Definition: Fund Flow Statement summarises the movements of funds in the business between the two accounting periods. It provides analytical data about the procurement and utilization of funds.

It is a technique that studies, controls and monitors the number of changes in the funds during a period. Consequently, financial managers can judge whether the funds are efficiently utilized in the business or not.

The fund flow statement depicts sources by which the firm has been financed. And the areas where these funds are applied or utilized.

These statements are an essential tool for financial statement analysis. It helps maintain the financial health and solvency of the business. As funds management is a must for survival.

We can also refer to it by a variety of names as follows:

- Statement of Sources and Utilization of Funds

- Where-Got Where-Gone Statements

- Funds Statements

- Inflow-Outflow of Funds Statements

- Statement of Sources and Application of Funds

The flow of funds refers to the inwards and outwards flow of ‘cash and cash equivalents’ inside the firm. Thus, the flow of funds impacts a firm’s working capital.

The fund’s statements depict the cause of changes in working capital. Therefore, we record only those financial transactions that affect the working capital.

Three statements are prepared during the fund flow analysis:

- Statement of Changes in Working Capital

- Funds from Operations or Adjusted Profit and Loss Account

- Fund flow Statement

Content: Fund Flow Statement

Fund Flow Statement Objectives

The Fund Flow Statement primarily assesses the cause of funds inflow and outflow. However, the objectives of the Fund Flow Statement are to:

- Estimate the working capital of the undertaking.

- Find out the changes and causes of changes in working capital.

- Perform a comparative study of the business’s financial position.

- Know the sources of the inflow of funds.

- Learn where the funds are being used.

- Formulate the policies for the financial soundness of the firm.

- Attain financial control over the business.

- Track and control the key resource of the company.

Conditions of Funds Flow

The flow of funds takes place when transactions between the following items occur:

- Fixed and Current Assets (Assets purchased in Cash)

- Current Assets and Capital (Redemption or Issue in Cash)

- Fixed Assets and Current Liabilities ( Assets purchased in Credit)

- Current Liabilities and Capital ( Debentures issued to Creditors)

How to prepare Funds Flow Statements?

Before preparing the funds statements, let’s review the sources from where we will extract the required information.

- The balance sheet of the current year and the previous year.

- Profit and Loss Statement of the current year.

- All the relevant information affects the firm’s fund flow.

After that, we need to prepare three statements, as discussed in the sections above.

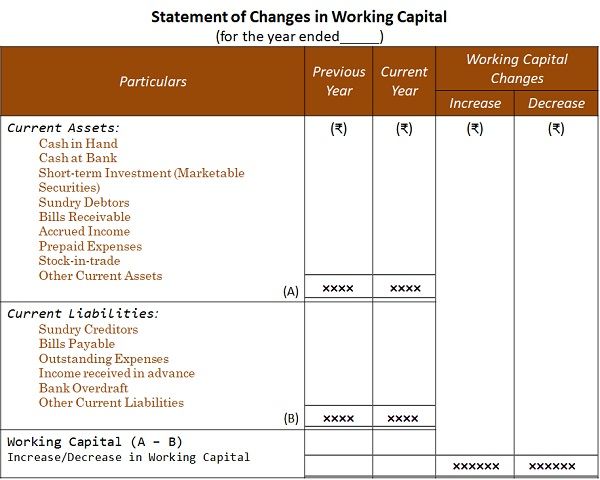

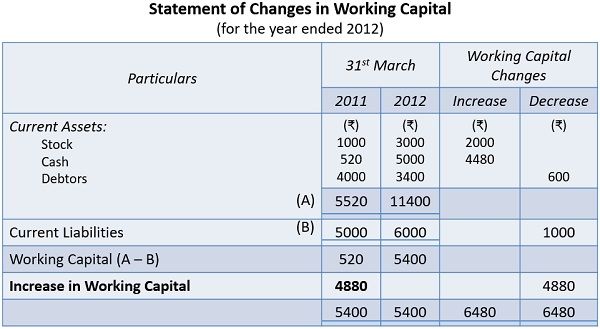

Firstly, we analyze the changes in working capital. The statement depicts an increase/decrease in current assets and liabilities between the two years.

Accounting Treatment in Fund Flow Statement:

- Record the net increase in working capital under the application of funds.

- Whereas a decrease in working capital under the sources of funds.

Format of Changes in Working Capital

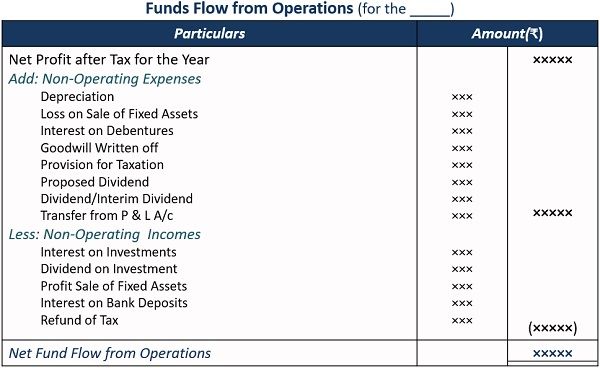

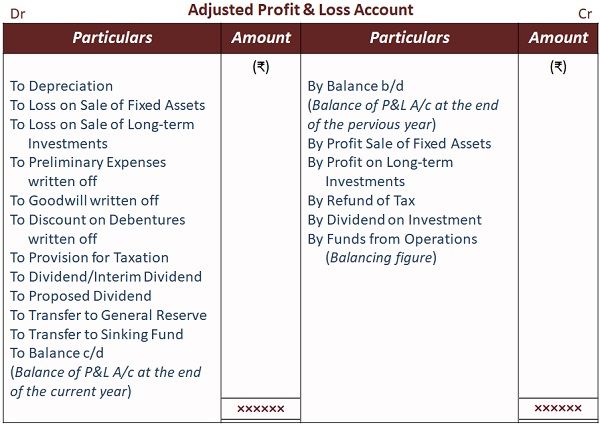

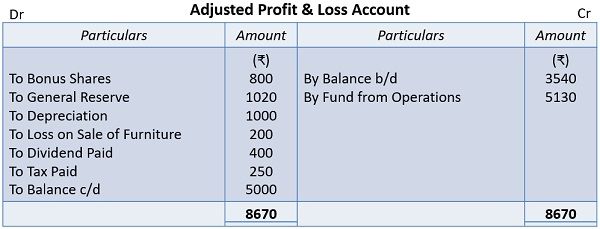

Secondly, we calculate the funds from operations. It depicts an increase or decrease in working capital due to operating activities.

We can calculate it by preparing the statements given below:

- Statement of Funds Flow from Operations, or

- Adjusted Profit and Loss Account

Accounting Treatment in Fund Flow Statement:

- Funds from operations appear under sources of funds.

- Funds lost in operations appear under the application of funds.

Format of Funds from Operations

Format of Adjusted Profit and Loss Account

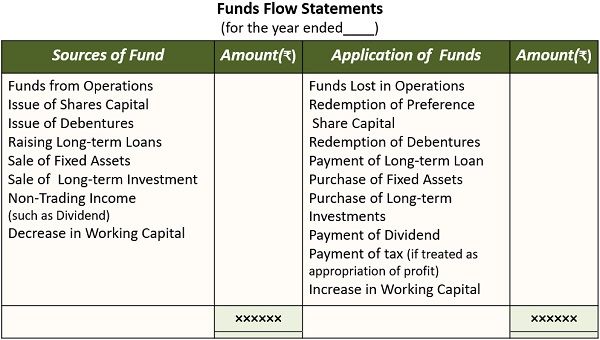

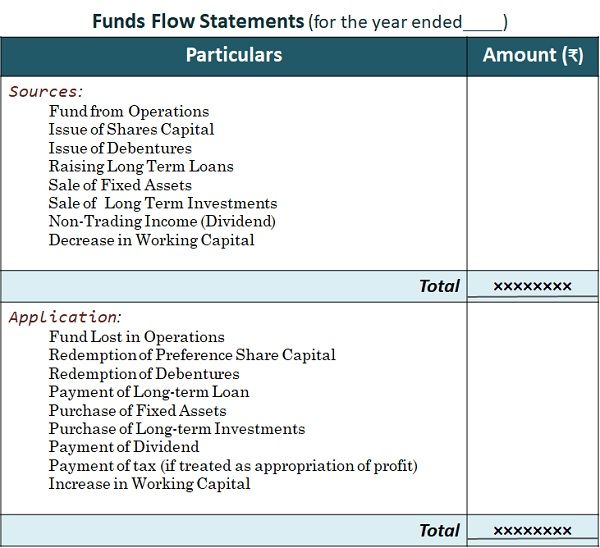

The third or final step in the process is making the fund flow statement. The fund’s statement has two separate sections, that is:

- Sources of Funds: It depicts the items responsible for the inflow of funds into the business.

- Application of Funds: This section shows the outflow of funds from the business.

Format of Fund flow Statements in the form of an account

Format of Fund flow Statements in the form of a Statement

Points to Remember

One must consider the following points while preparing funds flow statements:

- Always prepare the changes in working capital first.

- The funds flow statement and operations funds must be prepared simultaneously.

- Provide necessary working notes for the adjustments.

Importance of the fund flow statements

The fund flow statements are helpful to the firm’s stakeholders. This is because, it conveys vital information about the business. Besides this, the importance or uses of fund flow statements are as follows:

Management

Fund Flow Statements help management in the following ways:

- It helps management to determine the plan of action for the future.

- The fund flow analysis enables optimum resource allocation.

- After analyzing the application of funds, management can formulate its dividend policy.

- The management can analyze and improve its working capital positions.

- It depicts the firm’s financial position, which helps acquire loans easily.

Investors

Investors can get some vital information about the firm like:-

- Abilities of the firms to pay them dividend

- Firm’s capabilities to pay their obligations

- Effective sourcing and usage of the funds

Creditors

Fund flow statements provide the actual financial position of the business. The creditors can find out the companies’ capabilities of repaying their debts. It includes the short and long-term liabilities of the business.

Government

The government uses these statements to know the firm’s capital budgeting sources. The government forms industrial policies based on the data given in this statement.

Fund flow statements also help the government in capital control.

Financial Institutions

The financial institutions seek information about the firm’s liquidity and profitability. They get this information by way of Fund flow statements.

Researchers

Researchers use various financial statements to assess a business’s financial soundness. Fund flow statements help derive conclusions about the financial position of enterprises.

Limitations of Fund Flow Statements

There are certain limitations associated with the fund flow statement listed below:

- Only provides additional information about funds. Therefore, it cannot be considered a substitute for financial statements.

- It uses historical data, so it is not prepared with much accuracy.

- These statements only cover changes in working capital, not cash. However, for businesses analyzing changes in cash is very essential.

- Important non-fund transactions are not included in these statements.

Example of Fund Flow Statement

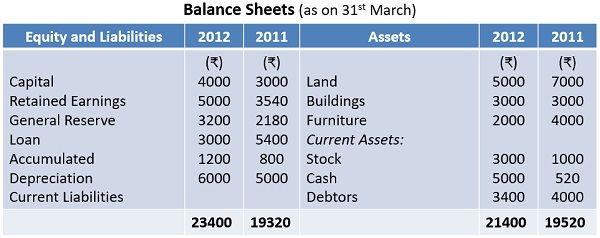

The Balance sheet of MRF Ltd. for 2011 and 2012 is given below. From the shared data prepare:

- Statement of Working Capital Changes

- Fund Flow Statement

Additional Information:

- Dividend paid Rs.400/-, Taxes Rs.250/-.

- Issue of Bonus Shares Rs.800/-.

- MRF Ltd. purchased land for Rs.1500/-.

- Sale of Furniture costing Rs.1000/- for Rs.800/- (accumulated depreciation Rs.600/-).

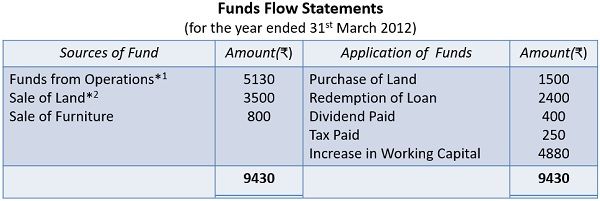

Solution:

We will record the increase in working capital of Rs.4880/- under the application of funds.

Working Notes

Note 1:

Note 2:

Opening balance of Land Rs.7000/-

Add: Land Purchased Rs.1500/-

Less: Closing balance Rs.5000/-

Hence, the Sale of Land is equal to Rs.3500/-

Final Words

The Funds statement helps analyze the changes in the financial soundness of a business over a while. The analysis is done by monitoring the firm’s inflow and outflow of funds.

It considers business transactions that are financial in nature. Also, the impact of these transactions on the working capital.

Leave a Reply