Definition: Non-profit organization are established to provide aid to society, such as developing charity, commerce and religion. However, it has a separate legal entity other than its members, and their primary objective is to provide services without the intention of earning profits in return like trading organizations. The main source of earning for such organizations are “Donations” and “ Government Grants” which are not certain.

Thus, the fund received is treated as “Surplus” and not a profit in the organization’s income and expenditure account. This surplus fund will be utilized for the further betterment of the organizations and providing more facilities to the society.

Content: Non-profit organization

- Types of Accounts

- Format of Receipt and Payment Account

- Format of Income and Expenditure Account

- Format of Balance sheet

- Features

- Advantages

- Disadvantages

- Receipt and Payment Account Vs Income and Expenditure Account

- Conclusion

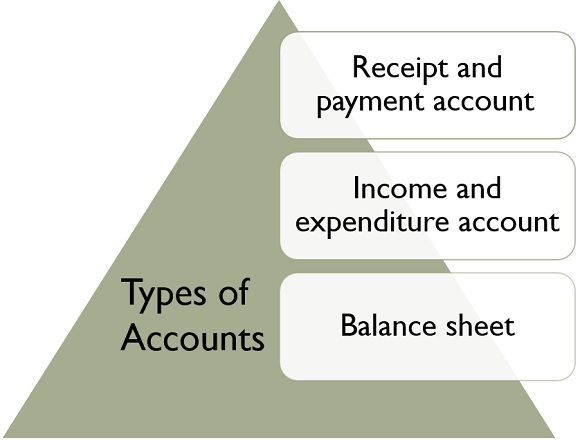

Types of Accounts in a Non-Profit Organization

Since, these organizations don’t work for profit-making, preparing trading and profit and loss account is not relevant for them, these organizations prepare:

1. Receipts and Payments Account

Numerous charitable organizations prepare receipt and payment account, which shows the random cash transactions that occurred throughout the year. It is competent for small organizations, but it has a disadvantage that pre-payments and accrual payments are not recorded in it; however,

- It only debits the account with all the receipts and credits the account with all the payments irrespective of its nature.

- It can be revenue or capital nature payments for the current year, previous year, successive year, and at last, it displays only bank or cash balance.

Format of Receipt and Payment Account

XYZ Limited

For the year ended 31, December 2019

| Receipts | ₹ | Payments | ₹ |

|---|---|---|---|

| To balance b/d cash xx bank xx | xxx | By wages | xxx |

| To subscription -Previous year -Current year -successive year | xxx | By electricity | xxx |

| To life membership fees | xxx | By stationery | xxx |

| To donations | xxx | By bank charges | xxx |

| To interest | xxx | By travelling expenses | xxx |

| To dividend | xxx | By sundry expenses | xxx |

| To entrance fees | xxx | By repairs | xxx |

| To sundry receipts | xxx | By balance c/d cash xx bank xx | xxx |

| -------- XXXX -------- | -------- XXXX -------- |

2. Income and Expenditure Account

Income and expenditure account is the final account for the non-profit organization which deals with the revenue receipts and expenses. It is prepared on the basis of the accrual concept of accounting, i.e., it displays the summary of only current accounting year transactions regardless of whether received/paid in the current year or not.

All the incomes are recorded on the credit side, and all the expenses are recorded on the debit side of the statement. If the credit side exceeds debit side it would be a surplus and vis-a- versa if debit side exceeds credit side it would be considered as a deficit. At last, the remaining balance, whether deficit or the surplus gets transferred to Capital account of the proprietor. It is like a profit and loss account of the trading organizations.

Format of Income and Expenditure Account

XYZ Limited

For the year ended 31, December 2019

| Expenditure | ₹ | Income | ₹ |

|---|---|---|---|

| To salary and wages (+) Previous Year Prepaid (-) Current Year Prepaid | ------- xxx | By donation | xxx |

| To depreciation | xxx | By dividends | xxx |

| To repairs | xxx | By interest on deposits | xxx |

| To bad debts | xxx | By subscription (-) Previous year outstanding (+) Current Year outstanding | ------- xxx |

| To printing and stationery | xxx | By entrance fees | xxx |

| To rent | xxx | By all revenue receipts | xxx |

| To all revenue payments | xxx | By grants received | xxx |

| To surplus *(excess of income over expenditure) | xxx | By deficit *(excess of expenditure over income) | xxx |

| ------- XXXX ------- | ------- XXXX ------- |

3. Balance sheet

After preparing receipt and payment and income and expenditure account, the non-profit organization prepares balance sheet stating the position of the organization’s assets and liabilities. Such organizations’ balance sheet is similar to the other trading organizations prepare at the end of the financial year. Capital fund in it is the overall excess capital after reducing all assets from all the liabilities, which includes revenue earned as well as surplus earned throughout the year by the organization.

Format of Balance sheet

XYZ Limited

As at 31, December 2019

| Liabilities | ₹ | Assets | ₹ |

|---|---|---|---|

| Capital account (+)surplus (-)deficit (+)entrance fees (+)life membership subscription (capitalized) --------------------- | ----- xxx ----- | Current assets Cash and bank balance Fixed deposit ---------------- | xxx xxx ------ xxxx ------ |

| Bank overdraft | xxx | Fixed assets Building (+)addition (-)depreciation --------------------- | xxx |

| Outstanding expenses | xxx | Furniture (+)addition (-)depreciation (-)sale of furniture --------------------- | xxx |

| Creditors | xxx | Investments Prize funds Government securities --------------------- | xxx xxx |

| Inventory | xxx | Machinery (+)addition (-)depreciation --------------------- | xxx |

| ------------- xxx ------------- | ------------- xxx ------------- |

Features of Non-profit Organization

Following are the features of the Non-Profit Organization:

- The primary objective of such organizations is to serve society.

- No surplus gets distributed among its members.

- Major funding is done by donation and contribution in the non-profit organization.

- The non-profit organization also considered as a separate legal entity.

- The elected members of the organization handle the administration.

- Numerous non-profit organizations are dependent on the active assistance of the volunteers.

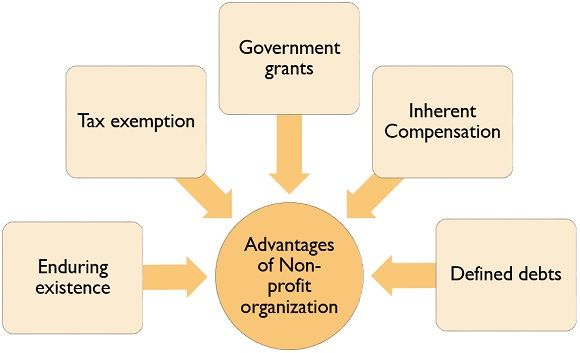

Advantages of Non-Profit Organization

Following are some of the advantages of Non-Profit Organization:

- Enduring existence: Non- profit organizations have life even if the promoter or donour leaves the organization. They are always admissible to make revenue from other donours.

- Tax exemption: Non- trading organization are exempted from paying taxes to the government; thus, they can regulate their whole income back in the organization’s advancement.

- Government grants: Non- profit organizations get various allocations from the government in the form of government grants for the betterment of the organization and to benefit society.

- Defined debts: In case of any dispute creditors have explicit rights for suing on the organization; they can only recover their debts with the organization’s assets, and the owner is not liable to pay any indebtedness with his personal assets.

- Inherent Compensation: Non- profit organization administer services and favour to the overlooked or neglected section of the society, such as impoverished children.

Disadvantages of Non-profit Organization

Following are the disadvantages of the Non-Profit Organization:

- Time and Money: For starting a non-profit organization, it takes a lot of money and devotion towards work, without any intention of earning profit in return.

- Maintenance Expenses: Non-profit organization have to maintain the costs incurred during the year from the limited available funds so that the organization continues for long run efficiently.

- Public Enquiry: Anyone from the general public can ask for the non-profit organization’s fillings and can review their incomes and expenditures. If you have a broad public-facing organization, you become liable to answer their questions to maintain your organization’s image.

- No Gain: Non-profit organizations don’t offer any profit to its members; thus, it becomes difficult sometimes to bring out concern from the likely investors.

- Filling Burden: To maintain the active and exempt status, the non-profit organization’s need to acknowledge annual fillings to the government.

Receipt and Payment Account Vs Income and Expenditure Account

| Basis of comparison | Receipt and Payment account | Income and Expenditure account |

|---|---|---|

| Initiation | It automatically initiates with the opening balance carried forward from the previous year. | It does not have any opening and closing balance. |

| Nature | It is summary of the overall cash affairs of the organization of the current accounting year. | It is an analysis of income and expenses of the organization. |

| Items | It comprises of both capital and revenue receipts and payments. | It only consists of revenue items. |

| Balancing | At the time of closing accounts the balance left in this account is treated as cash-in-hand or bank balance. | It shows the surplus or the deficit at the end of the year. |

| Recordings | In receipt and payment accounts subscriptions, Life membership fees, donations are recorded. | Provisions,bad debts, and depreciation is recorded is this account. |

| Debit/Credit | Receipts are debited and payments are credited in this account. | All expenses and losses are debited whereas; all incomes and gains are credited in this account. |

| System | Cash system of accountancy is used for preparing this account. | Mercantile system of accountancy is used for making of this account. |

| Accounts | It is treated as a real account. | It is treated as a nominal account. |

| Outstanding balances | Outstanding expenses and incomes are not considered in this account,it only deals with cash transactions. | All the outstanding expenses and incomes are considered in this account. |

Conclusion

Non-profit organization work for the betterment of humanity without any hope of rewards in monetary and non-monetary form. Members in it work with devotion towards society and provide various charitable services for which government and different investors offer a fund to these organizations.

These organizations are free from the tax burden, i.e. they do not have to pay taxes to the government in the form of income tax, but they need to maintain proper records of their works in the organized format for getting this advantage.

Sibusiso says

Nice detailed introduction.