Definition: Financial Ratios are the ratio amidst two values from the company’s financial records. These ratios are used to evaluate the true and fair position of the company in the market. Various standard ratios are set under this head for measuring the company’s status in the market, which is applied by the director, shareholders or the borrowers of the company to analyze the vitality and vulnerability of the company.

Content: Financial Ratios

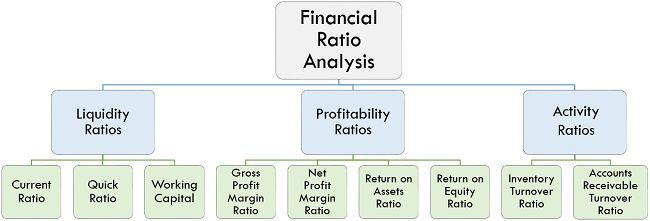

Financial Ratio Analysis

For implementing ratio analysis to the financial statement to determine the progressing accomplishment, breakdown and improvement of the business the balance sheet and income statement are requisite; however, they are just an offset spot for profitable financial management. Financial ratios analysis empowers the owner of the business to identify movements in business and to correlate its conduct and actions with the average behaviour of identical firms in a similar industry. For this correlate your ratios with the average of businesses similar to your business and correlate your own ratios for various consecutive years, especially for observing any adverse movement that can be originated.

Ratio analysis can administer all relevant information and early cautionary suggestions that support you in solving your business difficulties earlier than they ruin your business. Significant balance sheet ratios control a business capacity to compensate its bills as they become outstanding and the range to which the business is reliant on the receiver’s capital. They consist of the following ratios:

1. Liquidity Ratios

These ratios signify the efficiency of converting assets into cash. Liquidity ratios consist of following subsequent ratios:

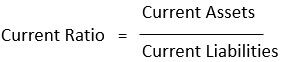

- Current Ratio

This ratio is one of the most famous methods of measuring the financial strength of the company. The following formula can evaluate it:

The primary question on which this ratio focuses on is, determine whether your business has sufficient current assets to match the payment plans of its current liabilities with a surplus amount as safety for probable deficits in current assets like the reduction of stock or valuable accounts. The universally agreeable current ratio is {2:1}. Although, whether or not the definite ratio is adequate, based on the nature of the business and the features of its current assets and liabilities. The least agreeable current ratio is {1:1}, however, that connection is generally present it too close for ease. If you conclude your business’s current ratio is inadequate, you can be capable of increasing it by:

- Reimbursing some liabilities.

- Raising your current assets by way of loans and other financings with a maturity time exceeding one year.

- Changing non-current assets into current assets.

- Raising your current assets coming out of new equity grants.

- Imposing gains back into the business.

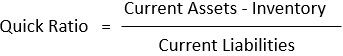

- Quick Ratio or Acid Test Ratio

The Quick Ratio also called Acid Test Ratio is one of the best methods of measuring the liquidity of the company.

The following formula can evaluate it:

This ratio is a more precise measure than current ratio; by eliminating inventories, it focuses on the real liquid assets, with an adequately certain value. Universally acceptable Quick Ratio is {1:1}.

- Working Capital

This is majorly a method of measuring the cash flow in a business rather than a ratio. The outcome of this computation should be positive.

The following formula evaluates it:

![]()

Financial institutions look at net-working capital above time to ascertain the company debt to overcome the financial crisis.

2. Profitability Ratios

These ratios measure the administration’s efficiency as displayed by the benefits produced on investment and sales. The significant ratios come under it are as follows:

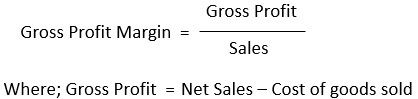

- Gross Profit Margin Ratio

Gross profit margin ratio is the percentage of sales value left after reducing the cost of goods sold from the net sales. It determines the percentage of sales amount leftover to pay the overhead expenses of the organization. Correlation of your business ratios to the same class of businesses will disclose the proportional strength or vulnerability of your business.

The following formula evaluates this ratio:

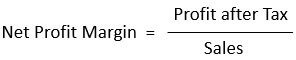

- Net Profit Margin Ratio

Net profit margin ratio is that portion of sales value which is left after reducing the cost of goods sold and all other overheads, except Income Taxes from the net sales. It furnishes favourable circumstances to equate your company’s “Return on sales” with the efficiency of other companies in a similar industry. It is computed ahead of income tax as tax rates and tax liabilities differ from organization to organization because of immense kind of reasons, executing correlation after taxes is more complicated.

The following formula evaluates this ratio:

- Return on Assets Ratio

This ratio evaluates how precisely profits are being produced from the assets engaged in the business when correlating with the ratios of other businesses of the same category. A low ratio related to industry averages signifies an ineffective use of business assets.

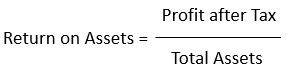

The following formula can evaluate this ratio:

- Return on Equity Ratio (ROE)

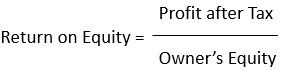

The Return on Equity sometimes indicated as the Return on Investment; is possibly the most significant ratio of all. It is the rate of return on capital lend by the owner of the business. If the Return on Equity is below the percentage of return on an alternate secure investment like saving account in a bank, the owner can be informed to sell the enterprise and invest the sum in alike saving instruments and refrain the day-to-day conflicts of small-scale business management.

The following formula evaluates the Return of Equity Ratio:

3. Activity or Turnover Ratios

These kinds of ratios consist of following subsequent ratios under it:

- Inventory Turnover Ratio

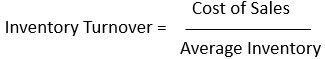

Inventory Turnover Ratio acknowledges how appropriately inventory is being handled. It is relevant as the more times inventory may be converted in an accustomed operating cycle, the higher the gain will be.

This ratio is evaluated by the following formula:

- Accounts Receivable Turnover Ratio

This ratio signifies how adequately accounts receivable are being composed. If accounts receivables are not composed sensibly according to their terms, the administration must examine its collection policy. If receivables are unreasonably slow in being transformed to cash, liquidity may be critically damaged. This ratio is evaluated by the following formula:

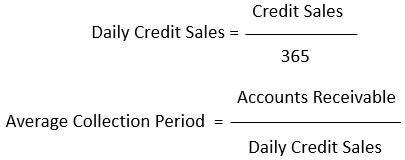

When the receivables turnover is very stagnant, it requires a long time sooner; the business is capable of turning the credit sales into cash. This intensifies the number of days overdue or average assortment extent of time.

This is evaluated as follows:

Conclusion

Financial Ratios can be explained as a connection among two values on a company’s financial statements, which can be derived by dividing one value by another. An extremely beneficial approach in financial analysis is the application of the financial ratios.

Leave a Reply