Definition: Trial Balance is a statement that assembles the balances of all ledger accounts in a definite format. It records both debit balance as well as credit balances from the ledger accounts, including cash and bank balances on a stated date. It is inclined with the purpose of testing the analytical or arithmetical accuracy of the books of accounts of a business.

Content: Trial Balance

- Format of Trial Balance

- Methods of preparing Trial Balance

- What is Adjusted Trial Balance?

- Uses of Trial Balance

- Objectives of Trial Balance

- Features of Trial Balance

- Difference between Trial Balance and Balance Sheet

- Illustration

- Key points to remember

- Conclusion

Format of Trial Balance

Trial Balance of M/s ABC for the year ended 31/03/2019

| Particulars | Debit balances (₹) | Credit balances (₹) |

|---|---|---|

| (A) Expenses and Losses | ||

| Wages | xx | - |

| Rent | xx | - |

| Royalty | xx | - |

| Purchases of material | xx | - |

| Commission paid | xx | - |

| Stationary expenses | xx | - |

| Carriage inwards | xx | - |

| Carriage outwards | xx | - |

| Discount given | xx | - |

| postage expenses | xx | - |

| Salary | xx | - |

| Interest paid | xx | - |

| Losses due to accident | xx | - |

| All other losses and expenses | xx | - |

| (B) Income and gain | ||

| Rent received | - | xx |

| Interest received | - | xx |

| Sales | - | xx |

| Discount Received | - | xx |

| Commission received | - | xx |

| All other receipts | - | xx |

| (C) Assets | ||

| Plants and machinery | xx | - |

| Land and building | xx | - |

| Furniture and fixture | xx | - |

| Cash | xx | - |

| Debtors | xx | - |

| Vehicles | xx | - |

| Stock of materials | xx | - |

| Bills receivable | xx | - |

| Other assets | xx | - |

| (D) Liabilities | ||

| Capital | - | xx |

| Creditors | - | xx |

| Loans from others | - | xx |

| Bills payables | - | xx |

| Loans from the financial institutions | - | xx |

| Other liabilities | - | xx |

| Total | xxxx | xxxx |

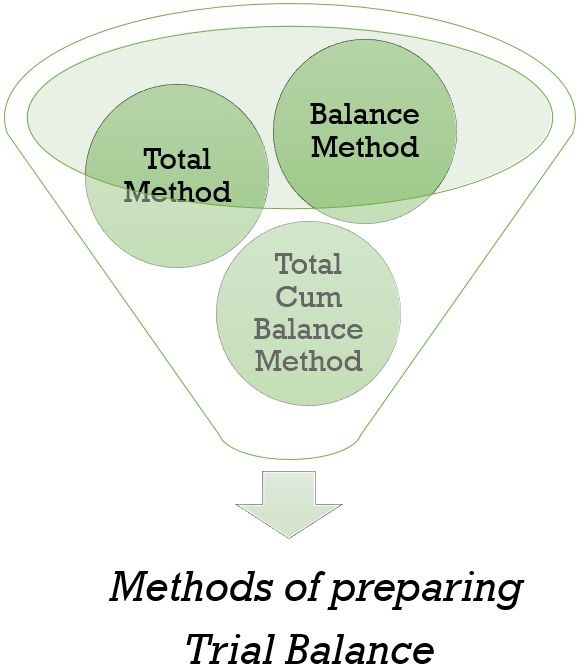

Methods of preparing Trial Balance

It can be arranged in the following three ways:

1. Total Method

In this method, both debit and credit side in the ledger is totalled; then, they are reported in the trial balance in specific columns. The sum of the debit column and the credit column should be equivalent. However, this method is not broadly used.

2. Balance Method

This method is widely used in the formation of trial balance. Trial Balance is arranged by reporting the balances of all ledger accounts; then, the debit and credit column of it is totalled, i.e., in this method, balances of both debit and credit sides of the ledgers are recorded. As the balance analysis, the net effect of all transactions pertaining to a particular account, balances are captured as a foundation for preparing a trial balance. In addition to this, it helps in the preparation of final accounts.

3. Total Cum Balance Method

This method is a four-column method of preparing a trial balance. In this method, the trial balance is made by combining the above two methods. However, this method is also not broadly accepted because it is very time consuming and creates duplication of work.

What is Adjusted Trial Balance?

Before finalizing the financial statement’s accuracy and truthfulness at the end of the year, books of accounts are rechecked once. If required, some adjusting entries are passed and posted in the respective ledger accounts. After that, an adjusted trial balance is prepared, including the entries that were not entered in the original trial balance, such as accrual income, accrual expenses, various allowances, etc.

Uses of Trial Balance

It is an advantageous tool because:

- It discloses that overall debits are equal to overall credits.

- It is an analysis of General ledger balances and needs to be examined to identify that it looks correct. If accounts are accompanying very higher or lower balances than normal, then a Journal posting to a General ledger requires to be scrutinized, as it can be placed to a wrong account.

- It acts as a support in adapting other accounting reports, like balance sheet and income statement.

- It manages to get a preliminary profit figure. If it is listed in the direction of the General ledger, which is in charge of a chart of accounts, then a subtotal can be computed after the owner’s equity account or a proprietorship nature and earlier than the accounts of an expense and income nature.

- If the subtotal of a debit side is higher than the credit side’s subtotal, the variation is considered profit, and if the credit side exceeds the debit side, it is considered a loss.

Objectives of Trial Balance

The following are Objectives of the Trial Balance:

- It is a summary of all the transactions posted in the ledger accounts and discloses the net position at a glimpse.

- Preparation of it is evidence of the arithmetical accuracy of the books of accounts.

- It forms the base for preparing the financial statement of the company, i.e., profit and loss account and balance sheet.

- It helps in locating the various errors in the accounts.

Features of Trial Balance

The following are some of the features of the Trial Balance:

- Trial Balance plays the role in checking and testing the arithmetical certainty of the entries posted from the journal to the ledger. If both debit and credit tallies, it is assumed that entries are correct.

- It is arranged for a specific date.

- Trial Balance is a total of all ledger accounts and can be made any time during the year to find out the difference or error made in an entry.

- Companies adopting a double-entry system of accounting can only prepare a trial balance, although it is not a part of the double-entry system.

- Trial Balance contains the closing Balances of all the ledger accounts maintained.

- Trial Balance is made in a tabular form containing a column – Particular, Debit (₹), Credit (₹).

- If any difference arises in Trial Balance, it indicates the mistake of the transaction and needs to be checked and corrected.

Difference between Trial Balance and Balance Sheet

| Basis for comparison | Trial Balance | Balance Sheet |

|---|---|---|

| Need for preparation | It is arranged to test the analytical accuracy of the transactions posted from a ledger. | It is inclined to identify the financial status of a company at a specific period of time. |

| Types of accounts | All kinds of accounts, i.e., personal, real and nominal accounts are reported. | Only real and personal accounts are reported. |

| Contents | Entire accounts of the ledger are presented. | Balances of only those ledger accounts are presented which have not been settled till the arrangement of trading, profit and loss account and balance sheet. |

| Closing stock | Usually, the closing stock does not arrive in the trial balance although the opening stock arrives. | Only the closing stock arrives on the asset side of the balance sheet. |

| Heading | The headlines of the columns in the trial balance is "Debit balance "and "Credit balance". | The headlines in the balance sheet are " Liabilities" and "Assets". |

| Periodicity | It can be inclined periodically, i.e., at the end of the quarter/ month or half-yearly. | It is usually inclined at the end of the financial year. |

| Adjustments | Adjustments regarding prepaid income, outstanding expenses etc., are not required in it. | Adjustments associated with specified items are precisely necessary to formulate a balance sheet. |

| Mandatory | Preparation of it is not compulsory. | Preparation of balance sheet is obligatory for companies registered under Companies Act. |

Illustration

- Question

The following balances are derived from the ledger balances of an M/S ABC on 31/03/2019. Prepare Trial Balance as on that date.

| Particulars | Amount(₹) | Particulars | Amount(₹) |

|---|---|---|---|

| 1. Drawings | 22000 | 12. Purchases | 151800 |

| 2. Creditors | 98000 | 13. Capital | 58000 |

| 3. Debtors | 120000 | 14. Bills payable | 18000 |

| 4. Loan from x | 30000 | 15. Bills receivable | 15400 |

| 5. Opening Stock | 9600 | 16. Furniture | 12000 |

| 6. Investments | 35000 | 17. Cash in hand | 2800 |

| 7. Sales | 293200 | 18. Taxes | 9000 |

| 8. Sales return | 2000 | 19. Salaries | 29000 |

| 9. Travelling expenses | 11200 | 20. Purchase returns | 3200 |

| 10. Trading expenses | 8000 | 21. Commission paid | 1200 |

| 11. Rent | 12000 | 22. Discount earned | 15000 |

| 23. Bank overdraft | 42000 |

- Solution

Trial Balance of M/S ABC as on 31/03/2019

| Particulars | Debit (₹) | Credit (₹) |

|---|---|---|

| Drawings | 22000 | - |

| Capital | - | 58000 |

| Creditors | - | 98000 |

| Debtors | 120000 | - |

| Bills receivable | 15400 | - |

| Furniture | 12000 | - |

| Opening stock | 96000 | - |

| Cash in hand | 2800 | - |

| Investments | 35000 | - |

| Taxes | 9000 | - |

| Sales | - | 293200 |

| Salaries | 29000 | - |

| Sales return | 2000 | - |

| Purchase return | - | 3200 |

| Travelling expenses | 11200 | - |

| Commission paid | 1200 | - |

| Trading expenses | 8000 | - |

| Discount earned | - | 15000 |

| Rent | 12000 | - |

| Bank overdraft | 42000 | |

| Purchases | 151800 | - |

| Total | 527400 | 527400 |

Key points to remember

|

|

|

|

Conclusion

Trial Balance is a catalogue of ledger balances following the principle of the double-entry system of book-keeping and accountancy, i.e., every debit entry must have an equivalent credit entry on a precise date. If both sides get tallied, that means the books are arithmetically accurate and are free from all the errors.

Leave a Reply