Retail Banking and Corporate Banking both are the system of the banking service but are differentiated according to their customer base, i.e., In retail banking banks deal with the general public or individual person face to face; in contrast in corporate banking, the banks deals with large corporate bodies and not the individuals.

However, the purpose of both banking system is the same, i.e., to provide and handle funds of the general public, companies and government.

Retail banking is nothing but a day-to-day banking service used by an individual, and the services offered under retail banking are opening deposit accounts, providing personal loans as well as providing debit and credit card to the desired clients.

In contrast, Corporate banking involves only those services which are provided to the corporate bodies and not to the individual persons such as cash management facilities, asset management facilities and other commercial banking activities, etc.

Content: Retail Banking Vs Corporate Banking

- Difference and Comparison

- What is Retail Banking?

- Features of Retail Banking

- What is Corporate Banking?

- Features of Corporate Banking

- Summary

- Conclusion

Difference and Comparison

| Particulars | Retail Banking | Corporate Banking |

|---|---|---|

| Definition | Retail Banking is a banking service provided to the general public or individual to regulate their funds in saving account or fixed account and to perform various other day-to-day banking transactions like depositing money and opening bank account. | Corporate banking is a commercial banking facility which only deals with small or large companies and corporate bodies and provides services to them such as trade finance, derivate, etc. |

| Products Orientation | Products of retail banking are customer-oriented. | Products of corporate banking is business-oriented. |

| Clientele or Customer's Range | Retail banking has a large clientele portfolio. | Corporate banking has a small clientele portfolio. |

| Handling Charges | In retail banking handling charges are low. | In a corporate banking handling charges are relatively higher than retail banking. |

| Transaction Value | Financial worth of transactions is generally low to medium. | Financial worth of transactions are comparably higher than retail banking. |

| Source of profit | Margin of interest amidst borrowers and lenders is the main source of profit. | Interest and fees charged on the services provided is the main source of profit. |

| Customer Relations | Moderate relationship amidst customer and bank. | High-level relationship amidst customer and bank. |

| Fulfillment of Grievances | Grievance fulfillment may delay because of the large number of clients. | Grievances settled on an urgent basis because of the limited number of clients. |

What is Retail Banking?

Retail banking is a mass-market banking service provided by the banks; it is nothing but banking which a general public knows like opening saving and fixed deposit accounts, depositing money, withdrawing money, etc.

Retail banking is, in general, a face to face banking system in which bank employees need to face and handle clients; thus, it is also known as consumer banking.

The products of retail banking are also customer-oriented such as car loan, home loan, personal loan, and the number of customers is also very large in retail banking as now-a-days almost every individual has a bank account.

Thus, it is difficult for banks to focus on an individual client; however, retail banking is one of the primary sources of income for the banks.

And the amount collected from retail clients is invested in the market and used for providing funds as a loan against which customers get some interest amount as a return.

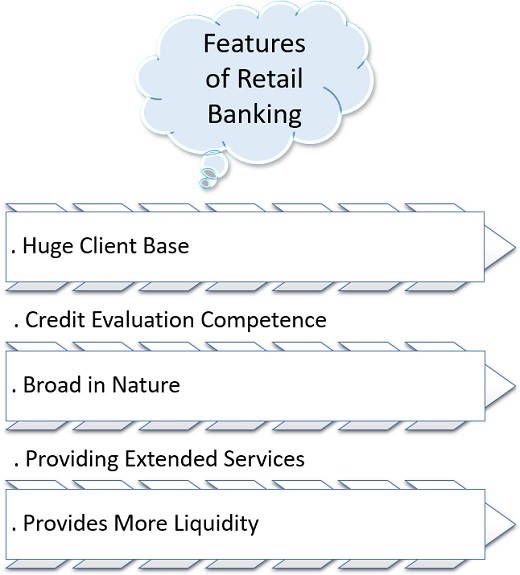

Features of Retail Banking

Following are some of the significant features of retail banking:

- Huge Client Base

In retail banking the customer base is vast in numbers; however, the size of the amount may vary in the account of every individual client, and the banks need to maintain a customer base for gathering the funds by way of any channel.

- Credit Evaluation Competence

As services provided and the number of clients is large in quantity maintain good infrastructure also becomes a need for a bank; however if the banks follow a qualitative approach for credit evaluation they become free from the future follow-ups.

- Broad in Nature

Retail Banking deals with various sectors of the banking facilities other than depositing money and providing loans such as providing insurance, securities and other investment facilities to their clients.

- Providing Extended Services

Retail Banking provides the services to their customers on the bank premises, but it is not possible to provide services in banks 24 X 7.

Thus, banks adopted a strategy of providing necessary service such as withdrawal of money by way of setting-up the ATMs in several areas with the intention of delivering timeless services to their clients.

- Provides More Liquidity

Retail banking aids in increasing the supply of money in the economy by way of regulating interest rates and time to time review of creditworthiness pacts.

What is Corporate Banking?

Corporate Banking only deals with corporate bodies, whether private or government, generally for the development of their business and projects.

However, there is very less number of clients in the corporate banking sector of the banks, but the existing clients have significant balances and make high-value transactions.

Thus bank always tries to maintain good relations with such clients and therefore provides them delay-free services and their grievances are solved before retail banking customers.

Corporate banks include a service of provision of credit, asset management facilities according to the needs and requirements of the clients.

However, corporate banking also includes the general banking services such as international transactions facilities, investment banking facility, project finance, advisory services, etc., along with the tailored services provided to their large clients.

Corporate banking always being a more profitable segment of the banking system than retail banking as various enterprises depend upon such banking services for fulfilling their financial needs.

Features of Corporate Banking

The corporate banking has the following features:

- Small Customer Base

Corporate banking generally serves to medium to large enterprises or groups and not the individuals; thus, have a smaller customer base than retail banking.

However, the clients of corporate banking deals with the high transaction amount and banks earn more profits from corporate banking clients by charging large amount as a fee.

- Authority

In a corporate banking account is opened with a name of a company, but to open an account consent of all board of directors is mandatory by passing a corporate resolution as authority to handle company matters is in the hand of its board of directors or members.

- Accountability

The corporate account of the company is only liable to the company’s contents and not the personal contents of the members, as according to law the company has its individual identity other than its members.

Thus, a company’s corporate account is not accountable for personal creditors of members.

- Helps in Evaluating Credit Rating

The functions of corporate accounts of a company evaluate the credit history, which affects the rate of interest applicable to loans as well as share prices of the company.

Investors look after a good credit rating company for investing their money; thus, maintaining a good credit rating becomes a responsibility of a company.

- Expertize Personnel

Banks recruit extremely expertize personnel having relevant knowledge of corporate banking by paying a high salary as corporate banking clients are very precious clients of the banks.

Summary

- Retail Banking is a banking service provided to the general public or individual to regulate their funds in their saving account or fixed account and to perform various other day-to-day banking transactions like depositing money and opening bank account.

In contrast, corporate banking is a commercial banking facility which only deals with small or large companies and corporate bodies and provides services to them such as trade finance, derivate, etc.

- Products of retail banking are customer-oriented such as personal loan, car loan, home loan, etc.

In contrast, corporate banking is business-oriented and can be tailored or customized according to the requirements of the entities such as credit facilities.

- In retail banking number of clients with small-value accounts are much more than corporate banking; thus, it has an extensive clientele portfolio.

In contrast in corporate banking, the number of clients is much lesser than retail banking, but the amount of transactions is much more; thus, it has a small clientele portfolio.

- In retail banking handling, charges are low.

In contrast in corporate banking handling charges are relatively higher than retail banking.

- In retail banking, the value of transactions is generally low to medium.

In contrast, in corporate banking, the value of transactions is comparably higher than retail banking.

- In retail banking, banks earn profits from the margin of interest amidst borrowers and lenders.

In contrast, in corporate banking, the primary source of profit is the fees and interest charged on the provided services.

- In retail banking relationship amidst customer and bank remains moderate as the number of customers is much more than corporate banking.

In contrast, in corporate banking relationship amidst customer and bank is of high level as there are only a selected number of prominent clients.

- In retail banking, banks deal with mass individuals; thus, there are more chances of delay in solving the grievances of a particular client.

In contrast in corporate banking, the banks settle the grievances on an urgent basis as the corporate banking clients are the VIP clients of the bank and are very few in numbers.

Conclusion

Retail banking and corporate banking both are the sectors of the banking services providing facilities to the clients but the significant difference amidst both the banking service is retail banking deals with the common public; in contrast corporate banking deals with companies and corporate entities.

banks in harrisburg pa says

Please continue to post such an enlightening and informative blog. Therefore, people like us will be motivated in real life.