Definition: Cash Budget is a precise statement depicting anticipated projections about the cash receipts and payments for a specific time period. It is a type of functional budget that is useful for cash management in the organization.

A cash budget is essential for companies and is referred to as the “Nervous System of Budgetary Control“. Also, it is alternatively known as Cash Flow Plans.

It basically operates upon two components, i.e. Cash Receipts and Payments. These components are ascertained by analyzing cash movement inside and outside the business.

It is conducted for a limited period known as Planning Horizon. It assists in planning short-term investments and making necessary arrangements in case of Deficit.

By preparing cash budgets, organizations can reduce Cash Shortages and lower Ideal Cash Levels. Also, it helps in avoiding severe uncertain consequences in the absence of financial planning.

Content: Cash Budget

- Format

- Key terms used during Cash Budgeting

- Importance or Objectives

- Duration

- Methods

- How to prepare a Cash Budget?

- Advantages and Disadvantages

- Conclusion

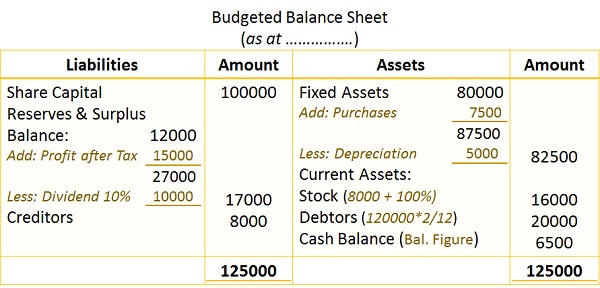

Cash Budget Format/Formula

The format or we can say the formula for preparing a Cash Budget is as follows:

Key terms used during Cash Budgeting

- Cash Receipts: The flow of cash inside the business- like Customer Sales Receipts, etc.

- Cash Payments: It is the movement of cash outside the business-like payments made in cash.

- Surplus/Deficit: The variance between the requirement and availability of cash during the budgeted period. A surplus is a positive balance, whereas a negative balance is a Deficit.

- Financing: It provides insight regarding funds raised by the company. It also includes its Payments, Interest Payments, Repayments, etc.

- Investing: It refers to the utilization of surplus cash in the form of short and long-term investments.

- Time Lag: It is the duration between the occurrence of a transaction and actual cash flow.

Importance or Objectives of Cash Budgets

Besides Sales Budget, the cash budgets are also of greatest concern. The following points depict its importance, which are also the goals of preparing a Cash Budget:

- Ascertain the availability of cash in the coming time.

- Helps in the estimation of Access and Shortage of cash.

- Assists in developing credibility among creditors.

- Can control the cash levels in the organization.

Duration of Cash Budget

The budgeting period for a cash budget varies depending upon:

- The long-term planning, nature and type of business

- Existing cash position of the business

- And the management needs

Based on these, we can classify cash budget under three major categories:

- Operational Budgets: These budgets help meet the operational goals of the organization. Managers can prepare these budgets Monthly, Weekly or Daily as per the need.

- Short-Range Cash Budgets: The management prepares these budgets annually following Annual Profit Plans.

- Long-Range Cash Budgets: This type of cash budget is usually formed for the duration of 5 years. It contains strategies related to businesses Long Term Projects, Profit Plans and Expansion.

Methods

The financial managers make use of the following methods for the preparation of cash budgets:

- Receipt and Payment Methods

- Adjusted Profit and Loss Account Method

- Balance Sheet Method

Receipts and Payment Method

It is the most simplified method and is similar to Receipt and Payment Account. But, this statement contains forecasted receipts and payments for the budget period.

Under this method, we need to calculate the Closing Balance. For this, we add receipts and deduct payments in cash from the opening balance.

However, this method is suitable when preparing budgets for the Annual Profit Plan. It is generally prepared for the budgeting for a short duration of time.

Note: The statement excludes adjustments, whereas time lag must be carefully included.

Format

The format is the same as the one given above under the head Cash Budget Format.

Example

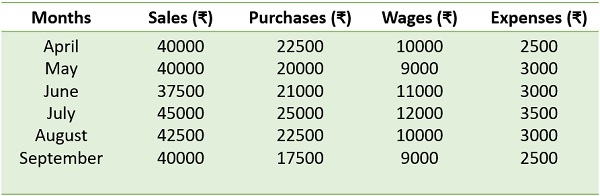

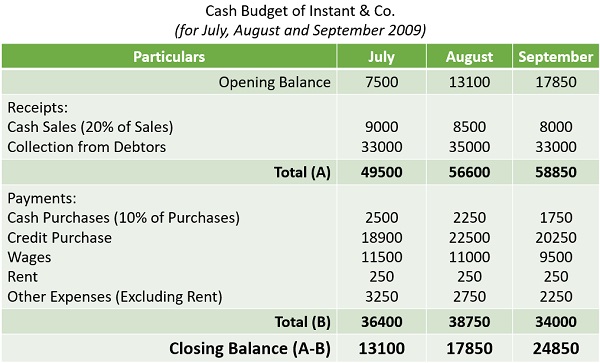

Create a Cash Budget for Instant & Co. using details below for the month of July, August and September 2009.

Additional Information:

- On July 01, cash balances are taken Rs.7500/-.

- Credit purchases are settled after one month. Cash Purchases are 10% of the Total Purchases.

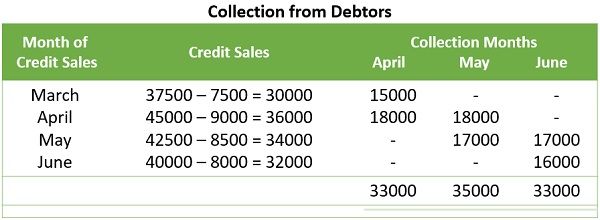

- Cash sales are 20% of the Total Sales. The Collection period is of 15 days in a month.

- The monthly expenses include Rent of Rs. 250/-.

- Payment of Wages every 15 days.

Solution:

Working Notes:

Note 1: Debtors

Note 2: Wages

July = 15th of June + 15th of July = 5500 + 6000 = 11500

Aug = 15th of July + 15th of Aug = 6000 + 5000 = 11000

Sept = 15th of Aug + 15th of Sept = 5000 + 4500 = 9500

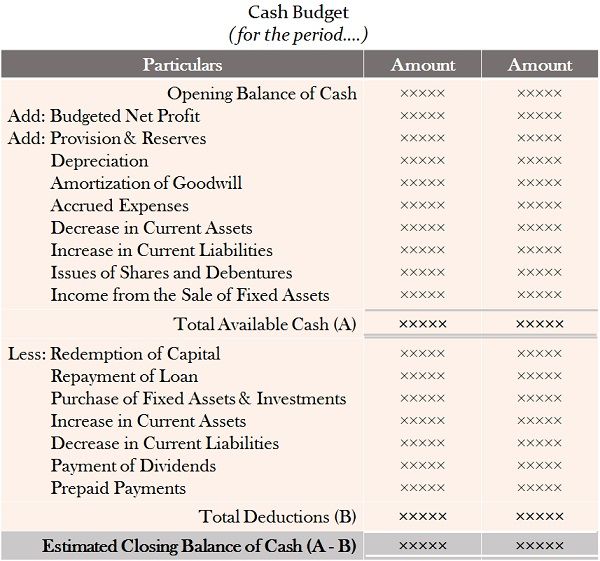

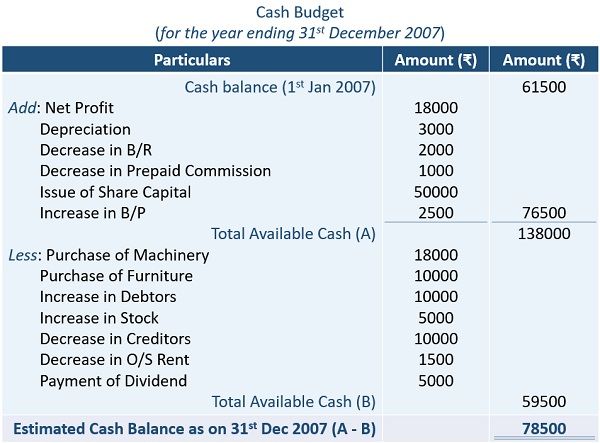

Adjusted Profit & Loss Method

A variety knows it by names like – Cash Flow Method & Profit Cash Forecast Method. This method is very much like Cash Flow Statements but mainly focuses on forecasted data.

The managers prepare the Cash Budget using the following items:

- Opening balance of Cash and Bank

- Projected Profit & Loss Account

- Assets and Liabilities balances appear on the balance sheet

Here, the cash budgeting begins by adding the Budgeted Net Profit to the Opening Cash Balance. After that, we make the following adjustments to the balance obtained:

- Add projected decrease in Current Assets and decrease in Current Liabilities.

- Deduct projected increase in Current Assets and decrease in Current Liabilities.

- Necessary treatment of expected payments of Tax and Dividends.

After the above adjustments, we will get the closing balance of cash, i.e. expected cash, by the end of the budget period.

Format

Example

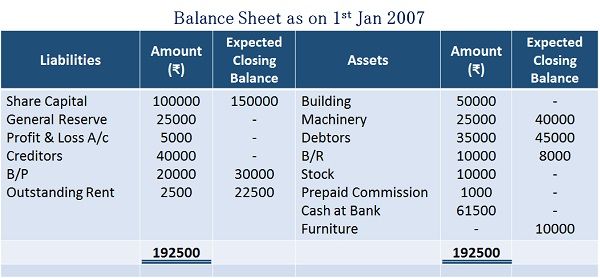

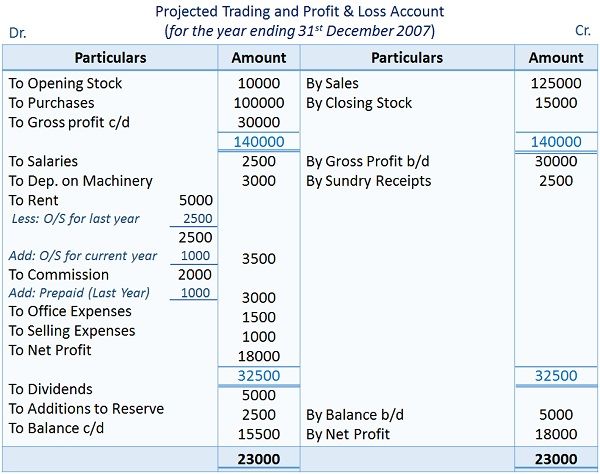

By using the data in the Balance sheet and Projected Profit & Loss A/c, prepare Cash Budget for December 31 2007.

Projected Trading and Profit & Loss Account

Solution:

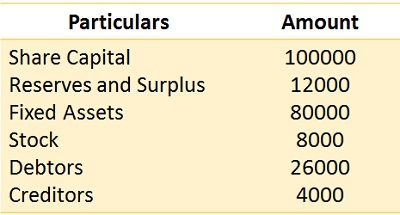

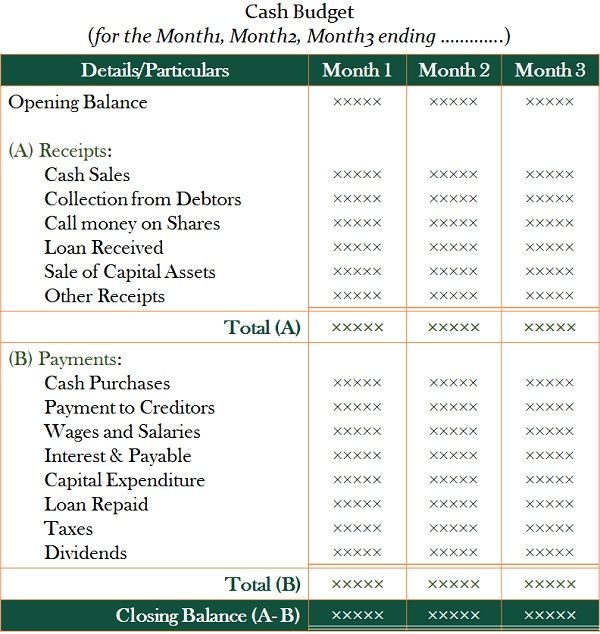

Budgeted Balance Sheet Method

By this method, we can estimate the cash position at a particular time. For this purpose, we prepare a Budgeted Balance Sheet at the end of the budget period.

The asset side of the balance sheet depicts estimates about all Assets. On the other hand, the liability side shows projections about all Liabilities. And the product of the variance between the asset and liability side will be Cash Balance or Bank Overdraft.

Note: Initially, we exclude Cash, Bank and Bank Overdraft balances from the asset side.

Format

The format of the Budgeted Balance Sheet is similar to the conventional Balance Sheet.

Example:

Based on the following information, prepare a Budgeted Balance Sheet to ascertain Cash Position.

- The estimated Net Profit is Rs.15000/-

- 100% addition in Stock by each year’s end

- Get a Machinery of Rs.7500/- as per Capital Expenditure Budget,

- 50% tax is charged on Profit

- Charge Depreciation of Rs.5000/- on Fixed Assets

- Creditors become double by the year’s end

- Estimated Sales as per Sales Budget is Rs.120000/-

- 10% Dividend is to be paid by the company

- Outstanding Debtors from 2 months

Solution:

How to prepare a Cash Budget?

It is one of the frequently asked questions about Cash Budget.

There are certain generalized steps that one can follow during cash budget preparation. These steps are discussed hereunder:

Step 1: Budget Period

The first step in preparing a Cash Budget is ascertaining the period of Budget. The managers have to decide whether to prepare a short or long-term budget.

Step 2: Estimate Sources and Application of Cash

The next step is identifying and estimating the sources and applications of cash. For this purpose, the finance manager forecasts their requirements for the budget period.

Step 3: Method of Cash Budgeting

The third step is the selection of a suitable Budgeting Method. The selection of the methods depends upon the budgeting duration and objectives.

Step 4: Cash Position

After that, the managers estimate the cash balances at the beginning and end of the budget period. The closing cash position can be obtained from any of the abovementioned methods.

Step 5: Analysis of Cash Budget

The final step is the analysis of the cash budget. The study thoroughly compares the actual results with the budgeted results. And taking corrective measures in case of any deviations.

Advantages and Disadvantages

Advantages

Preparation of cash budgets benefits the organizations in the following ways:

- Cash Projections: You can make projections about expected cash receipts and payments through cash budgets. As a result, one can make pre-arrangements and avoid borrowings.

- Expense Management: You can make estimates about expected expenditure while preparing cash budgets. Consequently, the respective departments can achieve control over their expenses.

- Dividend Policies: The company can review the availability of cash through budgets before announcing a dividend.

- Financial Planning: Financial managers use these budgets as a Financial Planning Tool. Because cash budgets cover all the essential information required to plan companies’ finances.

- Profitable use of Cash: Cash budgets help efficiently utilize the organization’s most essential resource.

Disadvantages

Some limitations of cash budgets are as follows:

- Uncertainties: The market is volatile in nature and full of uncertainties. Thus, managers may face difficulties in cash budgeting.

- Inaccurate Assumptions: Cash budgets largely depend upon the assumptions about Expenses and Incomes. And an erroneous assumption may lead to critical consequences.

- Expensive: The preparation of cash budgets involves considerable statistical research. Conducting these researches is a costly affair, also an addition to the cost.

Conclusion

To conclude, Cash Budget lays attention on the actual flow of cash within and outside the business. It provides an insight into the cash position and vital information for financial planning.

In practice, firms prepare these budgets to match the need for cash and capital budgeting.

L.Jeyasingh says

Very good presentation .

Much informative.