Definition: Capital rationing is a financial approach applied by the organizations to pick the utmost profitable projects out of all the investment opportunities available. It enables the organizations to determine an optimal capital budgeting and adequate capital expenditure, in the long run.

This a useful practice since the organizations usually have limited availability of funds and it is not possible to consider all the investment projects which yield profit.

Content: Capital Rationing

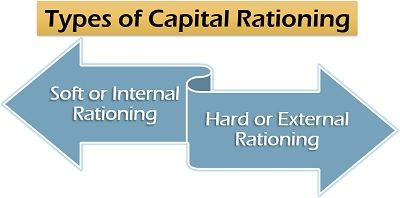

Types of Capital Rationing

Depending upon the reason for applying the capital rationing, we can bifurcate it into the following two categories:

Soft or Internal Rationing

Sometimes, the company reduces its capital expenditure due to certain internal factors or as a self-regulatory function. This is known as soft rationing.

Like, in case of a higher debt-equity ratio, companies opt for capital rationing to control its capital expenditure and secure a better financial position.

Hard or External Rationing

When the external factors or environment beyond control affect the organization such that it needs to resort to capital rationing, it is termed as hard rationing.

For instance, companies which are though performing well but lacks credibility and therefore cannot raise capital through debts have to rely upon the financial institutions. Since these lenders provide limited funds, the organizations need to go for capital rationing.

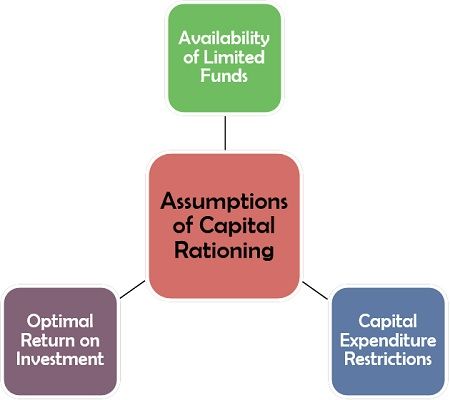

Assumptions of Capital Rationing

For applying the concept of capital rationing in an organization, the management needs to consider the following three assumptions:

- Availability of Limited Funds: While capital rationing, it is always assumed that the company has an inadequate amount of capital to undertake all the projects.

- Capital Expenditure Restrictions: It is presumed that due to the limited availability of capital or budgeting restrictions, the capital expenditure needs to be controlled.

- Optimal Return on Investment (ROI): By using various mathematical concepts or trial and error method, the organization has to figure out the selection of projects which provide the best ROI.

Advantages of Capital Rationing

Rationing sounds somewhat cynical, but capital rationing is an effective strategy for capital budgeting in any company. Let us now go through its various benefits in detail below:

- Project Management: Capital rationing ensures the selection of the most suitable and limited number of projects, which are easy to handle.

- Ensures Higher Stability: With limited project undertaking, the organization can maintain surplus funds for rainy days.

- Capital Budgeting: It is one of the most effective ways of optimizing the capital budget, through proper utilization of the owned and borrowed funds.

- Focus on Higher Returns: With the help of this strategy, the organizations can pick the most profitable projects by eliminating the ones with low ROI.

- Avoids Wastage of Resources: It prevents the company from investing in all those projects which looks rewarding. Instead, it evaluates each project’s profitability to utilize the available financial resource effectively.

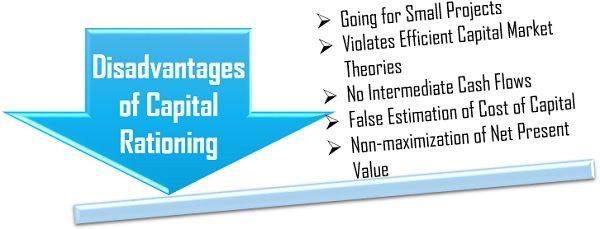

Disadvantages of Capital Rationing

Capital rationing is a narrow concept. It lacks the other perspectives which are essential for a project selection or rejection. Give below are some its other drawbacks:

- Going for Small Projects: Due to limited funds, capital rationing sometimes leads to opting for small projects which may not be very profitable in the long run.

- Violates Efficient Capital Market Theories: The efficient capital market theory suggests that, all the projects which hike the shareholders’ wealth and ensure value addition, should be selected. But this concept says that the projects which have higher profitability indices and are within the capital budget ceiling are most suitable.

- No Intermediate Cash Flows: Only the final ROI is considered in this technique; however, the in-between cash flows are avoided.

- False Estimation of Cost of Capital: If the cost of capital is not determined accurately, it may result in ineffective capital rationing and investment in inappropriate projects.

- Non-maximization of Net Present Value: Even if all the projects show high profitability indices, capital rationing limits their selection. Thus, it confines the scope of a higher NPV.

Capital Rationing Example

A company ABC Ltd. has to prepare the capital budget for the upcoming financial year. The finance heads presented seven different projects the purpose. The following table provides information about the initial cost, net present value and profitability index of each project:

| Projects | Initial Investment (₹) | Net Present Value (₹) | Profitability Index (P.I.) |

|---|---|---|---|

| T | 1,30,00,000 | 1,47,00,000 | 2.13 |

| U | 12,00,000 | 10,10,000 | 1.84 |

| V | 71,00,000 | 49,00,000 | 1.69 |

| W | 94,00,000 | 72,00,000 | 1.77 |

| X | 59,00,000 | 28,00,000 | 1.47 |

| Y | 2,13,00,000 | 1,91,00,000 | 1.90 |

| Z | 87,00,000 | 22,90,000 | 1.26 |

| Total | 6,66,00,000 | 5,20,00,000 |

The board of directors decided capital budget ceiling amounting to ₹5,50,00,000.

Find out which projects should the company select as a capital budgeting decision to maximize its profitability.

Solution

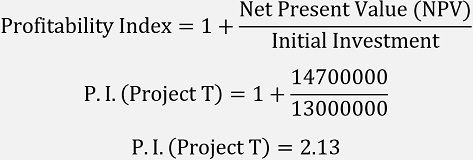

Given below is the calculation of profitability index of project T:

Likewise, the profitability indices of all seven projects have been computed and listed in the above table.

In the following table, we have rearranged the sequence of the given projects according to the descending order of their profitability indices.

| Projects | Initial Investment (₹) | Cumulative Cost (₹) | Net Present Value (₹) | Profitability Index (P.I.) |

|---|---|---|---|---|

| T | 1,30,00,000 | 1,30,00,000 | 1,47,00,000 | 2.13 |

| Y | 2,13,00,000 | 3,43,00,000 | 1,91,00,000 | 1.90 |

| U | 12,00,000 | 3,55,00,000 | 10,10,000 | 1.84 |

| W | 94,00,000 | 4,49,00,000 | 72,00,000 | 1.77 |

| V | 71,00,000 | 5,20,00,000 | 49,00,000 | 1.69 |

| X | 59,00,000 | 5,79,00,000 | 28,00,000 | 1.47 |

| Z | 87,00,000 | 6,66,00,000 | 22,90,000 | 1.26 |

We can see that project T will provide the highest profitability out of all.

Now, we have the following alternatives to select suitable projects, without exceeding the available capital budget of ₹5,50,00,000:

- Situation 1: Selecting projects T, Y, U, W and V where the project cost compounds to ₹5,20,00,000.

- Situation 2: If we replace project V with Z, i.e., selecting projects T, Y, U, W and Z, the total initial investment would be ₹5,36,00,000.

Let us now find out which combination will provide the highest profitability:

Situation 1: T+Y+U+W+V

Total Initial Investment = ₹5,20,00,000

Total Net Present Value (NPV) = 1,47,00,000+1,91,00,000+10,10,000+72,00,000+49,00,000 = ₹4,69,10,000

Situation 2: T+Y+U+W+Z

Total Initial Investment = ₹5,36,00,000

Total Net Present Value (NPV) = 1,47,00,000+1,91,00,000+10,10,000+72,00,000+22,90,000 = ₹4,43,00,000

Conclusion

While analyzing both the situations, we can easily make out that though the initial investment in both the conditions is less than ₹5,50,00,000, in situation 1, the net present value is higher in comparison to situation 2, that too with a lower initial investment.

Therefore, situation 1 is a more suitable option while preparing the capital budget.

In the above illustration, we have demonstrated the use of capital rationing for efficiently allocating the capital budget.

Leave a Reply