Definition: Wealth management is a complete financial assistance package designed for high net worth individuals (HNIs). A wealth manager aims at providing specialized and customized services by developing the most favourable strategy for the client.

Wealth management amalgamates the investment portfolio management with other financial services like tax planning, insurance, retirement planning, education planning, entity planning, risk management, legal planning and estate planning.

Content: Wealth Management

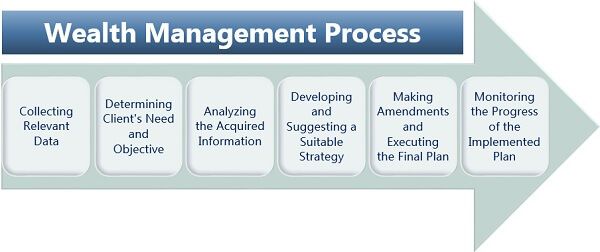

Wealth Management Process

How does a wealth manager provide superior services to the clients? What makes all this possible?

Wealth management is a well planned and organized process involving the following steps:

- The process begins with gathering valuable information about the client’s income, expenses, assets, liabilities, insurance benefits, retirement plans, etc.

- By the inputs received from the client, the wealth manager ascertain his/her objective of long-term investing. The planning can be regarding retirement, education, business, income tax benefits, cash flow management, insurance, etc.

- The wealth manager further assesses or brings together the complete financial data and align with the client’s objectives.

- This 360-degree analysis of all the aspects is taken into consideration for framing the most relevant wealth management strategy.

- The wealth manager discusses this strategy with the client and makes the required changes to it. Later, the final wealth management strategy is put into action.

- As the client’s financial condition or needs fluctuate with time, accordingly the wealth planning can be modified. The client has to keep in touch with the wealth manager for updating such changes timely.

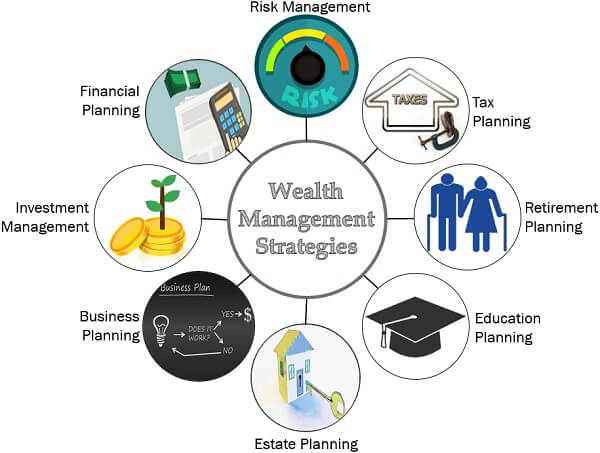

Wealth Management Strategies

Wealth management is multidimensional. It has multiple components which pave the way for the successful attainment of the long-term objectives.

Let us now discuss the various types of plans or ways of wealth management:

Financial Planning: The foremost aim of wealth management is to wisely handle the finances of an individual to achieve future goals.

Tax Planning: For high net worth individuals, wealth management is a means of tax saving strategy by availing various deductions and credit schemes.

Retirement Planning: Wealth management services add a favourable retirement plan along with the vital strategy of the individuals to ensure a secured future.

Estate Planning: Inheritance or passing on of assets to the forthcoming generations is also one of the objectives of the individuals. Thus, wealth managers are also responsible for the preparation of the client’s will, that initiates the transfer of assets to the inheritance.

Investment Management: Savings are useless if not invested. Therefore, wealth managers systematically plan and pool in the client’s capital in constructive long-term investment funds. A wealth manager evaluates the net present value of the client’s investment and projects to estimate the highest possible returns.

Risk Management: A wealth manager evaluates, calculates and designs strategies to mitigate the financial risk involved in a specific investment opportunity.

Business Planning: A business enterprise can be operated more effectively if the finance and accounting practices are backed up by the wealth management strategies.

Education Planning: Also, if an individual aspires to pursue higher studies, or desires to maintain sufficient funds for his/her child’s future education, wealth management can help to a great extent.

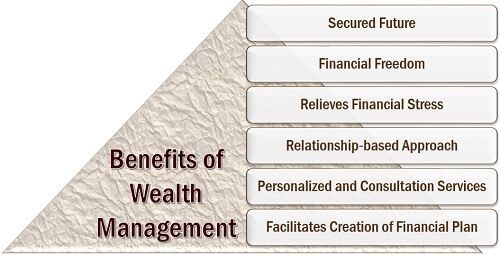

Benefits of Wealth Management

Management of wealth involves proper planning of an individual’s finance, investments, assets and future all together.

Let us now understand some of the prominent advantages of wealth management:

- Secured Future: Wealth management provides future security to the individual and his/her family, thereby realising the retirement goals, medical needs or other objectives.

- Financial Freedom: It strengthens the financial position of the investors and paves the way for attaining the desired objectives.

- Relieves Financial Stress: When an individual can fulfil his/her necessities, health and safety needs or other higher-order needs, he/she experiences ample satisfaction.

- Relationship-based Approach: A wealth manager significantly shows the path towards success. It promotes the development of interpersonal skills; along with sharing of ideas, thoughts and perception with the investors.

- Personalized and Consultation Services: The concept of wealth management has evolved to such an extent that the wealth managers render customized services. Also, they act as financial consultants to the clients.

- Facilitates Creation of Financial Plan: Wealth management is a one-stop destination for the clients looking forward to investment opportunities, tax benefits, building assets, securing future and mitigating risk.

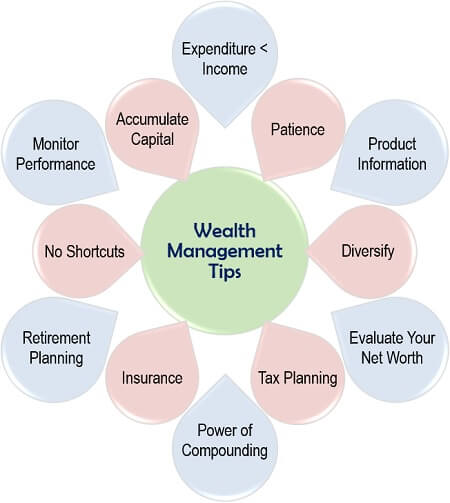

Wealth Management Tips

Wealth management is a sheer game of smartly handling your earnings, savings, expenses and investments.

Given below are some of the suggestions to intelligently manage your wealth:

Patience

Every investment entails a certain level of uncertainty, and the returns cannot be accurately predicted. Therefore, the investor should have the capability to handle risk, to avail impressive gains in the long term.

Expenditure Diversify

The investors should have a well-blended portfolio with different kind of assets, comprising of equity and debts. It not only minimizes the risk but also initiates capital savings.

Product Information

Before allocating your hard-earned wealth, gather complete knowledge about the investment product, you are about to invest in.

Insurance

Insurance is equivalent to savings when it comes to substantial medical bills or other such expenses. Therefore, every individual should have an adequate insurance plan to deal with uncertainties.

Tax Planning

The investors should estimate and efficiently plan for the tax payable by him/her on the investment returns made in the long-term.

Evaluate Your Net Worth

One of the crucial things every individual should know is his/her real worth, i.e., the assets minus liabilities. It acts as a mirror reflecting your actual financial position.

Power of Compounding

Investing in the various funds can provide compound returns on the investment value, creating a remarkable wealth for the investor.

Retirement Planning

Always consider the after retirement needs in your wealth management plan to remain financially equipped for the future.

Monitor Performance

Making investments or hiring a wealth manager is not just enough. The individual should continuously examine his/her portfolio to avoid any uncertainty.

Accumulate Capital

Money is not a small term in wealth management. The investor should make efforts to save funds so that a fair amount of capital is concentrated.

No Shortcuts

The investor should understand that there can be no quick alternative to wealth creation; instead, it is a result of making wise and long-term investments.

Conclusion

Wealth management has gained notoriety in the various parts of the world with growing needs for financial assistance. 1% of the total world population comprises of high net worth individuals (HNIs).

Today, affluent investors rely more on talented wealth managers, instead of investment portfolio managers, due to their extensive services.

Leave a Reply