Definition: Debenture Redemption Reserve (DRR) is a reserve created to designate a portion of the company’s divisible profits, used during the Redemption of Debentures. It acts as a shield against the default in payment to the debenture holder from the company’s end at the due date.

The goal behind the creation of DRR is to cut the risk of fund shortage on Redemption. As the redemption process lay severe impacts on the company’s liquidity.

It is helpful for companies in:

- Setting aside profit for repayment to debenture holders.

- Creating liquidity at the time of redemption.

Companies invest some amount outside the business to ensure the availability of funds. However, they can invest any time before the commencement of the redemption process.

The funds accumulated in the DRR are strictly for the Redemption of Debentures.

Content: Debenture Redemption Reserve

- Legal Provisions for Debenture Redemption Reserve

- Steps Involved

- Journal Entries

- Balance in DRR Account

- Accounting Treatment

- Uses

- Debenture Redemption Fund Investment (DRFI)

- Example

- Conclusion

Legal Provisions for Debenture Redemption Reserve

The rules about DRR are specified in the Companies (Share Capital and Debentures) Amendment Rules, 2019. The Ministry of Corporate Affairs gave these rules.

The company must meet the DRR and Investment of the Debentures requirements given in the rules above.

Before the Redemption process, companies must create DRR equal to 25% of the redemption amount. The companies that are obliged and exempted from the formation of the DRR are listed in the next section.

Obligation to Create DRR

The companies that are required to create DRR are as follows:

- All Financial Institutions (Other than AIFIs)

- Non-Banking Financial Companies– NBFCs (Public issued debentures)

- Housing Finance Companies- HFCs (Public issued debentures)

- Listed Companies (Privately placed debentures)

- Unlisted Companies(Privately placed debentures)

Exemption from Creating DRR

The companies exempted from the creation of DRR are as follows:

- All India Financial Institutions- AIFIs that RBI regulates

- Banking Companies (Public and Privately placed debentures)

- Housing Finance Companies- HFCs that are registered with NHB (Privately placed debentures)

- Non-Banking Financial Companies- NBFCs and other Financial Institutions (Privately placed debentures)

Guidelines

- The creation of DRR is compulsory only for non-convertible Debentures.

- The unlisted company has to maintain a DRR of about 10% of the debenture’s face value.

- DRR is created for the non-convertible part for partly convertible debentures.

- The total amount of deposits/investments must not fall below 15% of the redemption amount at the due date.

- The investments for redemption must be at least 15% of the redemption amount payable.

Steps Involved

Following are steps that one can follow while redeeming debentures using DRR:

- At first, we need to calculate the amount to be earmarked from the profits for Redemption.

- Post calculation, this amount is transferred to the reserve at the year’s end.

- To get liquidity while redeeming, we make some investments at the end of each year.

- The company reinvest the interest on investment with the principal amount each year.

- We transfer any profit or loss on the investment sale to the Debenture Redemption Fund A/c.

- Repay the debenture holders at the due date of payment. The funds are accumulated by selling investments made for this purpose and DRR.

- The loss on issue amount not written-off that equals the premium amount is recorded to the Debit of the DRR A/c.

- After redeeming all the outstanding debentures, we transfer the balance to General Reserve.

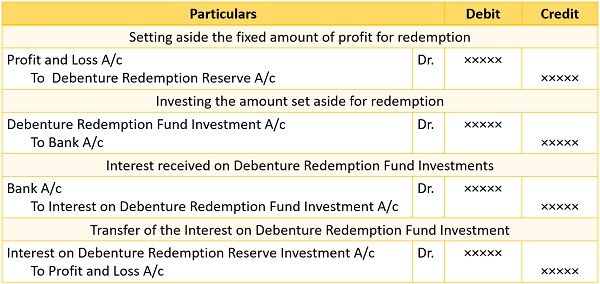

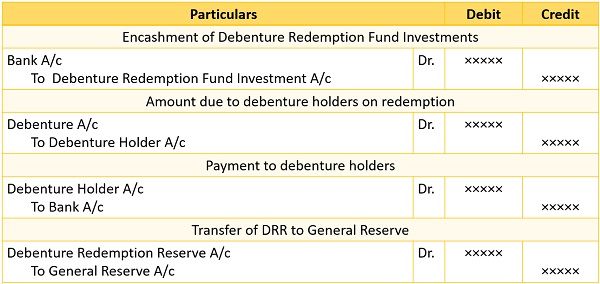

Journal Entries

After the Issue of the Debentures:

At the time of Redemption:

Balance in DRR Account

The amount collected in DRR may exceed the redemption amount due to holders. Moreover, this excess amount is the surplus for the company.

But, the company cannot use this amount for other purposes. They transfer the surplus money to the General Reserve.

Accounting Treatment

Debenture Redemption Reserve (DRR)

It appears on the liabilities side under the Reserves and Surplus part of the Balance Sheet.

Debenture Redemption Fund Investment (DRFI)

We place it under Non-current Assets on the asset side of the Balance Sheet.

Uses of Debenture Redemption Reserve

- It does not hamper the working capital of the company.

- DRR helps in reducing the financial burden on the company.

- Creating DRR reduces the risk of default in repayment to debenture holders.

- It enables companies in maintaining liquidity at the time of Redemption.

Debenture Redemption Fund Investment (DRFI)

The companies invest some amount from the redemption reserve in the secured instruments. However, they sell these investments before the due date of Redemption.

The Investment made for Redemption is the Debenture Redemption Fund Investment (DRFI). And the percentage of Investment must be at least 15% of the amount to be redeemed.

The investment duration depends on the due dates for Redemption. The sale of DRFI provides liquidity to the firm.

Companies can invest in the following instruments:

- Government Bonds

- Bank Deposits

- Commercial Papers

The company must make this Investment at the allotment of Debentures. Also, it is assumed that the company have enough profits for profit appropriation.

Like DRR, we cannot use the amount of DRFI for other purposes than Redemption.

Types of Debenture Redemption Fund Investment (DRFI)

- Cumulative DRFI

- Non-cumulative DRFI

Cumulative DRFI

It is the form of DRR in which we reinvest the principal amount with interest earned. We record the DRR A/c on the debit side and DRFI A/c on the credit side.

Non-Cumulative DRFI

As the name suggests, we reinvest only the principal amount. The reinvestment does not include the interest earned on that Investment.

We credit the interest earned on the Investment to the Profit and Loss A/c.

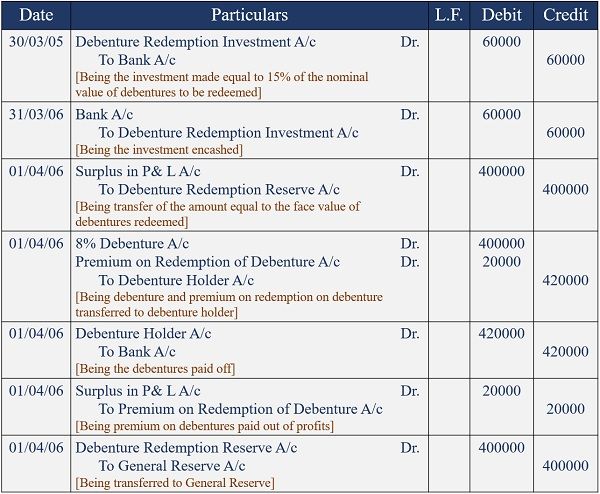

Example

Z Traders decided to redeem their outstanding 8% debentures of Rs. 400000/-. They provided the notice about Redemption to Debenture Holders on 01st April 2006. The company announced a premium of 5% at Redemption as of 31st March 2005.

The statement of profit and loss shows a surplus of Rs. 420000/-. Z Traders opted to redeem their outstanding debentures out of this profit. Make relevant Journal Entries for the redemption of debentures.

Solution:

Journal Entries in the books of Z traders:-

Conclusion

All in all, the companies must create for the Redemption of Debentures. It is a part of the divisible profits accumulated as protection against uncertainties.

Along with DRR company must make some investments for the Redemption of debentures. We refer to these investments as Debenture Redemption Fund Investments.

DRR keeps companies prepared for the financial instability resulting from the redemption process.

Leave a Reply