Definition: Shares are the smallest unit of the company’s capital or can be said as a unit of equity. The holder of such shares in a company is known as “Shareholders” (the owners of the company). These shares can be issued to the public for raising the funds of the company for its expansion. The market used for trading of shares is known as “Share Market” which deals in various markets, but the most popular share markets are NSE (National Stock Exchange) and BSE (Bombay Stock exchange).

Content: Shares

How does share market work?

Stock market primarily requires two parties for trading in the market, i.e., a buyer and a seller of shares for which companies need to register themselves in a stock exchange market for selling their shares to the various investors available in the share market. The investors need to open a Demat account (an account for holding financial securities in electronic form) for trading in the share market.

The third-party called financial broker also employed in the share market whose work is to guide, buy and resale the shares for the investors who do not have much knowledge about the share market but want to invest their sum in a market. The financial brokers help in selecting the most profitable investment option for which they charge a fee called “commission”.

Let us understand it with an example:

Ajay wants to invest in a share market; thus, he can opt any of the two options:

- He can buy the shares from his Demat account directly from the share market if he has a knowledge of the share market conditions, or

- If he does not have much knowledge about the share market conditions, he can contact the financial broker for investing his sum in the share market for which he has to pay some commission to the broker. Then the broker will deal in the market as per Ajay’s requirement. Getting help from brokers is the safest and suitable option for new investors.

Types of Shares

For generating capital from the market both private and public companies can issue only two types of shares. The following are the two types of shares:

- Preference shares

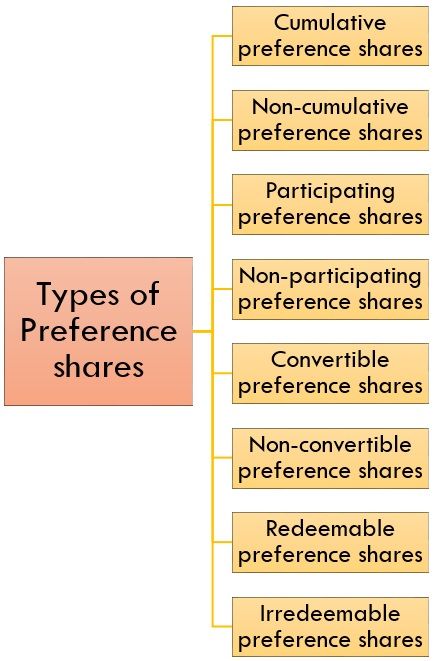

Preference shares by its name define preferential rights over other shares and get the claims before ordinary or equity shares. Preference shareholders get a dividend in priority at the time of dividend distribution. Even at the time of liquidation of the company, they have the preferential right over capital repayment. Preference shares have various sub-types; they are as follows:

- Cumulative preference shares: Preference shares usually bring a right to a definite rate of dividend out of the company’s returns. This interest may endure from year to year; subsequently, if there is any overdue dividend in one year it is considered as arrear and the same is endured to the next and in consecutive years, then it is assigned as a cumulative preference share.

- Non-cumulative preference shares: Instance with non-cumulative preference shares, shareholders are authorized to claim dividends only if the company acquires sufficient returns. If the company does not acquire adequate profit in any of the years, the dividend for such year will not be paid to its shareholders, and the benefits of that year’s dividend will be eliminated. This kind of shares is termed as a non-cumulative preference share.

- Participating preference shares: Occasionally, the preference shareholder has accustomed a right to the second dividend; these shares are known as participating preference shares.

- Non-participating preference shares: In these shares, shareholders don’t have any right of the second dividend or share in the company’s surplus profits. They don’t have the right to claim an asset in case of winding up of the company.

- Convertible preference shares: A alteration benefit may be used as an allure to investors. The convertible preference shareholder has a right to convert their preference share into equity shares during a specified period of time.

- Non-convertible preference shares: The preference share, which cannot be converted into equity shares at any point, are termed as non-convertible shares.

- Redeemable preference shares: The immunity for the company to redeem may also emphasize the preference shares issue. Correspondingly, the preference share, which can be reclaimed after a stated period or at the company’s attention, is termed as redeemable preference share.

- Irredeemable preference shares: The shares that cannot be reclaimed or redeemed during the company’s life span are known as irredeemable preference share.

- Equity shares

Equity shares are one of the most significant sources of long-term financing. They are also known as owner’s equity or ordinary share. The shareholders of such shares are the company’s absolute owner, but these shareholders get the dividend paid only after the payment of the dividends to the preference shareholders. Equity shareholders do not have the right to claim dividends on income or assets at the time of the company’s liquidation.

Features of Shares

- Preference Shares

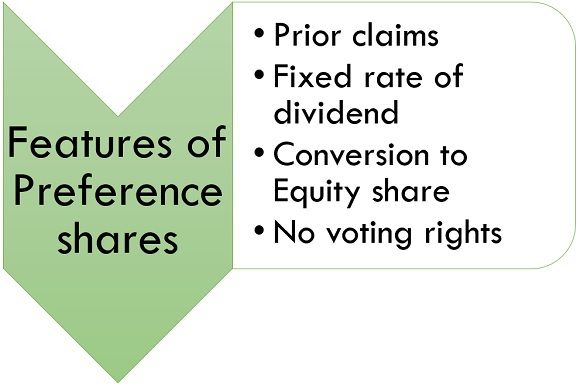

Following are some of the relevant features of the Preference Shares:

- Prior Claims: At the time of dividend distribution or in case of liquidation of the company, preference shareholders have a prior right to claim on the company’s asset and dividend’s sum.

- Fixed Rate of Dividend: The rate of dividends accustomed to the preference shareholder is fixed; thus, they have less hazardous than equity share. However, the participating preference shareholder enjoys a fixed dividend and participates simultaneously with the equity shareholder in the extra dividend.

- Conversion to Equity Share: Few preference shares are of convertible nature, i.e., they can convert into equity share within a stated duration of an agreement. These shareholders convert their preference share into equity share to raise their wealth.

- No Voting Rights: In general, preference shareholder doesn’t have any voting rights in the events of the company. However, in exceptional circumstances such as the verdict regarding the liquidation of the company, devaluation, reimbursement of share capital, they also can vote.

- Equity Shares

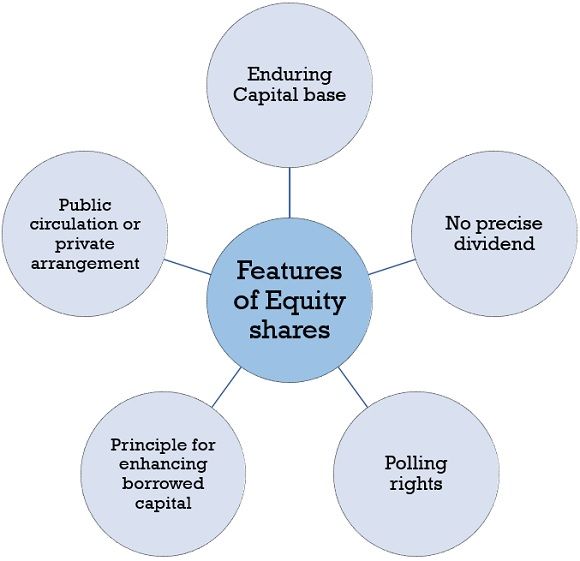

Following are some of the relevant features of the Equity Shares:

- Enduring Capital Base: These shares represent the company’s long-lasting capital base, i.e., the sum returned to the shareholders only after the liquidation of the company. However, it is not sure what amount will shareholders get at the time of liquidation as the shareholders will get their share of profit only if all the preferential claims have settled.

- No Precise Dividend: The sum of dividend on equity shares is not fixed so far, as the amount of dividend is the balance amount left after the holding of income and disbursement of dividend to the preference shareholders. Furthermore, the equity shareholders cannot pressurize the company to grant them dividends despite sufficient earnings. The company has full wisdom over this affair.

- Polling Rights: Being an owner of the company, the equity shareholders have the full right to make a vote in the company’s matters. An equity shareholder acquires one vote for each share they hold. If the equity shareholder is not capable of attending the company’s general meeting, he/she can appoint a proxy on his behalf to participate in the meeting.

- Principle for Enhancing Borrowed Capital: With accustomed leverage ratio, further borrowed capital can be lifted with a hike in the equity share capital. It implies that these shares design the fundamental for enhancing debts.

- Public circulation or Private Arrangement: Equity shares are depleted to the public over a prospectus advertised in the newspaper. Generally, a new company issues its share at par, and a company with goodwill in the market may issue its share at a premium or on discount. The underwriters such as financial institutions, brokers, and bankers underwrite these issues, and these underwriters assure that if the public does not purchase the shares, they will buy it instead.

Conclusion

Shares are unit of takeover interest in an enterprise or financial asset that grants an equal sharing in surplus of the company which is given in the mode of dividends to its shareholders. The shares are generally divided into two types, i.e., preference shares and equity shares.

Clement says

Thanks very helpful🌝😘😁😀

Clement says

Thanks very helpful🌝😘😁😀😍😍😍😍😍❤❤💓💖💖💞💛