Definition: Vouching is a procedure followed in the process of the audit to authorise the credibility of the entries entered in the books of accounts. In simple and easier words, it is a precise investigation of the presented documents of the firm by an auditor to check the correctness and accuracy of such documents. It is the foremost step of the auditing process based on which auditor performs his work and prepare an audit report.

For understanding the process of vouching in detail it is essential to understand the concept of the voucher.

Content: Vouching

- Concept of voucher

- Types of vouchers

- Sources of Vouchers

- Objectives of Vouching

- Importance of vouching

- Difference between Vouching and Verification

- Characteristics of Vouching

- Vouching of cash transactions

- Key points to remember

- Conclusion

Concept of voucher

The documentary pieces of evidence such as counterfoil, cash memo, receipts and pay-in-slips used for recording transactions in books of accounts is defined as a voucher. The transactions supposed to be recorded only if relevant evidences are available.

For Example, Purchase transaction should have these supporting documents for preparing voucher:

- Invoice bill

- Quotation

- Purchase order

- Requisition slip

- Entry gate pass (while receiving goods)

Types of vouchers

In general, vouchers are of two types:

- Primary Vouchers: The bills or the documents that are available in the original copy are known as primary vouchers.

- Collateral vouchers: These are the bills which are available in a duplicate copy.

Sources of Vouchers

There are two sources of vouchers:

- Internal vouchers: The vouchers prepared by the company inside its premises are termed as internal vouchers, such as sales invoice.

- External vouchers: The vouchers created outside the organisation are termed as external vouchers, such as bank statement.

Objectives of Vouching

It is the technique used by the auditors to judge the authenticity of the entries appearing in the financial statement. Procedure and accuracy followed for performing vouching decide the success or failure of the auditing. Some major objectives behind the vouching process are as follows:

- To ensure that all the transactions took place during the financial year for the business purpose only (not for personal use), and are appropriately recorded in the books of accounts with true and fair evidences.

- To check the accuracy of the totalling and carrying forward amount recorded in the financial statements.

- To ensure that the person responsible for the business has verified his records or not.

- To make the financial records free from malpractices.

- To make sure that financial records are prepared in a lawful manner.

Importance of vouching

While performing an audit, the auditor is totally dependent on the documents presented to him by the responsible person for the business during the whole financial year. If any bill related to sales, purchase, electricity, telephone, that are not associated with the business is presented, it can only be detected with fair vouching. Various frauds can be detected while doing vouching if it is done in an intelligent manner.

For preparing reliable profit and loss a/c, Balance sheet, the vouching should be done accurately. It’s an ethical duty of an auditor to check the arithmetical accuracy of records and see its substantial accuracy because if the primary document is wrong, the whole financial statement will show the wrong and unfair result.

Difference between Vouching and Verification

| Particulars | Vouching | Verification |

|---|---|---|

| Introduction | Vouching is a process of examining the evidences. | Verification is a process to verify the assets and liabilities of the business. |

| Basis | Vouching is done on the basis feasible narrative evidences like invoice receipts. | Verification is done on the basis information counting the observation. |

| Examination | Examining of profit and loss accounts is done in vouching process. | Balance sheet is examined in verification process. |

| Time of conduct | Vouching is a never ending process and conducted through out the financial year. | Verification is done at the end of the financial year. |

| Purpose | Vouching is done to check the accuracy of the evidences provided by the party. | Verification is done to check out the existence of the assets and liabilities appearing in the balance sheet. |

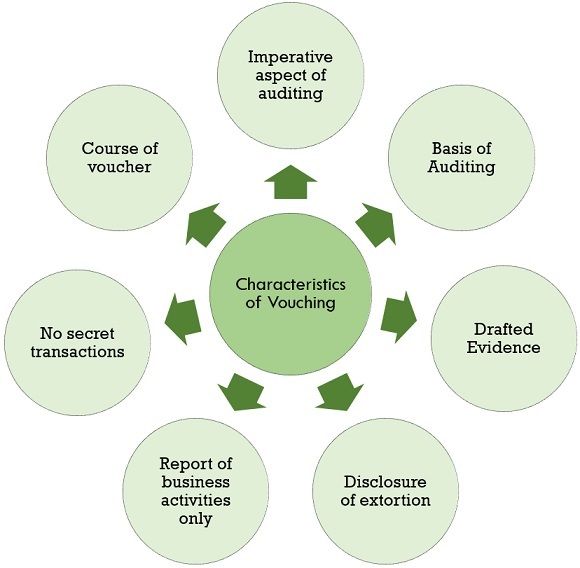

Characteristics of Vouching

Following are the characteristics of vouching:

- Imperative Aspect of Auditing: Vouching is an essential part of the auditing procedure. It makes the auditor’s opinion more optimistic about the veracity of the transactions emerging in the records.

- Basis of Auditing: Vouching acts as a base for the further procedures of auditing. To assure the fairness and accuracy of the further accounts maintained by the auditor proper vouching of the presented documents should be done.

- Drafted Evidence: Vouchers are the recorded form of evidence which proves that the transactions have genuinely occurred for the business during the current financial year.

- Disclosure of Extortion: Though vouchers are the recorded evidence signed by the owner, it helps in disclosing any fraudulent transactions documented in the books of accounts.

- Report on Business Activities Only: Vouchers helps in differentiating the business and personal transactions of the proprietor. Only the business transactions’ vouchers will be taken into consideration by the auditor for evaluating the correct profit and loss of the business, and no personal expense vouchers will be recorded in the books of accounts.

- No Secret Transactions: Vouchers helps the auditor in identifying business transactions. Thus, the owner cannot enclose any secret transaction other than business.

- Course of Voucher: The date quoted in the voucher defines that the transaction has arisen currently.

Vouching of Cash Transactions

Here, we will review some entries of the cash book

Recorded in Debit Side (Cash Receipts)

1. Opening Balance: Closing balance for the last financial year will be the opening balance or cash-in-hand for the current financial year.

2. Cash Received from Debtors: Points to be considered for vouching the cash received transactions-

- Actual date and time of cash received should be entered.

- The responsible authority should accredit any discount allowed to the customers.

3. Loan Repayment: The following points should be considered:

- Interest received on loan should be credited to interest received account.

- Substantiation of bank statement, i.e., verification of bank statement is necessary as the client can also deposit the amount directly in the bank.

4. Rent Received: Following transactions should be vouched properly:

- Records of the different rental properties should be maintained separately to record the rental income earned from various properties.

- Tax deducted at source should be properly accounted for if deducted by the party.

5. Commission Received: It can be vouched as follows-

- Agreement verification of the commission being received.

- Computation of commission receivable.

Recorded in Credit Side (Cash Payments)

1. Opening Balance: Credit opening balance represents bank overdraft because cash-in-hand of a company can never be negative.

2. Payment to Creditors: Examination of creditors payment can be done in following ways-

- Creditors account statement should be inspected.

- Any issue of receipt by creditors should be inspected.

- Any advance payment should be evidently quoted.

3. Payment of Salaries: It can be examined in the following ways-

- Salary register of the employees should be managed month wise.

- Amendments in the amount of TDS, advance payment, insurance, funds should be noted.

4. Purchase of Plant and Machinery: It can be vouched as follows-

- Excise duty treatment, according to excise rules.

- Go thoroughly to the purchase invoice or receipt of the machinery.

- All the charges incurred along with purchase such as freight inward, commission charges should be properly verified.

5. Income Tax: Following points should be considered for income verification-

- All the tax challans, whether it is of advance tax or self -assessment tax should be checked.

- Check if any demand notices from the income tax department.

- Check if any assessment orders by the income tax department.

Key Points to Remember

- Vouchers help in identifying the credibility of the transactions of the business.

- Vouchers should be adequately categorized.

- Vouchers must contain the date of transaction.

- Every checked voucher should be marked.

Conclusion

In brief, an inspection of vouchers or chronicle information is known as vouching. It is an imperative part of an auditing process, and the accuracy of the report prepared by the auditor is eminently dependent on the accuracy of the vouching process.

Leave a Reply