Definition: Deferred tax asset (DTA) refers to the excess tax paid or carried forward by the company in the current year as per the income tax provisions. However, such excess tax amount does not get recognition in the books of accounts during the same period. To accurately record this tax difference in the books, an intangible asset is created.

In simple terms, the taxable income exceeds the accounting income. Thus, the company end up paying additional tax, in comparison to the tax value presented in the income statement. Hence, a deferred tax asset is used for the tax deduction in the subsequent years.

Content: Deferred Tax Asset (DTA)

Understanding the Differences

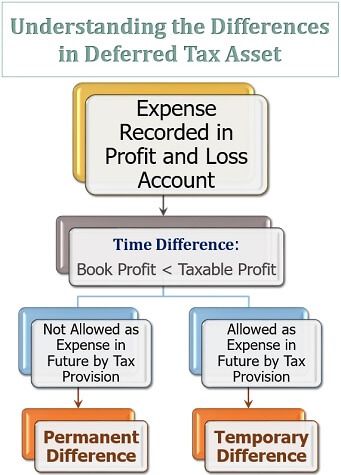

The primary reason behind deferred tax concept is the time difference in recording of the expense in the profit and loss account, as shown below:

Some expenses that are recorded in the books today are allowed as expenses in the future, by the tax provision. But many other expenses do not qualify for any such consideration.

Now let us see what happens to these expenses:

- Permanent Differences: The payments which do not qualify for a deduction in future as well, by the tax provision, result in the permanent difference. The deferred tax asset cannot adjust these expenses.

- Temporary Differences: The expenses which are allowed for future deductions by the tax provision make temporary differences in the books of accounts. Therefore, these can be adjusted through the deferred tax asset.

Deferred Tax Asset Recognition

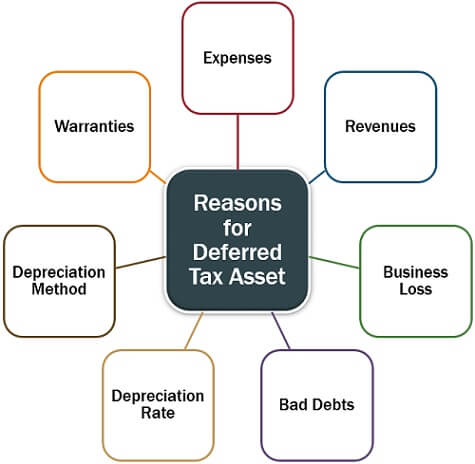

Deferred tax asset is created to record the over-taxation in the books of accounts. Some of the related reasons are as follows:

Expenses

Certain expenses recorded in the income statement but are not allowed as a deduction in the same year, by the tax authority during computation of taxable income. Thus, an additional tax paid on such expenses is taken into account as a deferred tax asset.

For instance; income tax is chargeable on rent paid in advance; however, it has been deducted as an expense in the income statement.

Revenues

A particular income is taken into consideration by the tax authority even before its actual recognition in the income statement. This leads to an increase in taxable income. Therefore, to record this excess tax in accounting, a deferred tax asset is created.

For instance; interest due but not received is taxable in the same year as per tax provision but not considered in the income statement.

Business Loss

In case the company incurs a loss in the current year, it can create a deferred tax asset. Since, the tax provision allows business entities to carry forward the loss, for setting it off against the income earned in the consecutive years.

For instance; loss of ₹250000 in the year 2018 can be adjusted against the profit of ₹1100000, in the year 2019. If income is taxable @ 30%, deferred tax asset amounts to ₹75000.

Bad Debts

The companies make a provision for bad debts; however, the tax authority does not allow it as a deduction until the bad debts are written off. This leads to an increase in the company’s taxable income and the creation of a deferred tax asset takes place.

Depreciation Rate

The rate of depreciation on the same asset may vary for the tax authority, and the companies act to a great extent.

When the depreciation rate as per the tax provision is less, however in the books of accounts the asset is depreciated at a higher percentage, the taxable income also increases. Therefore, the excess tax amount is recorded in a deferred tax account.

For instance; depreciation on machinery is 25% as per statements but 15% according to the tax provision; this excess 10% depreciation increases the taxable profit.

Depreciation Method

There are many different depreciation methods used in the accounting procedure to deplete the value of various assets. The technique adopted by tax authority varies from that of accounting standards.

In such a case, the depreciation charged in the books may exceed the amount allowed by the tax provision. Thus, it again hikes the taxable profit, and the excess tax amount is then entered in the deferred tax asset.

For instance; tax provision accounts depreciation of machinery on written down value method whereas, in the books, straight-line depreciation method is used. In the second year, the depreciation amount as per tax authority is less than that in the books, ultimately increasing the taxable profit.

Warranties

The goods manufacturing companies usually consider future returns and warranties as expenses. However, such assumptions are not allowed for deduction by the tax provision until it occurs. Therefore, the tax payable on these expenses is written down in the deferred tax asset.

For instance; the company assumes ₹50000, i.e., 5% of sales as future returns and warranties in accounting, but tax provision does not consider it for deduction during the computation of taxable income.

Deferred Tax Asset Example

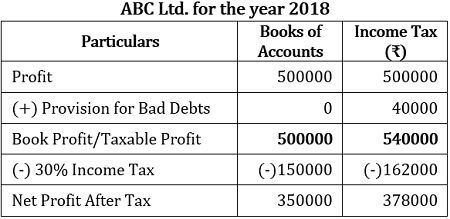

ABC Ltd. marked a profit of ₹500000 in the year 2018. This profit was computed after deducting the provision for bad debts of ₹40000. The transaction was recorded in the accounts. However, for taxation purpose, until the bad debts are written off, it cannot be considered as a loss.

In the year 2019, the book profit was computed is ₹600000. Also, the company writes off bad debts for Rs 40000, which were earlier considered as doubtful debts and recorded as a provision for bad debts.

If the tax rate is 30%, find out the income tax expense, deferred tax asset and tax payable for the year 2018. Also, pass the related journal entries, in the books of ABC Ltd.

Solution

Let us see how a deferred tax asset is created in the above problem:

Deferred Tax Asset Calculation

We know that the provision for bad debts is not allowed as a deduction in income tax, but we have already deducted it from the profit. Therefore, we need to add this amount of ₹40000 back to the income, to acquire the taxable gain. Given below is its computation:

Analysis

From the above table, we obtain the following information:

- On analyzing the time difference, we found that the book profit < taxable profit.

- Also, the tax provision allows bad debts as a deduction in future when it will be written off as a loss.

- Thus it is a temporary difference, and the company needs to pay the tax on this expense in the current year.

- The tax payable according to the books of accounts is ₹150000, but according to income tax, it is ₹162000.

- This excess sum of ₹12000 is the deferred tax which has been charged on the provision for bad debts.

- In the books of accounts, this excess tax amount can be adjusted by considering it as a deferred tax asset.

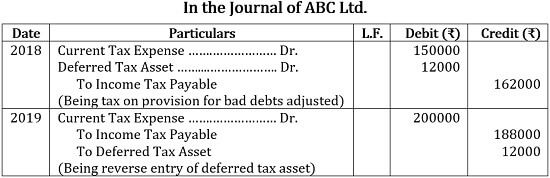

Journal Entries for Deferred Tax Asset

Let us now look at the journal entries for the above illustration:

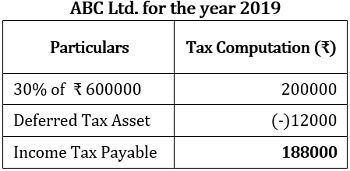

Note: The income tax payable for the year 2019 is computed as follows:

Thus, bad debts of ₹40000 have been taxed earlier in 2018, and therefore, it is not taxable in the year 2019. ABC Ltd. has to pay income tax of ₹188000 now, in the year 2019.

Conclusion

Please note that deferred tax asset is just an intangible asset. It facilitates the recording of any additional tax paid by the company on the surplus income over the gain shown in the income statement, as a result of certain expenses not considered for deduction in the same year by the tax provision.

Leave a Reply