Definition: An auditor is a body who organizes an audit process. He is the one who creates an audit report after due examination of accounting records and accounting statements of the company forming his impression/assumption regarding financial statements fairness and reliability.

Content: Auditor

- Qualification of an Auditor

- Qualities of an Auditor

- Responsibilities of an Auditor

- Duties of an Auditor

- Conclusion

Qualification of an Auditor

According to law, no specific qualification is recommended for the auditor in case of the proprietary concern, but in the case of the companies, the following qualification is must:

- According to the Companies Act, 2013, a chartered accountant having a certificate of practice from the Institute of Chartered Accountants of India can be a qualified auditor of a company.

- As per “Part B” of the State Law Act, 1953 a person holding a certificate stating that he is designated to act as an auditor.

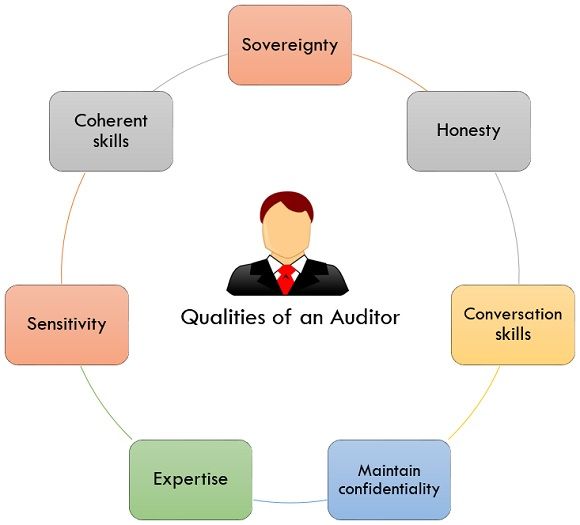

Qualities of an Auditor

Some relevant qualities that an auditor should possess are as follows:

- Sovereignty: The auditor should not make his decisions to the will of his clients or any other person and should keep himself free from any sympathy allegedly and prepare financial statement of the management in an impartial way.

- Honesty: The auditor should always maintain sincerity while operating his duties.

- Conversation Skills: In the course of managing a process of audit, the auditor has to collaborate with numerous officers and parties; thus, he should have excellent conversation skill.

- Maintain Confidentiality: The auditor should maintain the privacy of the books of accounts unless authorized by the client or enforced by the law.

- Expertise: The auditor must have an awareness about the client’s business and the current economic conditions, and a consciousness about the laws such as taxation laws, companies act and partnership act.

- Sensitivity: The auditor has to deal with different persons while performing his duties; he has to handle his sub-ordinates as well as various clients; thus, he should have the intelligence to handle them in any situations.

- Coherent Skills: The auditor must have the ability to analyze and illustrate the problems so that he can appropriately handle them when faced.

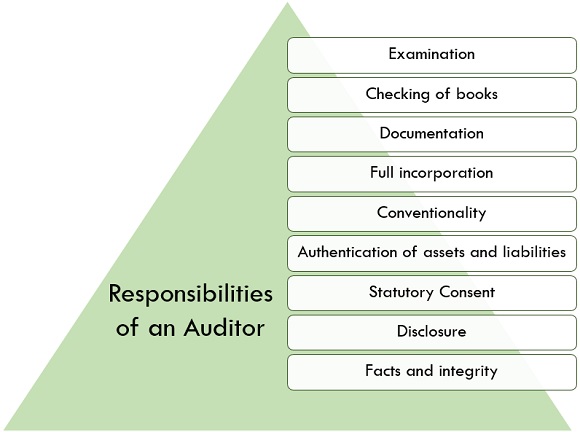

Responsibilities of an Auditor

Following are the responsibilities of an auditor:

- Examination: Cross-examination of the company’s accounting system and internal control system is necessary to safeguard the record’s appropriateness.

- Checking of Books: The books of accounts should be checked thoroughly by an auditor to ensure its arithmetical accuracy.

- Documentation: Proper documentation of the records should be maintained by the auditor after investigating documentary pieces of evidence. It helps him in gathering the appropriate information about the transactions of the business.

- Full Incorporation: An auditor should properly analyze whether all entries have been recorded in the books of accounts or not while preparing the financial statement.

- Conventionality: Examining that the books of accounts or financial statement should not contain any fraudulent or faulty entry.

- Authentication of Assets and Liabilities: Verification of assets and liabilities for checking their existence, valuation, completeness and disclosure in financial statements.

- Statutory Consent: In case of audit of general insurance companies and banks, the auditor secures the compliance of financial statements with the compatible decree.

- Disclosure: Auditor examines whether the data in the financial statement acknowledged adequately or not. He discloses his point of view by way of the audit report after the completion of the audit process.

- Facts and Integrity: Auditor ensures financial statement as a whole and serves an accurate and fair view of profit/loss, assets and liabilities of a company in the appropriate forms.

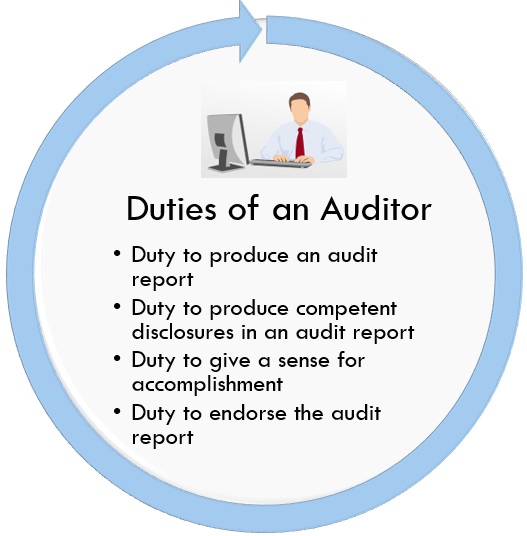

Duties of an Auditor

Along with the responsibilities the auditor has to perform certain duties; they are as follows:

1. Duty to Produce an Audit Report

- Description to members: An auditor must generate a statement to the members, yet he is not enforced to send a report to every member.

- Review of the auditor’s report: The report prepared by the auditor intends to read in the general meeting of the company. The report shall be open to any member for inspection.

- Capacity of audit report: The audit report should reveal the accounts maintained by the auditor, i.e. profit and loss statement, balance sheet of the company and the chronicles annexed with these accounts.

2. Duty to Produce Competent Disclosures in an Audit Report

- Report on Appropriate and Impartial View: The auditor shall state whether in his impression and to best of his knowledge and bestow to the description given to him, the balance sheet and profit and loss account give:

- The instruction prescribed by the law; and

- An authentic and fair view of the state of affairs of the company.

- Report on Principal Allegation: The audit report should state:

- Whether he has gathered all the material and justification.

- Whether from his point of view, appropriate books of accounts have been conserved.

- Whether in his view, all accounting standards have assembled.

- Whether any director who has disqualified from being appointed as a director.

- Report on CARO: The auditor has to address all the elements specified in CARO.

- Report on Precise Inquisition: This report describes:

- Whether loans and advances built by the company in support of security have been perfectly captured, and the circumstances on which they have been formed are not biased to the concern of the company or the members of the company.

- It states whether the book of entries is unfavourable to the interests of the company.

- Report on specific inquiries should state whether the retail price of the shares, debentures, and other guarantees held by the company is below its purchase price.

3. Duty to Give a Sense for Accomplishment

- The aspect in which competence is made in the auditor’s report should be as such that no allowance for doubt in the public minds. A qualification should deliver the full description and not simply create grounds for the impression of enquiry.

- The auditor should appraise, wherever possible, the enact of the financial statement’s capabilities, if the same is material.

- It states whether it is not achievable to accurately quantify the consequence of the qualifications he may use the authority estimates or indicate the sense for not appraising the requirement’s effect.

4. Duty to Endorse the Audit Report

The audit report or any other chronicle mandatory to be signed or validated by the auditor may be endorsed by:

- A person selected as an auditor of the company.

- A firm selected as an auditor or by a partner of the firm exercising in India.

Conclusion

An individual who regulates an audit process is known as an auditor. He is the one who takes the responsibility of analyzing the books of records of the firm or the company, whether they are showing accurate and generous values or not. Based on these records, he prepares the audit report signed by him stating that the business activities are investigated and verified by him.

Nirjharini. Mohapatra says

Good description.

Abraham Sei says

Good work done