Definition: Balance Sheet is the final statement of the financial report prepared after trading and profit/loss account of a company. It shows the company’s exact financial position at the end of the financial year after evaluating the true and fair value of all the assets and liabilities of a business.

In short, it is the basic statement of the company that examines the financial competence by the resources organized and investments enforced by the businessman.

Content: Balance Sheet

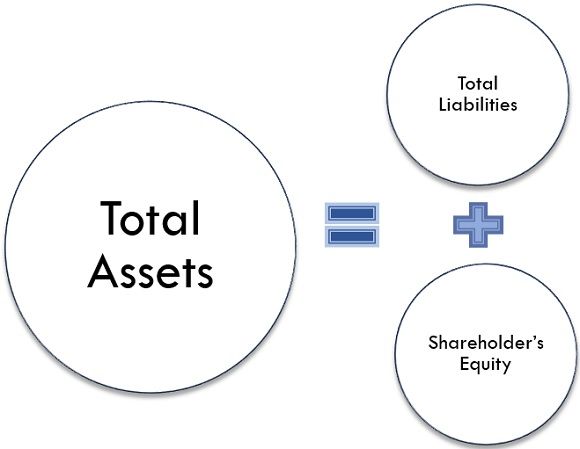

Formula of Balance Sheet

It is established on the elementary equation:

Where,

Total Assets = Current Assets (+) Current Liabilities

Total Liabilities = Current Liabilities (+) Non-Current Liabilities

Shareholder’s Equity = Retained capital (+) Retained Earnings

Formats of the Balance Sheet

It can be prepared in any of the two formats:

Horizontal (Traditional Format)

There are two popular methods in which the assets and liabilities can be organized in a traditional format. They are as follows:

1. In the order of dischargeability or liquidity

The assets are organized in order of their liquidity, the most liquid assets such as cash-in-hand are displayed first and least one such as goodwill will be shown at last. The liabilities are put in order of urgency of their payments. The urgent payments such as short-term creditors are displayed first, and least urgent payments like long-term creditors will be displayed at last. Generally, the banking concerns and partnership firms prepare their Balance Sheet in the order of dischargebility.

A format of Balance Sheet in order of dischargeability or liquidity is shown below:

Balance Sheet of XYZ Co. Ltd.

As at 31/03/2015

| Liabilities | ₹ | Assets | ₹ |

|---|---|---|---|

| Current Liabilities: | Current Assets: | ||

| Outstanding expenses | xx | Cash-in-hand | xx |

| Bills payable | xx | Cash at bank | xx |

| Income received in advance | xx | Bills receivable | xx |

| Sundry creditors | xx | Prepaid expenses | xx |

| Bank overdraft | xx | Sundry debtors | xx |

| Long-Term Liabilities: | Accrued income | xx | |

| Capital: | Closing stock | xx | |

| Opening Balance | xx | Other Investments: | xx |

| (+) Net Profit | xx | Fixed Assets: | |

| (-) Net loss | xx | Plant and machinery | xx |

| (-) Drawings | xx | furniture and fixture | xx |

| Land | xx | ||

| Building | xx | ||

| Goodwill | |||

| xxx | xxx |

2. In the order of permanence

Order of the permanence is completely opposite of the liquidity order. The assets are organized according to their permanence, i.e., least one will be shown first, and most liquid assets will be shown at last. The least urgent payments will be displayed first, and the most urgent one will be shown at last. As per Companies Act 2013, all the companies recommended preparing the Balance Sheet in order of permanence.

A format of Balance Sheet in order of permanence is shown below:

Balance Sheet of XYZ Co. Ltd.

As at 31/03/2015

| Liabilities | ₹ | Assets | ₹ |

|---|---|---|---|

| Capital: | Fixed Assets: | ||

| Opening Balance | xx | Land | xx |

| (+) Net profit | xx | Building | xx |

| (-) Net loss | xx | Goodwill | xx |

| (-) Drawings | xx | Furniture and fixture | xx |

| Long- term liabilities: | Plant and machinery | xx | |

| Loans and advances | xx | Other Investments: | xx |

| Current Liabilities: | Current Assets: | ||

| Sundry creditors | xx | Closing stock | xx |

| Outstanding expenses | xx | Prepaid expenses | xx |

| Income received in advance | xx | Accrued income | xx |

| Bank overdraft | xx | Sundry debtors | xx |

| Bills payable | xx | Cash-in-hand | xx |

| Cash at bank | xx | ||

| Bills receivable | xx | ||

| xxx | xxx |

Vertical Format

Vertical Format for preparing the Balance Sheet is shown below:

Balance Sheet of XYZ Co. Ltd.

As at 31/03/2015

| Particulars | ₹ | ₹ |

|---|---|---|

| (A) Fixed assets: | ||

| Land | xx | |

| Plant and machinery | xx | |

| Building | xx | |

| Furniture and fixture | xx | |

| (B) Current assets: | ||

| Stock | xx | |

| Bills receivable | xx | |

| Sundry debtors | xx | |

| Cash-in-hand | xx | |

| Cash at bank | xx | |

| (C) Current liabilities: | ||

| Bills payable | xx | |

| Sundry creditors | xx | |

| Outstanding expenses | xx | |

| (D) Working capital [ B- C ] | xx | |

| (E) Net assets employed [ A + D ] | xxx | |

| (F) Financed by: | ||

| Capital | xx | |

| (+) Net profit | xx | xxx |

Need for preparing Balance Sheet

Every business organization needs to prepare a Balance Sheet because of the following reasons:

- To determine the structure and value of the assets of the company.

- To determine the nature and volume of the liabilities of the company.

- To identify the financial competence of a company. A company is treated as indebted if its assets overtake its external liabilities.

Uses of Balance Sheet

Balance Sheet is treated as an important accounting report. In any business number of parties are involved, if any of them require any information about the business activities of the financial year, they can refer to the Balance Sheet of the company. Broadly, the following information can be borrowed from it:

- It facilitates to determine the proprietary interest of an individual or business enterprises.

- It empowers the businessman to calculate the substantial capital engaged in the business.

- It helps the creditors of the company in verifying the financial status of the business.

- It may provide the basis for deciding purchase consideration of the business.

- The movement of the working capital of a business can be driven by analyzing the Balance Sheets of the subsequent years. If required, curative measures can opt in a stipulated time.

- Divergent ratios can be determined from it, and these ratios can be applied for the enhanced governance of the business.

Limitations of the Balance Sheet

However, the Balance Sheet is prepared by all the establishments for revealing the financial condition; still, it has the following limitations:

- Fixed assets are conferred in the Balance Sheet at a historical cost minus (-) depreciation up to that date. A traditional Balance sheet cannot reveal the true values of the assets. Further, intangible assets are displayed in it at book value which may form no connection to market values.

- Consistently, it accommodates some assets which determine no market value like debentures discount, preliminary expenses, etc. The involvement of these assets excessively increases the total value of the other assets.

- It cannot display the value of definite factors like loyalty and skill of the personnel.

- The financial worth of a large number of current assets rely upon some measures, so it can’t reveal the accurate financial position of the business.

Conclusion

A Balance Sheet is a statement of the assets and liabilities containing the balances of the accounts arranged on a particular date. It is inclined to disclose the accurate and impartial view of the state of affairs of the business, and it is prepared after preparing the trading and profit and loss account of the business.

Leave a Reply