Definition: Redemption of Debentures is the reimbursement of the amount due to the debenture holder at its maturity. The Redemption includes a refund of the principal amount along with the amount of interest due on it. Companies might redeem the debentures at par and premium.

The debentures are the funds that the company borrows. Therefore, it is a liability for the company. Whereas, redemption is the discharge of this liability on reaching its maturity.

The repayment is made on completing the duration specified during the issue. It may also be redeemed before the maturity date if the company’s articles allow it.

The debenture certificates provide all the relevant information about the issued debenture. The Redemption process occurs as per the terms and conditions specified in it.

Important points in relation to the Redemption of Debentures:

- Redeemed on reaching its maturity or expiry.

- It is redeemable after the completion of a certain number of years.

- May redeem before expiry after providing notice.

- The company can also conduct redemption of the debentures in periodic instalments.

- Mostly, the company do not redeem debentures at a Discount.

Content: Redemption of Debentures

- Factors Affecting Redemption

- Sources of Redemption

- Methods of Redemption

- Journal Entries

- Debentures Redemption Reserve (DRR)

- Process of Issue and Redemption

- Example

- Final Words

Factors Affecting Redemption

At the time of Redemption of Debentures, one must consider the following factors:

- Time: The most crucial aspect is the time or due date of debentures redemption. The company must clearly state the duration or validity of debentures at the time of its issue.

The debenture certificate is given to the holder that contains details about its expiry. - Amount: At the time of redemption, we need to estimate the total amount payable to the holder. It includes the repayment of the principal amount and the interest thereon.

- Source: Another vital aspect is the sources used to pay off the redemption amount. The sources for redemption will largely depend on the need and convenience.

The company have to plan and make pre-arrangements to ease the redemption process.

Sources of Redemption

The various sources from which a company can redeem debentures are as follows:

- Companies Capital

- Profit Earned

- Conversion into Shares/Debentures

- Proceeds of Fresh Issue of Shares/Debentures

- Sale of Assets

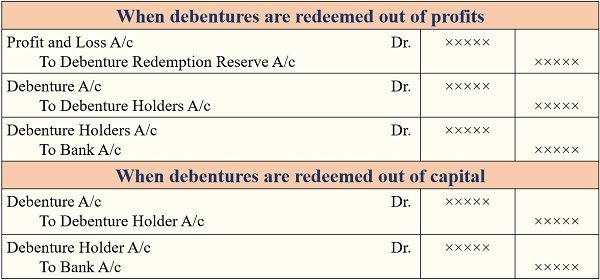

Redemption out of Capital

The company redeem debentures from its capital in the absence of a Debenture Redemption Reserve (DRR).

But, the company cannot redeem 100% of debentures from its capital. They may only pay 75% of the total value of the debenture. However, the rest, 25%, has to be repaid from profits by creating DRR.

Redemption out of Profits

The companies keep a part of profits every year under the reserve for redemption. We open the Debenture Redemption Reserve (DRR) to transfer the profit. By this, the company can collect enough profits required during the redemption.

As per SEBI, before redemption, the amount in DRR must be equal to 50% of the total amount of the debenture.

It can be of the following two ways:

- General or profits are not separately Earmarked

- Profits are separately Earmarked

The advantage of using this method is that it does not affect the company’s liquidity.

Conversion into Shares/Debentures

Here, the company issues new shares/debentures in exchange for matured debentures.

In this, the payment is not given in cash but issues the share/debenture equal to the amount payable to the holder.

The conversion is only possible when:

- The terms and conditions permit it at the time of issue.

- The debentures are convertible in nature.

Proceeds of Fresh Issue of Shares/Debentures

When the company issues shares/debentures in the market, there is an inflow of money. So they use this money for redemption purposes.

Sale of Assets

The company can use funds received from the sale of fixed assets to redeem debentures.

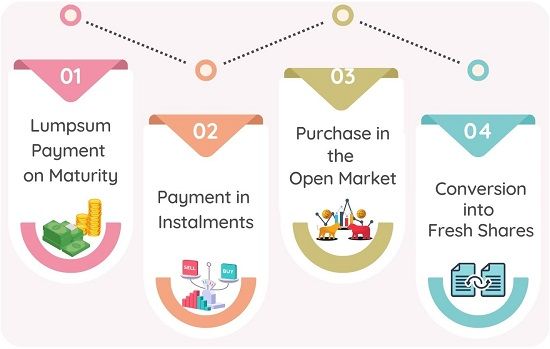

Methods of Redemption of Debentures

The popular methods for the redemption of debentures are as follows:

Lumpsum Payment on Maturity

Here, the payment of debentures is in one lot (lumpsum) at its maturity. The redemption process occurs according to the terms specified during the issue.

The company may redeem debentures before reaching maturity. However, it is only possible if permitted by the Articles of Association of the company.

The decision can be made by arranging a meeting with the Debenture holders. The repayment of debentures can be more or equal to the face value.

The company can make lumpsum payments by following sources:

- Working Capital

- Profits

- Issue of Shares and Debentures

- Sinking Fund

- Insurance Policy

Payment in Instalments

In this redemption method, the reimbursement is by way of periodic instalments. It is also known as “Draw of Lots” or “Annual Drawings“.

A part of the total redemption amount is paid through instalments after a fixed duration. But, the instalments continue until the holder receives the entire amount due to him.

Purchase in the Open Market

It is a redemption method in which the company purchases its previously issued debentures. The company make this purchase for the prompt cancellation of debentures.

The company can repurchase its debentures in the Open or Stock Market. The purchase can take place on or before the due date.

The purchase process is known as the Purchase of Own Debentures. The advantage of using this method is reducing the burden of interest on debentures.

The objective behind such a purchase are:

- Immediate Cancellation

- Investment

- Redemption

Conversion into Fresh Shares or Debentures

The company do not have to raise funds for the redemption in this method. They offer the holders to convert their matured debentures into shares or debentures.

The holder must make this decision before the due redemption date within a specified period. The conversion process must happen without violating the provisions of the companies act.

The company issues the new shares and debentures at Par or Premium.

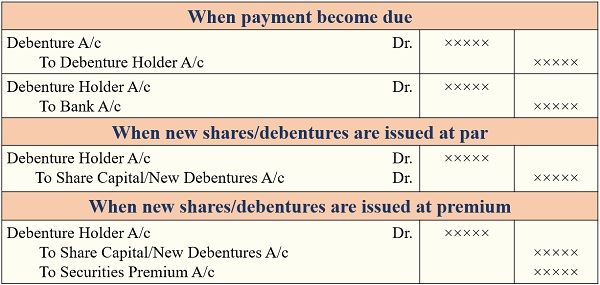

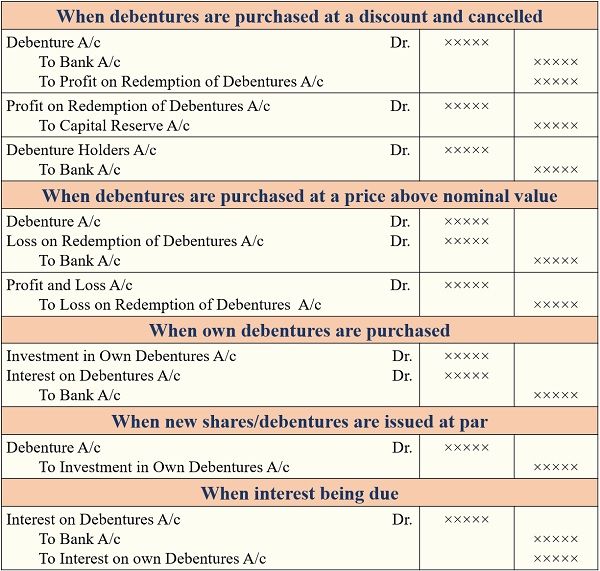

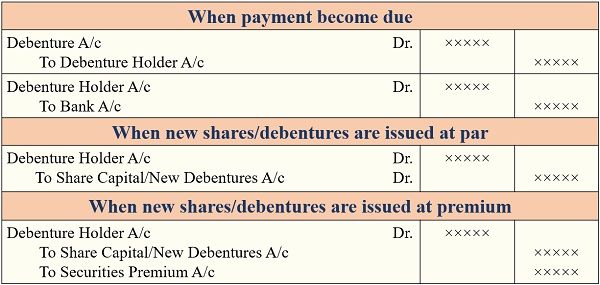

Journal Entries

Lumpsum Payment on Maturity

Payment in Instalments

Purchase in the Open Market

Conversion into Fresh Shares or Debentures

Debentures Redemption Reserve (DRR)

It is the reserve in which the company transfers some part of the profit while appropriating profits. The company will use these accumulated profits to redeem debentures.

We transfer the amount in DRR in the statement of Profit and Loss Appropriation A/c.

Section 71 of the Companies Act 2013 contains provisions about DRR.

Process of Issue and Redemption of Debentures

Step 1: Need for long-term funds

The company requires finances to operate its business smoothly. So, they need long-term funds to invest in the business for long-term growth.

Step 2: Funds generation by Issue of Debentures

The companies generate funds by issuing convertible and non-convertible debentures. After that, the company provides a Debenture Certificate to the holder.

The certificate contains all the information about the issue and redemption of debentures.

Step 3: Due date of payment

A debenture has a fixed expiry, i.e. it is issued for a specified number of years. At the expiry of this period, the company redeem debentures at the due date.

The due date of redemption is given in the debenture certificate issued to the holder.

Step 4: Sources of redemption

As per the requirement, the company analyzes the sources of redemption of debentures. That is, whether the company will use its internal finances or convert them into Shares/Debentures.

Step 5: Methods of redemption

It is the most crucial step in the redemption process. The company need to opt for such a method that does not impact the current financial health of the business.

There are four methods generally used for debenture redemption discussed above.

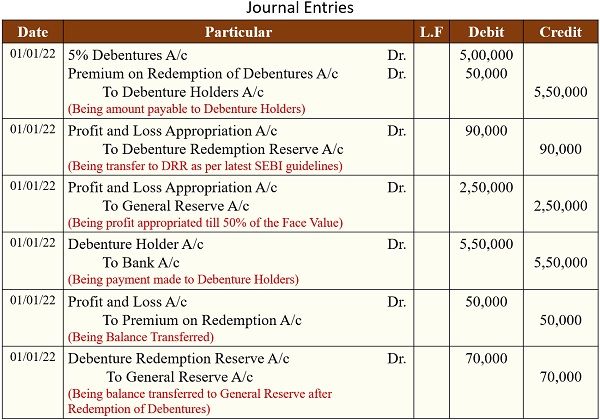

Example

ABX Ltd. issued 5% Debentures of Rs.500000/- in 2017. The due date for redeeming these debentures is 1st January 2022. The company opted to redeem the debentures out of profits.

ABX Ltd. gave a premium of 10% at redemption. Its DRR has a balance of Rs.1,60,000/-. Journalize the entries for the redemption of debentures in the books of ABX Ltd.

Final Words

Debentures are the source of long-term funds for the company. The money received must be returned to the holder after a certain period.

Redemption is the process of paying back the amount invested by the debenture holder. Thus, the company must select the sources and method of redemption very thoughtfully.

Payment to debenture holders involves a large amount of money. Therefore, the company must plan the redemption at its issue.

Leave a Reply