Definition: Bonus Shares are the supplementary or extra shares distributed to the current stakeholders of the company without taking any extra amount from them, and these shares are issued out of free reserves created from the profits earned by the company. They do not make any impact on the stakeholder’s equity as they are allotted to relocate the retained earnings to the share capital and are issued over the routine cash dividends.

Bonus shares are allotted to raise the capital base of the company when the company have a massive amount of reserves and want to avoid cash payments as well as want to capitalize their funds.

Thus, the issue of bonus shares is also defined as “Capitalization of Reserves.”

Content: Bonus Shares

- Security Exchange Board of India (SEBI) Guidelines

- Reasons for issuing Bonus Shares

- Advantages of Bonus Shares

- Tax Effect on Bonus Shares

- Conclusion

Security Exchange Board of India (SEBI) Guidelines for issuing Bonus Shares

Any company issuing such shares need to follow these guidelines issued by the SEBI.

- Bonus Shares should be fully paid-up; as partly paid-up shares cannot be issued as bonus shares.

- They can only be released from the realized profit of the company and not from the revaluation reserves or unrealized earnings of the company.

- A company issuing bonus shares should not have any default in loan re-payment or interest payment.

- If fully convertible or partly convertible debentures are inlined in the company, and they are waiting for their conversions into shares.

In that case, the company cannot issue bonus shares to its stakeholders before making provisions for convertible debentures shown their balance sheet. - Article of Association (AAO) of the company should permit the issue of bonus share; if such provision is not mentioned in company’s AAO, then it should be made by passing a resolution, then only a company can issue bonus share.

- Statutory dues of the employees such as provident funds, pension funds, gratuity payment should be made before issuing bonus shares.

- Once the resolution gets passed in the meeting, the company cannot take back-step and becomes bound to issue bonus shares; otherwise, directors will become personally liable.

- Bonus shares and dividends can never be adjusted with each other, bonus shares will always be given in the form of equity shares, whereas dividend can be given in the form of cash, cheque or dividend warrant.

Reasons for issuing Bonus Shares

Some of the reasons for issuing bonus shares are as follows:

- They are issued to shorten the market price per share by raising shares distribution.

- For promoting the trade operations of the shares, bonus shares are issued as it increases the number of owing shares.

- For maintaining a respectable position in the eyes of the investing community, bonus shares are issued as it raises the share capital base of the company.

- Issuing bonus shares indicates company’s prosperity in front of their investors and brightens the company’s image.

- Possibilities of enhancing additional funds increase with the issue of bonus shares.

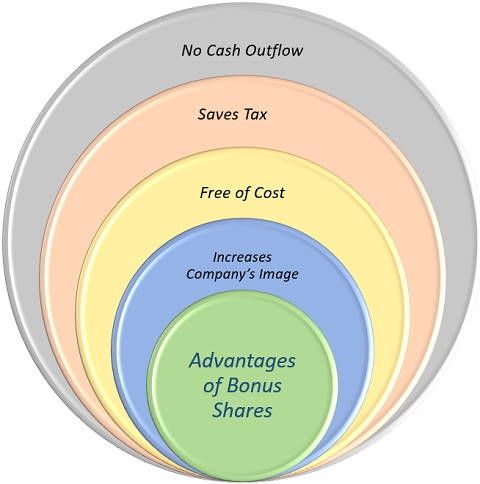

Advantages of Bonus Shares

Advantages of bonus shares are as follows:

Increases Company’s Image

Issue of bonus share raises the overall share capital of the company, which reflects a good impression over the investors and increases the image of the company in the market.

Free of Cost

Bonus Shares are issued free of cost to the existent stakeholders of the company out of the free reserves created out of profit which increases stakeholder’s wealth as well as saleability of shares in the market.

Saves Tax

Stakeholders can save the tax on Long-Term Capital Gain, i.e., by keeping a share for more than 1 year, as Long-Term Capital Gain is exempted from tax up to the limit of 1,00,000/-.

No Cash Outflow

A company need not use their cash funds for issuing bonus shares they are allocated out of reserve and surplus and reduced liability and increases the capital of the company. Thus, cash can be utilized for the expansion of their business.

Tax Effect on Bonus Shares

Imposition of tax on the bonus shares can be understood more precisely with the example illustrated below:

Case 1

- Long Term Capital Loss in purchased share and Short Term Capital Gain in bonus share

Suppose, Ruchi has bought 1 share of the company “X” on 01/10/2017 @ 2000/- and on 01/02/2018 company issued a bonus share in the ratio of (1:1) and the price rises from 2000/- to 2200/- per share on 01/02/2018.

The ultimate impact of issuing bonus share on Ruchi will be an increase in her number of shares, i.e., she will have 2 shares instead of 1 share she purchased.

However, the cum-bonus price of 1 share was 2200/- which will become 1100/- per share ex-bonus, i.e., double the shares half the value.

This seems to a deal of loss, but practically more and more people start buying such shares as its value became cheaper and as an effect of that the demand will increase, and price may move up to 1200-1400/- per share within few months.

Let’s assume that on 01/11/2018 one share is trading @ 1400/- and Ruchi take a call to sell her shares, then the taxation impact on her will be:

As given, the cost price of the 1st share, i.e., the purchased share was 2000/- which was purchased on 01/10/2017 and the selling price on 01/11/2018 is 1400/-.

It shows that the Ruchi has faced a loss of 600/- and such loss is termed as Long-Term Capital Loss (LTCL), as Ruchi has held a share for more than 1 year and then sold it.

However, the cost price of 2nd share, i.e., bonus share is 0/- and the selling price is 1400/-, here Ruchi is in profit of 1400/-, but here the important point to notice is the date of issue of bonus share which is 01/02/2018 and sold such share on 01/11/2018, i.e., within 1 year.

Thus, it will become a Short-term Capital Gain (STCG) which is taxable @15%; therefore, Ruchi will pay 210/- as a tax on 1400/- earned as STCG on sale of shares.

Now, here the question might arise in your mind that Ruchi can set-off her LTCL with her STCG.

So the answer here is a big “No” Income-tax Act has mentioned that no Long-Term Capital Losses cannot get set-off with Short-Term Capital Gains.

Case 2

- Long Term Capital Gain in purchased share and Long Term Capital Gain in Bonus share

Now, let see what if Ruchi has a Long-term Capital gain purchased as well as bonus share.

The treatment for the purchased share will be the same as above, and for bonus share, let’s understand it with the same example.

Ruchi sold her bonus share on 01/11/2019 @2000/- approx., and the cost price of a share is still 0/-; thus, the profit will become 2000/- on sale of bonus share.

Now, again the question will arise in your mind that the Ruchi will have to pay tax @ 15% on 2000/-.

The answer here will be “NO”, as these shares are sold post 1 year, and the income becomes a Long-Term Capital gain and according to Income Tax Act any Long-Term Gain upto 1,00,000/- is exempted from tax and over that 10% tax will be imposed.

Important Point to Remember here is Ruchi has to consider a date of issue of bonus share and not the buying date of share for computing tax impact on bonus shares.

Conclusion

Bonus Shares are nothing but the extra shares given to the current stakeholders of the company in a defined ratio from the retained reserves of the company when the company wants to capitalize their reserves.

It raises outstanding shares and increases the paid-up capital of the company.

Leave a Reply