Definition: A cash book is that unique book of accounts which fulfils the objective of both, a journal and a ledger. Like a journal, it is the first book which records all the cash transactions of the business. It also acts as a subsidiary book to post all the cash transactions, similar to a cash account in the ledger.

It can be broken down into two words, i.e., ‘cash’ and ‘book’. Cash is a real monetary instrument like currency, i.e., coins or notes used as a medium of exchange for acquiring goods and services. Book refers to a compiled record of the information available in the written or printed form.

Thus, we can say that cash book is the record of all the business transactions in the form of notes or coins, taken place in a particular period.

A cash book excludes the following type of transactions:

- Payments received or made through cheques: All the bank related transactions and exchange of cheques for making or receiving payments.

- All non-cash transactions: Any business transaction taking place in kind or for which the payment is due.

- Discount received or given: Any discount received on making purchases or discount allowed on carrying out sales of goods or services.

Content: Cash Book

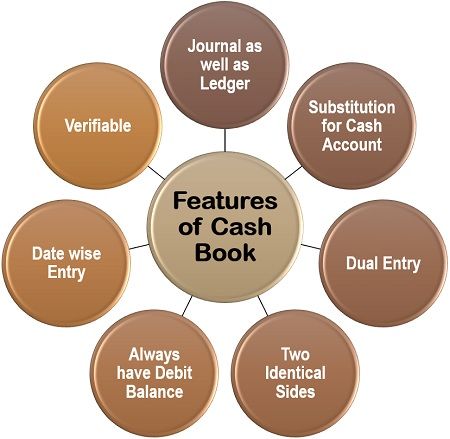

Features

Knowing about the essential characteristics of a general cash book will help us to understand more about it:

Journal as well as Ledger: A cash book is used to record the transactions immediately; thus, it serves the purpose of a journal.

At the same time, it is also a ledger since purely cash transactions are posted in it (similar to a cash account in a ledger).

Substitution for Cash Account: A cash book is used as an alternative of a cash account made in ledger. Since maximum transactions in the business are related to cash, it becomes convenient to prepare a separate book for it.

Dual Entry: Similar to other books of accounts, a cash book also has a debit side, that shows all increase in cash. Along with a credit side, that records all decrease in cash.

Two Identical Sides: In a cash book, the total of the debit side should always be equal to the credit side.

Always have Debit Balance: Cash in hand is the principal element of a cash book which is used to meet the day to day business expenses.

Logically, paying more than the available cash is not possible. Therefore, the business will always be left with a debit cash balance (or even no cash balance in some cases).

Date wise Entry: The cash receipt entries are made on the debit side or left-hand side. Whereas, the cash payments made are posted on the right side, i.e., the credit side.

Verifiable: The debit cash balance so acquired can be cross-checked by calculating the actual cash in hand remaining with the business.

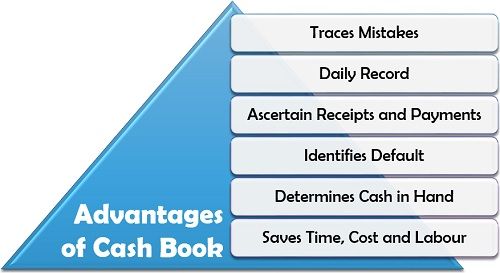

Advantages of Cash Book

A cash book has simplified the entry cash transactions for accounting purpose to a great extent.

Following are the various other benefits of maintaining a cash book:

- Traces Mistakes: The balance of the cash book can be verified by matching it with the actual cash in hand; thus, mistakes and errors can be easily detected.

- Daily Record: The cash transactions are recorded promptly in a cash book daily, which helps in maintaining a regular record of the cash receipts and payments.

- Ascertain Receipts and Payments: The cash receipts and the payments made in cash on a specific date can be easily determined with the help of a cash book.

- Identifies Default: Any default, theft, failure in payment or cash evasion can be easily identified while verifying the cash book balance with the actual cash balance.

- Determines Cash in Hand: It provides a clear picture of the remaining balance or cash in hand left with the organization.

- Saves Time, Cost and Labour: Recording the cash transactions first in a journal and then posting it in the cash account of the ledger is a hefty task.

A cash book initiates creating of a single book of accounts and thus saves a lot of time, efforts and expense incurred while preparing these two separate books.

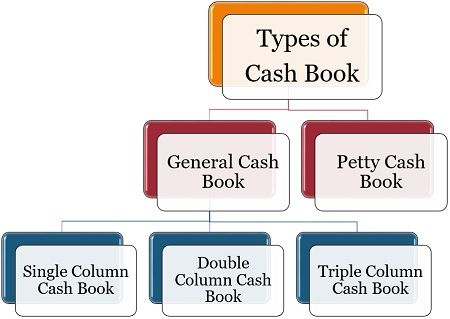

Types of Cash Book

A cash book varies based on its complexity and the needs and requirements of the business. Following are the two major categories into which a cash book can be bifurcated:

General Cash Book

The cash book, which serves as a journal for the first recording of the cash transactions and also replaces the cash account in a ledger, is called a general cash book.

It is further subdivided into three different categories:

- Single Column Cash Book: A single column or simple cash book is that type of cash book which is used to note down only the cash transactions.

- Double Column Cash Book: A double column cash book records two types of transactions under two separate columns. Here, one is compulsorily cash column, and the other can be either a discount column or a bank column.

- Triple Column Cash Book: This type of cash book records transactions related to three different types of accounts, i.e., cash, bank and discount. Thus, it substitutes the creation of cash account, bank account, discount received and discount allowed in the ledger.

Petty Cash Book

The small cash transactions taking place a significant number of times daily if recorded in a general cash book may make it bulky and difficult to handle.

Therefore such numerous business operations involving a minimal amount of transactions can be written down in a separate book called a petty cash book and the person responsible for maintaining it, is called a petty cashier.

Cash Book Format

Now that we know about the different kinds of cash book, we should go through the different formats of each of these types below:

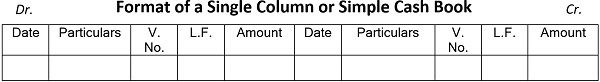

Single Column Cash Book or Simple Cash Book Format

A simple column cash book purely records cash transactions and is a substitute for cash related journal entries and cash account.

Following is the format depicting a single column cash book:

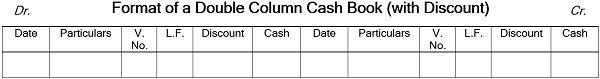

Double Column Cash Book Format

A dual column cash book can be of two types, the one which has cash and discount columns and the other which has cash and bank columns. However, double column cash book (with the discount column) is widely used.

Given below is the format of a double column cash book (with the discount column):

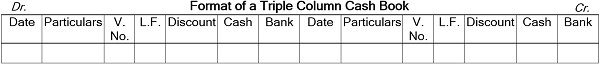

Triple Column Cash Book Format

The triple column cash book is a compact form of cash book in which all the three columns, i.e., cash, bank and discount, are included. Here all the cash and bank-related transactions are recorded along with the discount on sales or purchase of goods.

The format of a triple column cash book is given below:

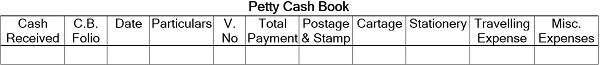

Petty Cash Book Format

A petty cash book records small cash transactions in separate accounts.

To get a clear picture of how it looks, go through the following format:

The elements of a cash book can be understood as follows:

Date: The date of each transaction is recorded in this column. On the top of the column, the year is noted down. This is to avoid repetitive entry (below the year, the month can be written to simplify the work further). The day of a particular is written in front of the related transaction.

Particulars: In the particulars column of a cash book, the second account involved in a transaction other cash, is mentioned. It is preceded by a ‘By’ when the particular account is debited and ‘To’ if it is credited.

V.No. (Voucher Number): While receiving any payment in cash from the debtor or customer, the company issues a cash receipt or memo or receipt voucher. This voucher number is recorded in front of the particular transaction under the V.No. Column.

Similarly, while making a cash payment for any expense or purchase, the company receives a cash memo known as payment voucher, which is recorded under the V.No. Column, in front of the related transaction.

L.F. (Ledger Folio Number): The second account or the account which is opposite to the cash account in a particular transaction, has its separate ledger account.

Thus, the page number of the ledger where the given transaction is recorded in the respective second account, is written under the L.F. in front of that transaction.

Amount: In a simple cash book, there are two amount columns. One is on the debit side to record all the cash receiving and the other on the credit side to record all the cash payments.

Cash: The cash columns replace the amount columns in the double column and triple column cash books. In which again, the cash column on the left side is used to enter all the cash receiving. Whereas the credit side cash column notes down all the cash payments.

Bank: Payments made or received through cheques or any other bank transaction is recorded either in a double column cash book (with bank column) or a triple column cash book. It is a replacement of a bank account made in ledger.

Discount: The discount received while making payment for purchases and the discount allowed to customers while collecting the amount of sales are written down under the respective discount column (i.e., discount received on debit side discount column and discount allowed on credit side discount column), in the double column cash book or triple column cash book.

Examples

The practical application of the four primary types of cash books discussed above, under the cash book format, can be better explained through the following illustrations:

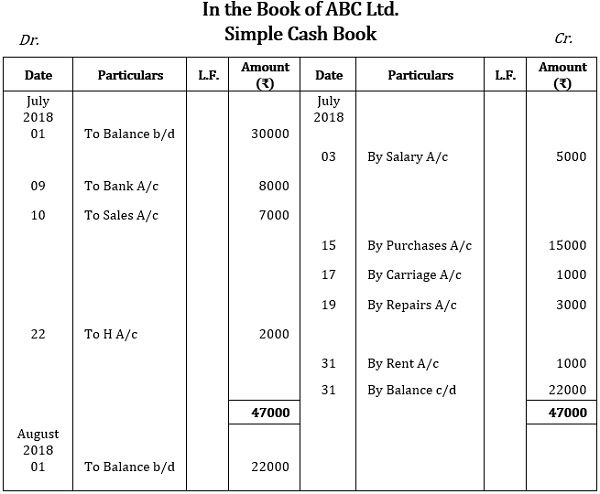

Illustration 1:

Following are the transactions of ABC Ltd. for July 2018:

| Date | Transaction | Amount |

|---|---|---|

| July 01, 2018 | Balance of cash in hand | 30000 |

| July 03, 2018 | Salary paid to D | 5000 |

| July 09, 2018 | Withdrawn from bank | 8000 |

| July 10, 2018 | Cash Sales | 7000 |

| July 15, 2018 | Goods purchased in cash | 15000 |

| July 17, 2018 | Paid carriage inwards | 1000 |

| July 19, 2018 | Paid for machinery repairs | 3000 |

| July 22, 2018 | Debts recovered from H | 2000 |

| July 31, 2018 | Rent Paid | 10000 |

Enter the above transactions in a simple or single column cash book.

Solution:

Illustration 2:

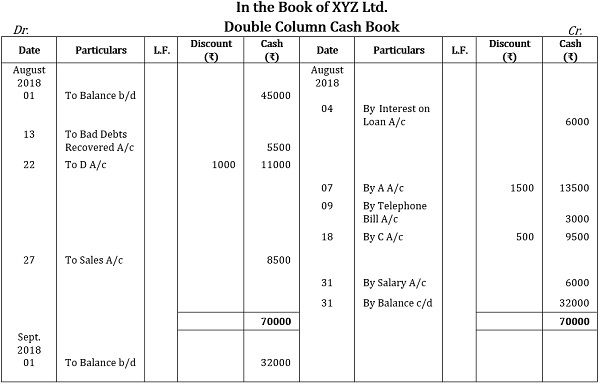

Following are the transactions of XYZ Ltd. for August 2018:

| Date | Transaction | Amount |

|---|---|---|

| August 01, 2018 | Cash in hand | 45000 |

| August 04, 2018 | Paid interest on loan | 6000 |

| August 07, 2018 | Paid to A | 13500 |

| August 07, 2018 | Discount received from A | 1500 |

| August 09, 2018 | Paid telephone bill | 3000 |

| August 13, 2018 | Bad debts recovered from B | 5500 |

| August 16, 2018 | Purchased goods on credit from C | 10000 |

| August 18, 2018 | Paid in full settlement to C | 9500 |

| August 22, 2018 | Received from D | 11000 |

| August 22, 2018 | Discount allowed to D | 1000 |

| August 27, 2018 | Cash sales | 8500 |

| August 31, 2018 | Paid salary to E | 6000 |

Enter the above transactions in a double column cash book.

Solution:

Illustration 3:

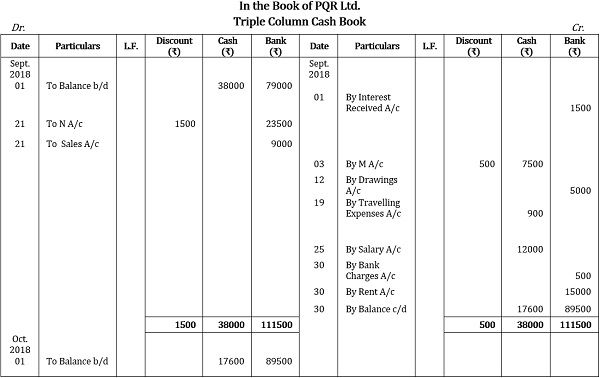

Following are the transactions of PQR Ltd. for September 2018:

| Date | Transaction | Amount |

|---|---|---|

| Sept. 01, 2018 | Cash in hand | 38000 |

| Sept. 01, 2018 | Balance at bank | 79000 |

| Sept. 01, 2018 | Interest received from bank | 1500 |

| Sept. 03, 2018 | Paid to M | 7500 |

| Sept. 03, 2018 | Discount received from M | 500 |

| Sept. 12, 2018 | Withdrawn from bank for personal use | 5000 |

| Sept. 16, 2018 | Goods sold on credit to N | 25000 |

| Sept. 19 2018 | Paid travelling expenses | 900 |

| Sept. 21, 2018 | Cheque received from N in full settlement | 23500 |

| Sept. 21, 2018 | Cash sales deposited into bank | 9000 |

| Sept. 25, 2018 | Salary paid | 12000 |

| Sept. 30, 2018 | Bank charges deducted | 500 |

| Sept. 30, 2018 | Paid Rent through cheque | 15000 |

Enter the above transactions in a triple column cash book.

Solution:

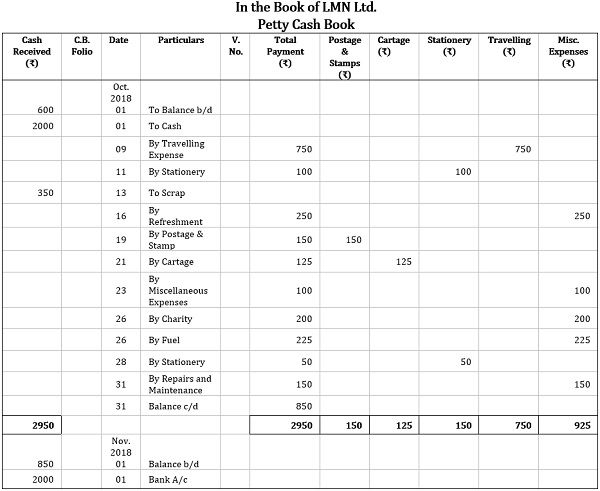

Illustration 4:

Following are the transactions of LMN Ltd. for October 2018:

| Date | Transaction | Amount |

|---|---|---|

| October 01, 2018 | Petty cash balance | 600 |

| October 01, 2018 | Reimbursement by Chief Cashier | 2000 |

| October 09, 2018 | Paid travelling fare for marketing manager | 750 |

| October 11, 2018 | Bought attendance register | 100 |

| October 13, 2018 | Sold scrap | 350 |

| October 16, 2018 | Paid for refreshment | 250 |

| October 19, 2018 | Paid postal expense for sending quotations | 150 |

| October 21, 2018 | Paid cartage expense for raw material | 125 |

| October 23, 2018 | Paid for temporary labor | 100 |

| October 26, 2018 | Donation to child welfare organization | 200 |

| October 26, 2018 | Paid fuel expenses for office van | 225 |

| October 28, 2018 | Bought pens for office work | 50 |

| October 31, 2018 | Paid to plumber for tap repairs | 150 |

Enter the above transactions in a petty cash book.

Conclusion

Every business organization, whether a small entity or a large company, needs to maintain and prepare the records of its daily transactions.

Also, cash being the most crucial element of business requires special attention and monitoring.

Thus, preparing a cash book serves multiple business purposes like reporting, accounting, taxation, cash flow, etc.

SAQIB GULL says

Wonderful …the content is precise n well summarised….👌👌👌

Shikha says

It’s really helpful to me ……..this is very good for 11th class students ….. thank you so much ………