Definition: Internal reconstruction is the rearrangement of the company’s existing capital structure. More precisely, it involves a change in the financial structure by Alteration or Reduction.

The reorganization takes place without liquidation. So, there is no need to dissolve the existing venture. Thus, the formation of a new company is not needed.

An Internal reconstruction is a form of corporate reconstruction. It is helpful for companies that have accumulated losses and overvalued assets.

In this, there is an alteration in the stakeholder’s claims. Consequently, the organization can write off its accumulated losses and fictitious assets.

Content: Internal Reconstruction

- What is the Reconstruction of a company?

- Need

- Accounting Treatment

- Conditions or Provisions

- Methods

- Benefits

- Features

- Format of Reconstruction Account

- Difference Between Internal and External Reconstruction

- Example

- Final Words

What is the Reconstruction of a company?

It is the re-organization of company structure, be it legal, capital or organizational. Reconstruction takes place through asset revaluation and reassessment of liabilities.

It takes place in two forms:

- Internal Reconstruction

- External Reconstruction

Need

The need for alteration arises in the organization when:

- There is an over or undervaluation of assets and liabilities.

- The company has been facing a financial crisis for a while.

- Reduction in external liabilities to become profitable.

- To save organizations from unforeseen circumstances.

Accounting Treatment

Let us see the accounting treatment during the internal rearrangement of capital.

On the debit side, we record:-

- The increase in the value of assets

- Decrease in liabilities

On the credit side, we record:-

- Capital Reduction Account

- Capital Reconstruction Account

We can avoid the debit balance of the Profit and Loss Account and the overvaluation of assets. For this, we have to:

- Debit the Capital Reconstruction/Reduction Account.

- Credit the concerned account.

- Companies must add the word “and Reduced” after their name on the Balance Sheet.

- The Balance Sheet of the reconstructed company must show the written-off amount for five years under respective assets.

Conditions or Provisions

- Article of Association: Companies can go for internal reconstruction post-authorization by the article of association. It specifies the course of action for all crucial decisions of the company.

It must contain a clause clarifying the method and procedure of capital reduction. - Special Resolution: The company must take consent from its stakeholder before capital reduction. They pass a special resolution when most stakeholders agree to alter the structure. In addition, the stakeholders must duly sign it.

- Approval by Court: Approval of the court is necessary for internal restructuring. Companies can start the procedure after getting permission for the same.

- Repayment of Borrowings: Before reconstruction, the companies must clear all borrowings and interest due.

- Approval by Creditors: The court needs creditors’ approval in writing before giving permission for capital reduction. The goal behind it is to protect the interest of the creditors.

- Notice to Public: The company have to notify the public about capital alteration. Therefore, the company issues a public notice mentioning valid reasons for reconstruction.

Methods of Internal Reconstruction

1. Alteration of Share Capital (Section 61 Company Act 2013)

In this, we alter the share capital to restructure the venture internally. Alteration can be in the form of:

- Increment in Share Capital: The company issues new shares with a view to increasing the share capital.

- Consolidation of Existing Shares: Here, we convert the existing shares or smaller values into higher denominations.

- Conversion to stocks: In this alteration method, the shares are converted into stocks and vice-versa. The fully paid shares are converted into one unit of stock.

- Subdivision: It includes converting shares with higher face values into smaller face values.

- Cancellation of Unissued Shares: It involves cancelling the shares that the company did not issue. Consequently, it results in a change in the structure of capital.

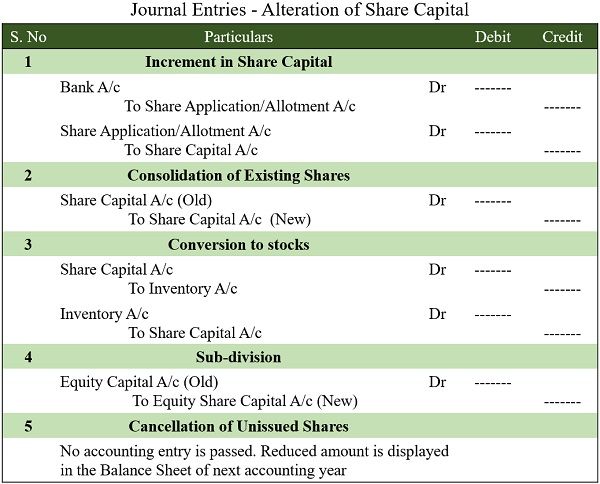

Journal entries for the above forms of alteration in share capital are as follows:

2. Reduction of Share Capital (Section 66, 67 Company Act 2013)

In this type of internal reconstruction, there is a reduction in the share capital. For capital reduction, the company have to take confirmation from the tribunal.

The company must fulfil some conditions before capital reduction. These conditions are given above under the head ‘Conditions or Provisions‘.

The capital reduction can take place in the following ways:

Extinguishment of Liability

Here we write off the uncalled amount, i.e. it is not asked from the shareholders. Consequently, the paid-up capital remains the same. But there is a reduction in the shares’ par value. Hence, it reduces the liability of the shareholders.

Payoff Surplus Paid-up Capital

The company may refund the amount that is in excess. This amount is in surplus with the company and is returned to the shareholders. It can be done:-

- Without reducing the face value

- By reducing the face value

Writing off the paid-up capital

We use this method when the assets do not fairly depict the company’s capital loss. In this, the capital reduction takes place by eliminating the lost capital and using it for:

- Writing-off fictitious and accumulated assets

- Reducing Losses

- Over-valued amount of assets

The face value of the shares may or may not change. Also, we open a reconstruction account to transfer the reduced amount.

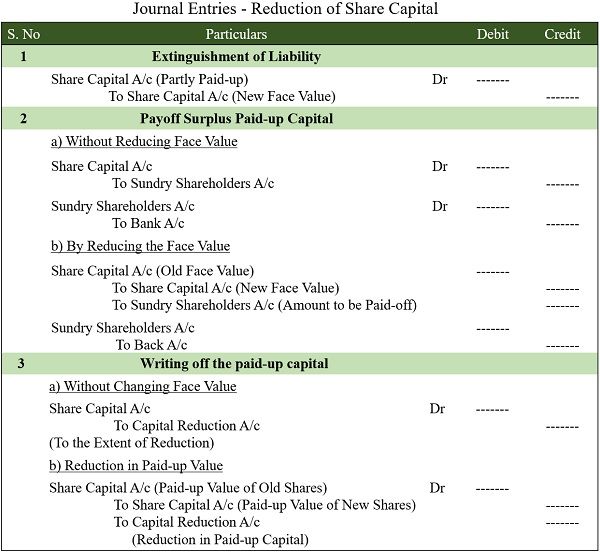

Journal Entries for reduction of the Capital structure are as follows:

Benefits of Internal Reconstruction

There are several advantages of restructuring companies’ capital structure. It helps in:-

- Writing-off accumulated losses

- Fair asset valuation in the balance sheet

- Depicting the actual value in the financial statements

- Taking the company back on track and making it profitable again

- Availing tax advantage

Features of Internal Restructuring

- New Company: There is no requirement to form a new venture.

- Liquidation: The process of liquidation of the company doesn’t take place.

- Reconstruction: In this, the current structure of the company’s capital is rebuilt.

- Overcapitalization: It helps optimize financial resources and adjust the excess capital.

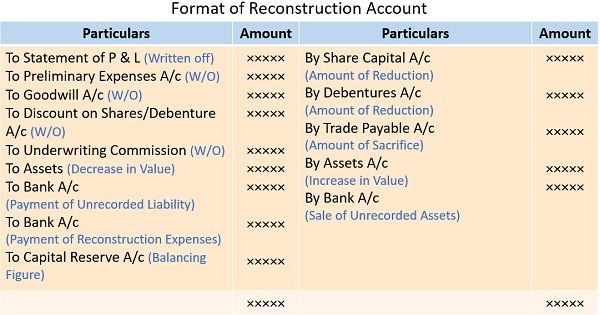

Format of Reconstruction Account

As mentioned above, we open a reconstruction account (nominal) while internal restructuring. It depicts a reduction in the capital used for writing-off assets and losses.

The account is credited with the sacrifice by the shareholders & investors. Conversely, we debit it with restructuring expenses and fictitious assets and losses. In the end, we transfer the balancing figure to the Capital Reserve Account.

Difference Between Internal and External Reconstruction

| Basis | Internal Reconstruction | External Reconstruction |

|---|---|---|

| Meaning | Altering the companies existing capital structure is Internal Reconstruction | Liquidating the current capital to form a new company is External Reconstruction |

| Liquidation | Not required | Liquidation is a must for the creation of a new company |

| New Company | The process does not result in the formation of a new company | It results in the construction of a new company |

| Transfer of Assets and Liabilities | No transfer of assets and liabilities | Transfer of assets and liabilities takes place |

| Accounting | We need to open a capital restructuring account | Here, we need to open a realization account |

| Objective | To write-off accumulated profits | To gain a competitive advantage in the market |

| Legal Approval | There is a need for courts approval or restructuring | In external reconstruction, approval by the court is not necessary |

Example

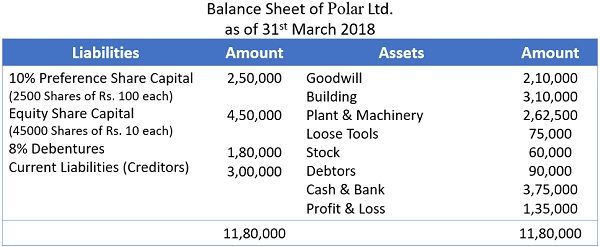

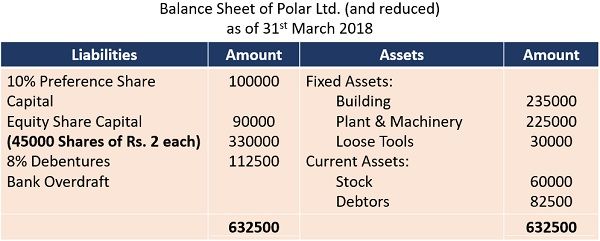

The following is the Balance Sheet of Polar ltd. as of 31st March 2018.

The reconstruction scheme of Polar Ltd. with due permission of the court and creditors is as follows:-

- Creditors are ready to accept 10% Debentures to settle half of their claims. The remaining sum will be payable in cash.

- Alteration in the face value of the preference shares, i.e. from 100 to 40 per share.

- The reduction in the face value of the Equity share is Rs.2/- per share.

- The amount of Goodwill is nil.

- It has been identified that the following assets are overvalued:

Building Rs. 75000/-

Plant & Machinery Rs. 37500/-

Loose Tools Rs. 45000/-

Debtors Rs. 7500/-

Journalize the above transactions and prepare the reconstructed Balance Sheet.

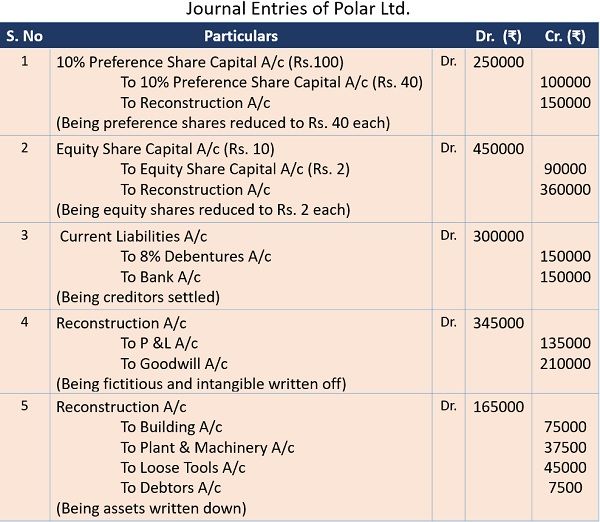

Solution:-

The revised Balance Sheet of Polar Ltd. after reconstruction is as follows:

Final Words

Internal Reconstruction is the change in original capital allotment without liquidation. Companies need to reconstruct their capital structure to remain profitable & set off losses.

It takes place by adjusting or reduction in the original structure. The company must fulfil the criteria before restructuring its share capital structure.

Leave a Reply