Definition: Double Entry System is one of the accounting method in which every transaction has a dual effect, i.e., every debit transaction will have an equivalent credit transaction. This system is followed by individuals and institutions for passing journal entries of their day to day business transactions, whether receiving and sacrificing benefits.

For instance, Mr. A makes some payment to Mr. B. In this transaction, Mr. B is a receiver and Mr. A is a giver; therefore, Mr. B’s account will be debited and Mr. A’s account will be credited.

Content: Double Entry System

- Stages

- Advantages

- Disadvantages

- Example

- Double-Entry System Vs Single-Entry System

- Features

- Conclusion

Stages of Double Entry System

The double-entry system of accounting is divided into three stages. They are as follows:

- First Stage

It starts with posting Entries in the Journal or Primary books of accounts.

- Second Stage

Classifying transactions by posting them to the appropriate ledger accounts and then preparing a trial balance.

- Third Stage

This process ends with closing books and preparing the final books of accounts.

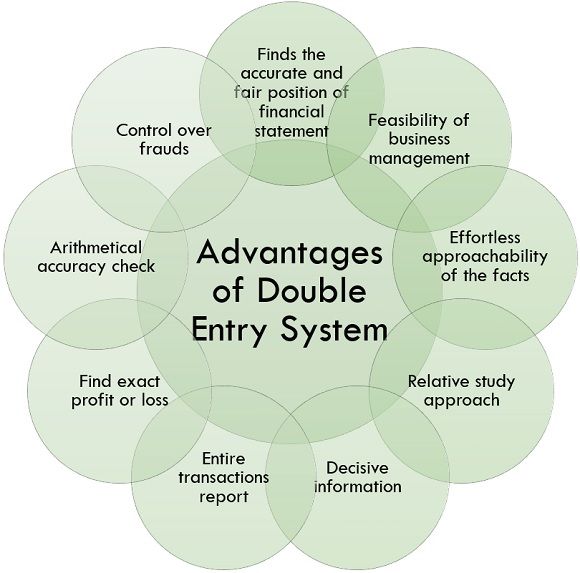

Advantages of Double Entry System

The double-entry system of accounting is a systematic approach contributing to various advantages. Some of them are as follows:

- Entire Transactions Report: All the transactions of the business, as well as personal operations of the proprietor or firm, are recorded in this system.

- Find Exact Profit or Loss: Preparing a profit and loss account, which shows the precise position of profit or loss earned by the business during the financial year, becomes more accessible with the double-entry system.

- Arithmetical Accuracy Checks: Every transaction has double entries and therefore arithmetical accuracy of transactions gets maintained, which can be double-checked later by preparing a trial balance.

- Control Over Frauds: Double entry system restricts fraudulent activities as it is a scientific system of accounting.

- Finds the Accurate and Fair Position of Financial Statement: Double entry system helps in preparing the balance sheet any time during the year to see the actual financial position of the company as and when required.

- Feasibility of Business Management: In this system, the administration has control over the business exercises as complete information is available to monitor.

- Effortless Approachability of the Facts: Gathering information and facts regarding business becomes much easier under this system which helps the management to grow the business.

- Relative Study Approach: In this system of accounting, it is feasible to do a comparative study of the statements of previous years with the current year which helps in taking necessary actions to achieve the desired results.

- Decisive Information: However, the data collected under this system is based on a scientific and systematic approach; it acts as crucial information for business actions.

Disadvantages of Double Entry System

Following are some of the disadvantages of this system:

- Double-entry system of accounting is convenient for large business enterprises.

- This system is quite expensive than the single-entry system.

- For maintaining this system of accounting, complete knowledge of accounting is essential.

- In the Double-entry system, if any transaction gets omitted, it becomes difficult to trace such a transaction.

- Although these are the disadvantages of this system, the fact is that the system is not faulty, it’s human who makes errors. If it is followed with proper care, it is scientifically proven as the best and perfect system.

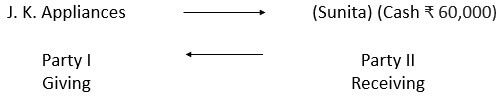

Example of Double Entry System

Sunita purchases a television from J. K. Appliances for 60,000; thus, for this purchase, Sunita paid 60,000 and received a television in exchange.

From the seller’s edge, it can be said that J. K. Appliances gave television and receives cash in exchange. I.e., there is a mutual exchange relationship between the two parties. It can be illuminated as follows:

From party I (Television) to Party II (Cash₹ 60,000)

From party II (Cash₹ 60,000) to Party I (Television)

These dual aspects, receiving and giving, are to be reported at the same time, this system is known as a double-entry system. This system reveals two aspects in every transaction for every business one aspect is “Debit Aspect” or “Expenses Aspect” and another aspect is “Credit Aspect” or “Income Aspect”.

Double-Entry System VS Single-Entry System

| Basis of Difference | Single Entry System | Double Entry System |

|---|---|---|

| Nature of Records | Incomplete records | Complete records |

| Accounts maintained | Cash book and Personal accounts | Personal, Real, and Nominal accounts |

| Reliability of information | Information is not much reliable as it is incomplete | Information is reliable as it is complete |

| Preparation of accounts | Trial Balance, Trading and Profit and Loss accounts cannot be prepared | Trial Balance, Trading and Profit and Loss accounts can be prepared |

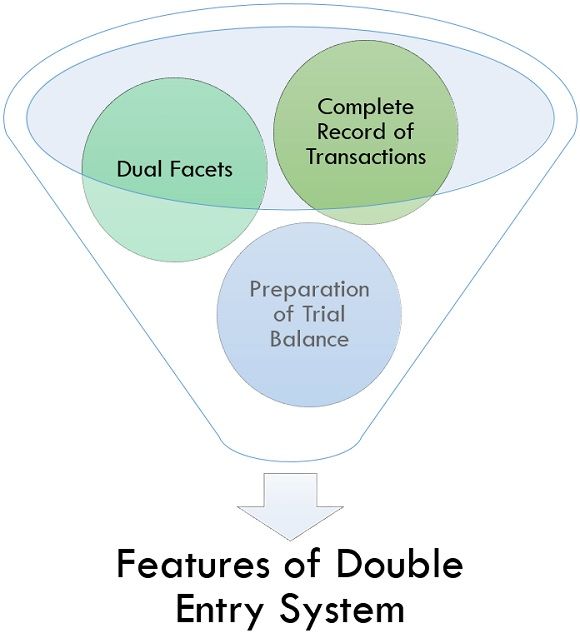

Features of Double Entry System

Following are the features of the Double-entry system:

- Dual Facets: In this system, every transaction has two facets, i.e., if one transaction gets debited in one account, it will get credited too in another account.

- Complete Record of Transactions: Under this system information of both the parties, i.e., buying and selling parties are recorded in one place, in case of any discrepancy it becomes easier to find transaction entry for the specific required date.

- Preparation of Trial Balance: Trial balance is prepared on the basis of the principle of the double-entry system as it includes both debit as well as credit transactions of the business. It is treated as a base for preparing further financial statements such as profit and loss account and balance sheet.

Conclusion

The double Entry System of accounting is a scientifically correct method of accounting as every aspect of the transaction gets covered under this system. i.e., entry of both buyers, as well as the sellers, is done for each transaction. The money receiver’s account will be credited, and the money payer’s account will be debited.

Kleadionangel says

well explained.