Definition: A non-banking financial company is that financial institution which provides the banking services to the customers without having a banking license. An NBFC needs to be compulsorily registered under the Companies Act 1956 however, it can be owned privately or by the government.

Example

Bajaj Finserv Ltd. is the NBFC belonging to Bajaj Finance Limited. It provides different types of loans, such as capital for small and medium enterprises, corporate finance, vehicle loan, insurance, home loan, wealth management, etc.

Content: Non-Banking Financial Company (NBFC)

Objectives of NBFCs

NBFCs serve the financial needs of individual customers as well as business organizations. The various other purposes of the non-banking financial companies are as follows:

- Provides Long-Term Credits: NBFCs facilitate lengthy credit periods to suit the long term financial needs of the commerce, trade, infrastructure and construction companies, for accomplishing massive projects.

- Growth of National Income: They provide capital to various private companies, accelerating the growth of industries and thus improving the Gross Domestic Product (GDP) of the country.

- Generate Employment Opportunities: By promoting and supporting small and medium enterprises (SMEs), NBFCs indirectly develops job opportunities in the country.

- Movement of Funds: NBFCs are always good for the economy since it mobilizes the funds by transforming the savings into investments and utilizing these funds to provide loans to the companies.

- Better Living Standard: With the growth of industrialization and loans provided by the NBFCs increases the purchasing power of the individuals, ultimately enhancing the standard of living.

- Strengthening the Financial Market: The NBFCs are the soul of the financial market. Most of the startups and SMEs solely rely upon the NBFCs to acquire loans for meeting the capital requirement.

Types of NBFCs

There are different types of NBFCs fulfilling multiple objectives of the investors and the borrowers. These are as follows:

Non-Banking Financial Company-Factors: NBFC-factors is that form of NBFCs which functions as a factoring business. At least 50% of the total assets, is the financial assets, and the business income should constitute at least 50% of the gross income.

Investment Companies: The principal function of an investment company is dealing in securities.

Mutual Benefit Finance Company: These companies invest the money collected by multiple investors or customers having similar investment objective, and pool the clubbed amount into the particular securities or bonds.

Asset Finance Company (AFC): An asset finance company usually provides a loan for the purchase of physical assets. These are used for business or production purpose such as automobiles, machinery, equipment, etc. The income generated by an AFC should not be less than 60% of its total assets or income.

Equipment Leasing Company: The companies which either give out equipment on lease or carry out the financing of such lease contracts are known as equipment leasing company.

Hire-Purchase Company: These companies provide the facility of buying goods on instalment where the hirer, i.e. the buyer needs to pay the amount (principal + interest) regularly in parts; till the total payment is made to the hiree.

Housing Finance Company: The housing finance companies are engaged in providing loans to the clients for constructing or acquiring houses along with the development of the land available.

Loan Company: Except for the AFC, any company sanctioning loans or advances to the public for any activity is called a loan company.

Residuary Non-Banking Company: The RNBCs are engaged in accepting deposits as per specific schemes or arrangements or through other means except the loan company, investment or asset financing.

Infrastructure Finance Company (IFC): These NBFCs grant loans (project loans and term loans) to the companies belonging to the infrastructure sector including social and commercial infrastructure, transport, communication, water, energy and sanitation.

Non-banking Financial Company: Micro Finance Institution (NBFC-MFI): A NBFC-MFI is that NBFC which has at least 85% of assets as qualifying assets, i.e. microfinance or the funds given out as loans; without any collateral and the repayment is in the form of regular instalments.

Infrastructure Debt Fund: Non-Banking Finance Company (IDF-NBFC): With the aim of generating fixed income on the investment value, these NBFCs engage the client’s funds into the infrastructure sector for the long term.

Systematically Important Core Investment Company (CIC-ND-SI): The companies which own a net asset of at least Rs. One hundred crores out of which 90% of the value is invested in the shares and debts while 60% of it must be out into equity shares or other instruments which can be easily converted into cash.

Chit Fund Company: A chit fund company runs, manages and controls various chit schemes by making the subscribers or investors subscribe for such plan by paying the sum in regular instalments up to a specific period. Every subscriber is then liable to receive a prize amount as per the lot, tender or auction.

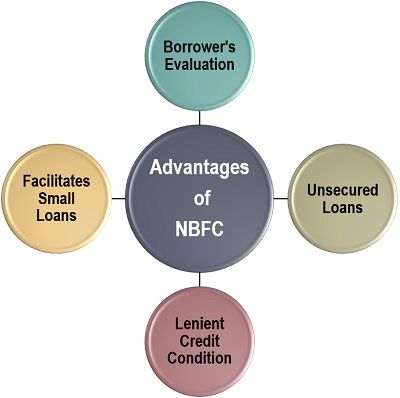

Advantages of NBFCs

NBFCs work parallelly with the banking organizations and function to facilitate loans and advances along with accepting deposits. The various benefits of an NBFC are as follows:

- Borrower’s Evaluation: NBFCs usually verify the credibility of the customer by going through the credit scores and business history of the companies. Thus, making the loans more reliable.

- Unsecured Loans: These financial companies also provide unsecured loans which let the borrower to avail loans without mortgaging any asset or property.

- Lenient Credit Condition: NBFCs offer loans to customers at easy terms and fewer formalities, making it suitable for small business enterprises.

- Facilitates Small Loans: Usually, banks provide high-value business loans, but NBFCs also entertain the smallest of the credit to meet the customer’s needs.

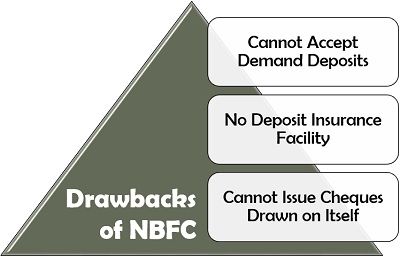

Drawbacks of NBFCs

There are certain limitations which differentiate an NBFC from a bank. These drawbacks are discussed below:

- Cannot Accept Demand Deposits: Since NBFCs lies within the dimension of commercial banks and therefore, they are not liable to accept demand deposits.

- No Deposit Insurance Facility: The depositor cannot avail any insurance facility on the sum deposited with the NBFCs.This is because such financial organizations are not covered under the regulations of Deposit Insurance and Credit Guarantee Corporation.

- Cannot Issue Cheques Drawn on Itself: The country’s payment and settlement system do not cover NBFCs. Thus, not letting them issue the cheques drawn on itself.

In Case of NBFC Non-Payment or Default

The depositor can approach the Consumer Forum or the National Company Law Tribunal and take legal action by filing the suit against the defaulter NBFC.

Leave a Reply