Reserves are the portion of the earning of the business which the company retains to meet any forthcoming emergencies or contingencies. In contrast, provisions are the charge against income and are treated as expenses and entered into a profit and loss account. Reserves lists beneath “reserves and surplus” head whether they are capital reserves or revenue reserves.

Provisions get divided into two parts in the balance sheet, the provisions that describe the liabilities are entered under the head “current liabilities and provisions”. On the other hand, provisions describing a reduction in the value of the asset gets subtracted from that asset on the asset side of the balance sheet. For Example, provision for depreciation of furniture will get deducted from the balance of the furniture in the balance sheet, and the net value will be considered as the current value of the asset.

Content: Reserves Vs Provisions

- Difference and Comparison

- What are the Reserves?

- Types of Reserves

- What are the provisions?

- Types of Provisions

- Summary

- Conclusion

Difference and Comparison

| Basis of Comparison | Reserves | Provisions |

|---|---|---|

| Introduction | Reserves are the allocation of the profits and is created by debiting profit and loss appropriation account. | Provisions are the charges against income earned and; thus, treated as expense and debited in profit and loss account. |

| Need for creation | Reserves are created to face the unknown future contingencies. | Provisions are created for the known liabilities which the business has to bear during the year. |

| Obligation | Company is not obliged to make reserves, it is made according to the financial policy of the company. | Company is obliged to make provisions as they are made with the known intentions of the future upcoming liabilities. |

| Dividend distribution | Previous unused reserves can be used by the company for the distribution of dividend. | Provisions cannot be used for the distribution of dividend only if it is in excess and written back then it can be used for dividend distribution. |

| Balance sheet head | Reserves lists beneath "Reserves and surplus" head. | Provisions are deducted from the asset for which it has made in the asset side of the balance sheet. |

| Possibility of creation | Reserves can be created only in case when company earns sufficient amount of profits, in case company faces losses no reserves will be created as reserves are the allocation of the profits. | It is mandatory to create provisions even if company faces loss, as they are the charges against profits and are made for the known expenses. |

| Auditor's responsibility | Reserves creation is unrestricted; thus, auditor need not to spend much time for reserve verification. | Creation of provision is must and auditor is also bound to verify provisions properly and qualify his report if appropriate provisions are not made. |

| Nature | The nature of the reserves is still and it will remain reserve untill it is fully utilized. | The nature of provision can change, according to Companies Act Schedule VI, if provision is in excess it can be converted into reserves. |

| Impact on profit | Divisible profits get decreased by creation of reserves. | Net profit exhibited in profit and loss account get decreased by creation of provisions. |

What are the Reserves?

The sum allocated from the profit earned by the business for meeting future’s unexpected emergencies or contingencies is termed as “Reserves”. Companies generally assign some percentage of their profit as reserves which provides strength to their business and balances the financial condition of the business. Reserves can be used for making dividend payments, purchasing new assets for the business. However, the company is not bound to create reserves, only if the company earns sufficient profits during the year from that the company can create reserves for the future to face any unexpected circumstances. And, if these reserves won’t get utilized for predetermined purposes, the amount allocated for such reserves can be used by the company for any other needs of the business.

Types of Reserves

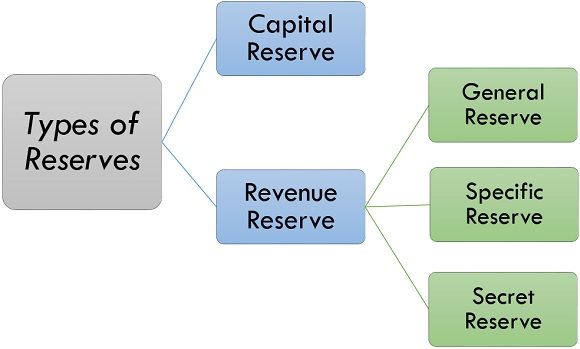

Contribution of shareholders, as well as overall static profits, are the part of the net worth of the company, these contribution or profit detained in profit and loss account or to a reserve. Reserves are split into two categories. They are as follows:

Capital Reserve

The reserves made from capital funds or profits are known as capital reserves. These kinds of profits do not arise from normal business activities and are made from the following:

- Selling of assets at a higher cost.

- Profit earned during the time of revaluation of assets.

- The income earned before the incorporation of the company.

- Re-issuing forfeited shares can make a profit for the company.

- In accordance with Schedule VI of part III in the Companies Act, the capital reserve does not contain any sum concerned as free for distribution by profit and loss account.

- It would only contain capital redemption reserve, security premium, expansion rebate reserves and profit earned on re-issue of forfeited shares.

- It can be used for issuing bonus shares, writing off intangible and fictitious assets.

Revenue Reserve

Revenue reserve implies that profit which is available for dividend distribution to the shareholder’s reserve for now for any purpose. These reserves usually become useful for the expansion of the business and to provide financial strength to the company. Although maintaining reserves are not mandatory for the companies; thus, the auditor is also not bound to report reserves in their report and need not verify it much. However, the auditor can guide the administration on the significance of creating reserves, and maintenance of reserves for the betterment of their business. There are three parts of the revenue reserve; they are as follows:

- General Reserve

The portion of the profit kept to enhance the company’s fiscal condition is known as a general reserve. It provides aid in increasing the working capital of the company, and to meet uncertain emergencies that can arise in the future span of the business. It may be considered as an undiversified profit of the company as it is an allocation of profit.

- Specific Reserve

Specific reserves are precisely the same as provisions. These reserves are created to meet specific precise expenses known to the company and are treated as a charge against revenue. This kind of reserve is created whether the company earns a profit or faces losses. They are known as a specific reserve as they are made with the provisions, especially for the fixed expenditure along with provision amount set aside for that expense. These types of reserves are made with the following objectives:

- To face the expected losses such as renew of machinery, depreciation, etc.

- To face a predicted event such as giving a discount to debtors, facing liabilities for disputed claims, etc.

- To face the pending liabilities for which expenses have already being aroused such as salaries and wages, commission, etc.

- Secret Reserve

It is a reserve that is not directly shown by the company in their balance sheet; they are considered as hidden reserves or inner reserve. The objective behind the creation of such a reserve is to demoralize competitors to enter in a similar kind of business as these kinds of reserves reduce the profit of the business and present wrong pictures of profitability to the rivals. These reserves are created by under-valuation of inventories at the end of the year, by maintaining exaggerated reserves for doubtful debts; by charging capital expenditure to revenue reserves, by escaping some assets from the balance sheet, etc.

What are the provisions?

Provisions are made with the accrual concept, i.e.; the company has to show their expenses for the current year whether they have occurred or will occur in future, but their amount is uncertain. To meet such specific expenses such as provision for depreciation, provision for bad debts, etc. the company with an estimated amount creates provisions. Provision for depreciation reduces the value of the depreciated asset; whereas provision for bad debt is treated as an outstanding liability and are shown separately on the liability side of the balance sheet.

Types of Provisions

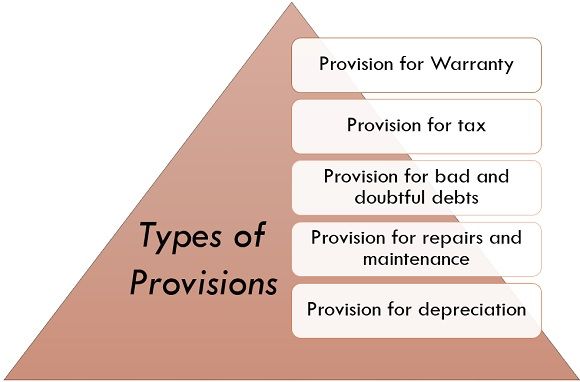

Some of the provisions are as follows:

Provision for Warranty

This provision is made by the company to meet the expenses incurred on warranted products. For example; if the company sold Air conditioners with a warranty of 10 years for its parts. And if the customer faces any issues with the product in these 10 years, the company will repair the product or will exchange it with a new one.

Provision for Tax

Tax provision is created by the company to pay the current financial year tax, which will become payable in the next year, i.e., if the company was doing business in 2019, they will have to pay tax on it in 2020 since the amount of which will be uncertain as it may change according to tax slabs. Thus, the estimated provisions are created by the company to meet such expenses.

Provision for Bad and Doubtful Debts

When companies are known with the fact by reviewing their financial statement that certain debtors will not pay their debts or it may be doubtful whether they will pay or not. For meeting such expenses, the company creates provision for bad and doubtful debts on an estimated basis as the amount may vary.

Provision for Repairs and Maintenance

This provision is made for the upcoming repairing and maintenance expenses of the plants and machinery of the business, although it is certain that repairs have to make, the actual sum remains uncertain, the company creates a provision for repairs and maintenance on an estimated amount.

Provision for Depreciation

Provision for depreciation is created to meet the reduction in the value of the assets used in the business. The provision for depreciation gets deducted from the value of the asset. It is created so that when an old asset gets obsolete, the new asset can be purchased from the provision amount.

Summary

- Reserves are created by debiting profit and loss appropriation account as they are the allocation of the profits; whereas provisions are treated as expenses and debited in profit and loss account as they are the charge against the earned income.

- Reserves are made to face unknown future emergencies or contingencies. In contrast, provisions are created to meet the known liabilities which the business has to bear during the year.

- Company is not obliged to create reserves, it depends upon their policies; whereas companies are obliged to create provisions as they are created for the known fixed liabilities which will definitely occur in future although its amount may be uncertain.

- Reserves which remains unused in previous years can be used for the distribution of dividend to the shareholders. In contrast, provisions cannot be used for dividend distribution untill it has written off.

- Reserves lists beneath “Reserves and Surplus” head. In contrast, provisions will get deducted from an asset for which it has created like a provision for depreciation for furniture will be deducted from the value of the furniture.

- Reserves are created only when the company earns a sufficient amount of profits during the year as they are the allocation of the profits. In contrast, the company must create provisions as they are made for known liabilities which the business has to face and, thus; it is treated as a charge against profit.

- Reserves creation is not restricted therefore auditor is not bound to spend much time in the verification of reserves. In contrast, the creation of provisions is a must and the auditor is also bound to verify all provisions properly and qualify his report if appropriate provisions are not made.

- Reserves are still in nature and will remain reserve till the end until it is fully utilized. In contrast, the nature of provision can change, in accordance with, Companies Act Schedule VI if provisions are in excess they can be converted into reserves.

- Reserves decrease the divisible profit of the company; whereas the creation of provisions reduces the net profit of the company as it is created to buy new assets if the old assets become obsolete.

Conclusion

Reserves are those liabilities of the business which are created for meeting uncertain contingencies that can arise in future while running a business and provisions are created for the known liabilities and reductions in the value of the assets, but the amount of liabilities remains uncertain.

Leave a Reply