Definition: Money Market acts as an essential part of economic development. It is concerned with that portion of the financial system where trading of the short-term fund is done for a period of less than 1 year. It is a product of the capital market, which is treated as a channel of short-term debt capital. Although it is undoubtedly distant from the capital market, money market deals with short-term call and notice deposit, promissory notes, government papers, short-period bills, etc.

Content: Money Market

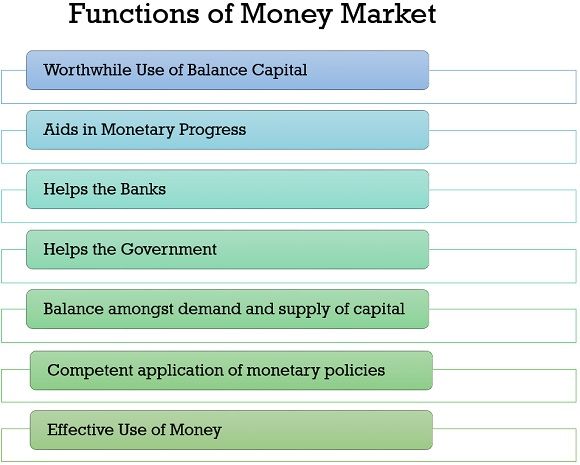

Functions of Money Market

Following are the functions performed by the Money Market:

- Worthwhile Use of Balance Capital

It facilitates to use of the balance capital funds efficiently for a short period by the financial as well as the non-financial institution and the government.

- Aids in Monetary Progress

For fulfilling the working capital requirements of the various financial institutions, a money market provides short-term capital to them. It boosts the expansion of commerce, industry and trade by discounting the trade bills by way of commercial banks, acceptance houses, brokers, etc.

- Helps the Banks

The commercial bank rather than borrowing from the RBI can borrow some loans from the existing money market, as the interest rate of the money market is lower than the RBI, which saves the cost of the bank.

- Helps the Government

By issuing Treasury bills, the government can obtain short-term capital from the money market at a minimal rate of interest rather than financing from RBI.

- Balance amongst demand and supply of capital

By way of transfer of savings into investments, the money market grants money to be used in a balanced way which maintains the balance amongst demand and supply of the capital amount.

- Competent application of monetary policies

By its monetary policies, RBI may effectively regulate its banking system and can give guidance to the development of commerce and industry. Competent application of monetary policies is thus effectively managed by the Reserve Bank of India.

- Effective Use of Money

Money Market aids the development of commerce and industry as it manages the money assets and money can easily be relocated from one place to another.

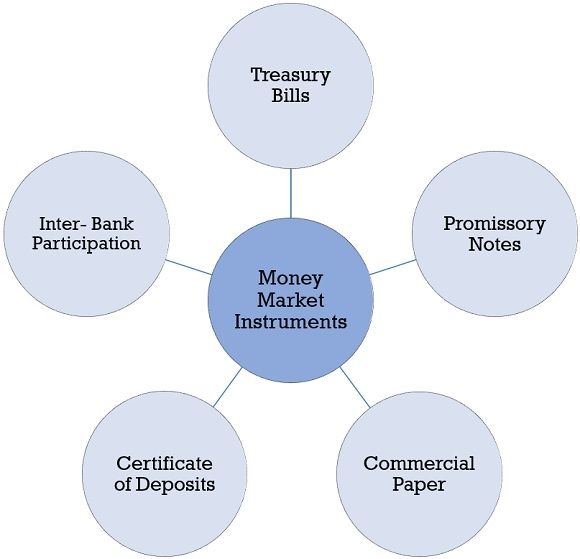

Money Market Instruments

The following are some of the instruments of the Money Market:

- Treasury Bills

Treasury Bills are the preeminent instrument of the Money Market which are issued for less than 1 year, i.e., for 91,182,360 days. The Central Government issues them for providing short-term capital to the market. It can be issued as ordinary or ad hoc treasury bills and any individual who is a resident of India can purchase such bills. Banks may convert their statutory liquidity ratio held in the form of treasury bills into cash as and when required for cash reserve ratio obligation.

- Promissory Notes

It is a written promise by one person to another to pay a certain amount at an acknowledged period of time mentioned in a note. In general, a promissory note is signed for 90 days plus 3 days of the grace period. It is drawn by the debtor and must be acknowledged by his bank, so that creditor gets it discounted directly from the bank on the due date.

Commercial Papers are the short-term liability issued by highly ranked companies to lenders for recent fund received from them. Companies having a minimum net worth of ₹ 4 crores can only raise the commercial papers for a minimum of 7 days and a maximum of 1 year of time. It is issued in the form of the customed promissory note at a discount to face value.

- Certificate of Deposits

Certificate of Deposits is the receipts issued by the financial institutions for a particular time at a fixed interest rate. These certificates can be issued with a minimum size of 5 lacs in a multiple of 1 lac for a minimum period of 7 days and a maximum period of 1 year. They are issued at the rate driven by the market forces at a discount to face value, here the stamp duty has to be borne by the financial institutions.

- Inter-Bank Participation

The bank has to decrease its advances or need to raise its deposits if it has an extensive credit deposit ratio, which can be done by decreasing the advances for some-time by granting permission to other banks to participate in its classified advance. For which a participation certificate is issued to the participating banks. Inter-bank Participation Certificates are issued:

- With Risk Sharing: If it is issued with risk sharing, then it is issued for 91 to 180 days with an interest rate determined by the participating bank.

- Without Risk sharing: If it is issued without risk sharing, then it is issued for not more than 90 days with an interest rate decided by the participating bank.

Importance of Money Market

Money Market is important for the economic growth of the country. The importance of it can be described more clearly below:

- It fulfills the finance needs of the trade and industry as & when required.

- For getting the short-term funds of the commercial banks, the money market furnishes the beneficial channels.

- By selling the treasury bills, the government can quickly raise the short-term capital from the market with a low rate of interest.

- It helps the RBI to formulate and implement the monetary policies, and to accomplish its open market operations on a large scale.

- It helps the RBI to regulate the funds in the market and provides commercial papers for rediscount.

Money Market Vs Capital Market

| Money Market | Capital Market |

|---|---|

| Money market deals with short-term financing. | Capital market deals with long-term financing. |

| Money market fulfills the working capital requirements. | Capital market fulfills the fixed capital requirements. |

| Instruments of the money market are bill of exchange, commercial papers, treasury bills, etc. | Instruments of the capital market are shares, debentures, bonds and any other long-term security. |

| Money market deals with foreign banks, Development financial institutions. | Capital market deals with investment banks. |

Conclusion

Money Market is that portion of the financial system where short-term capital is issued for not more than one year. It can be classified into the organized and unorganized money market. Organized market consist of financial institutions and an unorganized market implies the financial services offered by the domestic bankers which are not regulated by the government.

Leave a Reply