Definition: Unit linked insurance plan (ULIP) is a bundled financial product proposed for those investors who need a life cover as well. It comprises of insurance benefit along with investment opportunity, to serve the dual purpose of safety and wealth maximization to the investors.

ULIP was developed in India and is widely known for its tax-saving benefits among the investors. Thus, it is a long-term investment scheme for those individuals who look forward to tax relaxation.

A unit-linked insurance plan (ULIP) can serve the multiple financial goals of the investors. Its insurance feature grants a life cover to the insured or investor. Also, its investment feature backs the retirement goals, child education or marriage and wealth maximization in the long run.

Content: Unit Linked Insurance Plan (ULIP)

How do ULIPs work?

When an investor goes for a ULIP, he/she get a life cover along with the mutual fund investment opportunity.

The insurance company obtains the premium from the investors.

This amount is partly contributed to the insurance plan, while the remaining of it is invested in the shares and bonds of the investor’s choice, after deducting the initial charges.

The fund manager is accountable for investment portfolio management. Also, the investors have the advantage of shifting from equity to debt or back-forth in case they are not satisfied with their investment portfolio.

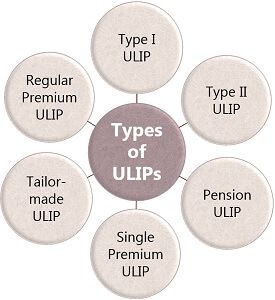

Types of ULIPs

There are numerous forms of unit-linked insurance plans available in the financial market to meet the varying demands or goals of the investors.

Let us discuss some of the utmost basic ones out of these:

- Type I ULIP: With nominal premium, in this scheme, if the policyholder dies, then the dependent is liable to receive the guaranteed sum or the fund value (whatever is greater).

- Type II ULIP: The policyholder pays a higher premium for this ULIP policy since on his/her death, the family is entitled to receive the assured sum as well as the fund value.

- Pension ULIP: This ULIP is uniquely moulded to serve the retirement needs of the investor. The policyholder receives annuity on retirement.

- Single-Premium ULIP: In this ULIP, the investor pays out the whole premium amount at once.

- Regular Premium ULIP: However, in the regular premium ULIP, the amount of premium is paid yearly, half-yearly, quarterly or monthly.

- Tailor-made ULIP: The insurance companies provide specially designed schemes to suit the needs of the amateur investors, such as trigger-based, age-based and risk profile based strategies, to name some of these.

Taxation of ULIPs

In India, the ULIP premium of up to Rs. 150000 is exempted from taxable income under Section 80C of the Income Tax Act 1961.

Along with this, the returns which the investor is liable to receive on the maturity of the policy, are also free from taxation under the Income Tax Act 1961’s Section 10 (10D).

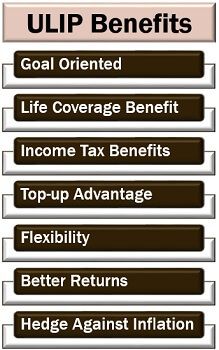

Unit Linked Insurance Plan (ULIP) Benefits

To many investors, ULIP seems to be like a jackpot with its dual advantages. Let us consider the other pros of this investment scheme:

- Goal-Oriented: The investor can get their ULIP customized or adjusted anytime, according to their long-term financial objectives.

- Life Coverage Benefit: One of the crucial features of the ULIP is the life insurance cover it provides to the investor in addition to the investment opportunity.

- Income Tax Benefits: When it comes to tax saving, ULIP is again a robust scheme providing dual tax advantage on both premium and returns.

- Top-up Advantage: The policyholder can put in any additional sum as an extra premium to maximize his/her returns on the ULIP.

- Flexibility: As we have already discussed, in a ULIP, the policyholder can turnabout between debts and equities as per his/her choice.

- Better Returns: Ofcourse, ULIP provides higher returns than the fixed deposits or savings account due to investment in equity funds.

- Hedge Against Inflation: Though yielding less in the initial years because of hefty charges, ULIPs successfully beats inflation in the long run.

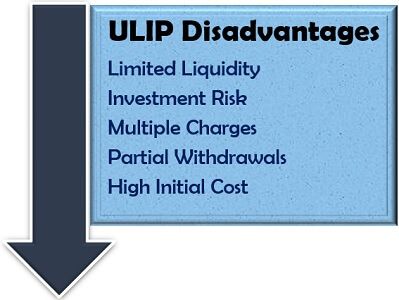

ULIP Disadvantages

Many investment advisors believe that insurance and investment products should not be blended into a single package.

However, ULIP is seen to have the following limitations:

Limited Liquidity: With a long lock-in period, i.e., of five years, the sum invested cannot be withdrawn before it. After this period, if the investor is in the urgency of funds, he/she can partially pull out the invested money that too without much gain (due to high charges applied).

Investment Risk: ULIPs invest in equity funds that are always exposed to market fluctuations or uncertainties.

Multiple Charges: This is scheme is considered to be highly complex due to the imposition of numerous fees. The liabilities include fund management charges, mortality charges, policy administration charges, surrender charges and premium allocation charges.

Partial Withdrawals: Till five years, the investor is strictly prohibited from withdrawing any sum, however after this period only a partial withdrawal is allowed, i.e., say 20% of the total funds.

High Initial Cost: Due to the involvement of multiple charges or fees, the cost of ULIPs is quite high in the stating years, when compared to other investment options.

Investment in Unit Linked Insurance Plan (ULIP)

ULIP is a much-debated instrument in the financial market and therefore, we cannot say that it is beneficial for all.

Before you invest in a ULIP, you must be crystal clear about the following aspects:

Whether ULIP is a Better Option than Your Current Investment and Insurance Schemes

Yes, if you are already investing funds in any of the plans, then comparing it with a ULIP opportunity is essential.

Your Financial Needs or Objectives in the Long Run

The foremost thing to consider the personal financial goals and requirements before going for any investment scheme to fulfil it.

Expected Lock-in Period and Affordability

This decision plays a significant role in your ULIP investment. If you feel that you can afford to strictly block your funds for at least five years, then go for it.

Capacity to Bear Risk

Another crucial factor of a ULIP is that it involves a higher degree of risk due to the investments in equity funds. Also, these instruments are less diversified when compared to other alternatives.

Conclusion

Unit linked insurance plan (ULIP) is a suitable investment opportunity for those who keep sufficient knowledge about the markets and its fluctuations.

For others, it may not be that beneficial since depending upon a financial advisor or fund manager may be quite risky.

Also, if the selected equity funds failed to perform as desired, the poor returns made may wash away in paying ULIP charges.

Leave a Reply