Definition: Accounting Principles are the rules and regulations of the accounting language accepted worldwide and are made to make the language understandable for all and ensures the accounting records reliability. Accounting principles should be followed to maintain the resemblance of the records.

So that the records should reveal the same information to everyone using the records to avoid the difficulties and confusions arising due to variation of patterns followed by every individual.

As if rules are not set up, every individual will perform transactions according to their way, and it becomes impossible to compare such records and measure the reliability of the accounting statement.

Thus, it is always advisable to the accountants to follow accounting principles while making the books of accounts of the business.

Content: Accounting Principles

Generally Accepted Accounting Principles

The rules derived from the experience and accepted universally becomes the principles when proved beneficial and such principles are known as “Generally Accepted Accounting Principles” or “GAAP”. It consists of accounting principles along with the methods of exercising such principles.

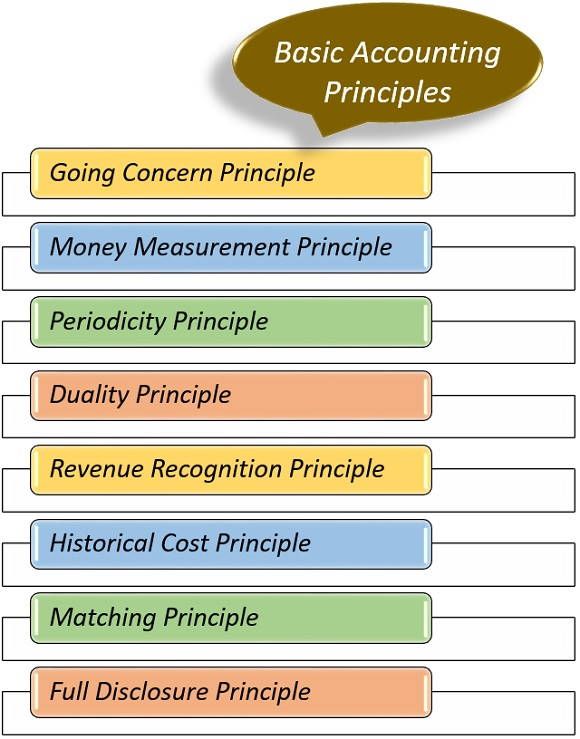

Basic Accounting Principles

For developing accounting techniques, few rules are required essentially to regulate such techniques, and such rules are the basic accounting principles, navigating the style of recording and reporting of transactions.

The following are some of the basic principles of accounting:

1. Going Concern Principle

Going Concern Principle is based on the assumption that the business will go on irrespective of its owner’s life. It is assumed that the business will not end up in near foreseeable future. This principle plays a role of basic accounting assumption for preparation of the financial statement of the company.

2. Money Measurement Principle

This principle underlines the fact that transactions occurring during the year should have a monetary value to record them in the financial statement. Else, they cannot be recorded such as skill level of the employees and product durability cannot be recorded.

However, these factors have a significant impact on the growth of the financial position, but they are not allowed to be stated in the financial records.

3. Periodicity Principle

This principle is based on the particular time-period concept, i.e., accounting has to be done for a definite period. In general, the profit/loss of the business is computed on the basis of the accounting year, i.e., (From 1st April to 31st March) and computed every year. So, the profit/loss can be compared every year from the previous year.

This will help in recognizing the loops of the business and the reasons behind losses on the basis of which necessary measures can be adopted to avoid such losses in the subsequent years of business.

4. Duality Principle

Duality Principle of accounting is based on the dual facets of the entries made in the records, the example of this principle is the double-entry system of accounting in which every entry has a dual effect, i.e., “Debit” and “Credit”. If any entry gets debited, it will get credited too.

According to this principle, both the parties involved in the transaction will have a dual impact of a particular transaction.

For example:

In case of Cash Transaction

The dual impact on the selling party would be

- Receipt of Cash.

- Foregoing of Goods.

Similarly, the dual impact on the purchasing party would be

- Payment of Cash.

- Receipt of Goods.

In Case of Credit Transaction

The dual impact on the selling party would be

- Acquisition of Right to Recover.

- Foregoing of Goods.

Similarly, the dual impact on the purchasing party would be

- Assumption of Obligation to Pay

- Receipt of Goods.

5. Revenue Recognition Principle

Revenue Recognition Principle by its name only defines that it is related to the ‘recognized revenue’ of a company. Here, revenue is a gross inflow of cash from the business activities, done throughout the year by the sale of goods, providing services, etc.

In the case of the agency relationship, the commission amount is considered as revenue income.

However, the revenue gets recognised in the earning year financial statement, whether it has been received or not.

6. Historical Cost Principle

Historical Cost Principle is based on the acquisition cost recorded in the books of accounts, i.e., the cost paid to acquire the asset will be recorded in the books of accounts, and that cost will become a base for further accounting of such asset.

Suppose, no amount has been paid for buying an asset such as a company’s reputation. In that case, however, it is a valuable asset for a company, but it will not get recorded as no amount has been paid to acquire such an asset.

Another example of Historical Cost principle is, suppose the land was purchased for 20,00,000 in 2015, now the value of that land has increased to 50,00,000 in 2020. The land is already recorded in the records for 20,00,000 and will be recorded on the same untill it has been realized. Its value will not increase in the books of accounts.

7. Matching Principle

According to this principle, the expenses and revenue should be matched for the current accounting year, i.e., if the revenue has recognised, cost of goods sold should also be charged in the same accounting period irrespective of the cash being received or not.

Matching principle works on an accrual basis; thus, focuses on the occurrence of the event and not on the receipt of the payment.

For Example, Income of X is 2,00,000 for the accounting year 2019 and has only one expense, i.e., rent of 80,000 annually. But this year, i.e., in 2019 house owner wants a rent in advance for next year, i.e., 2020.

Thus, X paid 1,60,000 in 2019 only, but X will record only 80,000 in 2019 in his books, and the remaining will be recorded in the books of the year 2020 for which it is accounted for.

8. Full Disclosure Principle

Full Disclosure Principle specifies that there should not be any omission while preparing books of accounts. This means 100% income and expenses of a particular accounting year must get recorded in that year accounts only, to show the true and fair value.

If anything gets omitted or not shown it should be mentioned, for example, only 90% sales have been recorded, but it is irrelevant to disclose partial transactions, as it will not fulfil the objectives of preparing accounts if they will not show a correct or exact profit/loss for the year.

If full disclosures were not made in the books of accounts, financial position and performance of the business would not get disclosed fairly.

Conclusion

Accounting principles are the common principles set up to maintain the similarity amidst the statement of accounts. It conveys the same meaning to every individual using such statement of accounts and fulfil the reason of preparing accounts.

In other words, it is a set of rules defining some concepts to be followed by the business to maintain the consistency of the records.

Leave a Reply