Definition: A cash flow statement is a financial statement which serves the inflow and outflow of the cash and cash equivalents by the company. It consists of all cash receipts and cash payments transactions of the company during the year. It aims to determine the difference between the company’s cash-in-hand at the beginning and the end of the year.

A specified protocol of divergent stock exchanges demands corporate entities to urge cash flow statement to the various stock exchanges. Thus, listed companies are constrained to prepare a cash flow statement.

Content: Cash Flow Statement

Structure of Cash Flow Statement

Shifts of cash associated with all these fields and cash movement are self-reliant on activity in the other field. It involves three spheres of activities. They are as follows:

1. Operating activities: Operating activities are those activities which deal with the daily operations of the business, such as increase/ decrease in current stock. Inflow and outflow in such activities can be easily understood with the following examples:

Examples of cash inflows in operating activities

- Revenue from selling goods and delivering services.

- Royalties, earning from fees, and brokerage increases the inflow of the cash.

- Cash proceeds concerned with a prospect, forwards, option and swap obligation where the arrangement is held for the exchange purpose.

Examples of cash outflows in operating activities

- Remittance to suppliers for goods and services acquired.

- Outflow through the disbursement of the cash to the employees or on the favour of the employees.

- Cash deposited for income tax, excluding distribution tax.

2. Investing activities: Inflow and outflow of cash for buying and selling the long-term assets comes under the company’s investing activities. Shifts of cash in this segment comprises of:

Cash Inflows

Following are some of the cash inflow activities:

- Cash proceeds from the disposition of fixed assets and investments apart from cash corresponding.

- Income received from interest and dividend returns.

- Cash proceeds from loans contrived to third parties and reimbursement of advances.

Cash Outflows

Following are some of the cash outflow activities :

- Cash disbursement to bring in fixed assets, shares, and other bonds apart from cash equivalents.

- The outflow of cash for settling loans and advances accustomed to third parties.

.3. Financing activities: Financing activities are related to the capital of the company. Inflow and outflow of cash under this activity involves cash movements combined with issuing and buying back shares in the company, serve dividends to shareholders and finance and compensate loans.

Some of the sources of cash inflows in financing activities are as follows:

- Cash revenue from the distribution of debentures, shares, etc.

- Cash inflow of the company increases by permanent financing from financial institution/ banks.

Some of the sources of cash outflows in financing activities are as follows:

- Restoration of loans

- Repurchase of shares and debentures

- Amount of Interest paid in cash

- Dividend amount paid in cash

- Dividend tax paid in cash

Format of Cash Flow Statement

1. Direct Method

XYZ Co. Ltd

Cash flow statement

For the period ending 31 March 2017

| Particulars | Amount |

|---|---|

| A. Cash flows from operating activities: 1. Profit before tax | xx |

| 2. (+) Non- operating (-) Non- cash items | xx |

| 3. Operating profit before working capital changes(1+2) | xx |

| 4. Working capital changes (excluding bank and cash balances) | xx |

| 5. Cash achieved from operations ( 3+/- 4) | xx |

| 6. Payment of taxes | xx |

| 7. Net cash flow from operating activities (5-6) | xxx |

| B. Cash flow from investing activities: 1. Acquisition of assets/investments | xx |

| 2. Reduction of assets /investments | xx |

| 3. Dividend/Interest paid | xx |

| 4. Others | xx |

| 5. Net cash used in Investing activities (1+2+3+4) | xxx |

| C. Cash flow from financing activities: 1. Income from issue of shares | xx |

| 2. Income from financing | xx |

| 3. Share repurchase | xx |

| 4. Dividend/interest paid Equity shares Preference shares | xx xx |

| 6. Net cash flows from financial activities (1+2+3+4+5) | xxx |

| D. Net change in cash and cash identical ( A+B+C) | xx |

| E. Cash and cash identical at the beginning of the year | xx |

| F. Cash and cash identical at the end of the year (D+E) | xx |

2. Indirect Method

XYZ Co. Ltd

Cash flow statement

For the period ending 31 March 2017

| Particulars | Amount |

|---|---|

| A. Cash flow from operating activities: 1. Net profit before tax and exceptional items: | xx |

| 2. (+/-) Adjustments for non-cash and non operating items | xx |

| 3. Operating profit before working capital changes | xxx |

| 4. Adjustments for (i) Increase/decrease in trade and other receivables | xx |

| (ii) Decrease in trade and other payable | xx |

| (iii) Cash obtained from operating activities | xx |

| (iv) Payments of direct taxes | xx |

| 5. Net cash flow from operating activities | xxx |

| B. Cash flow from investing activities: (i) Purchase of fixed assets | xx |

| (ii) Investments for addition of subsidiaries | xx |

| (iii) Removal of investments in subsidaries | xx |

| (iv) Loans to others | xx |

| (v) Decrease/ Increase in miscellaneous expenses | xx |

| 6. Net cash flow from financial activities | xxx |

| 7. Net cash flow during the year( A+B+C) | xx |

| 8. Cash and cash equivalents at the beginning of the year | xx |

| 9. Cash and cash equivalents taken over on addition during the year. | xx |

| 10. Cash and cash equivalents at the end of the year | xx |

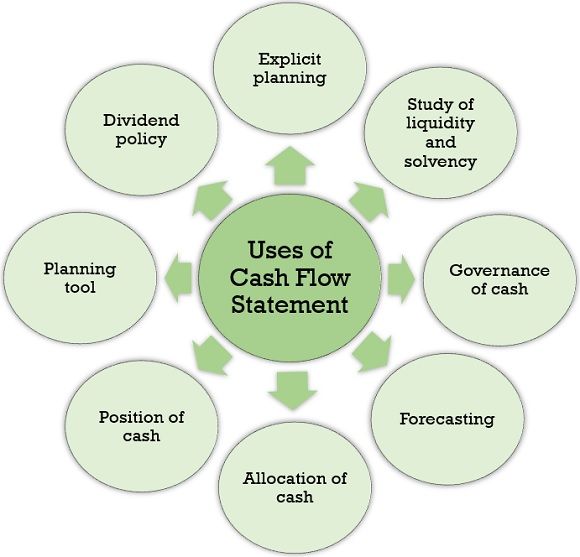

Uses of Cash Flow Statement

This statement can be used by companies for the following reasons:

- Explicit Planning: To do clear-cut planning, companies consider their cash flow statement as a base as it provides the definite status of the company’s cash. It is fruitful for an enterprise for generating short-term planning.

- Study of Liquidity and Solvency: Periodical cash flow statement helps determine the company’s liquidity and financial competence at the end of the year.

- Governance of Cash: It provides the exact position of the surplus or deficit of the cash and results in efficient cash management.

- Forecasting: It helps in forecasting the soundness and monetary status of the company in the near future.

- Allocation of Cash: It is profitable in adapting the cash budgets of the company.

- Position of Cash: It clearly shows the actual position of the cash and also justifies the reasons behind the inflow and outflow of cash.

- Planning Tool: It plays a vital role in planning for all future investments thereby, acts as a hindrance against imprecise decisions.

- Dividend Policy: It guides the company in framing the profitable dividend policy.

Limitations of Cash Flow Statement

Following are the limitations of this statement:

- All non-cash activities are not enclosed; therefore, this statement is established on the restricted concept of cash and cash equivalents.

- It is not an appropriate alternative as this statement announces the net cash flow only, and it may not be useful as an alternative for the income statement.

- It is not an effective means since this is not a reliable indicator of the financial position of the company as it generally neglects the working capital part.

- As it is established on the prior records, no consequent planning can be accurately planned except if some other document follows it.

- It is of a factual nature.

Conclusion

Companies prepare a cash flow statement to show the exact position of the cash-in-hand at the end of the year. It indicates the movement of both inflow and outflow of cash and cash equivalents for the time being. The inflow of cash indicates the escalation in cash from all the transactions, and outflow of cash indicates the reduction of cash from the transactions took place during the year.

Leave a Reply