Definition: Cash Management refers to the collection, handling, control and investment of the organizational cash and cash equivalents, to ensure optimum utilization of the firm’s liquid resources. Money is the lifeline of the business, and therefore it is essential to maintain a sound cash flow position in the organization.

Receivables Cash Management

Any amount which the company has earned however not yet received, i.e. its outstanding and is expected to be received in future, is known as receivables.

An organization must manage its receivables to maintain the surplus cash inflow. It helps the firm to fulfil its immediate cash requirements.

The cash receivables must be planned in such a way that the organization can realise its debts quickly and should allow a short credit period to the debtors.

Payables Cash Management

The payables refer to the payment which is unpaid by the organization and is to be paid off shortly.

The organization should plan its cash outflow in such a manner that it can acquire an extended credit period from the creditors.

This helps the firm to retain its cash resources for a longer duration to meet the short term requirements and sudden expenses. Even the organization can invest this cash in a profitable opportunity for that particular credit period to generate additional income.

Content: Cash Management

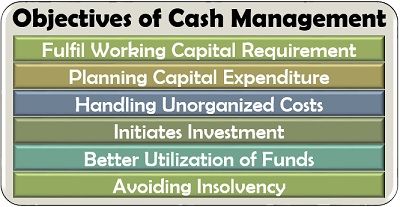

Objectives of Cash Management

Why do we need to manage cash flow in the organization? What is the use of cash management in the business?

Following purposes of cash management will resolve the above queries:

- Fulfil Working Capital Requirement: The organization needs to maintain ample liquid cash to meet its routine expenses which possible only through effective cash management.

- Planning Capital Expenditure: It helps in planning the capital expenditure and determining the ratio of debt and equity to acquire finance for this purpose.

- Handling Unorganized Costs: There are times when the company encounters unexpected circumstances like the breakdown of machinery. These are unforeseen expenses to cope up with; cash surplus is a lifesaver in such conditions.

- Initiates Investment: The other aim of cash management is to invest the idle funds in the right opportunity and the correct proportion.

- Better Utilization of Funds: It ensures the optimum utilization of the available funds by creating a proper balance between the cash in hand and investment.

- Avoiding Insolvency: If the business does not plan for efficient cash management, the situation of insolvency may arise. It is either due to lack of liquid cash or not making a profit out of the money available.

Cash Management Models

Cash management requires a practical approach and a strong base to determine the requirement of cash by the organization to meet its daily expenses. For this purpose, some models were designed to determine the level of money on different parameters.

The two most important models are discussed in detail below:

Let us now elaborate on each of these models:

The Baumol’s EOQ Model

Based on the Economic Order Quantity (EOQ), in the year 1952, William J. Baumol gave the Baumol’s EOQ model, which influences the cash management of the company.

This model emphasizes on maintaining the optimum cash balance in a year to meet the business expenses on the one hand and grab the profitable investment opportunities on the other side.

The following formula of the Baumol’s EOQ Model determines the level of cash which is to be maintained by the organization:

Where,

Where,

‘C’ is the optimum cash balance;

‘F’ is the fixed transaction cost;

‘T’ is the total cash requirement for that period;

‘i’ is the rate of interest during the period

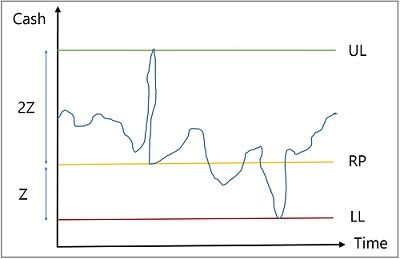

The Miller – Orr’ Model

According to Merton H. Miller and Daniel Orr, Baumol’s model only determines the cash withdrawal; however, cash is the most uncertain element of the business.

There may be times when the organization will have surplus cash, thus discouraging withdrawals; instead, it may require to make investments. Therefore, the company needs to decide the return point or the level of money to be maintained, instead of determining the withdrawal amount.

This model emphasizes on withdrawing the cash only if the available fund is below the return point of money whereas investing the surplus amount exceeding this level.

Given below is the graphical representation of this model:

Where,

Where,

‘Z’ is the spread of cash;

‘UL’ is the upper limit or maximum level

‘LL’ is the lower limit or the minimum level

‘RP’ is the Return Point of cash

We can see that the above graph indicates a lower limit which is the minimum cash a business requires to function. Adding up the spread of cash (Z) to this lower limit gives us the return point or the average cash requirement.

However, the company should not invest the sum until it reaches the upper limit to ensure maximum return on investment. This upper limit is derived by adding the lower limit to the three times of spread (Z). The movement of cash is generally seen across the lower limit and the upper limit.

Let us now discuss the formula of the Miller – Orr’ model to find out the return point of cash and the spread across the minimum level and the maximum level:

Where,

Where,

‘Return Point’ is the point at which money is to be invested or withdrawn;

‘Minimum Level’ is the minimum cash required for business sustainability;

‘Z’ is the spread across the minimum level and the maximum level;

‘T’ is the transaction cost per transfer;

‘V’ is the variance of daily cash flow per annum;

‘i’ is the daily interest rate

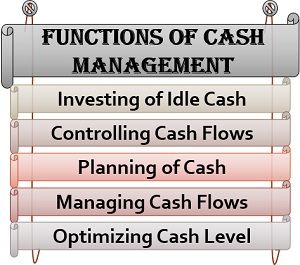

Functions of Cash Management

Cash management is required by all kinds of organizations irrespective of their size, type and location. Following are the multiple managerial functions related to cash management:

- Investing Idle Cash: The company needs to look for various short term investment alternatives to utilize surplus funds.

- Controlling Cash Flows: Restricting the cash outflow and accelerating the cash inflow is an essential function of the business.

- Planning of Cash: Cash management is all about planning and decision making in terms of maintaining sufficient cash in hand and making wise investments.

- Managing Cash Flows: Maintaining the proper flow of cash in the organization through cost-cutting and profit generation from investments is necessary to attain a positive cash flow.

- Optimizing Cash Level: The organization should continuously function to maintain the required level of liquidity and cash for business operations.

Cash Management Strategies

Cash management involves decision making at every step. It is not an immediate solution but a strategical approach to financial problems. Following are the strategies of cash management:

Business Line of Credit: The organization should opt for a business line of credit at an initial stage to meet the urgent cash requirements and unexpected expenses.

Money Market Fund: While carrying on a business, the surplus fund should be invested in the money market funds. These are readily convertible into cash whenever required and yield a considerable profit over the period.

Lockbox Account: This facility provided by the banks enable the companies to get their payments mailed to its post office box. This lockbox is managed by the banks to avoid manual deposit of cash regularly.

Sweep Account: The organizations should avail the facility of sweep accounts which is a mix of savings and fixed deposit account. Thus, the minimum balance of the savings account is automatically maintained, and the excess sum is transferred to the fixed deposit account.

Cash Deposits (CDs): If the company has a sound financial position and can predict the expenses well along with availing of a lengthy period, it can invest the surplus cash in the cash deposits. These CDs yield good interest, but early withdrawals are liable to penalties.

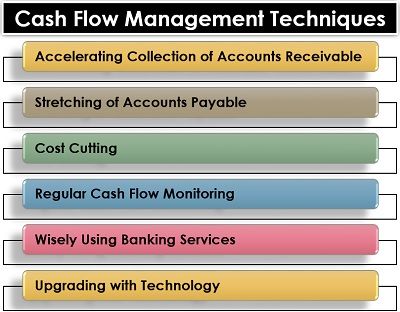

Cash Flow Management Techniques

Managing cash flow is a contemplative process and requires a lot of analytical thinking. The various techniques or tools used by the managers to practice cash flow management are as follows:

- Accelerating Collection of Accounts Receivable: One of the best ways to improve cash inflow and increase liquid cash by collecting the debts and dues from the debtors readily.

- Stretching of Accounts Payable: On the other hand, the company should try to extend the payment of dues by acquiring an extended credit period from the creditors.

- Cost Cutting: The company must look for the ways of reducing its operating cost to main a good cash flow in the business and improve profitability.

- Regular Cash Flow Monitoring: Keeping an eye on the cash inflow and outflow, prioritizing the expenses and reducing the debts to be recovered, makes the organization’s financial position sound.

- Wisely Using Banking Services: The services such as a business line of credit, cash deposits, lockbox account and sweep account should be used efficiently and intelligently.

- Upgrading with Technology: Digitalization makes it convenient for the organizations to maintain the financial database and spreadsheets to be assessed from anywhere anytime.

Limitations of Cash Management

Cash management is an inevitable part of business organizations. However, it has a few shortcomings which make it unsuitable for small organizations; these are as follows:

Cash management is a very time consuming and skilful activity which is required to be performed regularly.

As it requires financial expertise, the company may need to hire consultants or other experts to perform the task by paying administrative and consultation charges.

Small business entities which are managed solely, face problems such as lack of skills, knowledge, time and risk-taking ability to practice cash management.

senthil says

Respected Madam

I hereby thank you for your valuable contribution to the enhancement of my existing knowledge of cash management. Thanking you again for further contributions.

with Regards S. Senthil

Raynalyn says

’tis indeed helpful :). thank you!

Okeru Adaeze says

Thanks for enlightenment while staying safe in this covid 19.

ashenafi says

thank you for your explanationation,next time i need the asset management explanation;;