Definition: Journal refers to a ‘book’ or ‘diary’ and entry means noting down of something. On combining these two words, we get ‘journal entry’. It can be explained as a book meant for the original recording of the day to day business transactions or activities in a systematic order.

The formal step by step entry of these business activities in a journal is termed as ‘journalizing’. It is the first and foremost stage of preparing the books of accounts.

Content: Journal Entries

- Features

- Three Golden Rules of Accounting

- Modern Approach

- Specimen

- How to Prepare a Journal Entry?

- Types

- Purpose

- Limitations

- Example

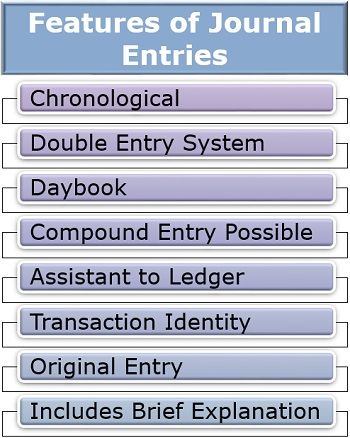

Features of Journal Entries

To pass the journal entries, one must have an idea of what exactly journalizing is and why do we need it?

To gain in-depth knowledge of this initial stage of accounting, we must understand its following characteristics:

- Chronological: The journal entries are to be recorded in a date-wise sequence or order in which the transactions happen.

- Double Entry System: It is a dual entry system where every transaction is equally entered on both debit and credit sides. That is, one account is debited, and the other is credited for the same value.

- Daybook: The journal is a daybook which records everyday transactions.

- Compound Entry Possible: In journal entries, more than one related transactions occurring on the same day or the ones involving more than two accounts can be compiled together to form a single entry in a journal.

- Assistant to Ledger: Journal entries serve as the base for all the other books of account like ledger since it is prepared from the information disclosed in the journals.

- Transaction Identity: It preserves the evidence of each transaction and makes it easy to identify every business activity through its date and other essentials.

- Original Entry: The journal is the first books of account where a transaction is recorded, and therefore, its originality and authenticity can be maintained.

- Includes Brief Explanation: Every transaction is supported by a brief description which is usually called narration and written in brackets (Being_), to clarify it in a better way.

Golden Rules of Accounting

These rules of accounting are based on two major types of accounts, i.e., personal and impersonal. The impersonal accounts are further classified into two types, namely, real and nominal accounts.

When we talk about the traditional approach to accounting, we must understand the following three golden accounting rules which act as the basis for preparing the journal entries:

| Debit/Credit | Personal Account | Real Account | Nominal Account |

|---|---|---|---|

| Debit | The receiver | What comes in | All expenses and losses |

| Credit | The giver | What goes out | All incomes and gains |

The above rules are based on three types of accounts, which are discussed in detail below:

Personal Account

This account emphasizes the individual or business entities which hold a separate identity, i.e., bank, customers, suppliers, debtors, creditors. During a transaction, the person or entity who receives the goods, cash or service is debited whereas, the person or entity giving the products, money or service is credited.

Real Account

The business accounts which are concerned with the tangible and intangible assets or objects are termed as real accounts. The tangible assets include inventory, machinery, plant, tools, etc. whereas intangible assets include patents, copyrights, goodwill, trademarks, etc.

According to this rule, any asset that enters into the business is debited. And on the contrary, the asset which is eradicated from the company is credited.

Nominal Account

The theoretical accounts have no physical existence but involve monetary exchange; it includes profit, loss, gains, expenses, etc. Any cost made or loss incurred by the company is debited, at the same time, any income or gain or profit earned by the company is credited.

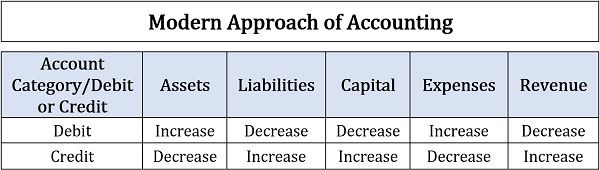

Modern Approach

To simplify the process of accounting and to better classify the accounts, a new set of accounting rules were formed, which is known as the contemporary approach to accounting.

This time, the accounts taken into consideration and the respective rules were as follows:

Assets: Assets include all the tangible and intangible belongings or resources owned by the company. The rule explains that all the increase in assets is debited, whereas any decrease in these assets is credited.

Liabilities: The obligations that are still to be met by the company are termed as its liabilities. The new rule states that any reduction in these liabilities is debited. However, the increase in liabilities is always credited.

Capital: Capital is the amount initially required for setting up a business entity and carrying on business operations. It can be the owner’s capital, i.e., from the internal source or acquired funds from the external sources. Any decrease in capital needs to be, and an increase in capital is to be credited.

Expenses: Expense refers to the direct or indirect cost borne by the organization to carry on the business activities. In journal entries, all the increase of the expenses are debited; however, any decrease in these expenses are credited.

Revenue: The income earned by the organization from carrying out the business activities or any other form of business gain is termed as revenue. In accounting, any decrease in revenue is to be debited, whereas an increase in the same needs to be credited.

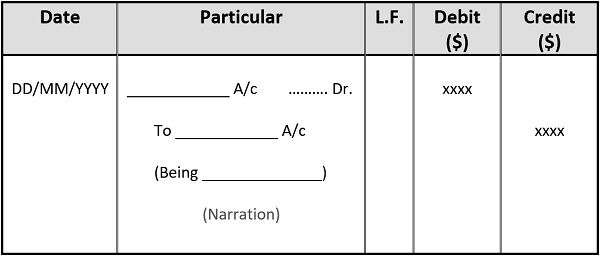

Specimen of a Journal Entry

Now that we know what journal entries are, we should know about its practical application while maintaining the Books of Accounts.

Given below is a format generally used by the organizations to record various business transactions systematically:

Let us now discuss each of the above heads in detail below:

Date: The journal entries are made for each financial year, and in the date column, the date of a particular transaction is mentioned. It signifies that the business activity belongs to a specific financial year.

Particulars: In the particulars column, a summary of the accounts involved in a specific transaction is mentioned. Here, the starting line states the account/accounts to be debited, and the next line signifies the account/accounts to be credited. The last line is the brief description of the transaction to give a clear picture is called Narration.

Ledger Folio Number (L.F.): Based on the journal entries, the ledger is prepared. The page number on which a particular journal entry appears in a ledger is noted down in the column of ledger folio number, in front of that specific journal entry. It facilitates quickly locating it on the ledger, whenever needed.

Debit: The amount of the account debited in the particulars column is written in the debit section parallelly.

Credit: Similarly, the amount of the account which has been credited in the particulars column is recorded in the credit section, parallelly.

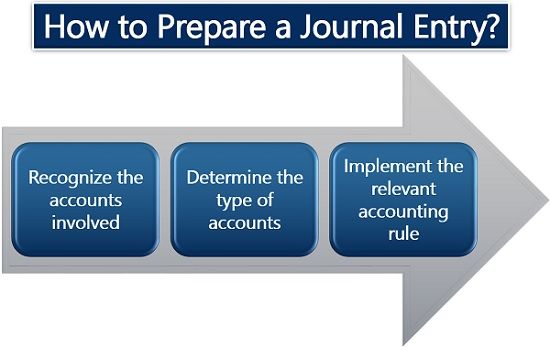

How to Prepare a Journal Entry?

Every transaction is somewhat different in one or the other way, though they can be classified into a similar type of accounts.

To simplify the process of recording these transactions in the format journal entries, the following three simple steps are adopted:

- Recognize the accounts involved: The first step emphasizes on reading every transaction carefully, which includes even its date, and identifying the different accounts which can be created.

- Determine the type of accounts: The next step is to frame a suitable accounting equation. And decide whether the accounts involved are personal or impersonal (according to traditional approach); or belongs to the category of asset, liability, expense, revenue or capital (as per modern approach).

- Implement the relevant accounting rule: Finally, after identifying the account type, appropriate accounting rule (traditional or contemporary) is to be applied, and the entry is to be made in the format mentioned above.

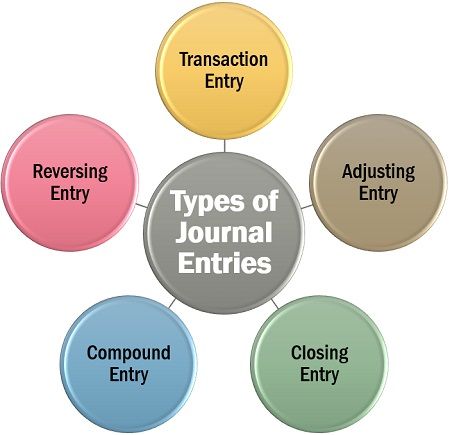

Types of Journal Entries

The recording of the journal entries varies according to the need and purpose of accounting. These accounting purposes determine the types of journal entries.

Let us now go through the different kinds of journal entries one by one:

Transaction Entry

The simple or basic journal entry made in the business to record a cash or accrual transaction is termed as a transaction entry. Most of the journal entries in a company are considered as transaction entries.

Adjusting Entry

A journal entry which is done on the accrual accounting basis to accommodate the balance amount to maintain the organization’s financial position and justify the accounting principles.

Closing Entry

The entry which is made at the end of a financial year or accounting period to carry forward the retained earnings to the next accounting period. It is calculated by considering the effect of profit account, loss account, revenue account and expense account.

Compound Entry

As mentioned above, a compound entry compiles two or more transactions to form a combined journal entry. This possible when these transactions are related to one another and are executed on the same date.

Reversing Entry

This a particular type of journal entry which is usually done at the beginning of a new financial year or accounting period for those expenses or revenue which remained accrued. It reverses a particular entry made in the preceding financial year which needs to be written off.

For this purpose, the expense account is initially debited to the accrued expenses account. It is later in the new financial year, debited back to the expenses account. While making the actual payment of this expense, finally the expense account is debited to the accounts payable.

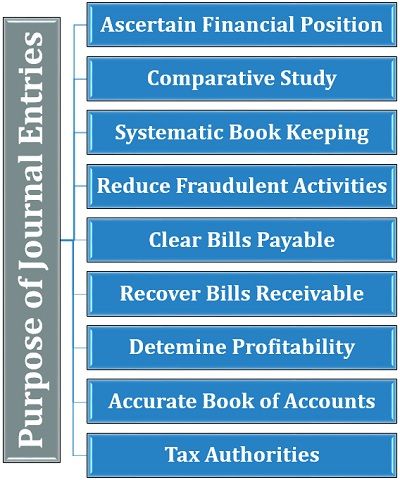

Purpose of Journal Entries

Journal entries have proved to be very useful to management, business entities, government, tax authorities and the economy.

To know about the various other reasons for which journal entries are to be maintained, read below:

- Ascertain Financial Position: Journal entries help to prepare the balance sheet which determines the financial health of an organization.

- Comparative Study: All the financial accounts used to carry out a comparative analysis are ready with the help of journal entries.

- Systematic Book Keeping: The journal entries are made in a datewise order to ensure the orderly arrangement of transactions and facilitate quick reference.

- Reduce Fraudulent Activities: If properly maintained, the journal entries help to eliminate fraud and misleading, since complete information is available and no manipulation is possible.

- Clear Bills Payable: The organization can keep a check on the bills due and ensure the timely payment of the same.

- Recover Bills Receivable: The management can keep track of the credit allowed to the customers and provide the accelerated recovery of these bills.

- Determine Profitability: The management can analyze the profitability of the business operations by the analysis of the books of account created through journal entries.

- Accurate Book of Accounts: The books of account so formed are incredibly appropriate, and it can be cross-checked with the help of a trial balance.

- Tax Authorities: The government and the tax authorities demand properly maintained accounts, and it all begins with the preparation of journal entries.

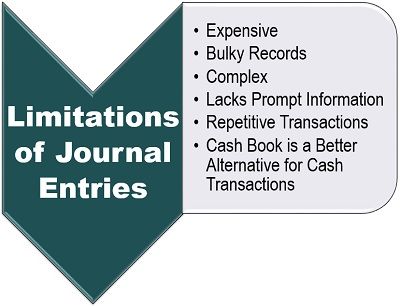

Limitations of Journal Entries

Though journal entries are an essential part of accounting, it has certain shortcomings. Thus, making it quite inconvenient for some business entities to journalize its business transactions.

Following are some of these drawbacks:

- Expensive: Recording of journal entries requires experienced accounting personnel, which makes it quite expensive for business entities.

- Bulky Records: When the business is well flourished with thousands of hundreds of transactions taking place every day; it becomes a hefty task to record each of these transactions in a journal.

- Complex: For the small business entities like a sole proprietorship firm, it seems to be a complicated process.

- Lacks Prompt Information: It becomes tough for the accountant to locate a particular transaction immediately in the manual books of account, due to its bulkiness.

- Repetitive Transactions: Though belonging to different dates, many transactions implicate the debiting or crediting of the same accounts repetitively, which makes it a tedious task.

- Cash Book is a Better Alternative for Cash Transactions: Cash book records all the cash related transactions under a single account. It has a debit and credit side, making it a more comfortable option than recording each cash transaction in separate journal entries.

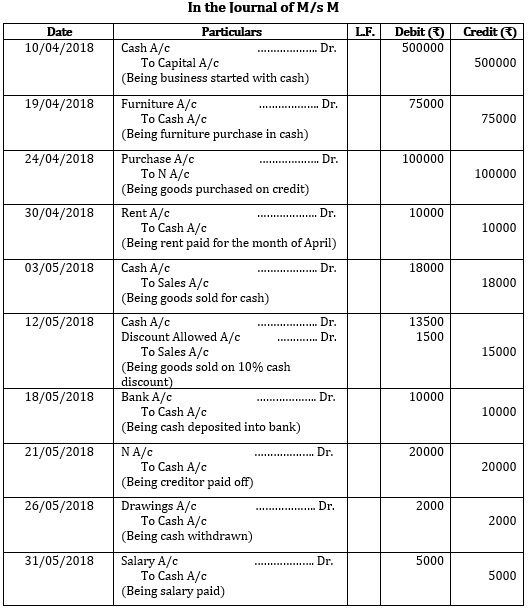

Example

Pass the journal entries for the following business transactions:

- April 10, 2018: M/s M started a business with a capital of Rs. 500000.

- April 19, 2018: Purchased furniture worth Rs. 75000.

- April 24, 2018: Purchased goods worth Rs. 100000, on credit from N.

- April 30, 2018: Rent paid Rs. 10000 for April.

- May 03, 2018: Goods sold for Rs.18000.

- May 12, 2018: Sold goods worth Rs. 15000 to P at a 10% cash discount.

- May 18, 2018: Rs.10000 deposited into the bank.

- May 21, 2018: Paid Rs. 20000 to N.

- May 26, 2018: M withdraw cash of Rs. 2000 for personal purpose.

- May 31, 2018: Paid salary Rs. 5000 to Q.

Solution:

Solution:

Please note, that in the above example, we have not filled up the ledger folio number column, since we have not yet made a ledger for the given transaction.

Journal entries are maintained in every kind of business organization, though with time, these have been modified to suit the individual company needs.

rose says

Explanations are very clear.thanks a lot. This is helpful to us who are not accounting professional.

Runner says

I love the detailed guide. It does not stop there. The way you have added the question and solutions of all journal entries are really helpful.

Keep up good job

Abhishek Chauhan says

I like the way that it’s in simple language anyone can understand by reading ..

Thank you for helping