Sole Proprietorship is the most accessible form of business that is solely or individually handled by one person called “proprietor,” subject to minimal regulation. However, the Partnership is a type of business in which at least two persons are required to become a partner by signing a contract that explains all the partners’ duties, responsibilities, and rights.

In the sole proprietorship business, a proprietor (owner) introduces the whole capital, labours, and machinery required for running the business. However, in partnership firms, the partners share the cost in the ratio of their share in the business.

Content: Sole Proprietorship Vs Partnership

- Difference and Comparison

- What is Sole Proprietorship?

- Features of Sole Proprietorship

- What is Partnership?

- Features of Partnership

- Summary

- Conclusion

Difference and Comparison

| Basis of Difference | Sole Proprietorship | Partnership |

|---|---|---|

| Evolution | Sole proprietorship firms get formulated whenever the owner decides to create a firm. | Partnership requires at least two persons who are mutually ready to start a business by signing a partnership contract. |

| Act | No specific Act is made for the sole proprietorship business. | The Partnership Act,1932 regulate a partnership. |

| Scope of Financial Resources | In a sole proprietorship business there is limited extension as only one person invests his capital in it. | There is a wide scope of gathering financial resources as all partners invest in a partnership business, which helps in increasing the expansion and growth of business. |

| Administrative Skills | As proprietor is a single person; thus, he has limited administrative skill. | As in partnership administrative skill of various partners is involved, it has a wide pool of such skills. |

| Life of Business | Life of sole proprietorship business rely upon the life of its owner if the owner dies the business automatically gets terminated. | In a partnership firm, the life of business does not depend upon the life of any one partner, a partner may come and go, but the business must go on. |

| Secrecy | In sole proprietorship, full business secrets are kept with proprietor only. | In a partnership firm, all secrets get shared amidst all the partners of the firm. |

| Profit-Sharing | All profit of the business belongs to its owners only. | Profit of partnership firms gets distributed amongst all the partners in their profit-sharing ratio, as mentioned in the contract. |

| Risk Sharing | As there is only one owner, all risk is also borne by him individually and by any other. | Risk gets shared amidst all partners. |

| Agility in making decisions | Quick decisions can be taken as an owner don't need to consult anyone for any business decision. | Decision-making process may be time-consuming as all decisions regarding business will be taken after consulting all the partners of the firm, and based on the majority, the decision will be taken. |

| Extension of audacious and rapid conclusions | As the proprietor or the owner is only decision -maker, there is more extension of audacious and rapid conclusions. | All partners or majority of partners takes decisions; thus, there is less extension of audacious and rapid conclusions. |

What is Sole Proprietorship?

A sole proprietorship business is a merely owned business by a single person who is the sole owner of that business; all business profit and risk come in its proprietor’s bucket. An individual utilizes his personal skills to manage all the business affairs and is the only one who is completely responsible for any good or bad outcome of the business. It needs limited capital to start and can efficiently be handled by its sole owner. A sole proprietorship firm does not have a separate identity from its owner from a legal viewpoint. The proprietor of the business has immeasurable liability for business debts.

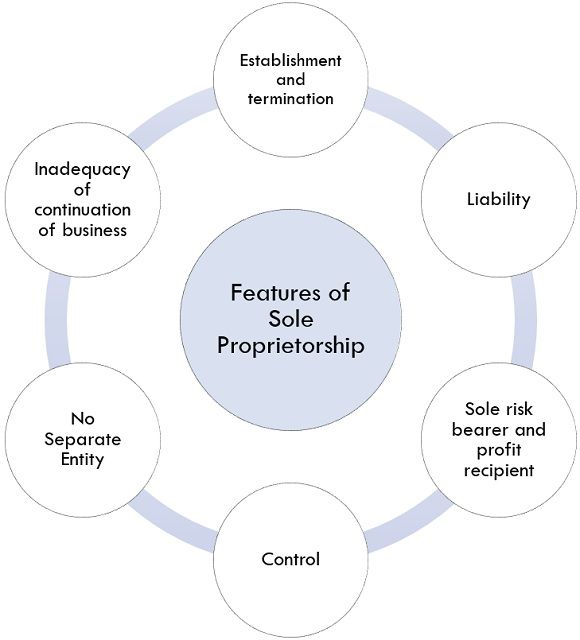

Features of Sole Proprietorship

The sole proprietorship firm has the following features:

1. Establishment and Termination: Establishing and terminating the sole proprietorship business is much easier than a partnership business. It does not require many legal formalities, as 90% of the proprietorship firms do not need a license certificate to start a business according to their wish. It can be started whenever a proprietor feels to do so. The most common example of a sole proprietorship business is retail shops handled by an individual.

2. Liability: In a sole proprietorship firm, the liability of its proprietor is unlimited. The debts of his business will be treated as his personal debts as well as all other liabilities incurred by the business during the life of its business will be considered as a liability of the proprietor, i.e., if there is any outstanding liability of the business first the assets of the business are sold to repay them, and if the assets of the business are not sufficient to pay off the debts, the proprietor has to pay them by selling his personal assets.

3. Sole Risk Bearer and Profit Recipient: As the sole proprietor is a single owner of his business, he is wholly responsible for the profit or loss of that business and has to bear alone whether the firm earns gain or faces loss.

4. Control: Control of business and decisions such as expansion, purchase, and sale are in the hands of the proprietor. He takes decisions for his business according to his decision-making ability and experience.

5. No Separate Entity: In the eyes of the law, the proprietor and the sole proprietorship firm both are treated as one entity. i.e., the business and the businessman will be considered as a single entity. Therefore, if any legal action taken on the product will be considered as legal action against businessman selling such product and vis- a- versa.

6. Inadequacy of Continuation of Business: In the sole proprietorship business, the business cannot go on without its owner. If the owner faces any health issue or if he dies, the business automatically gets terminated.

What is Partnership?

A partnership is a kind of business in which two or more than two persons are required as per the Companies Act, 2013. For formulating the Partnership, all the partners need to sign an agreement stating all the rights and liabilities in the business. The contract so signed by all the partners is known as “Partnership Deed.” A Partnership can be considered as an enlargement of proprietorship, where all the partners equally bear the risk and reap the profit from the business. All the partner’s income gets taxed at the rate of flat 30 % as it is a distinct legal and tax entity.

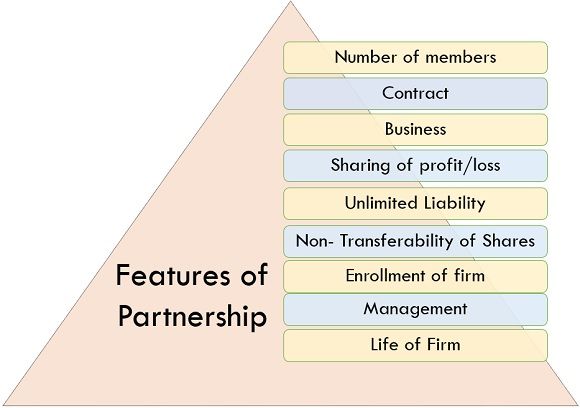

Features of Partnership

The following are the features of Partnership:

1. Number of Members: In Accordance with the Companies Act, 2013, the least number for formulating the partnership concern is 2, and the upper limit is 100 partners in case of general companies and utmost 10 partners in case of banking concerns.

2. Contract: A partnership needs a contract among all the partners, and such a contract is termed as a partnership deed. The contract can be oral or written, although the written contract is much appropriate to handle any disputes if it arises.

3. Business: A partnership is formed to perform lawful business activities to earn a profit by investing their capital according to their business share.

4. Sharing of Profit/Loss: In the partnership firm, all the partners share the profit or loss according to their profit/loss sharing ratio as determined in the agreement. If no ratio has been mentioned, all partners will share it equally.

5. Unlimited Liability: In a partnership firm also the liability of the partners remains unlimited; they need to pay their debts even if the company faces loss either by selling the company’s assets and if they do not have plenty of assets, they are bound to pay debts by selling their personal assets.

6. Non- Transferability of Shares: In the partnership firms, all the partners get the number of shares allotted in his/her name, which cannot be transferred to any other person. If he wants to do so, he needs to take consent from all the firm’s partners, and this will become possible only if all partners are ready to give their consent.

7. Enrollment of Firm: It is not obligatory for a partnership firm to get enrolled, although it is advisable to get enrolled so that in case of any disputes, legal action can be taken.

8. Management: However, all the partners have the right to regulate the firm, or they may specify the work of every partner in the partnership deed that what they have to do and what not.

9. Life of Firm: The partnership firm gets continued till all partner’s desire to run the business, although if any partner dies or retires, the firm gets dissolved legally, although if other remaining partners agree to pursue the company, they can continue the business.

Summary

- A sole proprietorship firm gets evaluated whenever the owner wants to create it, whereas for formulating a partnership firm, at least two persons are required who are willing to form a firm by signing a contract with mutual consent.

- No specific Act has been made for the sole proprietorship business, whereas partnership gets regulated by the Partnership Act,1932.

- Extension in the sole proprietorship business to gather financial resources is limited as only one individual handle it, whereas there is a wide scope in partnership business as all partners can gather financial resources, which helps in the extension and development of their business.

- In a sole proprietorship firm, a proprietor is a single person handling business, thus have limited administration skill, whereas in a partnership firm, there is a pool of administration skills as various partners are involved in it.

- The life of a business in a proprietorship firm relies upon the life of its proprietor. If he becomes sick or dies, the firm will automatically get wind up, whereas in a partnership firm, even if one partner dies, the business may run with a remaining partner.

- In a sole proprietorship firm, maintain secrecy becomes easier as an individual solely handles all the matters, whereas in partnership all secrets are shared amidst all the partners.

- In a sole proprietorship firm, all profit of the business belongs to its owner, whereas, in partnership, profits will get distributed amidst all partners in their profit-sharing ratio or equally if profit sharing ratio has not been decided.

- In a sole proprietorship firm, rapid decisions can be taken as the sole proprietor does not need to ask anyone for reaching a resolution for his business, whereas in a partnership firm managerial process is time-consuming as all decisions are taken with the assent of all partners.

- In a sole proprietorship firm there is only one individual, thus he has to endure all the risk alone and cannot share it with anyone, whereas in a partnership firm risk also gets distributed amongst all partners.

- As the proprietor is the only decision-maker in the sole proprietorship firm, there is more extension of audacious and rapid conclusions, whereas in a partnership firm, most partners make decisions, thus there is less extension of audacious and rapid conclusions.

Conclusion

Sole proprietorship denotes the single-handed operated business in which only one person becomes liable for all business activities and enjoys all benefits. However, in a partnership number of partners gets involved and takes decisions with each other’s consent for business matters as well as enjoys profit or shares losses equally or as per the profit/loss sharing ratio mentioned in the deed.

Leave a Reply