Definition: Partnership is a type of business in which two or more individuals combines their hands to perform an activity and distribute its profits and losses. It constitutes an agreement known as a partnership deed. The Indian Partnership Act,1932 regulate evolution and administration of partnership firms.

As the business extends, one requires more fund and more persons to regulate the business and spilt its risks. In that condition, people generally embrace the partnership form of firm or company. Accounting for such companies has its own traits, as the partnership organizations originate when two or more individuals associates to set-up a business and distribute its profits.

Content: Partnership

- Types of Partnership

- What is a Partnership Deed?

- Contents of Partnership Deed

- Relevant Statute in the absence of Partnership Deed

- Characteristics of Partnership

- Advantages of Partnership

- Disadvantages of Partnership

- Conclusion

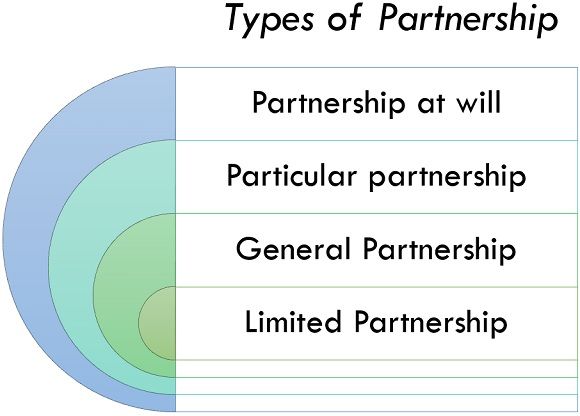

Types of Partnership

Following are some of the types of partnership:

- Partnership at Will: In this type of partnership no fixed duration is mentioned in the partnership deed for the termination. It is completely based on the will of the partners how long they want to continue the partnership. Any of the partners can leave such a partnership just by giving notice to the firm and is not bound to continue a partnership.

- Particular Partnership: This type of partnership is constituted for a specific project, and after completion of the project, it automatically gets terminated. These type of partnerships are generally for short-term.

- General Partnership: In this type of partnership all the partners has a right to participate in the decisions of the management. However, the liabilities of the partners are unlimited, i.e., all the partnership becomes personally liable for fulfilling the debts of the creditors if the assets of the company are not enough for fulfilling such debts. Such partnership automatically gets terminated if either of the partners dies or becomes insolvent, and it is optional to get registered such type of partnership.

- Limited Partnership: In this partnership liabilities of all the other partners are limited except one partner who has unlimited liability, and such partnership does not get terminated even after the death or insolvency of any of the partners. However, it is mandatory to get registered for such type of partnership.

What is a Partnership Deed?

Presence of an agreement is an obligatory element of partnership; however, the agreement can be written or spoken. A written agreement among the partners is termed as “Partnership Deed”. It is excessively beneficial in order to avoid disputes among the partners. All the terms and conditions of the partnership are mentioned in it.

Contents of Partnership Deed

Following are the elements of a partnership deed:

- Name and address of the company and its principal business.

- Name and address of all partners involved in the business.

- Total capital to be provided by every partner.

- The accounting cycle of the company.

- The period of initiation of the partnership.

- Guidelines concerning transactions of bank accounts.

- Profit and loss sharing percentage or ratio.

- Rate of interest on drawings, loan and capital, etc.

- Procedure of auditor’s appointment.

- Commission, salaries, etc., if outstanding to any of the partner.

- Duties, liabilities and rights of every partner.

- Treatment of loss emergent in regard to the insolvency of one or more partners.

- Settlement of accounts at the time of termination of the company.

- Approach of the settlement of conflicts amidst the partners.

- Procedure to be adopted in the event of admission, retirement and death of a partner.

- Any other point empathized to regulate the business.

Usually, the deed comprises of all points affecting relations of partners among themselves.

Relevant Statute in the absence of Partnership Deed

Following are some of the rules applicable to all the partners if the partnership deed is not prepared:

- Proportionate allocation of profits.

- No interest on capital is provided to any partner.

- No interest on drawings is given.

- No salary or commission is granted.

- Interest on loan arranged by a partner will be given @ 6% p.a.

Characteristics of Partnership

Based on the above definition, we can determine a few fundamental characteristics:

- More than two individuals

A partnership cannot be performed by an individual alone; at least two persons are needed for forming a partnership relation. However, there is an upper limit that is decided for the maximum number of partners. In banking concerns, a maximum number of partners can be ten, and in case of all other organizations, this limit is set to maximum of twenty partners.

- Contract

When two individuals mutually get ready to do business together, they sign a written contract in papers stating all the terms and conditions, duties and responsibilities of all partners as well as profit and loss sharing ratio of all the partners. Such papers signed by all the partners are known as a legal contract. Though the spoken contract is equally valid but to avoid any disputes in future, it is preferred to have a contract in written form.

- Trade

It is mandatory to do a business or any trade for creating a partnership; purchasing land together does not come under the partnership. For Instance: If A and B buy land together for making houses for their own personal use, it will not be considered as a partnership, although if they buy land together for making houses and selling them, i.e. if it is their business to build and sell houses, then it will be considered a partnership.

- Collective Organization

In a partnership concern, not all partners need to be active partners; any partner can operate it on behalf of all other partners, and all partners can actively participate in any event of the company. If any of the partners notice any unethical or non-beneficial conduct in business, they have a right to stop other partners from doing such conduct.

- Profit Allocation

Business is started with the intention of earning profits in return, but it is the rule of the universe if you get the flowers you will also get thorns along with that. Similarly, if the business gets a profit, it may also get losses some years, which will be distributed amidst all the partners in their profit and loss sharing ratio as mentioned in the contract of partnership.

- Partnership Accountability

In partnership, actions of all the partners are inter-related with each other and will make an impact on the business, i.e., if any of the partners has taken any action regarding the company when he is a partner in it, all partners are equally liable for that action and its results as well as liabilities of all the partners are unlimited for the operations of the company.

Advantages of Partnership

The partnership has the following advantages:

- A partnership firm has more prominent economic holdings in comparison to the sole proprietorship.

- Higher private contacts of the partners deliver more customer set-up and assistance.

- Individuals having distinct competence and talent can work for the improvement of the company or the firm.

- Limited spending per partner is inclined to incorporating a partnership firm.

- Losses will be assigned amidst the partners.

Disadvantages of Partnership

- A partnership firm may terminate subject to retirement or death of any partners in case of two partners.

- If all the partner criticizes one another or the business is facing losses. It may result in the dissolution of the partnership.

Conclusion

The partnership is outlined as the relationship among individuals assent with another to distribute gains and deficits of a business carried on by all the partners or any of them acting for all.

Leave a Reply