Definition: Multinational Capital Budgeting (MCB) is the decision-making process wherein financial managers evaluate long-term projects based on foreign lands worthy of investment.

Multinational companies (MNCs) aspire to invest outside their geographical boundaries. This is because they want to make the best use of their valuable resources.

If we split the keyphrase, we get two terms – ‘Multinational‘ and ‘Capital Budgeting‘. Here, the term ‘Multinational’ refer to Multinational Corporations.

Multinational corporations have their parent company in one country and operate subsidiary companies in other countries around the world.

Whereas, Capital Budgeting is planning long-term capital investments.

Thus, Multinational co-operations evaluate international projects using capital budgeting.

The parent companies can invest in capital assets or projects in foreign countries. In addition, they can set up their production units in economic locations.

MNCs are concerned about the potential cash inflow and outflow generated from investments. MCB helps them in finding the most profitable investment among various options.

For evaluation, the managers make use of capital budgeting techniques. Also, it includes the estimation of Annual Cash Flows and Salvage Value.

Post evaluation, the positive cash flow signifies that the project is acceptable. Whereas, a negative cash flow depicts the project’s inability to generate enough funds.

MCB process is critical as it involves the financial evaluation of the proposed investment projects. And, the generated net cash flow of parent and subsidiary companies varies.

Content: Multinational Capital Budgeting

Objective

The objective behind any investment is to earn maximum return on investments.

MNCs invest in projects in different countries to earn lucrative returns. In addition, it focuses on maximizing its shareholder’s wealth and finding profitable projects.

Consequently, it allocates resources like capital and management skills to the subsidiary company.

Factors affecting Multinational Capital Budgeting

Following are the major factors that affect multinational capital budgeting:

- Exchange Rate Fluctuations

- Inflation

- Financial Arrangement

- Blocked Funds

- Uncertain salvage value

- Present Cash flow

- Host Government Incentives

- Real Options

Importance

It is essential to perform capital budgeting before investing in long-term foreign projects. This is because the capital investment is huge, and the decision is not easily reversible.

There are several risks attached to international projects:

- Political Risks

- Economical Risks

- Financial Risks

- Market Risks

However, financial managers can adjust these risks with the help of Sensitivity Analysis.

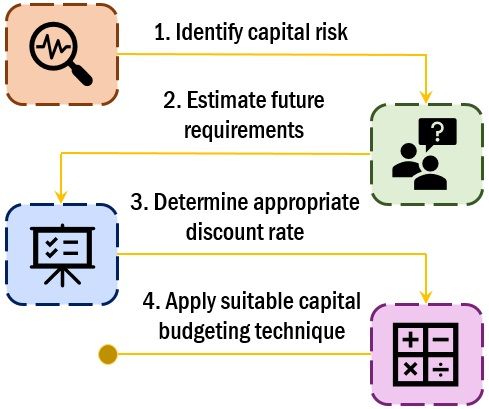

Steps

The process of multinational capital budgeting is similar to that of capital budgeting. However, the capital budgeting process for international companies is complex compared to home countries.

The steps involved in the process are as follows:

Step: 1 Identify the capital risk

Find out the amount of initial capital invested in the project.

Step: 2 Estimate the future cash flows

Compute the expected cash flow generated by the project in the future.

Step: 3 Determine the appropriate discount rate

Identify the discounting rate that will help estimate the present value of future cash flows.

Step: 4 Apply suitable capital budgeting techniques & decision criteria

Evaluate the projects using appropriate capital budgeting techniques like NPV and IRR. Post-evaluation decide – whether to accept or reject the project.

Inputs for Multinational Capital Budgeting

The financial manager has to make forecasts about the components given below. These components are the input for the multinational capital budgeting process.

- Initial Investment: It is the amount to be invested in the potential project. Besides, the financial manager must consider the additional funds required until sufficient cash inflow is generated.

- Price and Consumer Demand: The projections about the product price and expected lifetime of the project are required. For this purpose, managers can analyze the competitive products in the market. In addition, forecasts about current and future consumer demand are also essential.

- Cost: Cost is the most important aspect that needs to be projected. In order to make accurate projections, the future inflation of the host country is considered.

- Tax Laws: The tax laws of the parent and host country vary. Therefore, it is vital to acknowledge the prevailing tax policies beforehand.

- Remitted Funds: Finance managers also learn and foresee the norms regarding remittance. Moreover, they assess future changes in the norms as it affects the parent company’s net cash flows. The norms may change due to economic reasons.

- Exchange Rates: The fluctuations in the exchange rate impact multinational projects. But, making forecasts about these rates is quite challenging.

- Salvage/Liquidation Value: It is hard to assess the liquidation value of multinational projects during capital budgeting. The lifetime of the projects varies and depends on a variety of factors.

- Required Rate of Return: Based on the projected cash flow of the proposed project, estimate the required rate of return.

Techniques of MCB

The decision is based on the acceptance and rejection criteria. The methods consider the discounted cash flow at an appropriate discounted rate.

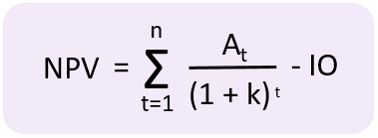

Net Present Value (NPV)

It is the variance between the present cash outflows and the present value of expected future cash inflows.

Formula:

Where,

At represents cash inflow

k is the required rate of return

IO is the initial cash outlay

n depicts the project’s expected life

Decision Criterion

Accept: When the Net Present Value is greater than zero. It depicts the positive cash flows.

Reject: When the Net Present Value is less than zero. It depicts the negative cash flows.

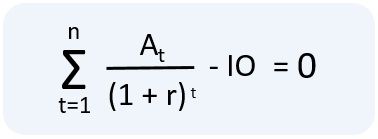

Internal Rate of Return (IRR)

It is the discount rate at which the present value of the expected after-tax cash inflow equals the present value of the after-tax outflows.

It is the discount rate that sets the NPV equal to zero.

Formula:

Decision Criterion

Accept: When IRR is greater than the Required Rate of Return.

Reject: When IRR is less than the Required Rate of Return.

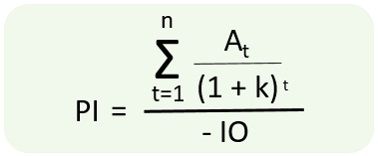

Profitability Index (Cost-Benefit Analysis)

It is the ratio between the present value of the future cash flows and the initial outlay.

Formula:

Decision Criterion

Accept: When the profitability index is greater than 1.

Reject: When the profitability index is less than 1.

Difficulties in MCB

Some difficulties faced by multinational corporations during capital budgeting are as follows:

- Administrative Environment

The taxation and government policies affect the cash flows of both parent and subsidiary companies. Thereby, creating a significant difference between the net cash flows of the parent and subsidiary. - Financing Method

The parent company’s decisions regarding the new project financing affect its cash flows. So, the financing decision and cash flows are considered together. - Inflation Rates

Managers must consider the inflation rates of host and parent companies to ascertain the actual rate of return. As the inflations impact the market conditions and competition. - Exchange Rates

Like inflation, exchange rates also affect the future cash flows of the MNC. The exchange rate changes impact the currencies of the parent and host country. - Subsidized Loans

It increases the complexity of capital structure and the calculation of the weighted average cost of capital. - Political Risk

The host country’s political environment affects the parent company’s cash flows.

Final Words

All in all, MCB is an investment in the real assets of a company in foreign countries. It involves the thorough evaluation of the projects and selection of the most suitable one.

Thabile Jali says

The information above has been very meaningful & insightful and will definitely help me in my current role and in future

Dheeraj keshari says

Characteristics of capital budgeting for Multinational