Definition: A target-date fund (TDF) is a long-term investment plan comprising of equity, bonds and various other fixed-income securities, where this asset allocation rebalance with the declining risk-taking capacity of the investor while moving towards the target date.

These investment plans are also termed as lifecycle funds since it keeps on rebalancing while heading towards maturity.

A target date is a future date when the investor would need to encash the funds for the specified purpose (say for retirement). Or, more particularly, it is the fund’s maturity year, as specified by the investor at the time of investing.

Content: Target-Date Fund (TDF)

Asset Allocation for Target-Date Funds

As we know that a target-date fund is a long term investment; therefore, the investors’ priorities change with time.

TDFs focus on the retirement goals of the investor by rebalancing the portfolio periodically. In simple terms, the aim is to make high profits initially and stable income in the later years.

Let us now discuss the different portfolios designed under TDF for suitable asset allocation:

- Growth Portfolio: The growth portfolio of target-date funds, the investments include more of stocks and less of bonds, to make high gains.

- Balanced Portfolio: In this portfolio, the stocks and bonds are blended almost equally, to balance the portfolio for risk and returns.

- Income Portfolio: The income portfolio is adjusted to generate stable returns with low risk by including more of bonds and MBS (mortgage-backed securities); but less of stocks.

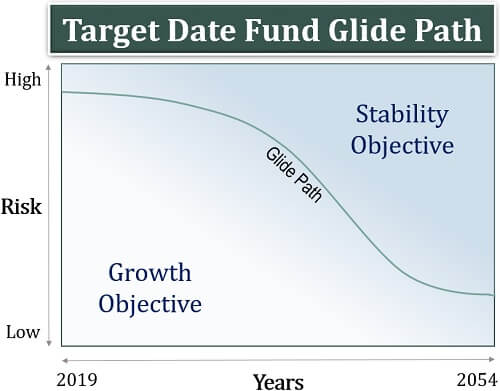

Target-Date Fund (TDF) Glide Path

The target-date fund glide path simplifies the understanding of how assets are allocated and reallocated in TDFs.

It shows the relationship between the risk and maturity period of the TDF. Let us now first have a look over the following TDF glide path:

In the above graph, we can make out that in the initial years (i.e., from the year 2019), the primary aim was the growth of funds. Therefore, the risk-taking capacity was also high during this period.

However, as the TDF moves towards maturity (i.e., to the year 2054), the objective gradually converted into attaining stability, rather than growth. Here, the portfolio was rebalanced to involve low risk.

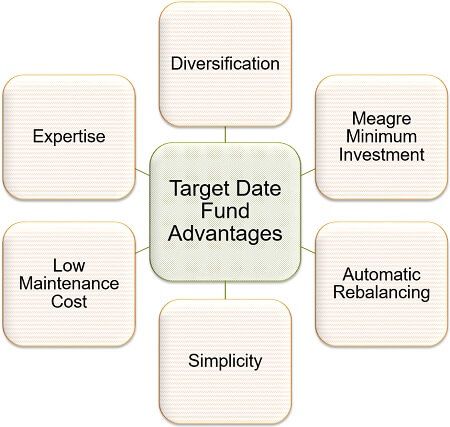

Target-Date Fund Advantages

We have already seen that the target-date fund is a prudent long-term investment option for the people who have secured earnings.

Let us now discuss its various pros in detail below:

- Diversification: The target-date fund portfolio has a great mix of varying kind of assets, thus eliminating the need for making an alternative investment.

- Meagre Minimum Investment: Even a person with low income (but stable earnings) can go for it since the minimum investment value is fairly low.

- Automatic Rebalancing: The investment portfolio comprising of target-date funds gets automatically adjusted for decreasing the risk involved.

- Simplicity: The fund managers facilitate the selection of a suitable portfolio by using an asset allocation formula as per the retirement year. The investor only needs to determine the year of his or her retirement.

- Low Maintenance Cost: Mostly, these funds are planned to suit the needs of all the investors unanimously; therefore, it does not involve much maintenance or customization cost.

- Expertise: The experts wisely design the target-date funds portfolio to provide optimum long-term gain to the investor.

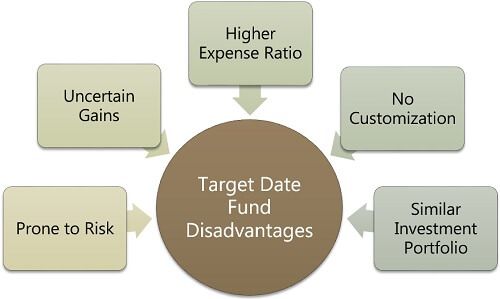

Target-Date Fund Disadvantages

On the contrary to all the positive aspects, some experts believe that target-date fund is not a wise investment idea.

Let us now understand some of its prominent drawbacks:

- Prone to Risk: Diminishing risk doesn’t mean that target-date funds are risk-free. These funds are usually exposed to uncertainties and fluctuations.

- Uncertain Gains: The income, in the long run, is quite uncertain due to frequent rebalancing of the portfolio.

- Higher Expense Ratio: Many target-date funds imply fund management charges along with the mutual fund fees, ultimately increasing the expense ratio.

- No Customization: These funds are universal for the investors retiring in the same year; therefore, the investor could not avail the facility of customization.

- Similar Investment Portfolio: A target-date fund becomes ineffective at times when it is not appropriately diversified and comprises of the investments belonging to a similar category or class.

Target-Date Funds Smartly Manage Inflation

Any long term investment will be worthless if it fails to cope up with rising price levels or inflation.

TDFs keep a check over inflation in the following two ways:

- By investing in high risk-high return stocks in the initial years, the investment value is appreciated to the extent that it crosses the rate of inflation.

- Also, if the investors opt for the TDFs comprising of real asset investments, get secured against inflation in the long run.

Tips to Self-manage Target-Date Funds Portfolio

When the investors actively manage their portfolio, the following suggestions should be kept in mind to derive the maximum benefit out of their asset allocation:

- Be aware of all kinds of underlying fees or charges involved in a target-date fund to yield maximum gain on maturity.

- Always keep in mind your investment objective; whether it is profit maximization, risk minimization or a balance of both.

- Don’t forget to adjust your portfolio for risk management as you move closer to the maturity date.

- Appropriately analyze the risk associated with different investments included in your portfolio to play safe.

- The more you diversify, the safer you are. Keeping this in mind, try to blend different kinds of stocks and bonds in your asset allocation.

- Choosing your correct retirement year or target-date is crucial since it would determine your asset allocation and gain on maturity.

- Be careful since a target-date fund is prone to automatic enrollment for some investments which may not be that beneficial to the investor.

Target-Date Fund (TDF) Example

MFS Lifetime Income Fund (MLLAX) is a target-date retirement fund which aims at providing a steady post-retirement income to the investors. Lifetime 2050 is one out of the MLLAX series.

The fund invests in nineteen different stocks and bonds managed by MFS. Each of these underlying investment has a distinct objective and market standing, making the portfolio well-diversified.

It generated the return of almost 6.25% in the previous years and 4.55% in the recent three years period. Also, the expense ratio is quite favourable, being 0.23%.

The biggest drawback of this plan is that it doesn’t guarantee a stable income. This is because it is volatile towards price fluctuation of securities and market uncertainties.

Leave a Reply