Definition: Capital budgeting is the method of determining and estimating the potential of long-term investment options involving enormous capital expenditure. It is all about the company’s strategic decision making, which acts as a milestone in the business.

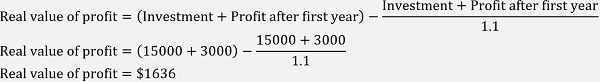

For Example; Let us now consider capital budgeting for buying a new printing machine by a publishing house. The machine is worth $15000 and will generate a return of $3000 annually. Thus the payback period of the machine is five years. The expected annual rise in inflation is 10%.

Let us calculate the real investment value after the first year:

We can say that the company’s actual profit after a year is estimated at $1636 instead of $3000.

Content: Capital Budgeting

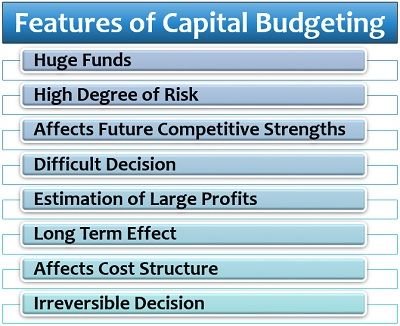

Features of Capital Budgeting

Capital budgeting is a crucial decision and to understand the concept in a better way, let us go through its following features:

- Huge Funds: Capital budgeting involves expenditures of high value which makes it a crucial function for the management.

- High Degree of Risk: To take decisions which involve huge financial burden can be risky for the company.

- Affects Future Competitive Strengths: The company’s future is based on such capital expenditure decisions. Sensible investing can improve its competitiveness, whereas a wrong investment may lead to business failure.

- Difficult Decision: When the future is dependant on capital budgeting decisions, it becomes difficult for the management to grab the most appropriate investment opportunity.

- Estimation of Large Profits: Any investment decision taken by the company is made with the perspective of earning desirable profits in the long term.

- Long Term Effect: The effect of the decisions taken today, whether favourable or unfavourable, will be visible in the future or the long term.

- Affects Cost Structure: The company’s cost structure changes with the capital budgeting; for instance, it may increase the fixed cost such as insurance charges, interest, depreciation, rent, etc.

- Irreversible Decision: A decision once taken is tough to be amended since it involves a high-value asset which may not be sold at the same price once purchased.

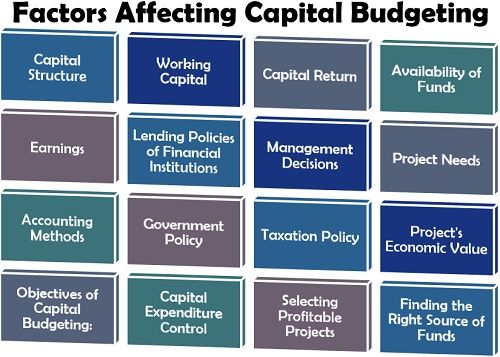

Factors Affecting Capital Budgeting

The capital budgeting decisions influenced by various elements present in the internal and external business environment. Following are some of the significant factors affecting investment decisions:

Capital Structure: The company’s capital structure, i.e., the composition of shareholder’s funds and borrowed funds, determines its capital budgeting decisions.

Working Capital: The availability of capital required by the company to carry out day to day business operations influences its long-term decisions.

Capital Return: The management estimates the expected return from the prospective capital investment while planning the company’s capital budget.

Availability of Funds: The company’s potential for capital budgeting is dependant on its dividivent policy, availability of funds and the ability to acquire funds from the other sources.

Earnings: If the company has a stable earning, it may plan for massive investment projects on leveraged funds, but the same is not suitable in case of irregular earnings.

Lending Policies of Financial Institutions: The terms on which financial institutions provide loans such as interest rates, collateral, duration, etc. contributes to capital budgeting decisions.

Management Decisions: The decision of the management to take a risk and invest funds in high-value assets or holding some other plan, also determines the capital budgeting of the company.

Project Needs: The company needs to consider all the essentials of a new project. Also, the means to fulfil the requirements along with the estimate of the related expenses should be clear.

Accounting Methods: The accounting rules, principles and methods of the company is another factor considered while capital budgeting to frame the reporting of such expenses and revenue to be generated in future.

Government Policy: The restrictions imposed and the exemptions allowed by the government to the companies while investing in capital nature, impacts the company’s capital budgeting decisions.

Taxation Policy: The taxation procedure and policy of the country also influences the long-term investment decision of the firm since additional capital will be required for such expenses.

Project’s Economic Value: The total cost estimated for the long-term investment and the capacity of the company determines the capital budgeting decisions.

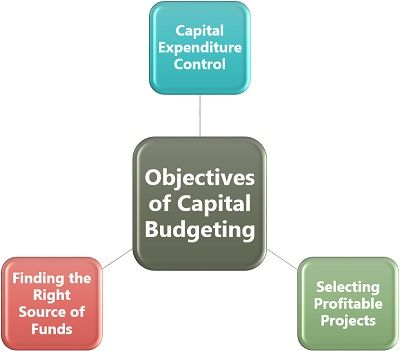

Objectives of Capital Budgeting

What is the need for capital budgeting? Why do companies invest so much time and efforts in it? Capital budgeting is the long-term decision which affects the business to a great extent.

To know more about the necessity of capital budgeting for the companies, let us go through the following objectives:

- Control of Capital Expenditure: Estimating the cost of investment provides a base to the management for controlling and managing the required capital expenditure accordingly.

- Selection of Profitable Projects: The company have to select the most suitable project out of the multiple options available to it. For this, it has to keep in mind the various factors such as availability of funds, project’s profitability, the rate of return, etc.

- Identifying the Right Source of Funds: Locating and selecting the most appropriate source of fund required to make a long-term capital investment is the ultimate aim of capital budgeting. The management needs to consider and compare the cost borrowing with the expected return on investment for this purpose.

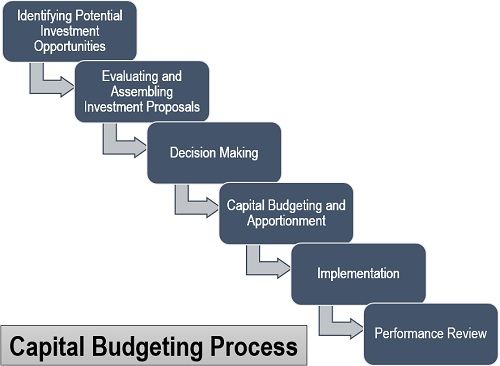

Capital Budgeting Process

Capital budgeting, as we know, is a decision making process. It involves the following six steps:

Identifying Potential Investment Opportunities: The company has various options for capital employment on a long-term basis. In the initial stage, the management needs to analyze the strengths and weaknesses of every project for foreseeing the potential of each option.

Evaluating and Assembling Investment Proposals: In the next step, the management assembles and compiles all the investment proposals on the grounds of cost, risk involvement, future profits, return on investment, etc.

Decision Making: Now, the company needs to decide as to which investment option it may select to suit its pocket and yield a high profit for the company in the long run.

Capital Budgeting and Apportionment: The next step is to classify the investment as per its duration. The long-term investment is generally considered under capital budgeting. This step helps in monitoring the performance of an individual investment.

Implementation: After the apportioning of the long-term investment, the company comes into action for the execution of its decision. To avoid complications and excess time-consumption, the management should lay out a detailed plan of the project in advance.

Performance Review: The last but the most crucial step is the follow-up and analysis of the project’s performance. While the company’s operations are steady, the management needs to measure and correlate the actual performance with that of the estimated one to figure out the deviation and take corrective actions for the same.

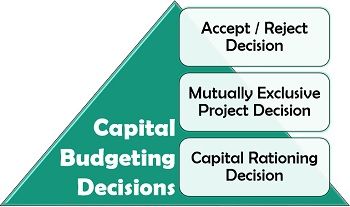

Capital Budgeting Decisions

The organization’s all capital budgeting decisions can be broadly categorized under the following three types:

- Accept / Reject Decision: This type of arrangement is fundamental and mostly applies to the independent projects which are not affected by the acceptance possibility of other projects. The projects which generate a high rate of return or cost of capital are accepted, and the plans which do not fulfil the criteria are rejected.

- Mutually Exclusive Project Decision: These projects compete with one another, i.e., the possibility of accepting one project excludes the acceptance of the other.

- Capital Rationing Decision: The term itself explains that the limitation of capital dominates such decisions. In a situation where the firm has multiple investment options demanding huge funds, the management rank the projects on specific criteria; such as the rate of return of each project. Then, the projects with the highest percentage of profit or those which fulfil the requirements most can be selected.

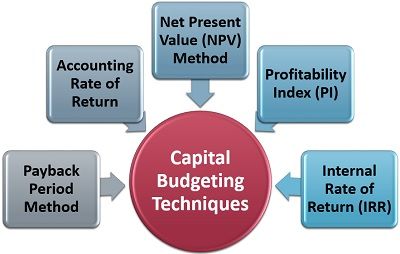

Capital Budgeting Techniques

Capital budgeting is a complicated and tedious process. It involves a lot of financial expertise and calculations. Following are the various computations required to determine the capital budgeting of a new project:

Payback Period Method:

The payback period method is the simplest of all. It defines the period in which the company can recover its investment value.

The formula for calculating the payback period of a project is:

![]()

The shorter is the payback period of the project, the more suitable it is for the company.

Accounting Rate of Return:

The accounting rate of return depicts the future profitability of a project with the help of accounting information mentioned in financial statements.

The formula for calculating the accounting rate of return is:

![]()

The higher is the ARR of the investment proposal, the more preferable it is for the company.

Net Present Value (NPV) Method:

Net present value is the discounted cash flow method. It functions on the principle that the cash inflow from the project will be acquired in a future period when the value of money will change. Hence, the future cash flow needs to be discounted at present value to compare the estimate performance with the actual one.

The Net Present Value (NPV) formula is:

![]()

i.e.,

![]()

Where, A1, A2, A3 are the cash inflows in consecutive years;

k is the cost of capital of the project;

We assume that all the cash outflows are done in the first year (t) and therefore, t=1.

Profitability Index (PI):

Profitability index is the ratio which relates the present value of earnings with the investment value.

The formula of the Profitability Index (PI) is:

![]()

or,

![]()

To denote the Profitability Index in percentage, Profitability Ratio of a new project is calculated. Its formula is:

![]()

Internal Rate of Return (IRR):

The internal rate of return determines the rate at which the investment amount is recovered by the cash inflows. The net present value of the project is zero in this method. Also, the discounted cash inflow and outflow are the same.

Initially, the Present Value of Cash Outflow (Co) is calculated as follows:

![]()

Where Co is the present value of cash outflow;

C1, C2, C3 are the cash inflows in the consecutive years;

n is the number of years;

r is the expected rate of return.

This is the cutoff rate of the project.

The Internal Rate of Return (IRR) formula is:

![]()

Where NPV (LR) is the net present value at a lower rate;

NPV (HR) is the net present value at a higher rate.

Analysis: If the IRR≥Co, the project is accepted; but if IRR<Co, the project is rejected.

Conclusion

Capital budgeting is a vital part of all the organizations, whether big or small. These decisions build the foundation of any business. With a single fault in capital budgeting, the company may end up into huge loss and vice-versa.

Leave a Reply