Definition: A stock warrant is an investment tool which provides the holder with the right (although not the obligation) to purchase or sell back the stock at the specific quantity and price within the stipulated future period. The stock warrants are issued by the company directly.

They are very similar to the options but involves higher risk and yields a better return to the investor.

Example: ABC Ltd. issues a bond worth $1200 along with the stock warrant allowing the holder to purchase the company’s 100 shares at a strike price of $10 each within five years. If the per-share value becomes $18 in four years, the investor will earn a profit of $800.

Content: Stock Warrants

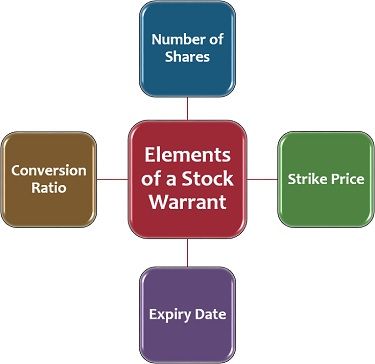

Elements of a Stock Warrant

What are the essential components of a stock warrant agreement? The four crucial details which are mentioned on a warrant agreement are as follows:

- Number of Shares: The warrants are offered in correspondence to a certain number of shares which the investor will be entitled to, on or before the expiry date.

- Strike Price: The pre-determined price at which the warrants are to be exercised is known as the strike price.

- Expiry Date: The date on or before which the stock warrant needs to be exercised, is its expiry date.

- Conversion Ratio: The ratio of converting the warrants into underlying shares is called conversion ratio.

Factors to be Considered for Stock Warrants

It requires a lot of analytical thinking and market awareness to choose the correct investment tool. Similarly, to opt for stock warrants, the investor needs to consider the following factors:

- Credit Risk: The investor may land up into credit risk if the warrants fail to perform in the desired manner.

- Limited Rights: If the warrants are not exercised, the investor cannot relish certain rights such as the voting right in the annual meetings.

- Market Risk: The value of the underlying stocks affects the price of the warrants, and these stocks are highly volatile to the market conditions.

- Effect of Extraordinary Event: Sometimes, due to an extraordinary event or particular circumstances, the stock warrant expires before its expiry date.

- Limited Life Span: Warrants have a limited life and expire on the specified date even if the investor does not realise the desired returns.

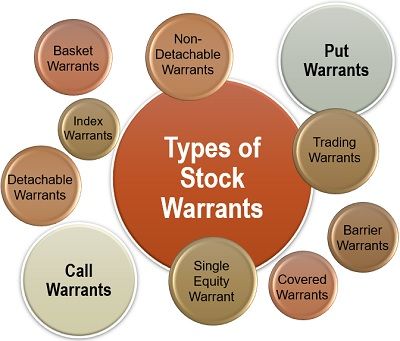

Types of Stock Warrants

There are majorly two types of stock warrants derived by buying or selling of the securities. Let us understand both of these in detail below:

- Call Warrants: In a call warrant, the holder agrees to buy the underlying securities on or before a specified future date from the issuing company at the pre-determined price or strike price. It is suitable in a bullish market.

- Put Warrants: Opposite to a call warrant, this one allows the investor or holder to sell the underlying securities back to the issuing company on or before the expiry date at the specified price, i.e. strike price.

Other Types of Warrants

There are some other warrants too, which are categorized by the securities it deals in. These are explained as follows:

- Single Equity Warrants: These warrants are very popular and are also known as vanilla warrants. They are either settled for cash or the possession of the underlying security.

- Barrier Warrants: Similar to the single equity warrants, the price of the security under these warrants is restricted to a certain level crossing which makes the warrant lapse.

- Basket Warrants: These warrants are the same as the vanilla warrants. The only difference is that here, the underlying securities are a combination of stocks or securities of the companies belonging to a particular industry.

- Index Warrants: The warrant that bets on the movement of the overall index involving stocks or other securities is called an index warrant.

- Detachable Warrants: The detachable warrants allow the holder to sell the warrant individually and retain the related bonds or stock with oneself.

- Non-Detachable Warrants: In non-detachable warrants, the holder has to compulsorily sell the warrants; along with the related bonds or stocks.

- Covered Warrants: The warrants that involve underlying securities which are already in possession of or readily obtainable by the issuer, i.e. the financial institutions are called covered warrants.

- Trading Warrants: The trading warrants are the ones which can be bought or sold like the common stocks on the stock exchange, with the help of the brokerage firms.

Warrant Styles

The execution of stock warrants on or before its expiry date determines the style of a warrant. The warrant styles are thus, bifurcated into the following:

The American style of warrants allows the investor to exercise the warrants before the expiry date anytime after its listing.

The European warrant style allows the warrant holder to exercise it only on the date of expiry.

Like other financial instruments, the stock warrants also have specific benefits and some limitations which are mentioned below:

Advantages of Stock Warrants

Stock warrants are highly profitable for investors who have an in-depth knowledge of the market and the company. Let us understand the benefits of the warrants in detail below:

- High Transparency: The performance of a warrant can be tracked by observing the movement of the underlying securities.

- Beneficial to Speculators and Hedgers: Warrants are highly advantageous to the speculators and hedgers who keep a keen watch at the market performance to make profits out of bull or bear market.

- Low Cost: The warrants are usually priced more economical than the shares to make it suitable for small investors. These prices are determined with the help of the conversion ratio.

- High Returns: The return on the warrants is quite high since these are generally done with the medium or long-term investing perspective. Also, companies usually earn high profits in the long term, making the warrants profitable.

- Transferable: The warrants are easily transferrable with the transfer of possession without any registration formalities.

- Capital Management: The warrants allow the investor to purchase the shares or securities on a future date. Thus, enabling the holder to gather the required sum over the period rather than taking credit or blocking the funds immediately.

Disadvantages of Stock Warrants

The drawbacks of the stock warrants make it unsuitable for the ones who are not very updated with the stock markets. Some of these limitations are as follows:

- High Risk: Since the performance of a warrant depends upon the return of the underlying stock, which is ultimately volatile to the market fluctuations, warrants are considered to be high-risk instruments.

- Fall to Zero Value: The value of the warrants can even become nil, leading to the loss equivalent to the entire investment value.

- High Loss Possibilities: As we know that it is wholly based on the stock market; the holder can either earn a considerable profit or may even incur a substantial loss.

- Limited Control on the Company: The warrant holders do not have the same rights as the shareholders have. For instance, they cannot participate in the annual general meetings of the issuing company.

- Lapse if Not Redeemed before Expiry Date: The warrant becomes obsolete if the holder fails to redeem it on or before its expiry date.

Conclusion

Stock warrants are beneficial to both the issuing company and the investors. On the one hand, it provides a source of finance and capital accumulation to the companies, saving it from situations like bankruptcy. It also acts as a high profit yielding investment option for investors who are looking for medium and long term benefits.

Leave a Reply