Definition: Wholesale banking refers to the complete banking solution provided by the merchant banks to the large scale business organizations and the government agencies or institutions. To avail the facility of wholesale banking, the companies need to possess a strong financial statement and operate on a large scale. Usually, multinational companies are the clients of wholesale banking.

Wholesale banking is an opportunity to expand the business even for those companies which lack sufficient capital for the purpose.

Content: Wholesale Banking

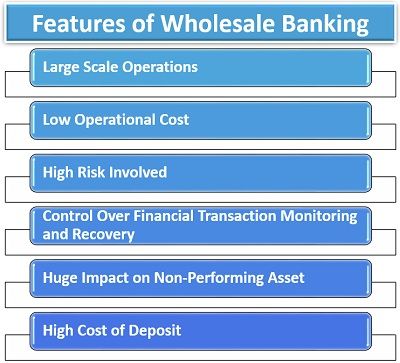

Features of Wholesale Banking

As the name signifies, wholesale banking operates to serve the large scale business objectives.

To know more about the concept, let us understand its various characteristics:

- Large Scale Operations: Wholesale banking majorly meets the enormous financial requirements of the large scale companies and the government.

- Low Operational Cost: The cost of carrying out transactions and other banking operations is quite low due to a limited customer base and few numbers of transactions.

- High Risk Involved: The risk level involved in wholesale banking is very high. T the failure of the borrower company can lead to the collapse of all the parties associated with it.

- Control Over Financial Transaction Monitoring and Recovery: Due to limited customers, it becomes convenient for the banks to monitor the financial transactions and recover the loans and advances.

- Huge Impact on Non-Performing Asset: If there is delay or default in the repayment of loans and advances provided under wholesale banking, the non-performing assets of the bank increases.

- High Cost of Deposit: The interest rates paid by the banks on the deposits made by the substantial business entities is high.

Functions of Wholesale Banking

Wholesale banking is an entirely different concept and does not serve the purpose of small businesses or individual clients.

To understand the various operations performed by the merchant bank, read below:

Primary Functions

Some of the major services performed by wholesale banks are as follows:

- Making Advances: The principal purpose of wholesale banks is to provide loans and advances of high value to the large scale business entities.

- Accepting Deposits: These banks also receive deposits from the big companies and provides high interest on the deposited funds.

- Credit Creation: The wholesale banks increase the flow of funds in the economy by initiating loans and deposits by the government and large scale companies.

Secondary Functions

The banks have some additional responsibilities which hare mentioned below:

- Underwriting: The wholesale bank raises capital for the projects of large business organizations by issuing debt or equity shares to the investors on behalf of the respective companies.

- Mergers and Acquisitions: Through operations like currency conversion, these banks facilitate the merger of two or more companies across the globe and also the acquisition of one business unit by the other is organization.

- Trust and Consultancy Services: The merchant banks provide various other services like investment advice and trust-building to the client companies.

- Fund Management: The merchant banks continuously function towards managing and handling of the funds deposited by the clients wisely.

Response of Wholesale Banks to Market Conditions

Wholesale banks function in the economy and need to adjust and cope up with the market conditions.

Following are the different adjustments and updations made by the merchant banks in this context:

- Global Expansion: Wholesale banks expand to the places where the multinational client companies have branches.

- Wholesale Credit Transformation: A wholesale bank focus on consistent client’s experience, processes, roles and technology used in the credit product and bank’s operations.

- Client Onboarding: The primary concern is enhancing the information, transparency, service speed and experience of the client companies.

- Data Management: The banks control and enhance the security, governance and quality of the confidential data.

- Monetize Mobile Capabilities: These banks facilitate customers with self-service operations and information related to various products and services through mobile channels.

- Platform Modernization, Simplification and Migration: The wholesale banks function to simplify and modernize the business operations by accepting of deposits and providing loans and advances.

- Relationship Management: Building up long term relationship with the clients is essential for the merchant banks.

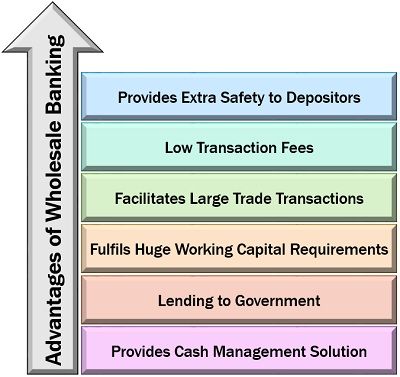

Advantages of Wholesale Banking

We can now say that wholesale banking is a suitable option for the companies which need substantial financial assistance from time to time. ANd also for the ones looking forward to availing the opportunities for growth and development.

The following are other benefits of wholesale banking:

- Provides Extra Safety to Depositors: In wholesale banking, the banks treat the deposited funds with a high level of safety and put the amount in comparatively secured investment opportunities.

- Low Transaction Fees: The banks charge the transaction fees at a discounted rate for the customers of wholesale banking.

- Facilitates Large Trade Transactions: It supports the high-value transactions of the companies operating on a large scale.

- Fulfils Huge Working Capital Requirements: Large business associations require a considerable amount of funds to carry out day to day operations. Thus, wholesale banking accomplishes this need by providing funds for working capital.

- Lending to Government: These banks even lend funds to the government of the country for carrying out various long-term projects.

- Provides Cash Management Solution: Wholesale banking also facilitates effective cash management, i.e. acquisition and investment of cash into the right opportunity.

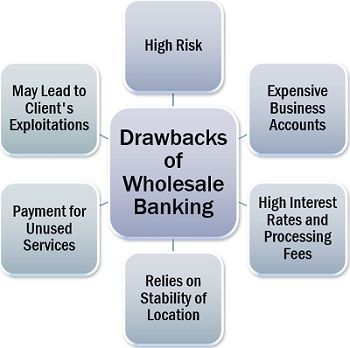

Drawbacks of Wholesale Banking

The transactions of wholesale banking involve a high amount of funds which makes it a complicated affair.

Let us now go through some of the limitations of wholesale banking:

- High Risk: As we know that the lumpsum transactions take place in wholesale banking, there is a high level of risk involved.

- Expensive Business Accounts: Maintaining accounts and records is a costly affair in wholesale banking when compared to traditional bank accounts.

- High-Interest Rates and Processing Fees: The borrower company is liable to pay off high interest and processing fees on loans and advances to the banks.

- Relies on Stability of Location: When the company deposits a large amount at a single location, i.e. the wholesale bank, there is a risk of loss if the bank faces a situation of downfall.

- Payment for Unused Services: In wholesale banking, there is always a complaint that the client companies have to pay even for those services which are not used by them.

- May Lead to Client’s Exploitation: When the borrowed sum is of high value, there are chances that the borrower company may be exploited by the bank.

Wholesale Banking in India

We know that India is a developing country, and with the increasing globalization, Indian firms are converting into multinational companies. These companies operate across the globe and therefore requires enormous funds to serve the working capital requirements, investment needs and other financial obligations.

Even the Indian government promotes medium scale industries to build a reliable infrastructure, facilitate sound market conditions, minimize deficits and for overall economic development. All these factors result in the need for business finance.

In fact, in India, the revenue generated from the banking industry comprises majorly of wholesale banking services. Since, these banks fulfil major corporate requirements such as merchant banking services, project finance, working capital needs, investment banking services, leasing finance, facilitates mergers and acquisitions, etc.

Wholesale banking is a whole sole solution to all the banking requirements of the companies with huge turnover and high net worth facilitating the smooth transfer of funds, proper allocation and investment of excess capital, internal stock transfer, etc.

There is a vast scope for wholesale banking in the Indian banking industry, and it is flourishing rapidly with the increase in globalization and industrialization.

Leave a Reply