Definition: A lease is a legal agreement amongst two parties known as lessor (owner) and a lessee (occupant). Lessor grants a temporary possession to the lessee to use his/her property or asset such as land and building against some monetary compensation for a certain period as mentioned in an agreement of lease.

Lease facility is generally used by the entities who want an asset for a long period but don’t have enough fund to buy an asset, so they prefer to take an asset on lease.

Content: Lease

Parties Involved in the lease contract

1. Lessor: Lessor is the holder or the owner of the property or land to be leased. It can be an individual or any legal entity.

2.Lessee: The person who is taking the property or land in a lease by paying money for a certain period is termed as lessee. Any person or entity who is in need of property or land can be a lessee.

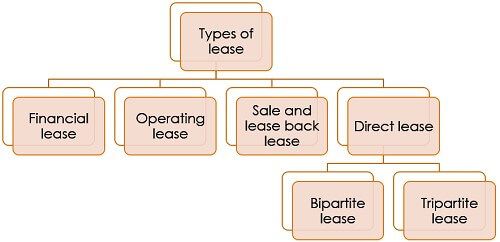

Types of lease

Following are some of the types of lease:

1. Financial lease: Financial lease is an agreement in which all the risks and rewards also get transferred to the lessee, along with the ownership of the asset till the time of expiry of an agreement. However, if any of the below-mentioned conditions gets followed it would be termed as financial lease –

- Ownership or Holding of the asset gets transferred at the end of the lease without or with very nominal consideration (purchase option).

- The lease period is generally of the commercial life of an asset.

- Assets are of specialized nature and cannot be used by a person other than lessee without making a significant modification.

- The present value of the lease rental with residual value is equal to the fair value of assets.

2. Operating lease: Operating lease is also known as a service lease. In an operating lease, no risk and rewards are transferred to the lessee, and the lessor has to provide services related to the asset such as maintenance, repairing, etc. In this type of lease, the lessor cannot recover the asset’s cost from one lessee as it is a short-term lease and therefore, rentals for operating lease is much higher than rentals for financial lease.

3. Sale and leaseback: It is an indirect lease generally used by the companies when they face a shortage in their working capital, they sell the asset to the other leading company for gathering the required capital amount and then takes back the same asset on lease for a long period of time against some rental amount. Thus, in this type of lease, the previous owner itself becomes the lessee, and the new owner becomes the lessor.

For example, A is the owner of the building; he sold the building to B and got that same building in lease from A for the long term.

4. Direct lease: In this lease, the lessee directly takes the asset on a lease, i.e., the lessee was not the previous owner of the asset at any time like sale and lease back. This lease can be of two types-

- Bipartite lease: It involves two parties, i.e. lessor and lessee. It is a systematic form of a lease provided by a lessor to the lessee with built-in facilities like up-gradation of plant and machinery, insurance premium payment, Tax payments, etc. The lessor keeps the asset in use and if necessary changes it with a similar one with an excellent working condition.

- Tripartite lease: This lease by its name only suggests that it is related to three parties. They are-

- Lease-holder

- Management

- Landlord

For bringing in loans for the properties against the planned purchase of property, tripartite agreement gets established to assist buyers.

Advantages of lease

Following are the advantages of the lease:

1. Rate of interest is fixed: The rate of interest throughout the lease period remains the same as decided during the time of signing the agreement with the mutual consent of the lessor and the lessee. Thus, the lessee need not worry about the rise in the rate of interest.

2. Tax benefits: Both lessor and lessee get benefited by the leasing facility. The lessor can claim depreciation in books; on the other hand, lease rentals can be claimed as an expense by the lessee.

3. Low initial investment: For the new set-ups leasing is an excellent option with low initial cost and expenditure on the purchase of assets.

4. Effective use of the company’s capital: Company can use their capital fund for increasing their other investments rather than investing in asset purchasing. Leasing becomes a better option than purchasing fixed assets; the company need not spend bulk amount together.

5. Convenience: Buying assets for the business will create an unnecessary burden and increase the company’s cost. Thus, leasing becomes the most convenient way of acquiring required fixed assets for the business without investing money in bulk.

6. Time saver: The lessee can get immediate possession of the asset after signing the lease contract and do not have to wait for the bank’s or financial institution’s approval for the loan to buy an asset.

7. No asset obsolescence burden: The lessee does not have to take a burden of the charge of asset obsolesces because of any technological advancements or changes as it is the liability of the lessor to change the obsolete assets, the lessee’s only liability here is to pay a rent for using such asset.

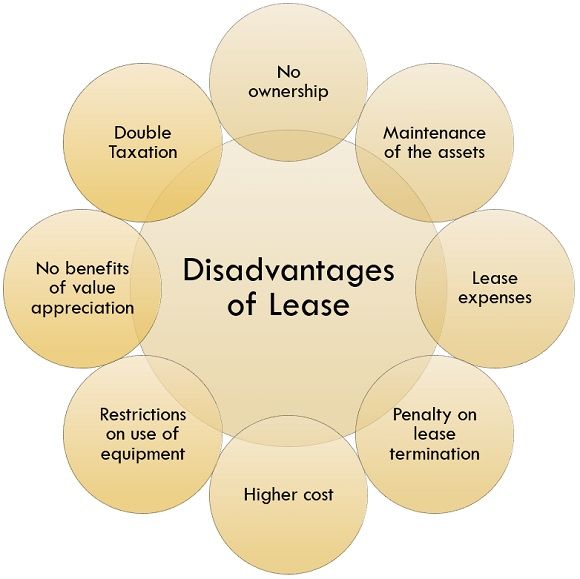

Disadvantages of lease

Following are the disadvantages of lease:

1. No ownership: Lessee doesn’t have the holding rights or ownership over the asset after the expiry of the lease agreement, i.e., the lessor has a right to lease its asset to another company or sell an asset after the lease period.

2. Maintenance of the assets: In case of the financial lease, the lessee enjoys the right of ownership on the asset till the date of the expiry of the lease agreement. Along with that, the lessee has to bear the burden of maintaining and repairing such assets till it is in their possession.

3. Lease expenses: The company has to make regular lease payments to the lessor for using their asset irrespective of the profits or losses earned, such expense is treated as a lease expense in the books of the lessee.

4. Penalty on lease termination: If in case lessee failed to complete lease term or violates any clause mentioned in the contract due to any reason he has to face heavy penalties for breach of contract.

5. Higher cost: However, leasing an asset does not put a one-time burden on the lessee. It may cost higher in the long-run as the lessor may charge a high amount as rent for recovering the asset’s cost plus his profit.

6. Restrictions on use of equipment: Lessor may impose some conditions regarding the use of assets at the time of lease and lessee is liable to follow those restrictions while using such assets.

7. No benefits of value appreciation: No matter the value of the asset increases during the period of the lease, the lessor won’t get any benefit from the price rise of the asset, the lessee will only pay the rental amount as mentioned in the lease agreement.

8. Double Taxation: Sales tax may be imposed twice once at a time of purchase of assets and twice at a time of leasing of an asset.

Difference between lease and rent

| Basis of comparison | Lease | Rent |

|---|---|---|

| Context | A lease is an agreement in which lessor gives his asset to the lessee for a fixed period as mentioned in an agreement in lieu of monetary consideration. | Rent is a nothing but a specific amount paid by the tenant to the landlord for using his/her space. |

| Time duration | Lease agreement is generally made for a longer period of time, i.e. more than a year remains | Rent is for a short period. |

| Parties involved | In the lease agreement, the parties involved are termed as the lessor and the lessee. | The parties involved in rent are known as land lord and tenant. |

| Maintenance | In case of financial lease liability of maintaining assets also transfers to the lessee till lease period, whereas in operating lease it is the liability of the lesser to take care and maintain the property or asset. | It’s an owner’s or landlord’s liability to take care and maintain the rented property. |

| Buying Offers | In case of financial lease at the end of the lease contract, the lesser gets an option to buy an asset by paying its current value. | No such option is provided to the tenant. |

Conclusion

Lease financing is the best option for those who cannot raise the fund with debt financing. Companies having excess assets can lease their assets to the companies those who require such assets. Thus leasing becomes constructive for both the parties the lessor and the lessee.

Leave a Reply