Definition: Inflation implies acceleration in the universal price level or moderate level of prices, of all goods and services. In microeconomics, the price of goods is determined when the demand is equal to its supply. Precisely, any factor that either reduces supply or increases demand creates Inflation and when the general price level continues to rise over a long time, it is known as “Sustained Inflation”.

Content: Inflation

Types of Inflation

Following are the types of Inflation:

Open and suppressed Inflation

If Inflation is open, the market economy mostly proceeds to function as a process in which rates are set. Any surplus demand leads to a rise in prices and money wages. Suppressed Inflation arises when government controls avoid goods prices and money wages from growing, so that surplus demand is not decreased but suppressed. If the restrictions are lifted, one must evaluate the increase in the general price level and money wages.

Galloping and Hyperinflation

Higher rates of price rise are classified ‘moderate’ and further study of the increase in prices is known as Galloping, and an extremely high rate of price rise which in general is very challenging is known as Hyperinflation. Still, one cannot fix precise boundaries among Galloping and Hyperinflation.

Anticipated and Unanticipated Inflation

Anticipated inflation is nothing but known inflation which can be predicted by the consumer. It does not harm much as the consumer was already prepared for such a rise in price due to certain known factors. Unanticipated inflation is always harmful inflation as it reduces the purchasing power of the money and cannot be predicted before the increase in the price level. However, only unanticipated Inflation gives real effects, i.e., only unanticipated Inflation influences output and employment.

Demand-Pull and Cost-Push Inflation

When the demand of goods are high in the market and its supply is low, the price of the commodities rises; such rise in the price causes inflation which is known as Demand-pull inflation and when there is an increase in the price of commodities because of increase in the production cost it is known as cost-push inflation.

Effects of Inflation

Following are the effects of inflation:

1. Effect on the Allocation of Income and Wealth: The effect of Inflation is noticed collectively in the nation’s economy by the various number of individuals such as creditors and debtors, producers and workers, fixed income earners, investors, traders, speculators, businessman, black marketers and farmers. Some classes of people win by making considerable wealth while some faces losses.

2. Effect on Production: The growing prices trigger the production of consumption as well as capital goods as producers get a higher profit, they produce more by utilizing the available resources at its best. However, after utilization of all resources, the production cannot increase the stock with a belief of further rise in the prices, as a result of which stockpile and cornering of goods will increase. But such suitable effects of Inflation at the time of production are not constantly found. Sometimes production can come to a deadlock position in spite of rising prices. This situation is termed as ‘stagflation’.

3. Effects on Government Investments: At the time of Inflation the revenue of the government increases by generating revenue from the taxes such as income tax, goods and service tax. Correspondingly, public spending increases as the government is enforced to pay out more for administrative as well as other purposes. However, rising prices diminishes the real burden of public liability as the fixed amount has to be paid in installment for each period.

4. Effects on Progress: A moderate Inflation promotes economic progress; however, runaway Inflation restrict economic progress as it increases the cost of improvement of the project. Even though moderate Inflation is necessary and beneficial for a developing economy, a high rate of Inflation looks after to reduce the growth rate by reducing the rate of capital formation and generating uncertainty.

5. Effects on Earnings and Employment: Inflation contributes to increasing the accumulated money income, i.e., national income on account of better spending and higher production. Likewise, the figure for employment intensifies under the impact of raise production. But the real income of the nation fails to rise uniformly as a result of the fall in purchasing power.

Causes of Inflation

Following are the causes of inflation:

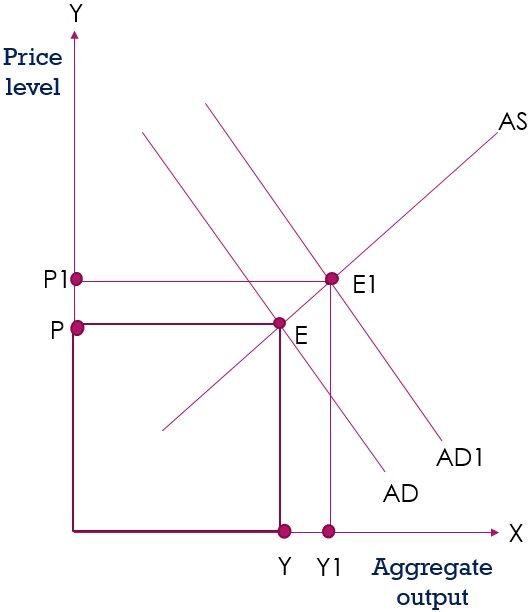

1. Rise in Aggregate Demand (AD)

Inflation introduced by a rise in aggregate demand is known as ‘demand-pull Inflation’. AD curve deviates to the right and creates an increase in the price level, as shown below:

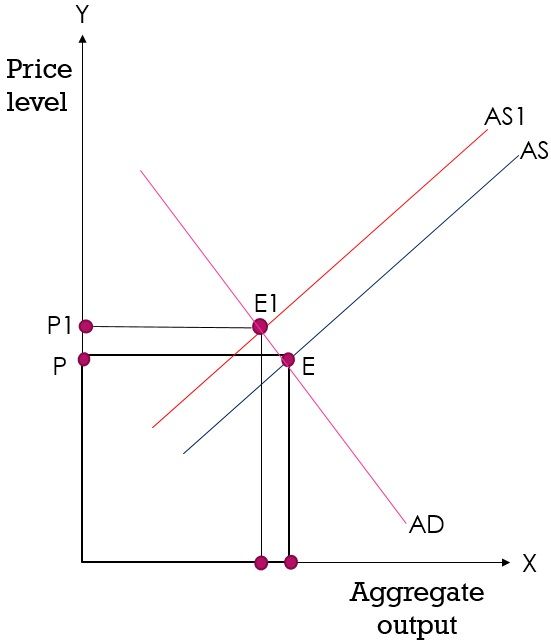

2. Rise in Cost

Rise in the cost of input like rent, raw material, wages, etc., raises the cost of production as supply price, rely upon the cost and the prices at which the manufacturers are ready to supply also rises. This shifts AS curve upwards, and it is termed as ‘cost-push Inflation’ shown as below:

3. Assumption of the Hike of Future Prices by the Company

If the company feels that the competitors are going to increase prices, all companies increase the price of the product it produces in expectation, which leads to an increase in the general price level.

4. Rise in Money Supply (MS)

Supply of more money in the market leaves more money with the people. By assuming, demand for money constant, money supply becomes higher than money demand. People try to spend this money which raises the aggregate demand, and the aggregate supply remains unchanged because of which price level rises. Increase in the price level raises market demand and price level continue to accelerate till market demand becomes equal to market supply again. The surplus supply of money is completely occupied by the system and rise in the market supply becomes the main source of sustained Inflation.

Measures to Control Inflation

The government takes various measures or draws policies for controlling Inflation in the economy. They are as follows:

Monetary policies

Monetary policies are those measures or policies which are taken by made by the RBI for credit creation and money supply in the economy. In the case of excess demand, the RBI controls the credit and the policies concerned with this are known as monetary policies.

Monetary measures to control Inflation

1. Quantitative measures

- Raising Bank Rates: The rate on which RBI gives loans to the commercial banks are known as bank rate. RBI raises it to control the demand-pull Inflation in the economy.

- Open Market Operations: To control the credit RBI issues their bonds in the market and collects money for controlling the Inflation.

Various Reserve Ratios

- Cash Reserve Ratio (CRR): It is a portion of the whole deposit which every commercial bank has to retain with the RBI.

- Statutory Liquidity Ratio (SLR): This ratio is a share of deposit which every commercial bank has to retain with themselves for the time of any emergency.

The reserve bank of India increases the rate of CRR and SLR to control Inflation.

2. Qualitative measures

- Marginal Requirement: RBI fixes the rate of the marginal requirement, and no commercial bank can provide loans exceeding such rates. Thus, after the valuation of the mortgaged asset the bank can only provide a loan up to a fixed percentage declared by RBI for the marginal requirement and at the time of Inflation RBI reduces such rates to control the flow of money in the market.

- Moral Suasion: If after taking all above measures RBI noticed that credit control is not regulated than they issue a circular to all the commercial banks and asks them to reduce the sum of loans offered to the public so that the Inflation in the economy gets controlled.

Fiscal Policies

Fiscal policies are concerned with the revenue and expenditure policies of the government. In the case of excess demand, the government reduces public expenditure and tries to increase its revenues.

- Revenue Policies: When there is demand-pull Inflation in the economy, and the expenditures of government are very high than they try to increase their revenue by way of taxes, fines, fees, or by increasing the profit percentage of the government undertakings.

- Expenditure policies: Government provides various facilities to the citizens regarding infrastructure, education, subsidy, scholarships, etc., for the development of the nation. But at the time of Inflation, the government tries to reduce its non-development expenses.

Other measures

- Control of Prices: Government reduces the cost of production of the products as a result of which Inflation gets controlled.

- Wage Freeze: When trade unions strike unnecessary to increase wages, in that situation government freezes the wages.

- Dividend Freeze: To control the demand-pull Inflation, the government reduces the rate of interest on the investment.

- Increase in Supply of Goods: Government keep an eye on the market and if there is a deficit in an amount of any goods than the government undertakings start manufacturing such goods to overcome the crises of Inflation.

- Public Distribution of Essential Products: During the time of scarcity of essential good government distributes such goods through their channels to meet the supply equal to its demand for controlling the Inflation.

Conclusion

Inflation is a state of affair in which money incomes are growing faster than the movement of goods and services on which to invest them, i.e., faster than real national income.

Tumalu Viola Jackson says

This is really helpful to me. Thank you so much!

alexandria charipea toto says

good work