Definition: Hedge funds are the pooled sum gathered from the accredited investors to be invested strategically and managed aggressively to earn high returns and mitigate chances of loss. These are not regulated by any securities market regulators and therefore hold high risk and are more volatile.

Example; An iron producer may face loss if he relies only on the cash market since the market price at the time of selling is uncertain. Therefore, to protect itself from this loss, the company can hedge his position. It can fix the desired price in advance to sell the commodity in the future market.

If the actual market price of iron goes up in comparison to the desired price at the selling time, the producer can sell it in the cash market.

If the actual market price falls, then the company can safeguard its position by selling the iron in the future market at the decided price.

Content: Hedge Funds

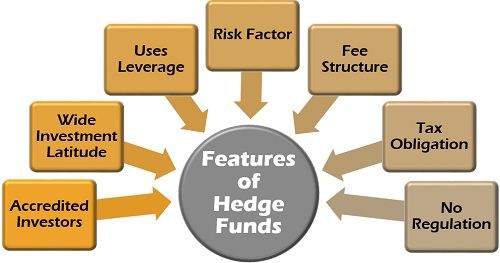

Features of Hedge Funds

Hedge funds are sometimes misunderstood as mutual funds. But they are very different from the latter.

To know more, let us understand what hedge funds are, with the help of the following characteristics:

- Accredited Investors: An ordinary investor cannot invest in hedge funds. Only qualified or accredited investors like banks, insurance companies and even high net worth individuals are allowed to invest in such funds.

- Wide Investment Latitude: The hedge funds cover almost all kinds of asset classes, including stocks, bonds, real estate, currencies, equities, derivatives, etc.

- Uses Leverage: The funds which are invested as hedge funds are usually the borrowed sum in the hands of the fund manager.

- Risk Factor: Some of the hedge funds are exposed to a high risk which may lead to huge losses. The lock-in period is comparatively very high regarding other investment options.

- Fee Structure: The fees of hedge fund managers are ‘Two and Twenty’, i.e. 2% is the fixed fees, whereas the manager takes 20% on the profit earned. This fee structure is quite high as compared to other investment options.

- Tax Obligation: The hedge fund is not exempted from tax and is taxable on the grounds of the level of investment. This tax will not be borne by the unitholders.

- No Regulation: These funds are not registered and do not lie under the regulation of the securities market regulators.

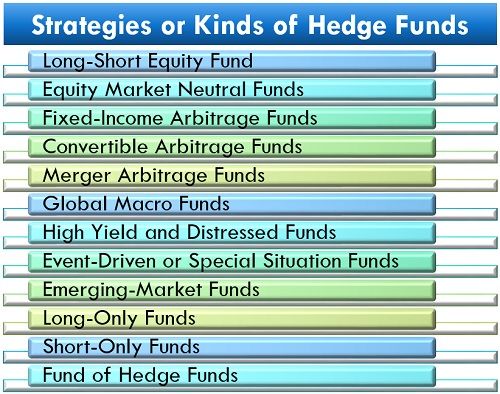

Strategies or Kinds of Hedge Funds

Almost all financial assets can be traded under hedge funds. Hedge funds can be classified into the following different types:

Long-Short Equity Fund: The fund manager buys and holds the stocks which he expects to perform well in future. He also short sell the shares which are assumed to achieve less than the expectations. Thus, he deals in both types of equity funds to reduce the risk.

Equity Market Neutral Funds: These type of hedge funds perform independently of the market volatility. They are similar to the long-short funds. Equity market neutral funds adopt strategies like using the borrowed money for high returns and hedging the portfolio through derivatives.

Fixed-Income Arbitrage Funds: These funds benefit from the price variation between the two stocks in a fixed income market like different bonds or credit default swaps. It has a high chance of making a small gain. It also involves the risk of a substantial one-time loss.

Convertible Arbitrage Funds: The fund manager deals in the stocks of a particular company; i.e., buy its convertible securities (usually convertible bonds which can be transformed into common shares) and short sell the company’s common stocks.

Merger Arbitrage Funds: The merger arbitrage is the buying and selling of stocks together, of those companies which are merging into a new company or one company acquiring the other. The arbitrageur purchases the shares before merger or acquisition and sells them after the deal is done to make a profit.

Global Macro Funds: These are usually highly leveraged funds and uses derivatives to make benefit out of global opportunities like fluctuation in the interest rate or change in government and economic policies.

High Yield and Distressed Funds: These funds as the name suggest, invest in the companies which are facing downfall, bankruptcy, restructuring, etc. intending to get high returns. These funds are available at steep discounts and have the potential of making good profits in future.

Event-Driven or Special Situation Funds: This investment is made by mere interpretation of the events that may occur and create an impact on the market value of the stocks. It includes natural calamity, corporate events, political development, etc.

Emerging-Market Funds: The fund manager invests in the stocks of the emerging market, i.e. the markets of the developing countries. These markets are highly volatile with a considerable amount of risk involved though the profit margin of these funds is also high.

Long-Only Funds: Similar to the mutual funds, the investment is made for a long term in the securities. The significant risk is the bear market which tends to fall by bringing down all the sectors at once.

Short-Only Funds: It deals in short selling of the securities in a bear market. The bearish bets are made while investing in short-only and bearish holdings are targeted through short-biased funds.

Fund of Hedge Funds: This type of investment involves creating a portfolio of various kind of hedge funds managed by different fund managers to diversify the assets with the aim of reducing the risk and maximising the returns.

Reasons to Invest in Hedge Funds

Why should an accredited investor go for hedge funds? To get the answer to these questions, we must know the following benefits of hedge funds:

- Absolute Return: The companies seek hedge funds to ensure a positive return even under unfavourable market conditions.

- Down Turn Protection: By investing in the hedge funds, the investor tries to minimize the risk of loss in a declining market by holding the asset for a long or short position as favourable.

- Active Fund Management: The fund manager aims at active management of funds by making use of unfavourable market conditions, market inefficiencies and situational opportunities; to increase return on investment.

- Diversification: The investor can benefit from diversifying his portfolio with the help of hedging. The return from the hedge funds is usually higher than the other investment options.

Who is a Hedger?

Hedger is the person who owns an asset, commodity or financial instrument which holds risk from price fluctuations and to protect himself from the loss; he safeguards his position.

Leave a Reply