Definition: Seed capital is the initial fund or money which is required by a budding entrepreneur to start a new business venture. ‘Seed‘ here refers to the business which is at the beginning stage. ‘Capital‘ refers to the money or funds required at the very beginning of a business.

A ‘budding entrepreneur‘ is the business aspirant who looks forward to making money from his or her business idea. But sometimes a person lacks sufficient money for funding the plan, and there comes the role of seed capital.

Content: Seed Capital

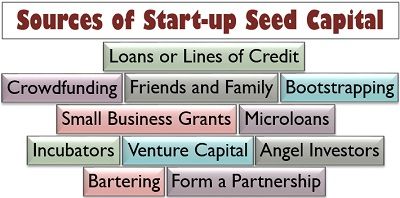

Sources of Startup Seed Capital

The startups require a substantial financial backup at the initial stage of the business to fulfil various requirements, such as meeting the operating expenses and grabbing new business opportunities.

Therefore, to acquire the initial capital for the business, the budding entrepreneur has the following means:

Friends and Family

The easiest way of raising fund for a startup is through family or friends since they are familiar with the budding entrepreneur and his/her idea. However, one must be careful while opting this source, as losing money may spoil relations with the lender.

For Example; A father withdraws his fixed deposit for seed funding his son’s startup business.

Bootstrapping

Savings is a vital source of raising initial funds for a startup. Even the investors hesitate to put in their money in a new business which lacks self-raised capital.

For Example; A person withdraws the amount from his bank’s savings account to start his business.

Loans or Lines of Credit

To avail small borrowings from external sources, a budding entrepreneur may go for loans or lines of credit from commercial banks. However, this source may require to keep personal collateral with the lender for security.

For Example; A budding entrepreneur approaches a bank to get a business line of credit to meet the working capital needs of the organization.

Small Business Grants

If one is lucky enough, he/she may get a small business grant from central, state or local government or big business entities. The funds so acquired need not be repaid by the budding entrepreneur.

For Example; In the USA, any female entrepreneur owning a startup business in the fields of design, art, music or fashion may be awarded a grant of $15000 by the Girlboss Foundation.

Microloans

These are small business loans offered by an individual or a group of individuals at a slightly lower interest rate for startups.

For Example; A person approaches another individual who provides money on a monthly interest of 1%, for availing the initial capital for the new business unit.

Angel Investors

An angel investor is the one who can invest between 10K to 100K in a new business venture only if the budding entrepreneur can convince the angel of the business idea and its profitability. Remember, they keep control over the operations and actively participate in the decision making of the business.

For Example; A person with a startup business in the field of robotics convinces and acquires fund from angel investors looking forward to investing in a similar idea.

Venture Capital

Though it is the source of high capital, i.e. more than one million, it should be avoided in the initial stage of the business. The venture capital investors look forward to owning a share in equity along with control and decision-making power.

For Example; One of India’s leading online furniture brand Pepperfry.com acquired USD 100 million for expansion of its business in Tier III and Tier IV cities through venture capital from Goldman Sachs and Zodius Technology Fund.

Incubators

The budding entrepreneur may avail the initial capital from incubators who not only provide funds but also give the required training and helps develop a network for the business. Accelerators are another similar source of funds, the only difference being that the accelerators support the company to take a significant transformational step.

For Example; UnLtd India acts as a business incubator for the entrepreneurs engaged in social startups in India.

Bartering

Another good option for small business organizations is the exchange of some commodity, i.e. any goods or services for other products or services.

For Example; An interior designer wanted to purchase the latest laptop for her startup but lacks the required money for it. The owner of an electronics store agrees to give her the laptop in exchange for the interior designing services for his premises.

Form a Partnership

Some of the well-established business organizations invest in the new business units and initiating a partnership with them since they find these startups to be of high potential.

For Example; A running Thai restaurant owner provides initial funding to an upcoming Italian cafe in the nearby locality to earn a dual profit. Thus, both the parties enter into a partnership deed.

Crowdfunding

The last one is the acquisition of initial funds from a massive group of individuals who get attracted to the budding entrepreneur’s business idea through crowdfunding websites or social media.

For Example; One of the most popular crowdfunded business was SkyBell Video Doorbell. It successfully collected $600000 in 30 days on Indiegogo for their idea of sending a live video of the person on the front gate, who rings the doorbell.

Advantages of Seed Capital for Start-ups

As we know that no business can be run successfully without the availability of the required funds, seed capital is considered to be the backbone of any startup.

Given below are the multiple benefits of seed capital for the startup owners:

- Investors Willing to Take Risk: The most significant advantage of seed capital is that the investors are ready to take the high risk of failure involved in the startup business.

- Usually, No-Debt Financing: Most of the times, the budding entrepreneur is not overburdened by the debts or liability. Instead, he/she needs to give away some share in equity to the investors.

- High Growth Prospectives: The seed capital provides financial leverage to the startups for grabbing new opportunities and accelerate growth.

- Flexible Business Agreements: The terms of a seed funding business agreement are negotiable and flexible, which is not the case in venture capital and bank borrowings.

- Angels Share Knowledge and Experience: In sources like an angel investor, venture capital, incubator, partnership and accelerator, the investor takes an interest in the business. He/she also share relevant knowledge and information with the budding entrepreneur.

- No Monthly Fees: Many of the investors (except in case of loans and borrowings) are interested in the ownership of the new venture rather than charging interest or monthly fees.

- Builds Relationship, Network and Community: Some sources of funds like angel investors, crowdfunding and incubators allow the budding entrepreneur to access their business networks and community to build public relations.

Disadvantages of Seed Capital for Start-ups

It is essential for the budding entrepreneur to plan the source of seed capital wisely. An inappropriate selection may even lead to business failures.

Following are the various limitations of the seed capital for new business entities:

May Lead to Diversions: Acquisition of funds for business is a time consuming, and tedious work with diverts the entrepreneur’s attention from the underlying business operations towards fulfilling seed capital requirement.

Loss of Control and High Interference: An investors, especially the angel investors, exercise control over the company’s decision making and operations, in the sake of providing guidance. This excessive involvement of the investors trouble the entrepreneurs a lot.

Giving Up Equity: The budding entrepreneurs by opting for means like angel investors, venture capitalists and incubators may land up giving away a share of business ownership in the form of equity and limiting the future profits for himself or herself.

Interpreting Seed Capital Acquisition as Success: Some budding entrepreneurs falsely consider the acquisition of funds as their most significant achievement. Thus, going into a relaxation mode when they need to perform in making their business a success.

Costly Affair Due to High-Risk Involvement: Since startups involve a high risk of failure and loss, the investors provide funds at a high rate of interest or in exchange for a significant business share.

Sometimes Investors Lack Expertise: In the practice of creating a diversified portfolio, the investors sometimes put their money in less-known business, thus increasing the risk of loss.

Limits Future Profits: Since some sources of capital acquisition demand giving up of a portion of business ownership by issuing equity shares to the investor, the budding entrepreneur needs to share all future profits with such investors.

Investments May Not Stay Lifelong: The investors purposefully pool in their money in a new venture. They aim at making profits, and when the business reaches a saturation point, they tend to withdraw their investments.

Conclusion

Going for an external source of seed capital may not be a suitable decision every time. It may lead to sacrificing business ownership, high-interest payments, high dividend payments sand losing control over the business.

However, if the budding entrepreneur wisely decides and acquires fund from a suitable source in the appropriate proportion with a planned repayment strategy; it can make the best utilization of such funds for the business growth and development.

Leave a Reply