Definition: Single Entry System is a hybrid and unscientific bookkeeping method that partially records business transactions. More precisely, it records only a single aspect of financial transactions and excludes the idea of duality.

Small businesses generally use this system of bookkeeping. Because these businesses can’t afford to hire a professional accountant for account maintenance.

We refer to it as a hybrid system because it contains:

- Double Entry: Dual entry of transactions between two personal accounts.

- Single Entry: One entry of transactions between cash/personal accounts and real/nominal accounts.

- No Entry: There is no record of the transactions between two nominal, two real or nominal and real accounts.

Besides, it is an unsystematic and improper form of accounting. The financial statement depicts inaccurate and unfair profits due to incomplete records.

This system only records cash and credit transactions. The credit transaction consists of entries related to the business’s Debtors and Creditors.

Consequently, it does not include Nominal and Real accounts in the books. Therefore, the financial records remain incomplete. For this reason, it’s additionally called “Accounts from Incomplete Records”.

Reasons for Incomplete Records:

- To avail tax advantage by skipping some transactions on purpose.

- Nil or least understanding of the Double Entry System.

- Lack of time, knowledge and expertise.

- Shortage of funds to hire an expert.

- Loss of data due to uncertainties.

- Less expensive and maintenance of a few books.

In a Single Entry System, the calculation revolves around:

- Amount Payable

- Receivables

- Present Stock Position

- Cash & Bank Balances

Content: Single Entry System

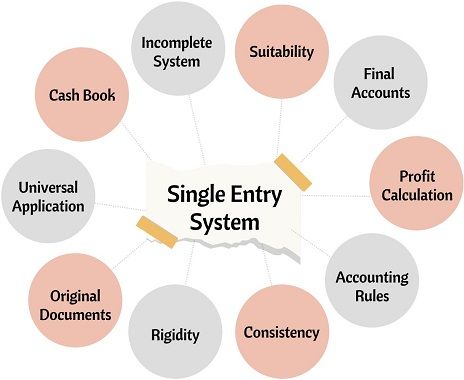

Features of Single Entry System

Following are the features of the Single Entry System:

- Incomplete System: The records are incomplete as it completely ignores real and nominal accounts.

- Suitability: It is suitable for Small Vendors, Partnership Firms, and Startups. Corporations do not accept this accounting method. As they prepare financial statements as per accounting principles and policies.

- Final Accounts: Due to data insufficiency, we cannot prepare Trial Balance and other financial statements. At first, we convert the single entries into double-entry. After that, we prepare the final accounts with the available data.

- Profit Calculation: The calculated profits are inaccurate as the system excludes some important financial transactions.

- Accounting Rules: This system doesn’t have a fixed set of rules and procedures like the Double-entry system. Also, it varies across businesses.

- Consistency: It is inconsistent as there are no fixed rules for maintaining accounts.

- Rigidity: It is less rigid in comparison to the Double Entry System.

- Original Documents: For authentication, the businesses need original vouchers for making the entry.

- Universal Application: This system is not applied universally because it provides incomplete information.

- Cash Book: The cash book contains all cash and credit transactions altogether.

Uses of Single Entry System

- It is useful for small businesses, i.e. sole proprietors and partnership firms.

- Companies that aim to spend less on accounting may adopt this accounting system.

- Entrepreneurs with less knowledge of accounting principles and policies opt for this system.

- The calculation of profit/loss is easy and less complex.

- A business with fewer employees may opt for a single-entry system.

Advantages

The advantages of Bookkeeping using Incomplete Records are as follows:

- Flexible: The system is flexible, so required alteration is possible according to convenience.

- Cash Transactions: It is helpful for firms with more cash transactions. Maintaining a cash book is enough because it covers all significant business transactions.

- Simple Bookkeeping: As we maintain a limited number of accounts, bookkeeping becomes simple and easy.

- Event Accounting: It is helpful when accounting for events and small functions.

- Economical: The system involves the maintenance of fewer accounts. Thus, saving time and money for entrepreneurs.

- Information Security: We can maintain secrecy in this system as the owner prepares the accounts.

Disadvantages

Along with some advantages, this accounting system possesses the following disadvantages:

- Rectification of Errors: Finding and rectifying errors is complex as we pass a single entry for transactions.

- Lacks Accuracy: In this, the trial balance is not prepared to check the accuracy of the recorded transactions. Hence, the accounts are arithmetically incorrect.

- Incomplete Records: The ignorance of Nominal and Real accounts from books results in incomplete records.

- Incorrect Profit/Loss: The Profit or loss calculated at the end of the Year is incorrect. As many business transactions impacting capital is excluded in the books.

- Faulty Financial Statements: In this, we prepare the financial statements from incomplete records. Thus, showing the faulty and incorrect financial position of the business.

- Unacceptable by Tax Authorities: Tax authorities do not consider the statements prepared by the single-entry system. Because the computed income is less reliable and not considerable for taxation purposes. So, the firms are unable to enjoy the tax benefits.

- Inaccurate Goodwill Valuation: While scaling the business, the firms face difficulty in the accurate Goodwill valuation.

- Difficulty in Comparative Analysis: Since there are no fixed rules and policies, the inter and intra-industry comparisons become difficult.

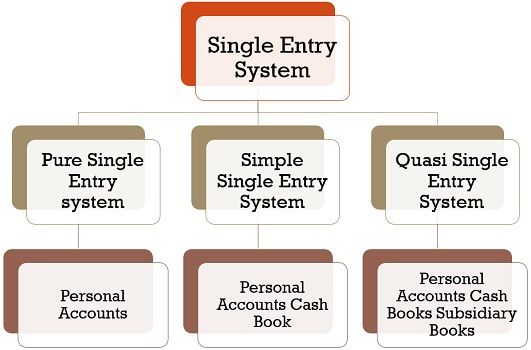

Types

We can maintain Accounts from Incomplete Records in three types discussed below:

Pure Single Entry System

We maintain only Personal Accounts in this system. The single entries are passed only for Debtors and Creditors.

Simple Single Entry System

In this system, only two accounts are maintained, i.e. Personal Accounts and Cash Book.

Quasi-Single Entry System

Here, we maintain Personal accounts, Cash books and several subsidiary books. Subsidiary Books mainly include:

- Purchase Book

- Sales Book

- Purchase Return Book

- Sales Return Book

Methods of Profit Calculation

Every Entrepreneur is keen to find out the outcome of his business at the Year’s end. The result may be a profit earned or loss born during the Year.

While preparing Accounts from Incomplete Records, we can determine Profits by way of:

- Net Worth Method

- Conversion to Double Entry Method

Net Worth Method

In this method, we find out the financial position by analysing the Capital or Net Worth.

Net worth is the owner’s share in the assets after settling liabilities. We calculate Net Worth through a Statement of Affairs at the year’s beginning and end.

This method discovers Profit and loss by analysing capital between two periods. As we calculate the variance between opening and closing capital post necessary adjustments.

After making adjustments in the capital if:-

Closing Capital > Opening Capital = Profit

Opening Capital > Closing Capital = Loss

We need to prepare two statements under this method mentioned below:

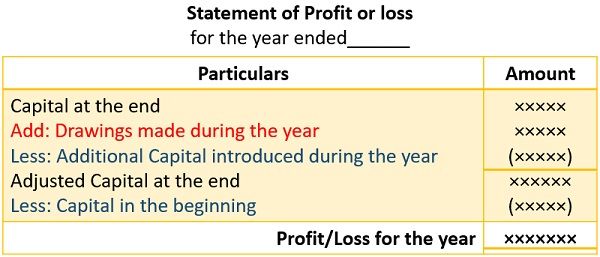

Statement of Profit and Loss

This statement shows the comparison of capitals (Opening and Closing) with adjustments. The result obtained is the profit or loss for the Year.

Format

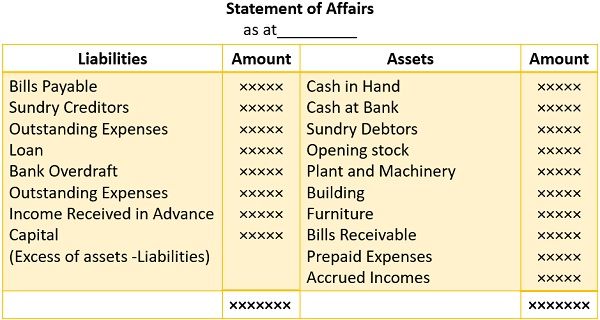

Statement of Affairs

It is the compilation of the assets and liabilities of the business. The balancing figure resulting after deducting liabilities from the assets is the capital. It seems similar to the Balance Sheet but differs from it in many aspects.

Format

Following adjustments are to be made in the capital to find adjusted capital:

- Capital Introduction: We must reduce the extra capital invested from the closing capital.

- Drawings: The drawings made during the Year must be added back to the capital.

Steps involved in the Net Worth Method:

- Opening Statement of Affairs (Opening Capital)

At first, we calculate the opening capital for the accounting year. For this, we make this statement with the number of assets and liabilities at the beginning. - Closing Statement of Affairs (Closing Capital)

Secondly, we prepare a statement of affairs to find out the closing capital. For this, we use the number of assets and liabilities at the end of the accounting year. - Adjustments in the Closing Capital

We must make adjustments to the balancing figure obtained from the above statement. The adjustments include drawing and extra capital added during the Year. - Ascertainment of Profit and Loss

In the fourth step, we prepare the Profit and Loss Statement. We determine it by comparing owners’ capital at the start and end of the period. - Estimation of Net Profit

The remaining adjustments are made after ascertaining the Year’s profit or loss. For Instance, adjustment of Interest of Capital in the profit.

Conversion Method

This method determines profits by preparing financial statements as per accounting standards. So, we convert the incomplete accounts to a Double Entry System.

Following are the objectives of adopting this method:

- Accurate and fair financial position.

- To estimate the correct amount of profit.

- Airthematically correct financial statements.

- Effective decision-making and control.

- To get benefits of the Double Entry System.

The steps involved in the Conversion Method are as follows:

- Preparation of Cash and Bank summary

- To gain the missing information, we must find out the balances of the following accounts:

- Total Debtors Account

- Bills Receivable Account

- Total Creditors Account

- Bills Payable Account

- After this, we prepare the opening statement of affairs to compute opening capital.

From the above information, prepare:- Trading Account

- Income Statement

- Balance Sheet

Example of Single Entry System

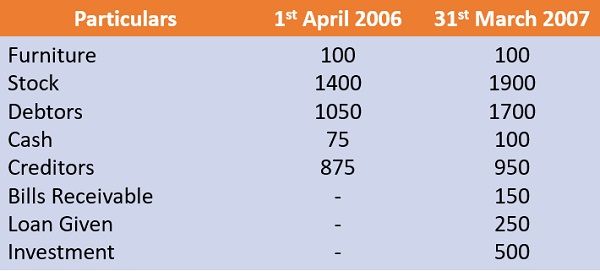

Cesear prepares his accounts as per the Single Entry System. His books display the following information:

He withdraws Rs. 750/- as drawings during the Year. Estimate his profit at the end of 31st March 2007.

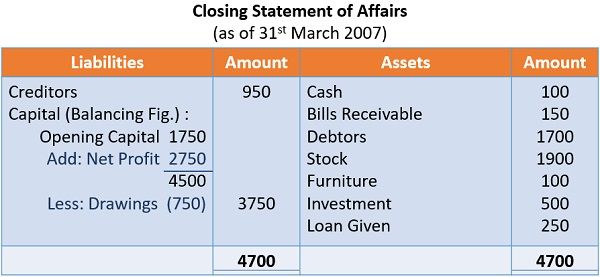

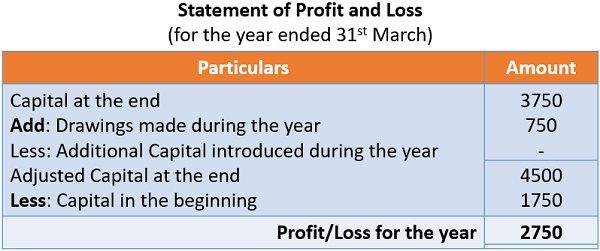

Solution:

Opening Capital for the year

Closing Capital for the year

Profit or Loss for the year

Conclusion

Accounts from Incomplete Records are helpful for small businesses. We record only one facet of the business transactions in the books.

The advantage of using this system is its simplicity and reasonable costing. One can always switch to the Double Entry system and maintain books as per standards.

Nisar says

This blog was awesome as it digs detailed information on the single entry system, its features, uses, types. This was useful information on single entry system.

Sunday Yakubu says

Is very good job