Definition: Company Auditor is an individual appointed for preparing an independent audit report of the company. They can be either appointed by the company’s Board of Directors, Shareholders, Central Government or Comptroller and Auditor General of India (C&AG) accordingly. An individual must have expert knowledge and a practising certificate from the Indian Institute of Chartered Accountants for becoming a company auditor.

It is mandatory for the companies to get their financial statements audited for every financial year for which Companies Act 2013, states all the provisions associate to company’s audit in Sec 139 to Sec 142, whereas; Sec 128 to Sec 132 reported the provisions linked with the accounts of the company.

Content: Company Auditor

- Qualification and Disqualification of Company Auditor

- Ways of Appointing Company Auditor

- Rights of Company Auditor

- Conclusion

Qualification and Disqualification of Company Auditor

Qualification and Disqualification of company auditor are regulated by the Companies Act, 2013 (Sec 141), and these provisions are pertinent for all kinds of appointments.

Qualifications

For becoming a company auditor one should have any one of the following qualifications:

1. Chartered Accountant

- According to Sec 141(1) of the Companies Act an individual holding a practising certificate of being a certified chartered accountant from the ICAI (Indian Institute of Chartered Accountancy) is qualified for being an auditor of a company.

- Chartered accountancy firm where all partners are practising in India is also qualified for being a company’s auditors. However, any partner of the firm acting on behalf of their firm can work as company auditor.

2. Confined State Auditor

The certificate holder issued by the law entitling him to act as a company’s auditor in India holds the right to become an auditor of a company.

Disqualifications

The following individuals are not qualified to become a company auditor:

- A Corporate Body as it has limited liability.

- Working employees or officers of the company.

- Partners of officers who are working in the company.

- Individual holding security of the company.

- A person disqualified by any subsidiary company from acting as a company auditor.

In case of a partnership firm, if any of the partners is disqualified because of any above reasons, the firm will also be disqualified from being appointed as company auditor.

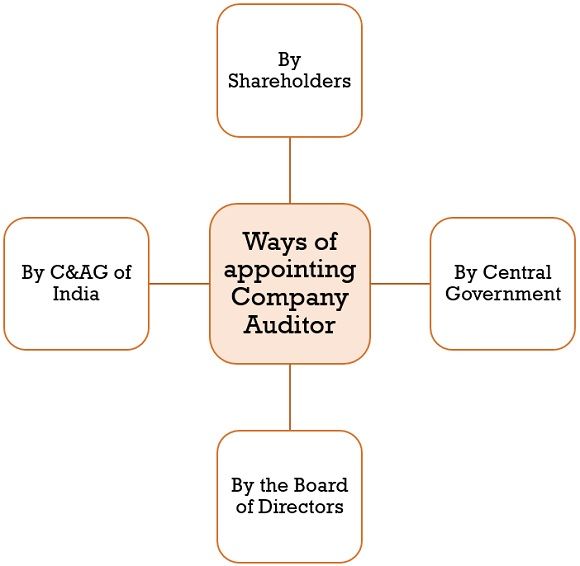

Ways of Appointing Company Auditor

The following are the ways of appointing the company auditor:

- Appointment by Shareholders

Regardless of the nature of the company, i.e., whether a company is public or private, it is obligatory for them to appoint a company auditor in every annual general meeting (AGM). The point which should be kept in mind here is that word “Every” is important as it is compulsory to pass a resolution at every annual general meeting to appoint a company auditor. i.e., the retired auditor will not be automatically re-appointed. The auditor appointed can carry on his rights till the next annual general meeting of the company. It is also applicable to foreign companies running their business in India.

The appointed auditor must get declared within the 7 days of the resolution passed by the company, and the auditor should send written acceptance or denial of the appointment within 30 days of receiving notice. If he accepts the offer, he will be a company’s auditor from the appointment date till the next annual general meeting of the company.

- Appointment by Central Government

For enabling the central government power, the company must inform the government in writing within 7 days of their annual general meeting, that no auditor has been appointed for the company. If the company and its officers fail to serve the notice, fine of ₹ 500 will impose on every officer of the company.

If the central government is authorized to appoint an auditor for the company, then the shareholders of the company have no right to appoint an auditor in their annual general meetings by passing a resolution. The auditor appointed by the central government will be the final auditor and cannot be questioned by the company and its officers.

- Appointment by the Board of Directors

Appointment of the first auditor of the company is made by its Board of Directors within 1 month from the date of the registration of the company by means of passing a resolution. After that the auditor appointed will remain company auditor till the appointment of next auditor in the first annual general meeting of the company. If the Board of Directors fails to nominate the auditor for the company, the shareholders can appoint an auditor in their general meeting (need not to wait for the annual general meeting, only for the first appointment of auditor).

In case of appointment of the first auditor, the company is not obliged to inform the auditor within 7 days. Neither the auditor requires to intimate the acceptance or refusal within 30 days, nor to take permission by the central government for the removal of the first auditor of the company.

- Appointment by Comptroller and Auditor General of India

The auditor for the government companies should be appointed by the Comptroller and Auditor General of India (C&AG). Here, the Government company implies any company in which the central government, State government or partially Central Government and State government holds more than 51 % of Share capital. It also includes subsidiary government companies.

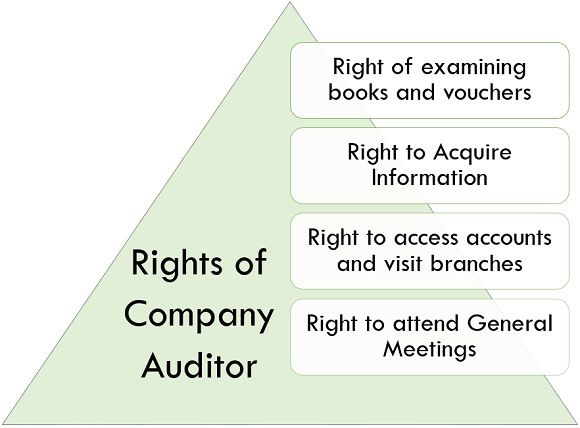

Rights of Company Auditor

The company auditor has the following rights:

1. Right of Examining Books and Vouchers

The auditor has a full right to ask for any document of business if required by him for performing his work. He can ask for all the documents of the head office or any other branch in the working hours of the company for verifying the vouchers to prepare his audit report. The company cannot refuse to present the asked documents by the company auditor.

2. Right to Acquire Information

The company auditor can ask for any information regarding company from the officers of the company to perform his duty accurately and precisely and if the proper information is not received the auditor has a right to report it to the members of the company.

3. Right to Access Accounts and Visit Branches

The company auditor has a right to visit the branches of the company and access their accounts if he feels to go through it for his report generation even if another auditor audits the accounts of branches. He has full right to access vouchers and books of accounts of the branches whenever required.

4. Right to attend General Meetings

The company auditor has a right to receive the notices regarding General Meetings of the company; although it’s not his duty to take part in the discussion, he can give clarification on any part where his consent is required as an auditor. However, he cannot outbreak responsibility of any omission in his report.

Conclusion

Company Auditor is an individual appointed to examine or verify the fiscal records of the company, he should have specialized knowledge in his field, and along with expertise, he should be honest, thoughtful, cautious and careful.

Leave a Reply