Definition: Investment Portfolio management refers to the analysis of various investment opportunities, selection and formation of the most suitable investment blend to fulfil the objective, revision and evaluation of the investment portfolio from time to time and implementation of the required changes.

The companies or individual investors tend to hire an investment portfolio manager to look after their funds.

Content: Investment Portfolio Management

Investment Portfolio

Different investment options have different risk levels, and yields separate returns in different periods. Thus, to minimise risk and maximise profits, a portfolio manager chooses to invest in multiple options. This combination of selective investments is known as the investment portfolio.

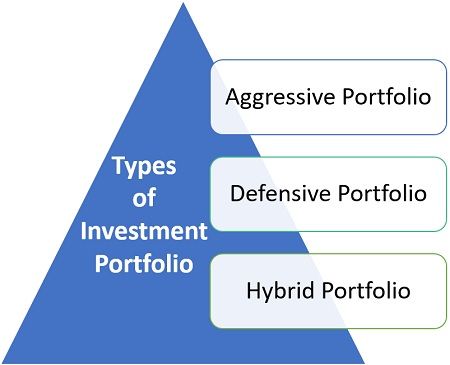

Types of Investment Portfolio

- Aggressive Portfolio: An aggressive portfolio comprises of high-risk investments like commodities, futures, options and other securities expecting high returns in the short run.

- Defensive Portfolio: Defensive portfolio comprises of stocks with low risk and stable earnings — e.g. investments in high quality, blue-chip stocks.

- Hybrid Portfolio: This portfolio is the most balanced and commonly used portfolio by the portfolio manager. A right combination of different kind of assets is seen where some are high risk-high return profile others are low risk-low return ones.

Factors Influencing Investment Portfolio Management

Investment portfolio needs to be planned considering the various factors related to the investor’s attributes. The significant factors influencing investment portfolio management are discussed below:

- Time Span: Type of investment is selected by the period for which the investor is willing to invest the sum. Investment in stock and equity must be for long-term to yield high returns.

- Age of Investor: The age of investor decides the type of investment, risk-taking ability and the returns yield. A young investor may be able to take a high risk as well as pool funds in long-term investments to earn higher returns and vice-versa.

- Risk Tolerance Level: The level of risk which an investor is willing to take, influences the investment portfolio. Investors belonging to the low-income group or older may not be ready to invest in high-risk assets.

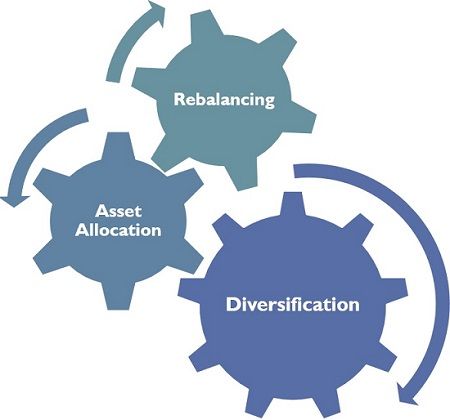

Ways of Investment Portfolio Management

Investment is not a hit and trial method; it is all about going for a properly planned strategy. To create a useful portfolio, we must first understand the following ways of investment portfolio management:

- Diversification: The returns of some investments are unpredictable, and thus, the risk involved in it is quite high. But when a diversified portfolio is prepared by combining such investments with the secured ones, the risk becomes moderate, and the returns are reasonably fair.

- Asset Allocation: Asset allocation is the combination of volatile and non-volatile assets in which an investor is willing to invest. A portfolio manager must create a balanced portfolio to seek high returns and minimise risk for investors.

- Rebalancing: The portfolio manager needs to evaluate the client’s portfolio from time to time and revise the ratio of investment in different assets (volatile and stable assets) to avail of high value. Rebalancing lets the investor make use of future opportunities and brings in flexibility.

Process of Investment Portfolio Management

A step by step sequence needs to be followed to achieve the desired results. The same is elaborated below:

- Identification of Investment Objectives: The portfolio manager clearly understands the client’s investment objective. It can be either capital appreciation or stable returns.

- Estimation of Capital Market: The expected returns and risk involved in the various capital market assets are analysed and compared.

- Decision Regarding Asset Allocation: Decisions regarding the ratio or combination of different assets like stocks and bonds are taken wisely to generate better returns at minimal risk.

- Formulation of Portfolio Strategy: Accordingly, a strategy for investment duration and risk exposure is formulated.

- Selection of Securities and Investment: The assets are analysed on fundamental, technical, maturity, credibility and liquidity grounds. The best options are selected out of the proposed ones.

- Implementation: The planned portfolio is executed by investing in the selected investment options.

- Revision and Evaluation of Portfolio: The portfolio is evaluated at regular intervals, and the scope of improvement or better opportunities are analysed.

- Rebalancing the Portfolio: Necessary steps to improve the portfolio are taken by rebalancing the ratio of investment and the assets to enhance the efficiency of the investment portfolio.

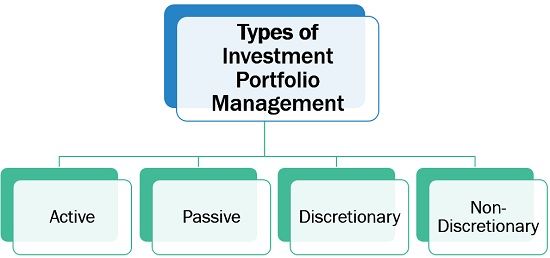

Types of Investment Portfolio Management

The portfolio manager has to follow a style or a combination of methods of different portfolio management. Based on these styles, the following types of investment portfolio management are described:

- Active: In, active investment portfolio management, the portfolio manager is mainly concerned about making better returns than expected for his clients. He depends on financial hypothesis and past experiences and actively participates in the market by buying and selling stocks regularly.

- Passive: Passive portfolio management focuses on a robust portfolio based on the present market scenario. It aims at stable returns in a long-term period.

- Discretionary: In discretionary investment portfolio management, the investor hands over the investment fund to the portfolio manager to handle his investment portfolio, complete relevant documents and take related decisions on his behalf.

- Non-Discretionary: The portfolio manager can only advise and suggest his clients on different investment opportunities. He does not have the authority to make any decisions on their behalf.

Objectives of Investment Portfolio Management

To understand the need for investment portfolio management, it necessary to go through its goals. The below description will help you know about the necessity for investment portfolio management.

- Investment portfolio management aims at capital growth and seeks for the appreciation of the investment value or net present value.

- It strategises the gradual return on investments to create maximum value.

- Diversification of funds leads to stability and security against market uncertainties.

- It provides flexibility to switch among different investment options at any point in time to avail better opportunities.

- Regular evaluation of the well-diversified portfolio optimises the risk of loss.

- It helps the investors to make the best possible use of their funds by creating the most appropriate portfolio.

- With the practice of right asset allocation, diversification, and rebalancing the prepared portfolio, the efficiency of the investment portfolio improves significantly.

Conclusion

With the emergence of multiple investment opportunities, possessing different risk levels and varying returns, the investors found the need for expert guidance and support; to create the best possible value out of their funds. Thus, Investment Portfolio Management has gained vital importance among investors.

Leave a Reply