Definition: Auditing is the procedure in which a qualified individual examines the books of accounts and assemble the evidence to form an assessment and convey their point of view to the responsible person or the management by submitting the audit report at the end of the financial year.

The term “Audit” is borrowed from the Latin word “Audire”, i.e. to hear. In ancient times when the person who has possession of business suspected fraud, they assign particular individuals to inspect the accounts, such individuals were appointed as an accountant and perceived what they had to say in respect of accounts. From the above statement, it is precise that auditing or audit consists of three elements. They are as follows:

- Books of Accounts

- Auditor

- Approaches and measures of audit

Content: Auditing

Types of Auditing

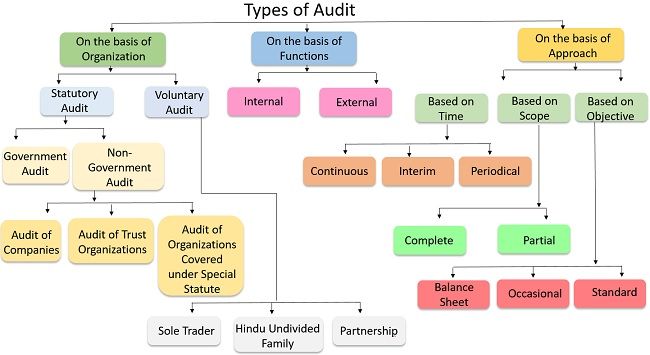

An audit can be categorized under various groups on a distinct basis. Types of auditing based on different aspects are as follows:

On the basis of Organization

In this class, the audit is classified on the basis of the nature of the company for which auditing task is initiated. It consists of the following types:

1. Audit Enforced by Law

These are the organizations which are enforced by the law to get their accounts audited every year:

- Companies ruled by the Companies Act,2013

- Banking organizations ruled by the Banking Regulation Act,1949

- Electricity supply corporations ruled by the Electricity Supply Act,1948

- Co-operative Societies certified beneath the Cooperative Societies Act,1912

- Civic or humanitarian trusts enrolled beneath distinct Religious and Endowment Acts.

- Specified entities beneath distinct sections of the Income Tax Act,1961

- Certified Clubs, associations, etc. enrolled beneath Societies Registration Act, 1960

2. Audit Under Voluntary Class

Certain organizations which perform voluntary audit:

- Proprietorship concern

- Partnership organization

- Hindu undivided family

- Federation of individuals

- Non-profit organization.

On the basis of Function

Under this class, the audit is categorized on the basis of practical actions of the auditor. Altogether, this class of audit is based on the auditor’s work involved in an audit. It consists of the following types:

- External Audit

- Internal Audit

On the basis of Practical Approach

The categorization of audit beneath this class includes practical access to the work. It consists of the following types:

- Continuous Audit

- Interim Audit

- Partial Audit

- Periodical Audit

- Complete Audit

- Balance sheet Audit

- Standard Audit

On the basis of Audit Dimension

In this class, the audit is categorized on the basis of the dimension of the audit. It consists of the following types:

- Management Audit

- Cost Audit

- Tax Audit

- Human Resource Audit

- System Audit

- Proprietary Audit

- Efficiency Audit

- Environment Audit

- Social Audit

- Cash Transaction Audit

- Government Audit

- Secretarial Audit

- Energy Audit

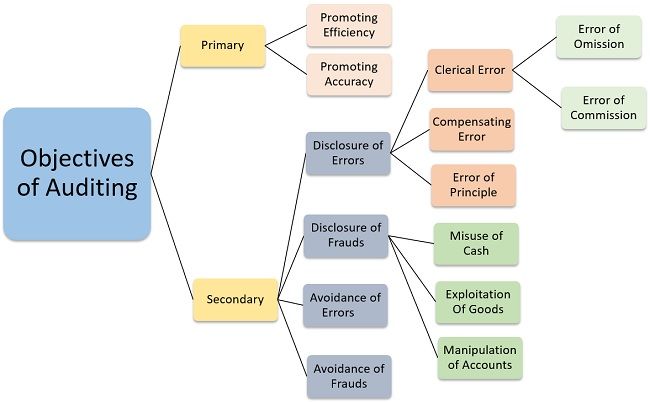

Objectives of Auditing

The Indian Institute of Chartered Accountants (ICAI) in its Auditing and Assurance Standard-2 (AAS-2) specifies the following objectives of auditing:

The purpose of an audit of books of accounts, inclining a structure of identified accounting policies, practices and appropriate statutory obligations, if any, is to authorize an auditor to articulate a point of view on such financial statements. The auditor’s point of view helps in determining the true and fair view of the economic condition and functioning outcomes of a company. The auditor must be an autonomous body who is authorized to examine the enterprise, its records and financial statements inclined from an enterprise and therefore, create a point of view on the efficiency and preciseness of the financial statements.

The elementary target of auditing is to facilitate to harmonize that the books of accounts displays a true and fair view or not. Thus, the auditing is performed to build-up effectiveness and certainty in the accounts before putting them in front of the shareholders and administration. It provides authentic information about the economic position of the business, which may help the overall management of the business enterprise. For the attainment of the elementary objectives of auditing, the following ancillary objectives are to be required:

- Disclosure of errors

- Disclosure of frauds

- Avoidance of errors

- Avoidance of frauds

Besides, errors which occur because of innocence and negligence, are of three types:

- Clerical error

- Compensating error

- Error of principles

Again, clerical errors are of two types:

- Error of omission

- Error of commission

However, the frauds which occur with a purpose to gain something by some influencing methods, they are of three types:

- Exploitation or misuse of cash

- Exploitation of goods

- Manipulation of accounts.

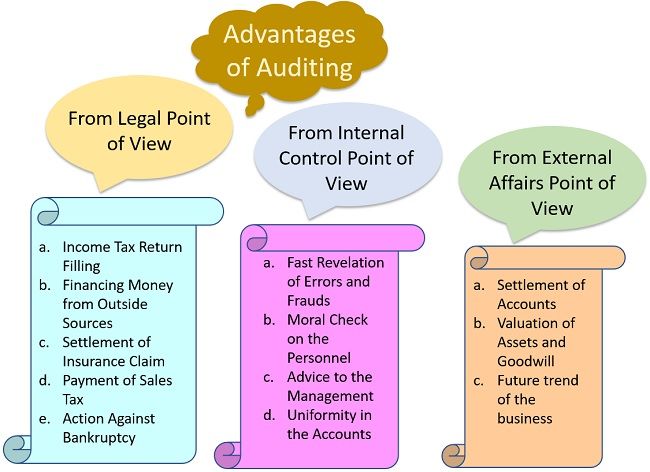

Advantages of Auditing

The job of an auditor is of great significance for all affected parties. The auditor should produce his audit report accurately and efficiently based on the information and real figures. If this is concluded, the subsequent advantages may be anticipated from the auditing:

From Legal Point of View

- Income Tax Return Filling

Income tax experts usually affirm the profit and loss statement that has been processed by a certified auditor, and they don’t go into specifics of the statement. - Financing Money from Outside Sources

Money can be financed conveniently on the basis of audited books of accounts from the outside sources. Nearly all financial institutions approve a loan on the basis of audited financial statement. - Settlement of Insurance Claim

In the event of flood, fire and alike unanticipated circumstances, the insurance company pays the claim for loss or destructions based on audited accounts of the preceding years. - Payment of Sales Tax

Sales tax experts may often acknowledge the audited financial statement. - Action Against Bankruptcy

The audited financial statement provides a base to decide the action in bankruptcy and deterioration cases.

From Internal Control Point of View

- Fast Revelation of Errors and Frauds

Errors and frauds are positioned at an initial date so that eventually no effort is made to carry out such frauds, as one will be moderately attentive not to carry out an error or a fraud as the financial statement are accountable to regular audit. - Moral Check on the Personnel

The auditing of financial statement manages the accounting clerk regular and aware as they realize that the auditor would object adjacent to them if the appropriate accounts are not inclined or if there is any distortion. - Advice to the Management

The management can ask the auditor for a consultation on certain technological points, despite the fact it is not the responsibility of an auditor to provide such consultation. - Uniformity in the Accounts

If the books of accounts have inclined on a consistent base, accounts of one year can correlate with the accounts of other years, and if there is any conflict, the origin of conflict may be investigated.

From External Affairs Point of View

- Settlement of Accounts

The audited financial statement would expedite the arrangement of accounts of a departed or dead partner. - Valuation of Assets and Goodwill

If the business is getting bankrupt, there may not be much difficulty regarding estimation of assets and goodwill as the financial statement is audited earlier by an auditor. - Future trend of the business

The expected flow of the business can determine with assurance from the audited financial statement.

Conclusion

Auditing or Audit is the analysis of books of accounts or the financial statement by an independent individual known as an “Auditor”, pursued by personal checking of stock to make sure that section of the organization is following chronicle system of reporting transactions. It is executed to determine the efficiency of financial statements inclined by the organization.

Debasish says

I’m eternally grateful to you Miss Prachi ( forgive me if I’m wrong about your marital status ). Your article on auditing helped me a lot because I’m pursuing my graduation, in my current semester auditing is a core paper. The auditing faculty in my college is not good as much I needs and being in rural area its a tough job to find a good tuition. Once again thank you so much for the time and efforts to bring a piece of cake in front of many students (including me).