Definition: Liquidity Preference Theory implies that Interest is an economic event determined by two factors, i.e. the Demand for Money and the Supply of Money. The great economist Lord Keynes gave this theory for Interest rate determination.

Conventionally, classical theorists suggested that people only use the money for transaction motives. They keep the money to meet their daily needs and acquire goods and services.

In contrast, as per Keynes, people store some cash besides spending money on necessities. And this money is later used for investment with the motive to earn some reward.

They maintain liquid money to invest it in the capital market instruments like Bonds. He emphasized that money is used for exchange and is also used for Saving and Investment.

According to him, people store their wealth in the form of:

- Money

- Bond

- Government Securities

- Debentures

Among these, Debentures and Bonds demand payment first. After that, we can take advantage of the benefits associated with it. People are ready to block liquidity and prefer to earn rewards.

Keynes proposed this theory in his book based on economics. The book’s name is “The General Theory of Employment, Interest and Money “.

This theory is alternatively known as:

- Keynes Theory of Liquidity Preference

- Liquidity Preference Theory of Interest

What is Liquidity Preference?

Liquidity Preference is the amount of money people hold in cash. It is the term used for money demanded in this theory.

What is an Interest?

Interest is a reward generated by holding the liquidity for some time in some form other than cash.

Content: Liquidity Preference Theory

- Supply of Money

- Demand for Money

- Liquidity Trap

- Variation in the Equilibrium Interest Rates

- Features

- Criticism

- Parting Words

Supply of Money

The money supply is the total quantity of aggregate sum of money that the regulators and banks decide. As per Keynes, it is the summation of the money in circulation and bank deposits.

Demand for Money

In the Keynesian analysis, cash is an asset with the highest liquidity. Thus everyone requires liquid assets with them, and therefore it is demanded.

People sacrifice their liquidity and give their assets in the form of a loan. They receive an amount above the principal amount as a reward for dissolving liquidity.

Keynes explained that people keep liquid money for three causes or motives. He proposed two additional motives besides the Transaction motive. These motives constitute the demand for money in the market.

The causes or motives for holding money are as follows:

- Transaction Motive

- Precautionary Motive

- Speculative Motive

Transactional Motive

As per Keynes, people use a part of their income for daily transactions. They use this money as an exchange medium for goods and services.

This motive is also stated by economists earlier in their theories.

Precautionary Motive

The precautionary motive is the people’s money kept as a precaution against contingencies. It is the money one keeps aside for unforeseen expenses and opportunities.

The money for this motive leads to delays in the receipts and additional expenses. But, to earn more returns, one may maintain less money for Precaution.

Speculative Motive

People store the excess money left after transactions and precautionary motives and invest it in Bonds. They invest this money to generate some interest over the principal amount invested.

People will only invest when they are expected to earn high interest from the market. If they think the Interest is likely to fall, they will keep the money and invest it at higher interest rates.

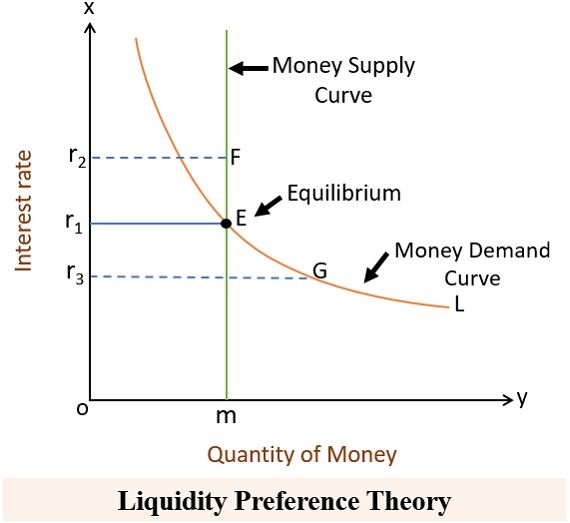

Diagrammatic Representation of Liquidity Preference Theory

The diagram below explains the determination of interest rate with supply and demand.

Where,

- The Interest rate lies on the x-axis.

- The y-axis shows the different quantities of money.

- L is the Demand for Money curve.

- M shows the Supply of Money curve.

- E is the point where L and M intersects. It is the situation of market equilibrium.

- r1 is the determined Interest rate.

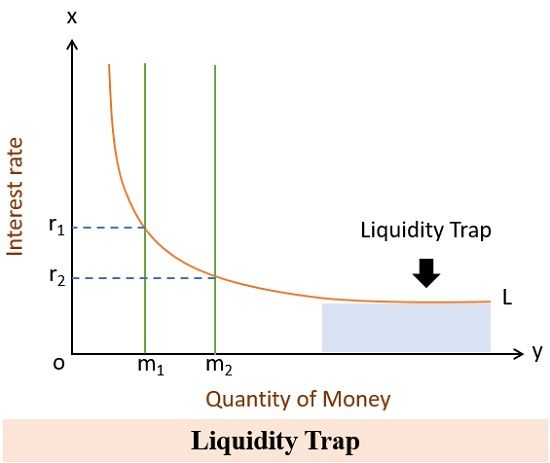

Liquidity Trap

A liquidity trap is when people prefer liquidity over investment in the capital market. Because, there is a fall in the interest rates that makes people indifferent between cash and capital market instruments.

People will continue to prefer liquidity until they expect an increase in interest rates. As they invest to earn a specific reward on their principal amount.

Liquidity Trap- Theory of Liquidity Preference

According to Keynes, there comes a situation when the interest rates are considerably low. Here, people prefer absolute liquidity in place of investment in Bonds.

The people prefer absolute liquidity to hold money and invest at increasing interest rates in the future.

Here,

- The money demand becomes perfectly elastic.

- The interest rates cannot be decreased further by increasing the money supply.

- The monetary policy turns out as ineffective.

- It is a situation of severe economic depression.

The liquidity trap is an excellent contribution to economics by Lord Keynes in this theory.

Graphical representation of Liquidity Trap:

Variation in the Equilibrium Interest Rates

There are variations in the interest rates and market equilibrium. These variations are due to the considerable changes in the demand and supply of money. Let us see the impact on the Interest Rate due to changes in:

- Supply of Money

- Demand for Money

- Transaction Demand

- Speculative Demand

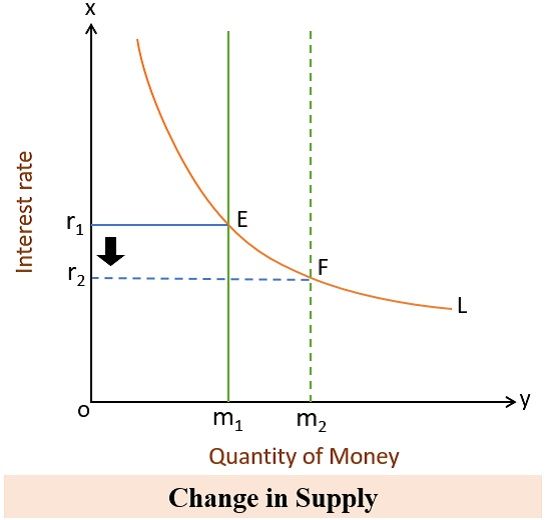

Changes in Supply of Money

When the money supply increases with constant money demand, the rate of interest decreases and vice-versa. Hence, there exists an inverse relationship between supply and interest rate.

If the money supply increases rapidly beyond market equilibrium, the interest rate will fall aggressively and get caught in a liquidity trap.

In this situation, any further increase in supply will not decline the interest rate. Consequently, people will hold cash and stop Investment in Bonds.

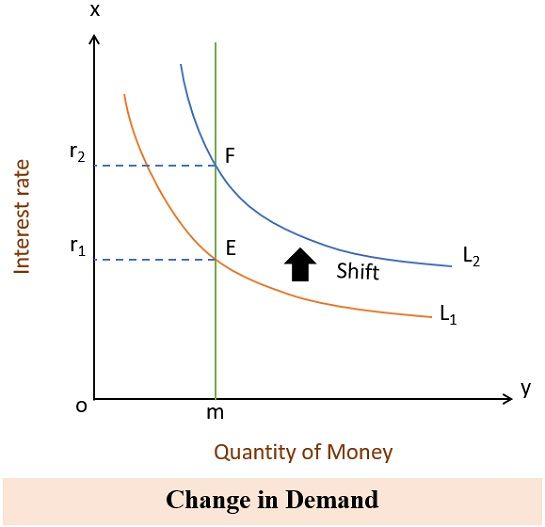

Changes in Demand for Money- Shift in demand for Money Curve

The demand for money changes as the Transactional and Speculative Demand changes.

Changes in Transactional Demand

The increase in income will induce transaction demand resulting in an outward shift in the demand curve. Whereas with the decrease in the income level, the demand curve shifts inwards.

The shift in the demand for money curve will give a new interest rate each time. So, there is a direct relation between transaction demand and interest rate.

Changes in Speculative Demand

The speculation demand is based on the future projections of the people. These projections can be an expected increase or decrease in future interest rates.

If people expect a rate below the regular interest rate, the demand curve moves inwards and vice-versa.

Features

It is among the essential theories of Economics. Its various features are as follows:

- Applicability: It applies to all types of economies except Barter-based economies.

- Monetary Factors: There is an addition of monetary factors in the classical theories of Interest. Earlier, economists believed that Interest is the price of money.

However, according to Keynes, it is a monetary phenomenon regulated by authorities and banks. - Interest influence on Investment: The variations in the interest rates impact the amount of investments. Consequently, there are changes in Income, Production and Employment.

- Economic Policy: Liquidity preference theory helps in the formulation of economic policy. The increment in the quantity of money and the formulation of a cheap monetary policy can influence interest rates.

- Balance: He suggested that the savings and investment balance is due to Income and Employment. The fluctuations in the interest rates do not control it.

Criticism

- Ignorance of Non-Monetary Factors: The theory excludes non-monetary factors. These factors are producers, economic sacrifices and assumed interests.

- Biased: The theory emphasizes more on the demand side in comparison to the supply.

- Interdependency: The interest rate is not independent. The demand for Investment and Interest is interdependent on one another.

- Restricted to Monetary Economy: It is applicable only in a money-driven economy. But not relevant in the economy that follows the Barter system.

- Duration: The theory is suitable for determining interest rates in the short run. However, it is irrelevant in the long run.

- Narrow Approach: It is a narrow approach as it does not consider some factors affecting interest rates. These factors are the marketing efficiency of capital, the propensity to save & consume.

- Ignorance of Real Factors in Interest Determination: Keynes has denied the influence of real factors while determining the interest rate.

- Indeterminant Theory: The equation given by Keynes consists of a single equation and two unknowns. The supply and money curves cannot determine the interest rate without knowing the income level. Thus, like classical and loanable theories, liquidity preference theory is also indeterminant.

Parting Words

To sum up, besides many criticisms, Lord Keynes contributed a lot through the Liquidity Preference Theory. He enlightened the two more causes of holding liquid cash. These are Precautionary and Speculative motives.

As per him, the equilibrium interest rate is when the money demanded equals supply demand. There will be disequilibrium due to the changes in speculative demand.

Hla Moe Kyaw says

Excellent explanation of Liquidity Preference.