Definition: Long-term investing refers to the acquisition and holding of the assets for at least three years or more to generate wealth in the future. Long-term investing needs patience, strategy, foresightedness and commitment. It maximises the possibility of higher returns and minimises the risk and uncertainties.

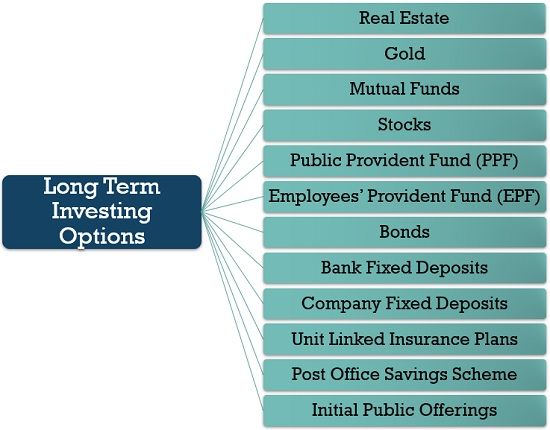

There are various options for long-term investing, like real estate, mutual funds, fixed deposits, provident funds, bonds, Unit Linked Insurance Plan (ULIP), post office deposits, initial public offerings and gold. These are explained in detail below:

Content: Long-Term Investing

Long-Term Investing Options

An individual needs to select out of multiple options available. One must consider the amount he/she is willing to invest, the level of risk he/she can bear and the return expected from the prospective investment.

The various alternatives available for long-term investments are discussed in detail below:

Real Estate

Buying of commercial property, residential house or agricultural land are all considered to be real estate investing. With inflation and increasing demand for land, the price of properties is rising remarkably.

Thus, real estate investments can lead to immense capital appreciation in the long-term.

Gold

Investing in gold ETFs, gold equity funds and gold mutual funds or buying of gold ornaments, jewellery, coins and bars provides safety against inflation by adding value over a long period.

However, investing in various gold funds is considered to be more beneficial than buying jewellery, coins or bars.

Mutual Funds

When many investors with a collective investment objective, pool in their funds regularly in small amounts through Systematic Investment Plans (SIP) for generating fair returns, such funds are known as mutual funds.

Investing in mutual funds is the ideal decision nowadays since it gives the most favourable returns in the long run. Creating a diversified portfolio with different types of mutual funds minimise the risk of market volatility.

Public Provident Fund (PPF)

Public Provident Fund (PPF) is one of the most secured government scheme. Since, it provides a fixed rate of return, a fund blocking period of 15 years, tax exemption benefits and the minimal risk involved.

It is best suitable for people belonging to high-income groups or non-salaried individuals.

Employees’ Provident Fund (EPF)

Employees’ Provident Fund (EPF) is the scheme where a percentage of employee’s salary is deducted and deposited by the employer to the employee’s EPF account. The same amount is contributed individually by the employer too.

Such funds accumulate to provide retirement benefits and tax-free interest on EPF account to the employees. It is mandatory in most of the companies to enrol employees under EPF.

Bonds

Bonds are long-term debt instruments. Here, the investor lends fund to large organisations like corporates, municipal corporation or national government for a specific period to generate variable or fixed interest.

Bonds ensure certainty of returns, although the rate of interest is quite low.

Bank Fixed Deposits

Depositing a sum with the bank for a long-term period is the simplest way of investment. However, it does not yield fair returns, since the rate of return is just higher than that of a savings account but not too high to beat the inflation.

Such deposits are governed by the Reserve Bank of India (RBI).

Company Fixed Deposits

Many companies raise funds from the public through fixed deposits. The manufacturing companies’ fixed deposits are regulated by the Company Law Board, whereas fixed deposits by Non-Banking Financial Companies (NBFC) are governed by the Reserve Bank of India (RBI).

The company fixed deposits has a better interest rate as compared to bank fixed deposits.

Unit Linked Insurance Plans (ULIP)

ULIP is a dual beneficiary plan, comprising of investment and insurance. The premium paid is partially contributed to providing life insurance coverage to the investor, and the rest is pooled in the equity or debt funds personally selected by the investor.

A ULIP premium can be paid monthly or annually, and the minimum term period is five years. Some ULIP investments are even better than mutual fund investments concerning charges and commissions involved.

Post Office Savings Scheme

A Post Office Savings scheme is similar to the savings bank account. However, it facilitates the investor to open a savings account with the investment value as low as 20/-; the rate of interest is also low.

It also provides the facility of ATM, transfer of funds from one post office to another and opening a joint account.

Initial Public Offerings

Initial Public Offering (IPO) is the first initiative of the company owners to invite shareholders for investing in their company. Afterwards, the company will be considered as a public company, and issuing of IPOs is also termed as ‘going public’.

It sometimes proves to be an excellent opportunity to avail impressive returns from IPOs.

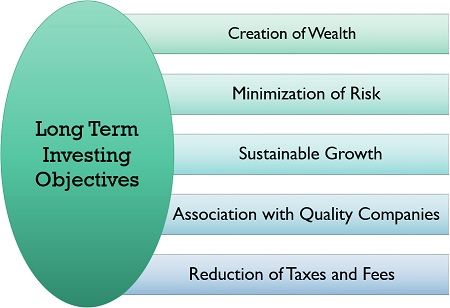

Long-Term Investing Objectives

To achieve financial goals, it is essential that an individual understands the need for long-term investing. For this purpose, the long-term investing objectives are elaborated below:

- Creation of Wealth: Holding up assets or stocks for a long-term period or till maturity gives incredible returns and adds value to the investment.

- Minimization of Risk: Holding up investments for an extended period eliminates the risk emerging from the unfavourable market conditions, like a recession.

- Sustainable Growth: Long-term investing is an excellent option for the sustainable growth of funds or assets since it ensures better and stable returns.

- Association with Quality Companies: Long-term investing in equity and funds of big brands or well-known companies provides the investor with a share in the ownership. Thus, the investor gets a chance to be associated with the growth and success of that company.

- Reduction of Taxes and Fees: Many long-term investments come with a tax exemption plan. If the frequency of investments is low, the processing fees of that investment automatically reduce.

Long-Term Investing Strategies

Any investment without a strategy is of no use and can prove to be a blunder. Thus, to fulfil the investment goals and objectives, it is necessary to frame a plan of action.

Read further to understand the long-term investing strategies, one can follow.

- Understand the Business Insides: Going through the company’s past, present and future, it’s vision, mission and objectives before investing in it, makes the investor aware of the risk involved and potential returns.

- Review the Company’s Balance Sheet: To analyse the company’s financial health and stability, it is essential to study the balance sheet of the company.

- Envision Company’s Profit and Growth: The investor must focus on the company’s previous years’ performance to determine its net present value, future profitability and growth possibilities.

- Analyse Company’s Adaptability to Technology: The investor must find out whether the company is adapting to the new evolving technology or it is still following the conventional ways. The success of a company majorly depends on its adaptability to new technology with time.

- Focus on Company’s Next Three Years: Forecasting the company’s performance for the next 15 or 20 years is in vain. Thus an investor must keep an eye on the company’s vision for the succeeding three years.

- Competitors’ Analysis: Competitors can turn the game around if they can capture the company’s possible market share. Hence, it is essential to find out the competitors’ potential.

- Evaluate Company’s Competitive Moat: Company’s SWOT (Strengths, Weaknesses, Opportunities and Threats) Analysis is equally essential to determine the ability of the company to fight off the competition in the long run.

Long-Term Investing – Do’s

- Plan your emergency funds first to ensure uninterrupted long-term investments.

- Be clear about your investment goals and plan for your retirement goals.

- Be patient and hold the investments until maturity.

- Check your asset allocation once a year and rebalance your portfolio if necessary.

Long-Term Investing – Don’ts

- Don’t invest all your capital in one kind of asset (diversify your money) to avoid the risk of loss or low returns.

- Don’t be afraid of buying the dips if the asset has performed considerably well in the past.

- Don’t try to time the market by buying and selling stocks to earn a margin, because it is risky and may lead to a loss.

Conclusion

It is said that ‘slow and steady wins the race’, so goes for long-term investing. With a properly planned investment strategy, well diversification of funds and patience to hold the investment for a long-term period, an investor can generate tremendous wealth.

Leave a Reply