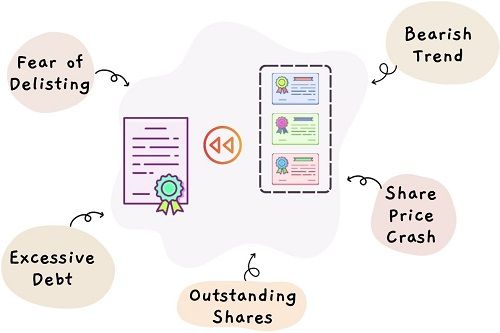

Reasons behind Reverse Stock Split

Companies go for a reverse stock split for a variety of reasons. However, it is purely a strategic decision of the company as some giant companies have also opted for it.

Some common reasons that may lead to it are as follows:

- Bearish Trend: Companies’ stocks are depicting a bearish trend for a notable time.

- Share Price Crash: The share price is reduced to a number that it may get delisted.

- Outstanding Shares: A large number of low-priced shares are being traded on the exchange.

- Excessive Debt: The company owes a huge loan and suffers from excessive debt.

- Fear of Delisting: Companies mostly conduct shares rollback out of fear of being delisted from the exchange.

Example

Suppose the company’s share capital is $70,000/-, which breaks down to 7000 shares of $10/- each. The company has announced a Reverse Stock Split of 5:1, considering the decline in the share prices on the stock exchange.

Now, let’s see the subsequent changes due to share consolidation on the Company and Shareholders.

Company

Post-split, the total number of shares will be 1400 shares (7000/5).

Whereas, the share price will be $50/- per share (10 × 5).

So, the Market Capitalization will be $70,000/- (1400 × 50).

Shareholder

The holders with 40 shares of $10/- per share will now be replaced with 8 shares of $50/- each.

Advantages

Performing a shares consolidation outlines the following advantages to the company:

- Post-stock consolidation, there is a hike in the market price of shares.

- Due to the distribution pattern changes, shares’ face value increases.

- The reduction in the number of shares ultimately decreases the transaction cost.

- The conversion of multiple shares into fewer shares reduces the outstanding shares in the books.

- It helps save the company’s brand image that was ruined due to lower share prices.

- In the long run, the shares will remain concentrated in fewer hands.

- The stock charting also remains the same as everything adjusts proportionately.

Disadvantages

The company suffers the following disadvantages post reverse stock split:

- After consolidation, the investors with few shares might sell off their shares.

- The announcement about the reverse split may hamper the investor’s perception about the company.

- The new investors may hesitate to invest in such a company due to trust issues.

- We have learned above that there is an increase in share price. So, the renewed share prices might look expensive.

- The existing investors may lose faith in the company.

- Post reverse split, the company may south to be a struggling company.

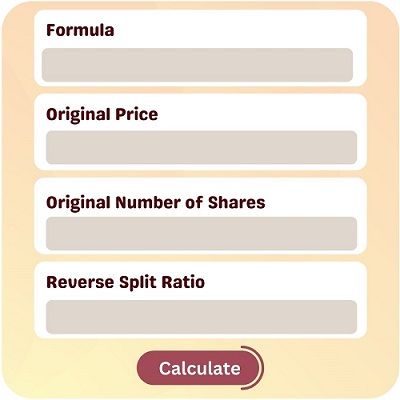

Reverse Stock Split Calculator

It helps estimate the number of shares owned and the changed share price post-split. You need to input the original share price, your current holding and the reverse split ratio.

Generally, the formula used for calculation is:

NP = OP/SP

where,

NP depicts the new stock price,

OP is the original share price,

SP is the reverse stock split ratio

Reverse Stock Split – Good or Bad

We cannot ignore the fact that the companies take this decision in their rough patch. Specifically when there comes a fear of being delisted.

This leaves a negative impression on the customer’s mind. Moreover, it portrays that the company’s shares are crashing, and it is falsely amplifying it.

In addition, the companies performing reverse split multiple times don’t attract new investors. And some shareholders may even dilute their holdings and encash their stocks.

The bottom line is that the stock split is not a good signal, so companies must avoid it.

What does a reverse stock split mean?

It is basically the conversion of stocks into smaller numerical units. It is merely an accounting change in the company’s stock distribution structure.

How to profit from a reverse stock split?

We’ve learnt that a share consolidation does not affect the investors. Still, existing and potential investors could make a profit out of it in the following ways:

- The small units that are insufficient in accord with the specified reverse split ratio may round up to a full share. That is, if the ratio for split is 6:3 and some holder has 5 shares in his account, he will also get 3 shares in his account.

- Purchasing shares before a reverse split and selling them off at an increased price. By doing this, they make a profit from the price variations. But, this is risky, and one can also suffer loss if the share price falls further.

How does reverse stock split work?

The math behind the reverse stock split is nothing but conversion and replacement.

The company take back the existing shares from the holders and replace them with fewer ones. This conversion is based on a predetermined ratio decided by the company.

For example, if the company announces a reverse split for 2:1, then the holders with 4 shares will be replaced with 2 in their respective accounts.

Leave a Reply