Definition: Mutual fund is an investment opportunity which sums up the limited capital of various small investors to invest in different investment options like equities, bonds, cash and other money market instruments. An investor can either invest the whole amount in a lump sum or can opt for a systematic investment plan (SIP) where he can contribute in a small amount each month, throughout his employment period.

There are numerous kinds of mutual funds available for investors to make a choice. A mutual fund advisor designs a suitable portfolio for his client, keeping in mind the age, income, financial goal, risk-taking ability, etc. of the investor.

The various types of mutual funds facilitate the mutual fund advisors to plan and invest the client’s capital in the most appropriate option. Or tend to create a blend of two or more types of funds to solve the investor’s purpose of investment.

The mutual funds can be categorized on the basis of their purpose, flexibility, risk involvement, composition and other characteristics.

Content: Types of Mutual Funds

- Based on Investment Goals

- Based on Structure

- Based on Risk

- Based on Asset Class

- Specialized Mutual Funds

- Related Terminology

Based on Investment Goals

What is the purpose of investing in mutual funds? What is the short-term objective of the investor? What is the long-term goal of the investor?

The fund manager must have the answers to all such questions. Thus, based on the reasons for starting a mutual fund, we can divide it into the following types:

Growth Funds: The funds which majorly invest in the equity market or the flourishing segments, involving a high-risk factor and generating fair returns are known as growth funds.

Liquid Funds: These funds put money into debt and money market instruments for a short period usually less than 91 days. The NAV is determined by its value for 365 days (also include Sundays) and the investment value lies within the sum of 10 lakhs.

Income Funds: As the name suggests, these funds are more concerned about the stable returns and hence invest in a variety of debt funds like CDs, bonds, FMPs, etc. These are most suitable for investors who avoid taking high risk.

Tax-Saving Funds: These are generally known as Equity Linked Savings Scheme (ELSS). It provides a dual advantage of wealth generation along with tax saving benefit to the investor. It is a desirable investment option for salaried employees and income taxpayers.

Pension Funds: The retirement saving plans offering post-retirement benefits or income to the investors are listed under the pension funds. These funds include employees’ provident fund (EPF), public provident fund (PPF) and various other pension plans offered by banks and insurance companies.

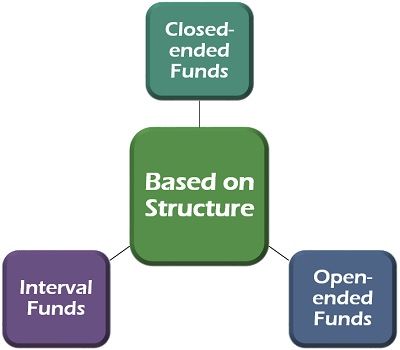

Based on Structure

The flexibility of buying and selling of mutual funds by the investors, also determine its types. On this basis, mutual funds can be divided into the following three categories:

Closed-ended Funds: These funds are usually offered once through new fund offer (NFO), putting up a deadline for buying its units. It cannot be sold before the predefined maturity period, i.e., three years, five years, seven years, etc

Open-ended Funds: These are the regular mutual funds like SIP where the investors are free to enter the market, regular trading of funds can be done. The investors can even exit the market whenever they want to. The net asset value (NAV) of funds keep on changing constantly, and these AMCs can also stop absorbing new investors at their convenience.

Interval Funds: The interval funds are the combination of both kinds of mutual funds, closed-ended and open-ended funds. These can be traded freely for a limited period beyond which they become closed-ended funds for the defined period.

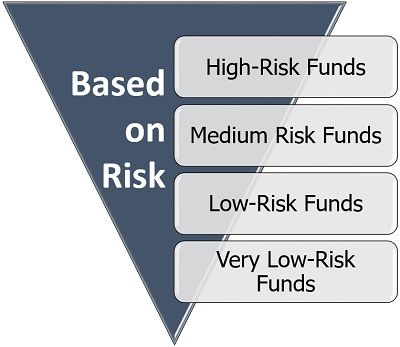

Based on Risk

The simple fundamental of every investment is high risk means more return and less risk means low performance.

Based on the above statement, mutual funds can be classified into the following four types:

High-Risk Funds: The funds which are substantially exposed to market volatility are termed as high-risk funds. Such funds are suitable for young investors aiming high returns but require regular monitoring. The gains may range between 15% to 30%.

Medium Risk Funds: When the funds have a mix of debt as well as equity funds providing a balanced return of 9-12% and involving a moderate risk, are termed as medium risk funds.

Low-Risk Funds: The liquid funds or arbitrage funds which hold less risk and yields as low as 6-8% returns are considered as low-risk funds. These funds are suitable at the time of unfavourable market conditions like recession, depression, crisis, etc.

Very Low-Risk Funds: These funds are best suited for meeting the short-term objectives of the investors. The amount is invested in ultra short-term funds targetting returns even less than 6%.

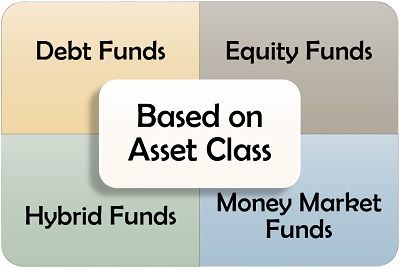

Based on Asset Class

As we already know that the AMC diversifies the client’s money into various investment schemes and options. We must also understand that they follow particular criteria or agenda, based on which they decide their investment category.

These categories can be better understood by going through the following kinds of mutual funds:

Debt Funds: The funds which pool the money into fixed income securities like bonds, debentures, fixed maturity plans (FMPs), certificate of deposits (CDs) and treasury bills. These funds generate a fixed return in the form of interest where the rate of interest and maturity date is fixed.

Equity Funds: The stock funds majorly invest the funds into the share market, i.e. in the equities of various companies. These funds are considered to be high-risk funds or growth funds and are highly volatile.

Hybrid Funds: The funds investing the money in both equity as well as debt are termed as hybrid funds to yield average returns at moderate risk. These are bifurcated into the balanced fund and monthly income plan.

The balance fund consists of more equity funds and fewer debt funds. The monthly income plan includes fewer equity funds and more debt funds.

Money Market Funds: These funds focus on money market securities issued by the government, corporations or banks. It includes treasury bills, certificate of deposits, bonds, and other money market instruments. These are less risky and provides regular returns in the form of interest and dividend.

Specialized Mutual Funds

There are certain funds which can be distinguished by their unique characteristics. Some of them are explained in details below:

Sector Funds: The funds which focus on the equity funds of one particular sector are known as the sector funds. These funds need careful and regular observation and immediate action to gain high returns and avoid losses.

Real Estate Funds: These funds tend to invest in the real estate projects of well established real estate companies for the long-term. Thus, it neutralizes the risk and reduces the legal formalities, which are otherwise high while purchasing a property.

Asset Allocation Funds: Similar to hybrid funds, but are more organized; the asset allocation fund includes a variety of equity, debt and other funds in a perfect ratio. It requires a lot of experience and knowledge of the market trends.

Inverse/Leveraged Funds: The funds which follow and invest in the adverse market condition is known as Leveraged Funds. Here, the fund manager sells out the shares when the market is falling to repurchase them at the lowest price. The primary objective is to hold these shares until the prices shoot up even higher than before.

Index Funds: These funds invest in the equities of the market index. These stocks are the replica of a particular market index and yield returns in a similar ratio.

Funds of Funds: It is a cost-effective mutual fund type. These funds invest in a bunch of selected mutual funds to diversify the client’s portfolio efficiently.

Exchange-Traded Funds: ETF is a type of index funds which enables the investor to invest in the stock markets across the globe. It is more of a regular stock trading activity where day to day buying and selling of shares take place.

Global Funds: These are funds that invest in the share market of different countries, along with investing in the domestic stock market. These funds hold high risk related to the currency fluctuation, market volatility and trading policies.

International/ Foreign Funds: In international funds, the investors look forward to investing in the overseas funds, wholly or partially (mix of domestic and overseas funds). It helps to yield high returns in spite of downfall in the local market.

Emerging Market Funds: These funds tend to invest in the stocks of the growing markets or economies of various developing countries to earn good returns.

Market Neutral Funds: Like hedge funds, these funds also aim at fair returns through neutralizing the effects of unfavourable market conditions or volatility.

Commodity-Focused Stock Funds: The active investors with high-risk bearing ability can look forward to investing in commodities like the stock of different companies and gold. The return from such funds is uncertain and performance-based.

Gilt Funds: The funds which prefer investing in the government bonds, debts and securities either for short-term or long-term are considered to be as gilt funds. These funds bear less risk and generate a low return.

Related Terminology

Systematic Investment Plan (SIP) is a means of investing in mutual funds where an investor can invest in small amount recurring weekly, monthly or quarterly.

New Fund Offer (NFO) is an offer of AMCs, which enables the investors to buy a new scheme within a limited period. It facilitates capital generation for the AMCs.

Net Asset Value (NAV) is the valuation of the company’s net worth, calculated by deducting the total liabilities from the total assets of the entity.

security bank partner schools says

You’ve written it so nicely, and you’ve come up with some great ideas. This is a fantastic post!