Definition: Hire Purchase System is a system in which the hirer (hire purchaser) buys a good from the seller (hire vendor) but does not make a full payment at one time. However, makes a lumpsum amount as a down payment and the remaining amount will be paid in installments by the hirer. It is somehow like an installment system but, the major difference in installment system and hire purchase system is the time of transfer of ownership.

The hire purchase system is generally imposed on the goods which have a good resale value in the market. Thus, in case hire purchaser fails to make an installment payment hire vendor has an option to repossess and resale the asset in the market to recover his cost and profit margin.

Content: Hire Purchase System

- Parties Involved

- Formulas

- Hire Purchase Agreement

- Advantages

- Features

- Accounting Treatment in the Hire Purchase System

Parties Involved in the Hire Purchase System

1. Hirer: A “Hirer” in general terms implies the buyer of a good or a person who obtains a good from the owner or the seller under hire purchase system.

2. Hire Vendor: A “Hire Vendor” is an owner or seller of the good who delivers the goods to the hirer under a hire purchase system.

Formulas

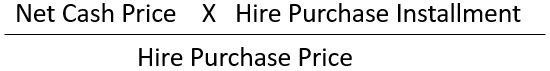

1. To calculate the hire purchase price

![]()

2. To calculate Cash Price Installments

Hire Purchase Agreement

Hire purchase agreement contains the terms and conditions on which the purchaser and seller mutually agree to let the goods on hire. This agreement contains the following clauses:

- Vendor or seller gives the possession of goods to the hirer or hire purchaser with the condition that ownership will be transferred only when the hirer makes the payment of the last installment.

- Hirer has an option to terminate the agreement anytime if he/she don’t want an asset or unable to pay the further installments. The installments paid till that date will be considered as rent for using an asset, and with the termination of the agreement, the hirer should return the asset to the vendor.

Contents of Hire Purchase Agreement

According to the Hire Purchase Act, 1972 (Section 4), the following contents should be mandatorily mentioned in a hire purchase agreement:

- Description of goods.

- Selling price of the goods sold.

- Actual cash price of the goods sold.

- Date and time of agreement initiation.

- Amount and number of installments to be paid by the hirer along with the rate of interest.

- Last date till all installments should be paid off.

- The name of the person to whom the installment is payable.

Advantages of Hire Purchase System

Following are some of the advantages of the hire purchase system:

- Buying an asset becomes much easier for the hirer by making payments in easy installments.

- After paying all the installments, the hirer can enjoy the ownership of the asset.

- Hirer can claim the depreciation benefits on the hired assets.

- Hirer can enjoy the tax benefits over the interest payable by them on hire purchased goods.

- Hire purchase system is beneficial for the vendors too as it increases their sales volume.

Features of Hire Purchase System

Some of the relevant features of the Hire Purchase System are as follows:

- Act: It is regulated by the Hire Purchase Act, 1972.

- Parties: It is an agreement amidst hirer and hire vendor for hiring an asset.

- Claiming rights: In case hirer fails to make a payment, hire vendor can sue or claim only for the return of the asset and not for the remaining due installment payments.

- Selling Rights: Hirer cannot sell or mortgage the hired asset untill ownership gets transferred to the them.

- Loss bearer: Hire vendor remains liable for any loss of goods untill ownership gets transferred to the hirer.

Accounting Treatment in the Hire Purchase System

In the books of Hire Vendor (Seller)

1. On the date of Purchase

- Entry for sale of an asset

| Hire purchase A/c Dr. – |

| To Hire Sales A/c – |

| To Interest Suspense A/c – |

- Entry for cash down payment received

| Cash/ Bank A/c Dr. – |

| To Hire Purchaser – |

2. At the end of the first year and successive year

- Entry for the due Interest

| Interest Suspense A/c Dr. – |

| To Interest A/c – |

- Entry for the received installment

| Cash/ Bank A/c Dr. – |

| To Hire Purchaser – |

- Entry for the depreciation on an asset

No Entry

- Entry for transferring depreciation and interest amount to Profit and loss Account

| Interest A/c Dr. – |

| To Profit/Loss A/c – |

3. At the time of Repossession

When the amount receivable from the hirer (hire Purchaser) is equal to the asset repossessed by the hire vendor.

- The entry will be

| Goods Repossessed A/c Dr. – |

| To Hire Purchaser – |

The profit/ Loss on Repossession will be recorded as:

1. In case of Profit

| Goods Repossessed A/c Dr. – |

| To Profit/Loss A/c – |

2. In case of Loss

| Profit and Loss A/c Dr. – |

| To Goods Repossessed A/c – |

When Repossession of asset is done on Agreed value

- The entry will be:

| Goods Repossessed A/c Dr. – |

| To Hire Purchaser – |

| (With the Agreed value of an asset) |

In the books of Hire Purchaser(Hirer)

1. On the date of Purchase

- Entry for the purchase of the asset

| Asset A/c Dr. – |

| Interest Suspense A/c Dr. – |

| To Hire Vendor A/c – |

- Entry for cash down payment paid

| Hire Vendor A/c Dr. – |

| To Cash/ Bank A/c – |

2. At the end of the first year and successive year

- Entry for the due Interest

| Interest A/c Dr. – |

| To Interest Suspense A/c – |

- Entry for the installment paid

| Hire Vendor Dr. – |

| To Cash/ Bank A/c – |

- Entry for the depreciation on asset

| Depreciation A/c Dr. – |

| To Asset A/c – |

- Entry for transferring depreciation and interest amount to Profit and loss Account

| Profit and Loss A/c Dr – |

| To Depreciation A/c – |

| To Interest A/c – |

3. At the time of Repossession

When the amount payable to the vendor is equal to the asset returned to the hire vendor.

- The entry for it will be:

| Hire Vendor A/c Dr. – |

| To Asset A/c – |

| (With the amount payable to hire vendor) |

If the amount payable is more than the book value of the asset, it will be treated as profit.

- The entry for it will be:

| Asset A/c Dr. – |

| To Profit and loss A/c – |

| (With the amount of profit) |

If the amount payable is less than the book value of the asset, it will be treated as a loss.

- The entry for it will be:

| Profit and Loss A/c Dr. – |

| To Asset A/c – |

| (With the amount of Loss) |

When an asset is returned at an Agreed Value

| Hire Vendor A/c Dr. – |

| To Asset A/c – |

| (With an Agreed value of an asset) |

Conclusion

Hire purchase system is a credit purchase system in which hirer buys goods from the hire vendor on credit and makes payment on installments. Although the hirer gets the possession of the goods from the date of the agreement; however, the ownership of the asset only gets transferred with the last installment payment, till then the hire vendor holds the right of ownership of the asset.

Leave a Reply