Definition: A monthly income plan (MIP) is a debt-oriented hybrid mutual fund scheme generating monthly returns in the form of a dividend, by investing more than 60-80% of the amount in debts and the remaining amount in equity, cash or money market.

These funds reduce the level of risk on the one hand by investing majorly in debts and increases the possibilities of high returns by investing in the equity, as compared to pure debt funds or fixed deposits.

Content: Monthly Income Plan (MIP)

- Example

- Features

- Options

- Advantages

- Disadvantages

- Taxation

- Who should Invest in Monthly Income Plans?

Example

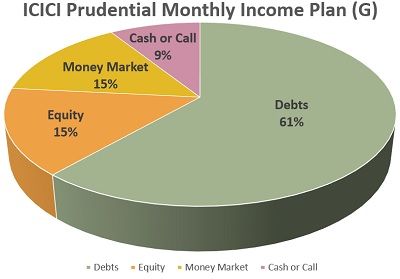

ICICI Prudential Monthly Income Plan (G) generates a regular income for the investors, and it is an open-ended income fund. The investors can earn up to 7.6% return in three years and 9.1% return in five years period.

The asset allocation of this MIP as on April 30, 2018, is as follows:

- 61.41% in Debts;

- 15.19% in Equity;

- 14.44% in Money Market;

- 8.94% in Cash or Call

The plan has no entry load; however, the exit load is 1% if the fund is withdrawn within one year from the date of its allotment.

Note: W.e.f May 28, 2018, the ICICI Prudential Monthly Income Plan (MIP) and ICICI Prudential MIP 25 have been merged to form ICICI Prudential Regular Savings Fund.

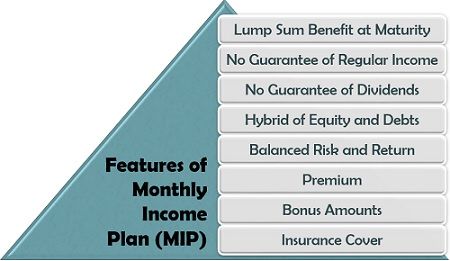

Features of Monthly Income Plan (MIP)

A monthly income plan is a hybrid of the debt and equity funds, holding some properties of both. To know more about the various characteristics of the MIPs, read below:

Lump-Sum Benefit at Maturity: With the completion of the policy period, the investor can demand lumpsum return at his or her convenience.

No Guarantee of Regular Income: These funds do not ensure a regular monthly, quarterly, bi-annual or yearly dividends to the investors. The income generated from these funds is dependant on their performance.

No Guarantee of Dividends: The MIPs are supposed to pay dividends only when they have a distributable surplus, according to the existing guidelines. No company is liable to pay dividends from its capital.

Hybrid of Equity and Debts: A MIP is a combination of both, the debts amounting to 60-80% of the total funds available and the remaining funds in the equity, other money market instruments and cash

Balanced Risk and Return: The risk of loss or uncertainty is minimized as these funds invest majorly in the debt funds. Also, the return is quite high when compared to the gains of the pure debt funds, due to some proportion invested in the equity.

Premium: A MIP includes the premium amount which the insured investor is liable to pay monthly, quarterly, bi-annually or annually to its insurance career or the company.

Bonus Amounts: The bonus is usually declared at the end of the policy after the last instalment is paid. The reversionary bonus is paid either by paying it personally, i.e. simple reversionary bonus or by adding the amount to the sum assured, i.e. compound reversionary bonus.

The interim bonus is paid on maturity of the MIP or death of the policyholder. The terminal bonus is paid by an insurance career as a recognition for the timely and regular payment of the premium.

Insurance Cover: All the MIPs of LIC and other insurance companies provide insurance cover to the investor and also declares bonus on completion of the policy.

Monthly Income Plan (MIP) Options

A monthly income plan can be selected as per the dividend it yields and the pattern of income withdrawal. It can be thus bifurcated into the following two types:

Dividend Based Monthly Investment Plan: A dividend MIP option ensures payment of dividends (monthly, quarterly, bi-annually or annually) to the investors as income.

This dividend is tax-free at the investor’s end. However, a dividend distribution tax is pre-collected by the government from the companies which are ultimately paid from the distributable dividend.

Growth Based Monthly Income Plan: A growth MIP option has the power of compounding, i.e. the income earned on the funds is added up to the fund value, and the investor can make returns on this compounded value in future.

In short, the profits earned on these funds will generate further returns. The fund can be redeemed all at once in future.

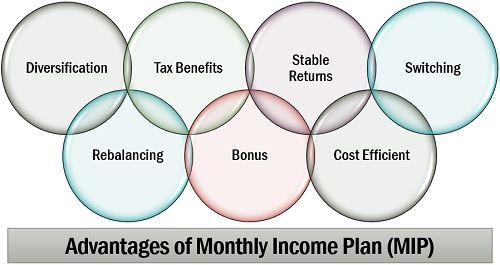

Advantages of Monthly Income Plan (MIP)

A monthly investment plan is always a better option than investing in a vanilla equity fund or pure debt fund. Why is it so? It is because of MIP’s potential of generating a better return than pure debt funds and low risk as compared to the plain equity funds.

Let us now discuss the various benefits of opting monthly income plans:

- Diversification: Since the asset allocation of a MIP is in debts and equity both, the portfolio has a variety of investment instruments.

- Rebalancing: The fund manager can rebalance the ratio of equity and debts by buying and selling these stocks to maximize gains and minimize losses.

- Tax Benefits: The short term gains are only taxable under the income tax by adding the MIP income to the regular income of the investor which is an added advantage. However, the long term gains from MIPs are taxable @10% without indexation or 20% with indexation, whichever is lower.

- Bonus: The investor enjoys various bonus at the end of the policy period like the reversionary, interim and terminal bonus.

- Stable Returns: The rebalancing and switching of the assets, help the fund managers to create a stable portfolio yielding favourable returns.

- Cost Efficient: Most of the MIPs don’t have any entry load or charges, and even many of them do not charge any exit fee if the fund is withdrawn after one year of its allotment date.

- Switching: Switching the funds from equity to debts and debts to equity depending upon the market fluctuations makes keeps the MIP returns high in all situations.

Disadvantages of Monthly Income Plan (MIP)

When we talk about monthly income plans, the image of a secured investment with guaranteed returns appears in our minds. But this is not the reality. MIPs have never been risk-free investment option. The following are the drawbacks and limitations of MIPs:

- Misleading by Agents: Sometimes the agent promotes the MIPs as “safe investment option” or “risk-free product” seeking for a high commission from the investors. However, MIPs too involve risk and uncertainty which the investor must beware.

- Involves Risk: No investment scheme is risk-free. The level of risk involved in the MIPs depends upon the proportion of equity involved.

- Irregular Income: The return on MIPs is ultimately dependant on the market volatility, and therefore the income is not guaranteed.

- Lack of Liquidity: MIPs yield the desired returns only if they are done with a long term perspective, i.e. for three years or more. Withdrawing the funds in the short term leads to reduced yields and exit load.

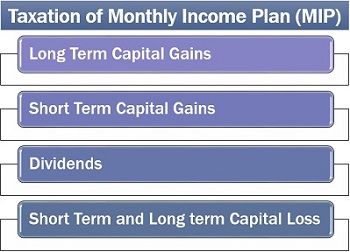

Taxation of Monthly Income Plan (MIP)

Monthly income plans are never tax-free. They are taxable under different heads at varying rates depending upon the period of investment or policy. Let us now go through the taxation of the MIPs under different situations:

- Long Term Capital Gains: The income from MIPs in the long term which is one year from the date of allotment is taxable @ 10% without indexation or 20% with indexation, whichever is lower.

- Short Term Capital Gains: If the investor withdraws the fund invested in a short term period, say within a year, such gains are added to his/her income and is taxable under the income tax.

- Dividends: The dividends received by the investor is tax-free. However, the companies have to pay a dividend distribution tax to the government.

- Short Term and Long term Capital Loss: In case of any loss in MIPs, it can be set off by the investor against the capital gain of that particular year and also of the next eight years for tax saving purpose.

Who should Invest in Monthly Income Plans?

The investors who are highly risk-averse but looking for favourable returns can opt for MIPs. Even the ones who are in search of a regular passive income can invest in MIPs.

People who own a lumpsum amount and looking forward to investing this sum for the medium or long term period to earn a reasonable return at low risk can go for the MIPs.

The investors belonging to the high-income group can invest in the MIPs for the long term with the aim of saving income tax.

Leave a Reply